Table of Contents

The Bloomberg Terminal, officially called Bloomberg Professional Service, is a powerful and widely used platform among financial professionals. Developed by Bloomberg L.P., it provides real-time data, news feeds, and messages and allows for the execution of trades. It is also well-regarded for its advanced analytics capabilities.

The terminal offers vast information on equities, fixed-income securities, foreign exchange and commodities markets, mortgage-backed securities, derivatives, and more. It also provides data on historical trading patterns, detailed company financials, broad economic data, and news stories. Moreover, the terminal allows users to message one another, making it an essential communication tool in the financial industry.

Single terminal subscriptions can cost over $20,000 annually, with bulk discounts available for corporate clients with multiple terminal needs. The exact cost can vary depending on the level of service, the specific features required, and the number of terminals a user or firm subscribes to.

Given the high cost, the Bloomberg Terminal is primarily used by professional investors, financial analysts, fund managers, traders, and other finance professionals. Small individual investors or those new to investing may not find the cost justifiable. Despite the high cost, the Bloomberg Terminal remains popular due to its depth and breadth of data and its sophisticated analysis tools.

If you are not a student, you should learn about Bloomberg Terminal’s Free Alternative. Koyfin, a data visualization and investment research platform, is an excellent free alternative. Read our Koyfin review.

How can you access the Bloomberg terminal for free?

You can access the Bloomberg terminal for free if you are a faculty student whose institution has a Bloomberg license. Bloomberg education licenses enable students and faculty to create an educational account to access Bloomberg data and resources.

Here’s a step-by-step guide on how to do it:

- Check with your Institution: First, confirm that your institution has a Bloomberg Terminal subscription. You can typically find this information on your institution’s library website or by asking a librarian or faculty member.

- Go to the Terminal: If your institution has a physical Bloomberg Terminal, you must go to the terminal’s location (usually in a library or a finance lab). You can also access it from home.

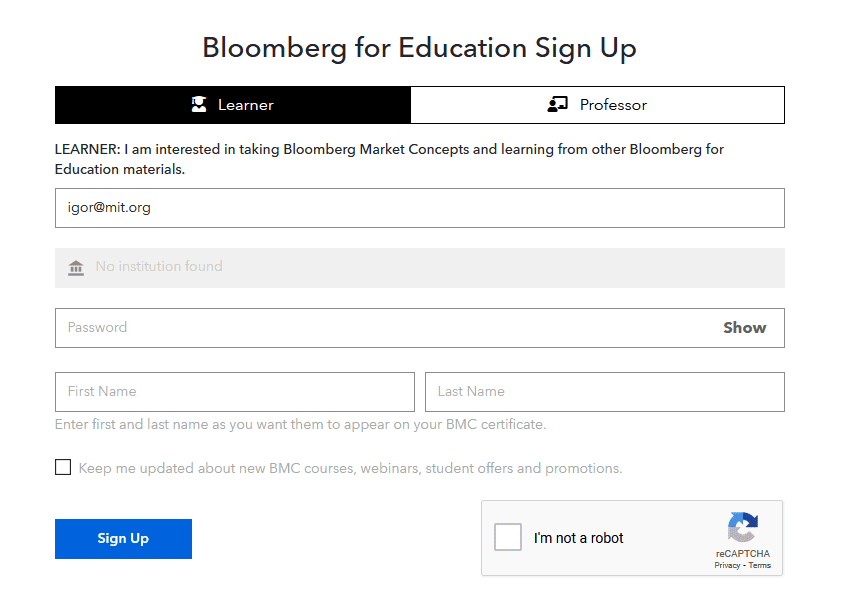

- Create an Account: Once at the terminal, you can create a Bloomberg education account. This usually involves providing your name, email address, and institution.

- Bloomberg Market Concepts (BMC): As a student, you’ll likely have access to Bloomberg Market Concepts (BMC), an 8-hour self-paced e-learning course that introduces the financial markets. To access BMC, log into the terminal and type ‘BMC <GO>’ to start the program.

- Usage: After setting up your account, you can use the Bloomberg Terminal to access a vast amount of financial and business information, including company profiles, market data, news, and much more.

Students do have access to Bloomberg terminals in some cases. This is typically through their university or college, which may have a subscription to the Bloomberg Terminal. The terminal allows Students to access real-time financial data, news, and information. The availability ability of Bloomberg terminals for students varies from university to university. Some universities have limited terminals available to students on a first-come, first-served basis. Other universities have more terminals available for students to use in designated areas.

Students must have a Bloomberg ID and password to use a Bloomberg terminal. They can typically obtain these from their university’s Bloomberg representative. Once they have their ID and password, students can log into the terminal and access the data and analysis it offers.

The Bloomberg Terminal is a powerful tool for learning about the financial markets and conducting research. It can be a valuable resource for students interested in a finance career or who want to learn more about the markets.

Here are some of the benefits of having access to a Bloomberg terminal as a student:

- Access to real-time financial data: The Bloomberg Terminal provides real-time financial data, including stock prices, bond yields, and currency exchange rates. This data can be used to track the markets and to make informed investment decisions.

- Access to news and analysis: The Bloomberg Terminal also provides access to news and analysis from various sources. This can help students stay current on the latest market developments and learn about different investment strategies.

- Learn about the financial markets: The Bloomberg Terminal can be used to learn about the financial markets. Students can use the terminal to explore different asset classes, learn about different investment strategies, and track the performance of their investments.

Bloomberg’s intent with BMC is to provide an interactive introduction to finance using the same market data, analytics, and software used globally by finance professionals.

Here’s a general overview of what the Bloomberg Education platform looks like:

- Courses: BMC consists of four modules – Economics, Currencies, Fixed Income, and Equities.

- Dashboard: Once logged in, you will see a dashboard showing your course progress. It indicates the completed modules and those you still need to work on.

- Learning Materials: Each module is packed with Bloomberg data, current news stories, and Bloomberg functions for students to explore and enhance their understanding.

- Exercises: Throughout the course, mini-quizzes and exercises are designed to test your understanding of the material.

- Certification: Upon completing all modules, you can receive a certificate of completion, which you can list on your resume or LinkedIn profile.

- Additional Resources: Additional resources and tools for learning more about particular topics, such as video tutorials, forums for asking questions, and supplementary reading materials, may be available.

Bloomberg Terminal Unique Features

Core Functionalities

1. Data Access and Management

- Real-Time Data: Bloomberg provides real-time data on all listed securities worldwide, including stocks, bonds, commodities, Forex, and derivatives.

- Historical Data: Users can access decades of historical data for back-testing and analysis.

- Market Indicators: Key market indicators and indices worldwide are available in real time.

2. Analysis Tools

- Equity Screening: Bloomberg allows users to screen equities using various criteria, including financial metrics, industry data, and proprietary ratings.

- Risk Models: It offers sophisticated risk assessment tools that analyze portfolio risk under various scenarios.

- Charting: Extensive charting options for all types of securities and economic data.

- APIs: Bloomberg offers APIs that allow users to stream data into other analytics platforms like Excel, SQL, and Python for custom analysis.

3. Supply Chain Analysis

- Bloomberg provides tools to visualize and analyze companies’ supply chains, showing how revenues are tied to different vendors and how companies interconnect within industries.

4. Trading and Execution

- AIM and EMSX: Bloomberg’s Asset and Investment Manager (AIM) and Electronic Market Securities Execution (EMSX) platforms facilitate seamless trading execution and portfolio management.

- Direct Market Access: Users can directly access market makers, choose trading venues, or use dark pools to execute large trades discreetly.

Additional Features

5. Communication and Networking

- Instant Messaging/Chat: The platform includes a built-in chat function that connects users with market professionals globally, enabling swift communication and compliance with industry standards.

- Customer Support: Bloomberg is renowned for its robust customer support, including the option for live chat with experts and one-on-one function training.

6. Research and News

- News Aggregation: Real-time news updates from various global sources are integrated directly into the platform.

- Analyst Coverage and Research: Access to a wide range of research reports from industry analysts and the ability to connect with sell-side analysts.

7. Integration and Customization

- Custom Alerts and Workspaces: Users can customize their workflows and alerts to suit their needs and focus areas.

- Data Export: Data can be exported for further analysis or reporting in various formats, supporting a seamless workflow integration.

Industry Impact and Considerations

- Indispensable Tool: The Bloomberg Terminal is regarded as indispensable for its comprehensive data, analytics tools, and trading capabilities. It supports various financial services, from trading to risk management and regulatory compliance.

- Cost and Accessibility: Despite its high cost, which can be prohibitive for smaller firms, the terminal is vital for larger institutions that rely on real-time data and in-depth analysis.

- Monopoly Concerns: The platform’s extensive reach and capabilities mean that Bloomberg L.P. can exert considerable influence over pricing and access, leading to concerns about its monopolistic position in the market.