Table of Contents

Everyone is aware of Apple and how the company redefines technology. Despite being a pioneer at introducing updated technology with each model, the brand still hasn’t overtaken the likes of SAMSUNG regarding sales. When iPhone sales dropped, every investor got spooked. Although Apple is considered one of the most controversial stocks to invest in, many believe that the tech giant is on the brink of witnessing a new era.

What is Apple’s stock price today?

[stock_market_widget type=”inline” template=”generic” assets=”AAPL” markup=”Apple price today is {price} that represents {change_pct} change percent from yesterday’s previous close {previous_close}. Last 52 weeks low is {52_week_low}, while 52 weeks high is {52_week_high}.” display_currency_symbol=”true” api=”yf”]

Apple stock live chart

How many shares of Amazon stock are there?

[stock_market_widget type=”inline” template=”generic” assets=”AAPL” markup=”There are exactly {shares_outstanding} Amazon shares of Amazon stock based on the latest update on {last_update}.” display_currency_symbol=”true” api=” of”]

About Apple Company

Apple Inc. is an American multinational technology company headquartered in Cupertino, California. Apple company sells consumer electronics, computer software, and online services.

Apple company history:

Apple Computers, Inc. was founded by college dropouts Steve Jobs, Steve Wozniak, and Ronald Wayne on April 1, 1976. in the garage of Jobs’ parents. Jobs and Wozniak wanted to make computers small enough for people to have them in their homes or offices. The Apple II revolutionized the computer industry by introducing the first-ever color graphics. Apple sales jumped from $7.8 million in 1978 to $117 million in 1980. In that year, 1980. Apple has become a public company.

Is Apple a private company?

Apple is not a private company; it is a publicly held company. Nevertheless, Apple has become the world’s 1st private-sector company, Worth 1 trillion dollars in market value.

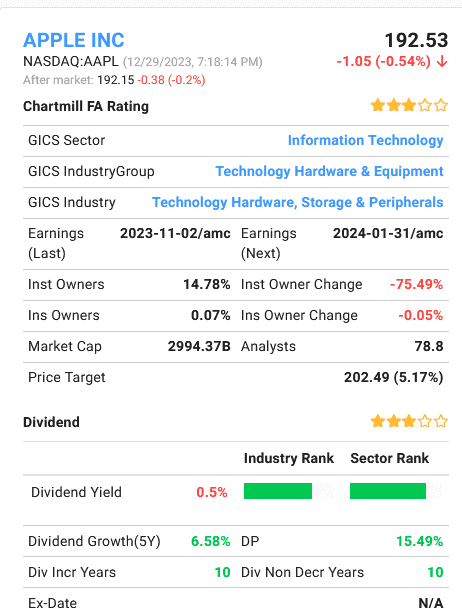

Apple financial analysis – Apple key stats

AAPL stock price forecast will not be straightforward, but if you are wondering about these stocks’ future, you are at the right place. We will discuss its past performance and use it to make future predictions. We will also highlight the major drivers that will allow us to answer the most-asked question, “Will Apple shares go up?”.

Apple stock forecast 2024.

Apple stock forecast for 2024 shows that the maximum price for Apple stock can be $280, the minimum cost $160, and the high probability price can be $215. Predictionsyares see that Apple’s price can go up during 2024 because of the potential US Interest rate cut and high company annual profitability.

Apple stocks have been a popular investment for many investors over the last few years, and analysts have long watched the price of Apple stocks closely. While there have been some high points, such as the company’s record-breaking market capitalization in 2020, some analysts are now forecasting a downtrend for Apple’s stock price by 2024.

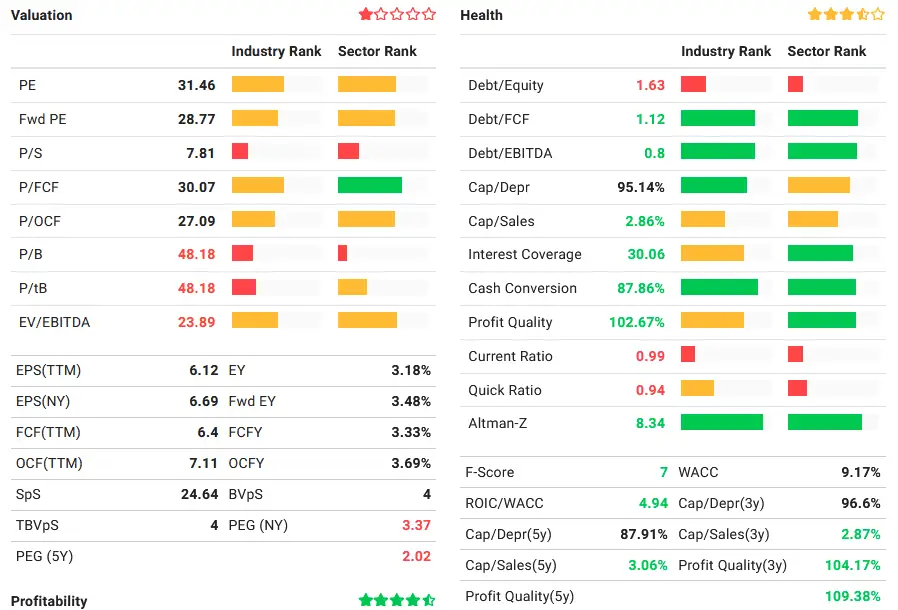

Apple Inc.’s (AAPL) stock analysis reveals a robust and consistently profitable company, as indicated by various financial metrics and ratios:

- Basic Profitability Checks: AAPL has demonstrated positive earnings and cash flow from operations over the past year and five years, indicating strong and consistent profitability.

- Yearly Financial Performance: An upward trend in Net Income, EBIT, Operating Cash Flow (OCF), and Free Cash Flow (FCF) over the years (2014-2023) reflects AAPL’s growing financial strength.

- Profitability Ratios: AAPL’s Return on Assets (ROA) at 27.51%, Return on Equity (ROE) at 156.08%, and Return on Invested Capital (ROIC) at 45.31% is notably higher than most industry peers, signifying exceptional efficiency in utilizing assets and equity to generate profits.

- Historical ROA, ROE, and ROIC Trends: The company has maintained a strong performance in ROA, ROE, and ROIC over several years, with these ratios consistently outperforming industry averages.

- Profit Margin: AAPL’s profit margin, operating margin, and gross margin are higher than most of its industry counterparts, demonstrating its superior ability to convert sales into profit.

- Margin Growth: The improvement in AAPL’s margins over recent years indicates increasing operational efficiency and cost management.

- Financial Health Checks: AAPL’s ROIC is well above its Cost of Capital, indicating value creation. Additionally, reduced shares outstanding and an improved debt-to-assets ratio over recent years signify a solid financial position.

- Solvency Ratios: The high Altman-Z score and low Debt-to-FCF ratio reflect AAPL’s financial health and low bankruptcy risk despite a higher Debt/Equity ratio than some peers.

- Liquidity Analysis: Although AAPL’s current and quick ratios suggest potential short-term liquidity concerns, its overall solvency and profitability mitigate these risks.

- Growth Metrics: AAPL’s Earnings Per Share (EPS) and Revenue have grown over the years, though recent trends indicate a slight deceleration.

- Future Growth Projections: The company is expected to maintain strong EPS growth, although revenue growth projections are moderate, indicating a stable but slowing expansion pace.

- Valuation Metrics: AAPL’s Price/Earnings (P/E) ratio suggests a relatively expensive valuation compared to the industry average and S&P 500. This is supported by similar trends in Price/Forward Earnings and other valuation multiples.

- Growth Compensation in Valuation: The high PEG (Price/Earnings to Growth) Ratio implies an expensive valuation, although AAPL’s profitability could justify this.

- Dividend Analysis: AAPL’s dividend yield is lower than the industry and S&P 500 averages, but its dividend growth is consistent and sustainable.

- Dividend Sustainability: The payout ratio and the relationship between dividend growth and earnings growth indicate that AAPL’s dividend payments are sustainable.

Overall, AAPL’s stock analysis underscores a financially healthy, profitable, and growing company, albeit with a relatively high valuation and modest dividend yield.

The leading cause for this projected decline is the current economic recession in the United States. This economic downturn has already caused severe damage to many industries, with small businesses and large corporations experiencing financial struggles. As Apple’s products rely on consumer spending as its primary source of revenue, it is assumed that this will be one of the hardest hit companies in the face of continued recessionary trends.

Given these conditions, it can be expected that Apple’s stock prices will continue to fall throughout 2023. This would not only be bad news for current investors who may see their portfolios take a hit, but it could also mean bad news for potential investors looking to gain access to Apple stocks at a lower price point. Even if the economy begins to recover in late 2023 or early 2024, investors may miss out on an opportunity to buy at cheaper prices now and enjoy greater returns when prices rise again.

However, this doesn’t mean all hope is lost for those wanting to invest in Apple stocks in 2023. Many factors, such as new product launches or a particularly supportive investor base, could contribute to an upward trend in subsequent years. Additionally, although consumer demand may dip due to recessionary movements, there’s no guarantee that this will happen – especially if other countries can keep their economies healthier or if industrial-scale fiscal support comes from worldwide governments.

Overall, it remains challenging to predict what exactly will happen with regards to Apple stock prices during 2023 – but whatever happens, potential investors must do their research ahead of any investments they make to make sure they understand what they are getting into and how much risk they are taking on board before committing their funds.

Optimistic Apple 5-year stock forecast

Apple’s 5-year stock forecast shows a predicted price of $438 (median price) for 2026. The model has included 30 technical and 29 financial analysis parameters in the projection. However, the presented projection may be unreliable because of a possible recession.

Conclusion

The robust financial health and consistent profitability of Apple Inc. (AAPL), as evidenced by strong earnings and revenue growth, provide a solid basis for a stable or rising stock price. However, the high valuation metrics, such as the Price/Earnings ratio, suggest that AAPL’s stock is priced at a premium, indicating it’s a relatively expensive investment compared to its industry peers and the broader market.

This premium pricing reflects investor confidence in Apple’s market position and prospects. Despite the high valuation, Apple’s sustained profitability, efficient asset utilization, and steady dividend growth will likely continue attracting investors, potentially supporting the stock’s price stability or growth.