Table of Contents

Gross Domestic Product (GDP) is one of the most critical indicators for a country’s economic performance. The term Advance GDP (Gross Domestic Product) Q/Q refers to the preliminary estimate of a country’s economic growth on a quarter-over-quarter basis. Released by statistical agencies such as the U.S. Bureau of Economic Analysis (BEA), the Advance GDP report provides an early snapshot of economic health, typically one month after the quarter ends. This initial report can significantly impact investor sentiment in financial markets, influencing everything from stock prices to currency values.

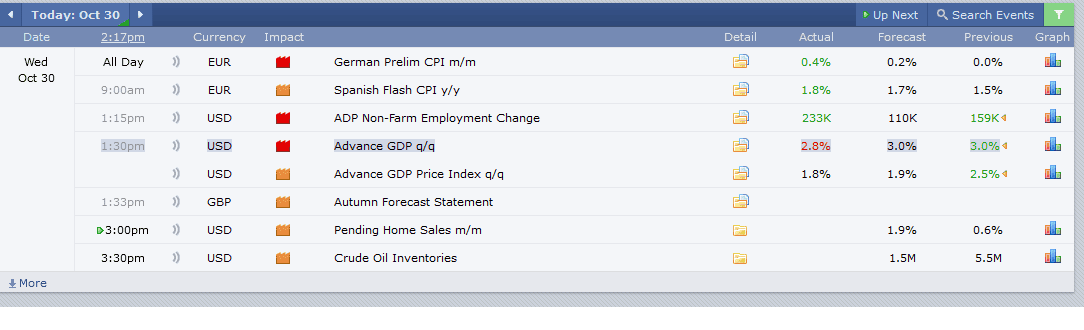

Today’s Advance GDP Q/Q report shows an actual growth rate of 2.8%, which is slightly below the projected growth rate of 3.0% and lower than the previous quarter’s growth rate of 3.0%.

This result suggests that while the economy is still expanding, the pace of growth has slowed a bit more than anticipated. A lower-than-expected GDP growth rate can indicate reduced economic momentum, potentially leading to a cautious response from policymakers and investors who may interpret it as a sign of cooling economic activity. This minor discrepancy can affect market sentiment for traders, possibly leading to volatility in stocks, bonds, and currency markets as participants adjust their expectations for future interest rate policies and economic performance.

This article explores the intricacies of Advance GDP Q/Q, why it is of immense importance, and how traders, investors, and policymakers use this data to make informed decisions.

What is GDP, and why is it measured every quarter?

GDP represents the total monetary value of all goods and services produced within a country’s borders during a specific period. Calculated in three main forms—nominal, Real, and Purchasing Power Parity (PPP)—GDP provides a comprehensive measure of economic activity, reflecting the strength or weakness of a nation’s economy.

Quarter-over-quarter (Q/Q) analysis is one method used to track short-term economic trends by comparing a given quarter’s GDP with the previous quarter’s. This metric is ideal for measuring recent economic shifts and momentum without the seasonal influences that affect annual comparisons.

What is Advance GDP Q/Q?

Advance GDP Q/Q is the first preliminary estimate of a country’s GDP growth for a quarter. Unlike Final GDP, which includes fully revised data, the Advance GDP report is based on incomplete data, with estimations filling in for missing information. While this report provides an early read on economic performance, it is subject to revisions in subsequent GDP reports (Preliminary and Final).

The United States, the Eurozone, and other significant economies publish advanced GDP estimates as part of their regular economic reports, with the U.S. BEA’s report particularly influential in global markets. Released a month after the quarter ends, this report gives a general indication of growth trends and momentum despite being an estimate.

Critical Components of Advance GDP Q/Q

The Advance GDP Q/Q report breaks down GDP by major economic categories, providing insight into the drivers of economic growth. Key components include:

- Consumption Expenditure Measures consumer spending, which often comprises the largest part of GDP. It’s a significant indicator of consumer confidence and economic stability.

- Investment: This category includes business investments in infrastructure, equipment, and inventories, which show corporate sentiment and expansion plans.

- Government Spending: Public sector expenditures, including infrastructure projects, defense spending, and public services, indicate governmental support to the economy.

- Net Exports: Calculated as exports minus imports, net exports reveal the effects of trade balance on the economy and shifts in global demand for a country’s goods and services.

Each component provides insight into a different aspect of economic health, and changes in these categories often guide interpretations of GDP data.

Importance of Advance GDP Q/Q for Economic Analysis

- Predicts Economic Trends: Advance GDP is an initial gauge of a country’s economic growth trajectory, allowing policymakers, investors, and businesses to react to the most recent economic conditions. This initial report is a valuable forecasting tool that helps project growth for upcoming quarters.

- Influences Monetary Policy: Central banks, such as the Federal Reserve, use advanced GDP data to make policy decisions, including interest rate adjustments. For instance, robust GDP growth may prompt tightening monetary policy to prevent overheating, while sluggish growth could lead to stimulus measures to spur economic activity.

- Impacts Business Planning and Forecasting: Companies rely on GDP data to strategize and plan based on expected economic conditions. For example, strong GDP growth may encourage firms to expand operations, while weaker growth may lead to a more conservative approach.

- Signals Potential for Employment Trends: Since GDP growth is correlated with employment levels, advanced GDP can foreshadow job market trends. Faster economic growth is typically associated with increased hiring, while slower growth may signal a potential slowdown in employment rates.

- Global Market Impact: Countries with major economies, like the United States, have advanced GDP reports that can affect global markets. For instance, robust U.S. advanced GDP growth might boost global stocks and lead to an appreciation in the U.S. dollar, as investors expect higher interest rates.

How Advance GDP Q/Q Influences Financial Markets

- Stock Market: A higher-than-expected GDP growth rate typically boosts investor confidence, leading to a rise in stock prices, especially in growth-sensitive sectors like consumer goods and technology. Conversely, a weaker GDP can result in a bearish market sentiment.

- Currency Market (Forex): The GDP report can significantly impact forex markets, as solid GDP growth may attract foreign investment, driving up demand for local currency. For example, if the U.S. Advance GDP report shows stronger-than-expected growth, the U.S. dollar often appreciates against other currencies as investors anticipate a possible interest rate hike.

- Bond Market: Bond yields and GDP growth tend to be inversely related. Robust GDP data may lead to rising yields and declining bond prices as investors expect higher interest rates. Weak GDP, conversely, may lead to lower yields and a bond price rally as investors seek safe-haven assets.

- Commodity Markets: The GDP report can also affect commodity prices. Strong economic growth often increases demand for raw materials and energy, resulting in higher commodity prices. Conversely, weak growth can reduce demand, leading to falling commodity prices.

The Impact of Revisions in GDP Reports

Since Advance GDP Q/Q is a preliminary estimate, subsequent reports often revise it. These revisions can significantly lead to significant market reactions if the revised data deviates notably from the Advance GDP. Revisions are categorized as follows:

- Advance Estimate: The initial estimate, based on partial data, often relies on assumptions to fill in missing data.

- Preliminary Estimate: Published approximately one month after the Advance report, the Preliminary Estimate includes additional data and offers a more refined analysis.

- Final Estimate: The most accurate and complete report, released two months after the Advance report, using comprehensive data with minimal estimations.

These updates can lead to market adjustments, as revised GDP estimates may alter economic perceptions, affecting everything from stock prices to central bank policy.

Challenges with Advance GDP Q/Q Data

- Incomplete Data: Advance GDP relies on estimates and incomplete data, making it susceptible to significant revisions. This can sometimes lead to misleading conclusions about economic growth.

- Potential Market Overreaction: Due to its importance, any unexpected deviation in the Advance GDP figure can trigger immediate market reactions, which may later be corrected after revisions.

- Seasonal Adjustments: The quarterly GDP figures are seasonally adjusted, which can complicate interpretations if adjustments don’t accurately reflect seasonal variations.

Key Takeaways for Investors and Traders

- Stay Informed: Advance GDP Q/Q data is essential for short-term market reactions, but traders should also monitor preliminary and final estimates to ensure a complete economic outlook.

- Understand Risk: Volatility around GDP releases can present both risks and opportunities, especially in currency and equity markets.

- Monitor Policy: Central bank responses to GDP reports can influence interest rates, impacting borrowing costs, consumer confidence, and investment strategies.

Conclusion

Advance GDP Q/Q serves as an essential economic indicator for assessing the near-term health of an economy, making it highly influential in financial markets. Although a preliminary measure, Advance GDP provides insights into consumption, investment, government spending, and trade balance, helping shape monetary policy and investment strategies. Despite its limitations, such as reliance on incomplete data, the Advance GDP report is invaluable for traders, investors, and policymakers seeking to make timely, informed decisions in an ever-evolving economic landscape.