MetaTrader 4 (MT4) is a widely used and highly regarded trading platform that allows traders to access various financial markets, including commodities. Trading commodities in MT4 offers individuals and institutional investors a unique opportunity to participate in the global commodities market and potentially profit from price fluctuations in assets such as precious metals, energy resources, agricultural products, and more.

One of the key advantages of trading commodities in MT4 is the platform’s user-friendly interface and robust features that cater to novice and experienced traders. MT4 provides a comprehensive set of tools, charts, and indicators to assist traders in analyzing price movements, identifying trends, and executing trades effectively. In addition, with its intuitive design and extensive customization options, MT4 allows traders to adapt their trading strategies and preferences to suit their needs.

As an asset class, commodities possess unique characteristics that make them attractive to a diverse range of traders. These tangible goods, such as gold, silver, oil, natural gas, wheat, coffee, and many others, have inherent value and are influenced by various factors, including supply and demand dynamics, geopolitical events, weather conditions, and global economic trends. By trading commodities in MT4, traders can take advantage of these factors and potentially capitalize on price movements in the market.

Usually, you can not see all commodities in your MT4 platform by default. So, how can we fix that?

How to Add Commodities in Metatrader 4?

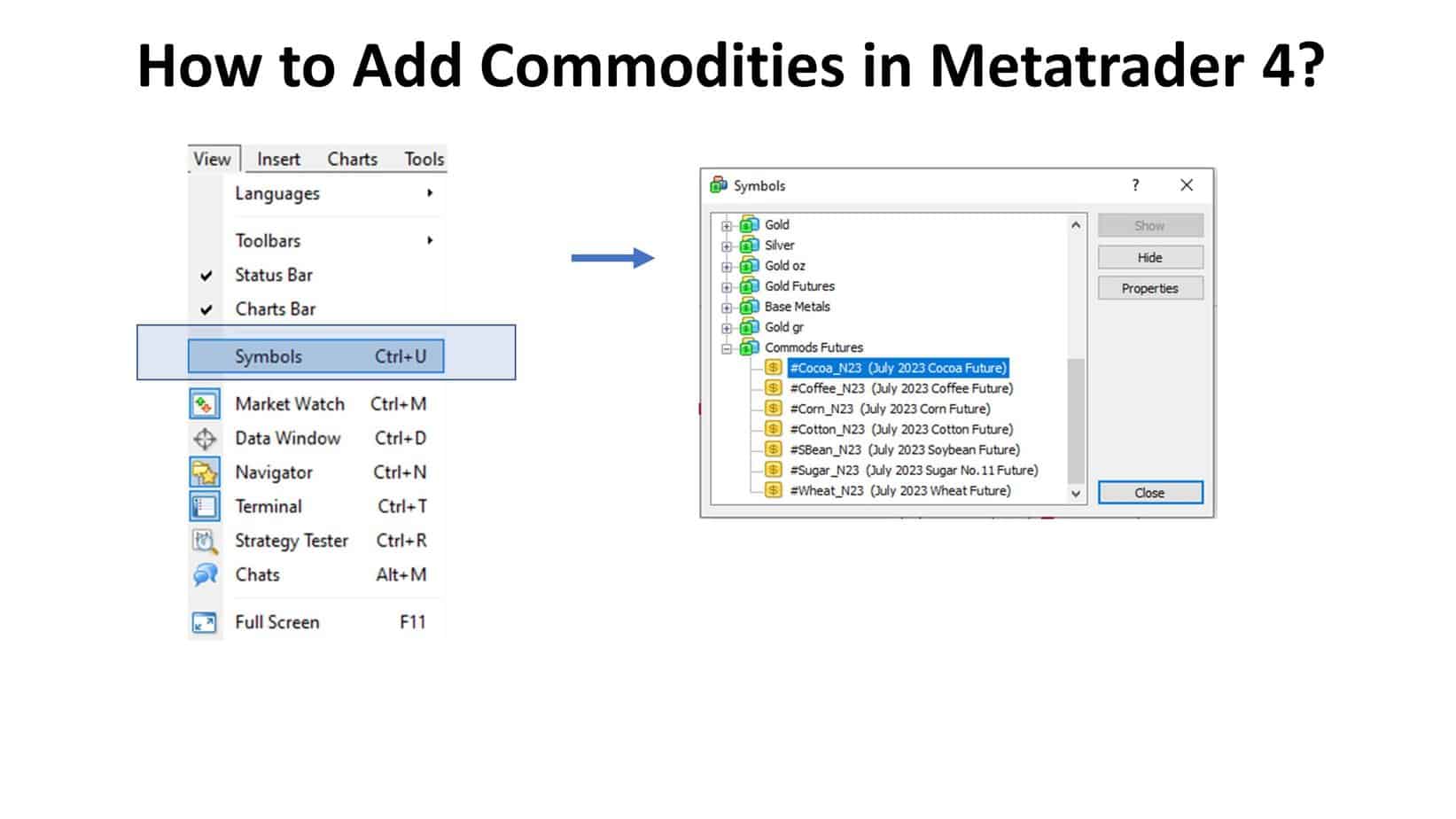

To add all commodities to your Metatrader 4 platform, select View in the horizontal menu and choose Symbols (shortcut CTRL+U). Then, choose each asset separately and press the Show button to make it visible in Market Watch and enable the asset for trading.

When you make all commodities visible, you can open new commodity charts (File/New chart) or pick commodity assets from Market Watch Window.

Please watch the whole video on how to add commodity assets to MT4:

Instructions on how to add Commodities in MT4

To add all commodities to your MetaTrader 4 (MT4) platform, you can follow these steps:

- First, open your MT4 platform and navigate to the horizontal menu at the top.

- Click on “View” in the menu. This will open a dropdown list with various options.

- From the dropdown list, select “Symbols.” Alternatively, you can use the shortcut CTRL+U on your keyboard.

- A new window will appear, displaying a list of available symbols or assets.

- You will see a list of all the assets currently available in your MT4 platform in the symbols window. This includes currency pairs, commodities, indices, and more.

- To add commodities to your platform, scroll through the list and locate each commodity individually.

- Select a commodity by clicking on it once to highlight it.

- Once you have selected a commodity, click the “Show” button on the window’s right side. This action will make the commodity visible in the Market Watch window and enable it for trading.

- Repeat steps 6-8 for each commodity you want to add to your platform.

- After you have selected and shown all the desired commodities, click the “OK” button to close the symbols window.

- Now, you can find the added commodities in the Market Watch window on the left side of your MT4 platform. In addition, the Market Watch window displays the available instruments and their current prices.

- You can start trading commodities by selecting an instrument from the Market Watch window and executing trades based on your analysis and trading strategy.

By following these steps, you can add all commodities to your MT4 platform, making them visible in the Market Watch window and enabling you to trade them seamlessly.

Commodities Trading Tips

Commodity prices are determined by several factors, with demand and supply being the most fundamental. Here are some of the key influences:

- Supply and Demand: Basic economic principles guide commodity prices. When demand for a commodity increases or supply decreases, the price usually goes up, and vice versa. For instance, if the global demand for gold rises or gold mining decreases, the price of gold will likely increase.

- Geopolitical Events: Political instability, war, or changes in government policies can significantly impact commodity prices. This is particularly true for commodities like oil and gas concentrated in politically volatile regions.

- Natural Disasters: Events like hurricanes, floods, or droughts can influence commodity prices by impacting production. For instance, drought can impact grain prices, while hurricanes can disrupt oil drilling and refining.

- Inflation and the Value of the U.S. Dollar: Commodities are typically priced in U.S. dollars on the global market. Therefore, the strength of the U.S. dollar can significantly influence commodity prices. If the dollar weakens, commodities become cheaper for other countries, increasing demand and prices. Conversely, a stronger dollar can make commodities more expensive for other countries, potentially decreasing demand and lowering prices.

- Technological Innovations: Breakthroughs in technology can impact commodity prices by making production more efficient or by creating new uses for a commodity.

Therefore, if you trade commodities, always monitor the U.S. dollar index and gather seasonal information about commodities. Usually, commodity prices are inversely correlated with the U.S. dollar index.

Now, about trading gold and its relationship to the U.S. dollar:

Gold is considered a safe-haven asset and a hedge against inflation. This means that in times of economic uncertainty or when inflation is expected to rise, demand for gold often increases, increasing its price.

When it comes to the relationship between thU.S.US dollar and gold, they typically have an inverse relationship. This is because a weakeU.S.US dollar makes gold cheaper for investors holding other currencies. This increases the demand for gold, which drives up its price. Therefore, a weak dollar usually signals a bullish trend for gold.

If you like to trade gold, closely monitoring the U.S. dollar’s value is crucial. You can do this by keeping an eye on the US Dollar Index (DXY), which measures the value of the US dollar against a basket of foreign currencies.

It would help if you also considered other factors that may impact the price of gold, including geopolitical events, overall market sentiment, inflation rates, and central bank policies. Finally, remember that while historical patterns and economic indicators can provide valuable insights, they do not guarantee future price movements. Therefore, always use prudent risk management strategies when trading gold.

Please read our article to learn how to add indices to MT4.