A forex pair, also known as a currency pair, represents the quotation of two different currencies, with the value of one currency being quoted against the other. The first currency listed is the base currency, which is the currency bought or sold. The second currency listed is the quote currency, and it represents how much of the quote currency is needed to purchase one unit of the base currency. By comparing these two, traders can speculate on the strength and movements of one currency relative to the other, which forms the basis of the forex trading market.

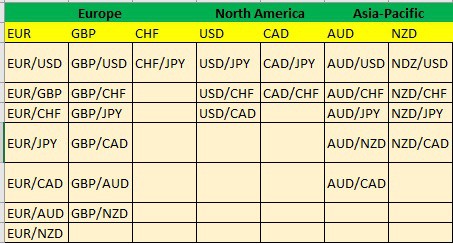

28 Major Forex Pairs List

The 28 major forex pairs are combinations of the seven key currencies: EUR, GBP, CHF, USD, CAD, AUD, and NZD. They are formed by pairing each currency with all the others, resulting in a comprehensive matrix representing the most traded pairs in the forex market.

- EUR/USD: The Euro paired with the U.S. Dollar represents the two large global economies that are widely traded.

- GBP/USD: The British Pound, paired with the U.S. Dollar, known as “Cable,” is marked by its high liquidity.

- CHF/JPY: The Swiss Franc paired with the Japanese Yen, a cross-rate representing two safe-haven currencies.

- USD/JPY: The U.S. Dollar is paired with the Japanese Yen, a significant, heavily traded pair, especially in Asia.

- CAD/JPY: The Canadian Dollar pairs with the Japanese Yen, which is often influenced by commodity prices such as oil.

- AUD/USD: The Australian Dollar is paired with the U.S. Dollar, which frequently reflects changes in commodity markets.

- NDZ/USD: It seems to be a typo; it should be “NZD/USD,” which is the New Zealand dollar paired with the U.S. dollar, known for its relation to dairy commodity prices.

- EUR/GBP: The Euro paired with the British Pound, reflecting the economic interplay between the Eurozone and the U.K.

- GBP/CHF: The British Pound is paired with the Swiss Franc, which is often seen as a gauge for European stability.

- USD/CHF: The U.S. dollar is paired with the Swiss dollar, another pair where the Swiss dollar is considered a haven.

- CAD/CHF: The Canadian Dollar paired with the Swiss Franc, mixing a commodity-driven economy with a safe-haven one.

- AUD/CHF: The Australian Dollar paired with the Swiss Franc, combining commodity exposure with a safe-haven currency.

- NZD/CHF: The New Zealand Dollar pairs with the Swiss Franc, which is often affected by global risk sentiment and dairy prices.

- EUR/CHF: The Euro pairs with the Swiss Franc, which is closely watched for interventions by the Swiss National Bank.

- GBP/JPY: The British Pound pairs with the Japanese Yen, which is known for its volatility and nicknamed “the Dragon.”

- USD/CAD: The U.S. Dollar is paired with the Canadian Dollar, often called “Loonie,” and is influenced by oil prices.

- AUD/JPY: The Australian Dollar is paired with the Japanese Yen, a famous currency in the carry trade.

- NZD/JPY: The New Zealand Dollar paired with the Japanese Yen, another carry trade pair with ties to commodity prices.

- AUD/NZD: The Australian Dollar, paired with the New Zealand Dollar, is often traded based on regional economic differences.

- NZD/CAD: The New Zealand Dollar paired with the Canadian Dollar, a minor cross pair influenced by commodity prices.

- AUD/CAD: The Australian Dollar is paired with the Canadian Dollar, a significant commodity currency pair.

- EUR/JPY: The Euro paired with the Japanese Yen, a widely traded cross that serves as a barometer for global risk.

- GBP/CAD: The British Pound paired with the Canadian Dollar, offering insights into U.K. and Canadian trade relations.

- EUR/CAD: The Euro paired with the Canadian Dollar, a cross-rate combining European and North American economic signals.

- EUR/AUD: The Euro paired with the Australian Dollar, reflecting the economic dynamics between Europe and Australia.

- GBP/AUD: The British Pound paired with the Australian Dollar, a pair sensitive to global trade and finance changes.

- GBP/NZD: The British Pound is paired with the New Zealand Dollar, which is known for its significant price movements.

- EUR/NZD: The Euro paired with the New Zealand Dollar, representing a mix of the Eurozone and the South Pacific economies.

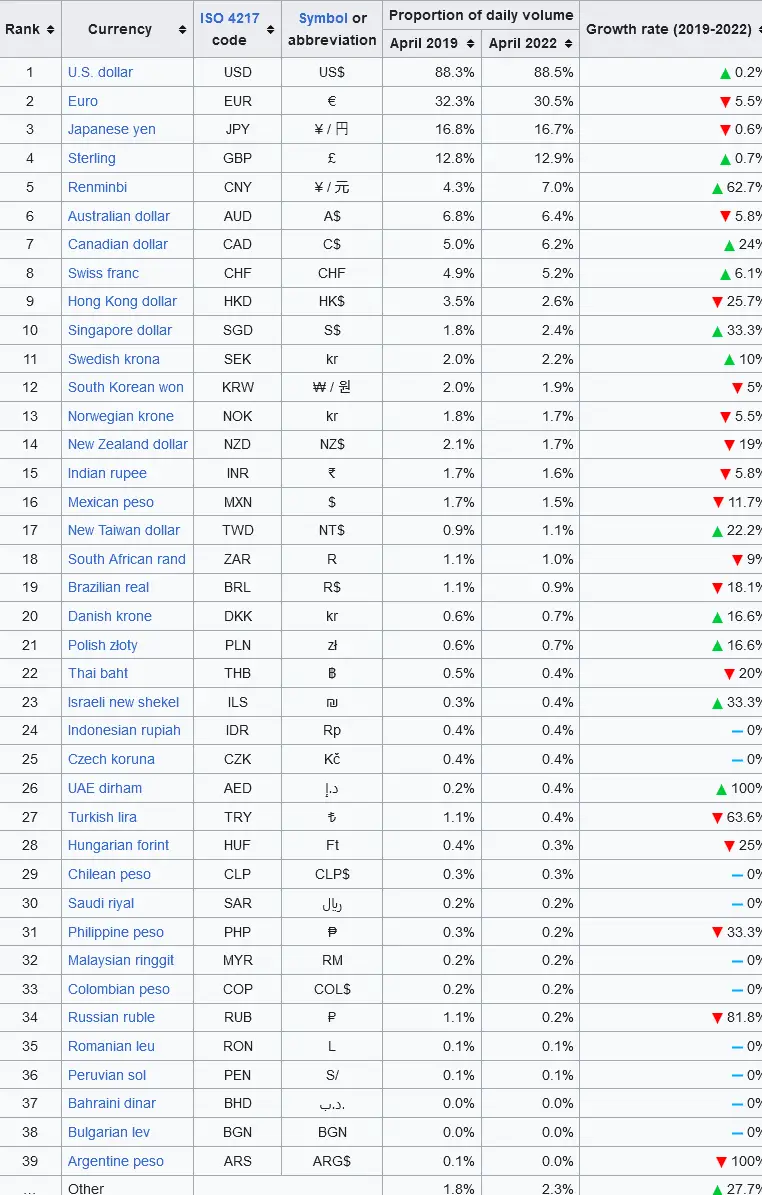

The economies of the EUR (Eurozone), GBP (United Kingdom), CHF (Switzerland), USD (United States), CAD (Canada), AUD (Australia), and NZD (New Zealand) are among the most stable and liquid globally. They have large-scale foreign exchange reserves and significant international trade flows. The Eurozone, the U.S., and the U.K. are major economic powers with extensive financial markets that contribute to a substantial volume of daily forex transactions.

- The U.S. dollar (USD) is the world’s primary reserve currency and is involved in nearly 90% of all forex transactions. It acts as the benchmark currency for commodities such as oil and gold, meaning most global trade is priced in dollars, which amplifies the influence of USD pairs on the entire forex market.

- The euro (EUR) is the second most traded currency, heavily impacted by European Central Bank (ECB) policies and economic data from the Eurozone’s largest economies, especially Germany and France. Political events such as Brexit or EU policy changes also make EUR pairs highly reactive.

- The Japanese yen (JPY) is often used as a funding currency in carry trades due to Japan’s historically low interest rates. Traders borrow yen at low cost and invest in higher-yielding currencies, which increases volatility in JPY pairs when global risk sentiment shifts.

- The British pound (GBP) is one of the oldest and most volatile major currencies, often sensitive to political changes, Bank of England (BoE) interest rate decisions, and U.K. trade relations. Its nickname “Cable” for GBP/USD comes from the undersea telegraph cables that once transmitted exchange rates between London and New York.

- The Swiss franc (CHF) is frequently influenced by actions of the Swiss National Bank (SNB), which has historically intervened in the forex market to control appreciation. Because Switzerland is a global banking hub, CHF often strengthens during financial crises.The Swiss Franc is considered a safe-haven currency due to Switzerland’s stable political system and strong financial policies, which influence forex during times of global economic uncertainty. The Canadian, Australian, and New Zealand dollars are known as commodity currencies, as their values are closely tied to their countries’ abundant natural resources. This affects the forex market as commodity prices fluctuate.

- Commodity-linked currencies like the Canadian dollar (CAD), Australian dollar (AUD), and New Zealand dollar (NZD) are not only tied to natural resources (oil, gold, and dairy, respectively) but also to trade relations with Asia, particularly China, which is a major consumer of these exports. This makes AUD and NZD especially reactive to Chinese economic data.

Liquidity and trading sessions also play a key role. For example, EUR/USD is most active during the overlap of London and New York sessions, while AUD/JPY and NZD/JPY see strong movements during the Asian session.

Finally, correlations exist between certain pairs and other markets:

-

USD/CAD often moves with oil prices.

-

AUD/USD and NZD/USD show correlation with gold and agricultural commodities.

-

EUR/CHF and USD/CHF often act as gauges of European and global risk sentiment.

These currencies are associated with countries with strong governance, low inflation, and consistent policies, making them attractive for forex traders. Therefore, due to their economic significance, financial stability, and governance, these seven currencies significantly impact the forex market, often setting trends and serving as benchmarks for global economic health.