Table of Contents

The current economic state has caused widespread panic among investors, particularly those with a 401k retirement plan. In addition, the stock market’s sudden and sharp decline has prompted many to consider reallocating their investments to protect their savings.

A 401(k) is a type of retirement savings plan that many employers offer. One of the most important decisions you’ll need to make when you start contributing to a 401(k) plan is allocating your investments among the available options.

How to Allocate 401k During Recession?

Using the Asset Class Allocation methodology, you can allocate 401K during the Recession. Your main goal is to decrease the percentage of stocks and indices in your portfolio and increase the rate of bonds and precious metals.

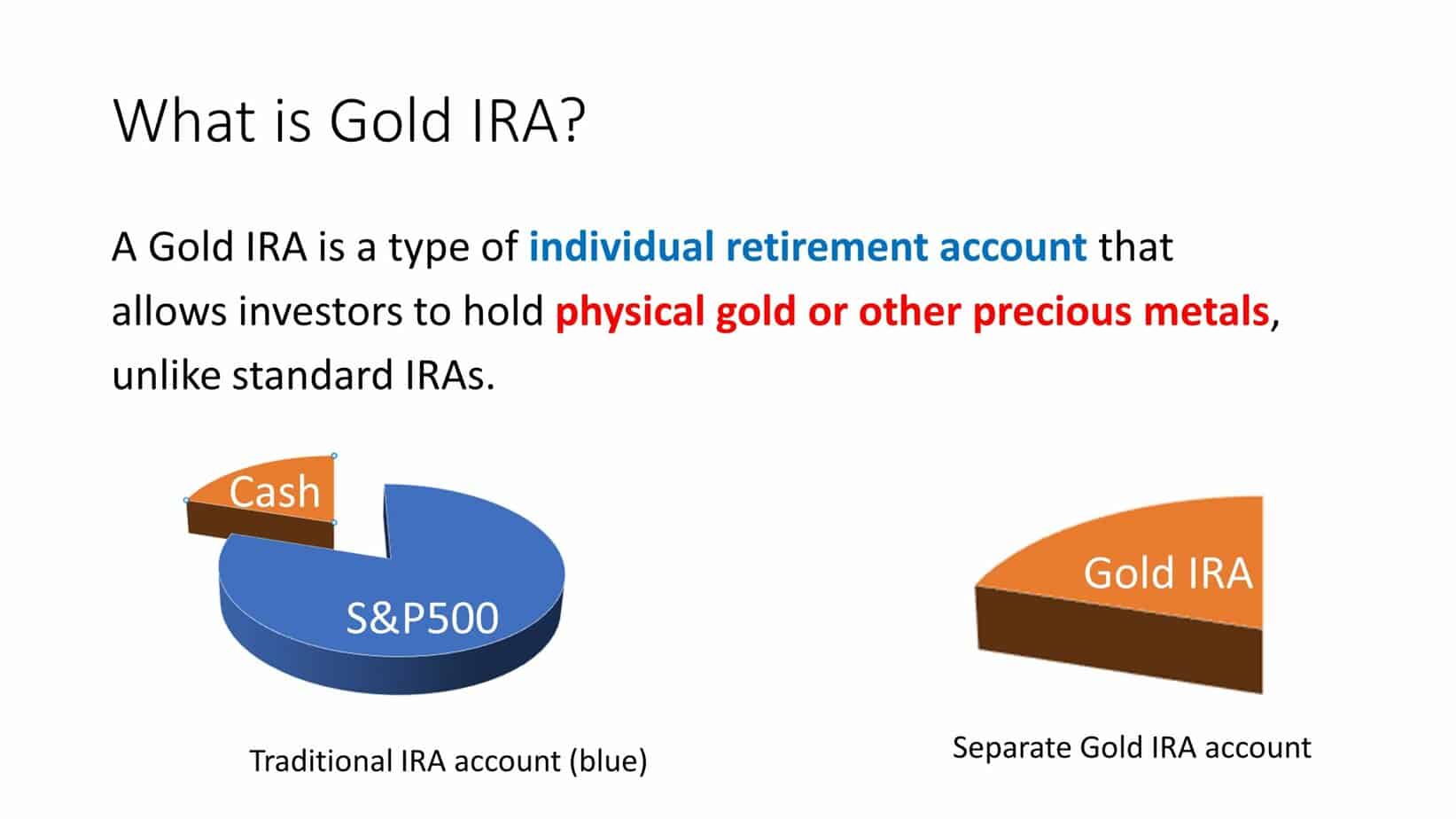

For example, you can try Gold IRA asset allocation.

GET GOLD IRA GUIDEFor example, if you have 55 years and 1 million dollars in your 401K portfolio, you can allocate 10% up to 15% into Gold IRA like in the image below:

In theory, there are four common 401(k) allocation methods:

- Age-Based Allocation: This is a popular method for allocating your investments based on age. When you’re younger, you may want to take more risks with your investments to allocate more of your funds to stocks. As you get older and closer to retirement, you may want to take fewer risks so that you may allocate more funds to bonds or other conservative investments.

- Risk Tolerance Allocation: This method involves allocating your investments based on risk tolerance. If you’re comfortable taking risks, you may allocate more funds to stocks. If you’re risk-averse, you may allocate more funds to bonds or other conservative investments.

- Asset Class Allocation: This method involves allocating your investments among different asset classes, such as stocks, bonds, and cash. You may give a certain percentage of your funds to each asset class based on your investment goals and risk tolerance.

- Target-Date Funds: These funds automatically adjust your investments based on your target retirement date. As you get closer to retirement, the fund automatically adjusts your assets to become more conservative.

It’s important to note that there is no one-size-fits-all allocation method. Instead, your allocation strategy should be based on your goals, risk tolerance, and investment timeframe. It’s also good to periodically review and adjust your allocation strategy to ensure it remains aligned with your goals and changing circumstances.

While the temptation to make drastic changes to your 401k may seem logical, it’s essential to approach any decisions with caution, as creating the wrong choices could significantly impact your future. In this article, we’ll delve into how to allocate your 401k during a recession, providing you with the knowledge and tools you need to make informed decisions.

Understand Your Risk Tolerance

Before you consider reallocating your 401k in the midst of a recession, it’s crucial to understand your risk tolerance. Of course, the level of risk you’re willing to take is subjective and depends on your investment goals and stage in life.

- Your risk tolerance is your ability and willingness to take on investment risk in exchange for potentially higher returns.

- Understanding your risk tolerance is essential in determining how to allocate your 401(k) investments.

- Factors affecting your risk tolerance include age, investment goals, financial situation, and overall attitude toward risk.

- If you’re comfortable taking on more risk, you may allocate more of your 401(k) investments to stocks or other higher-risk assets.

- If you’re more risk-averse, you may allocate more of your 401(k) investments to bonds or other lower-risk assets.

- It’s essential to strike a balance between risk and return that aligns with your circumstances and goals.

- Regularly balancing your 401(k) portfolio can help you stay aligned with your risk tolerance and investment goals.

- Finally, it’s worth noting that risk tolerance can change over time, so it’s a good idea to reassess your risk tolerance periodically to ensure that your 401(k) investments remain aligned with your overall financial plan.

Generally, the younger you are, the more risk you can take on, as you have time to ride out the fluctuation of the market. On the other hand, if you’re closer to retirement, it makes sense to be more conservative with your investments to protect your savings.

Review Your Portfolio

The next step is to evaluate your portfolio to ensure it aligns with your risk tolerance and investment goals. During a recession, some sectors will perform better than others. For example, consumer staples, healthcare, and utilities generally hold up better during a downturn.

- Review your investment objectives: Before reviewing your 401(k) portfolio, it’s important to remind yourself of your investment objectives and overall financial plan.

- Check your asset allocation: Make sure your portfolio is still appropriately allocated among different asset classes, such as stocks, bonds, and cash, based on your goals and risk tolerance.

- Review individual investments: Look at each investment in your portfolio and assess how it’s performing relative to its benchmark and the market as a whole. Consider expense ratios, historical performance, and current market trends.

- Rebalance if necessary: If your portfolio has strayed from your desired asset allocation, consider rebalancing to align with your goals.

- Consider your contributions: Assess whether your current contribution rate is sufficient to meet your retirement goals. If not, consider increasing your contributions.

- Evaluate fees: Check the costs associated with your investments, such as expense ratios and administrative fees, to ensure they are reasonable and not eating into your returns.

- Review beneficiary designations: Confirm that your beneficiary designations are current and accurately reflect your wishes.

- Please seek professional advice: Consult with a financial advisor or planner to review your 401(k) portfolio and ensure it aligns with your overall financial plan.

Moreover, your asset allocation should reflect your goals and risk tolerance. Typically, a diversified portfolio is the best option to minimize risk, and it should include a mix of stocks, bonds, and other assets. Consider spreading your investments across various stocks and bonds rather than putting all your eggs in one basket.

Consider Rebalancing Your Portfolio

Rebalancing your portfolio during a recession might help you exploit market fluctuations. In addition, if your asset allocation has strayed from your target, rebalancing can restore it to the appropriate level.

- Determine your target asset allocation: Before you can rebalance your portfolio, you need to know your target asset allocation. This mix of stocks, bonds, and other assets you want in your portfolio is based on your goals and risk tolerance.

- Review your current asset allocation to see if it aligns with your target. For example, if some asset classes have grown more than others, your portfolio may be over or under-weighted in certain areas.

- Identify which investments to buy or sell: Based on your desired asset allocation, identify which investments you need to buy or sell to bring your portfolio back in line with your target. For example, if your target is 60% of stocks and your current allocation is 70%, you may need to sell some stocks and buy more bonds to reach your target.

- Consider tax implications: Remember that selling investments can trigger capital gains taxes. Therefore, if you have investments with significant gains, you may want to consider a tax-efficient strategy for rebalancing.

- Set a rebalancing schedule: Decide how often you want to rebalance your portfolio. For example, some investors do it quarterly, while others do it annually or as needed. Setting a schedule can help you stay on track with your investment strategy.

- Automate the process: Many 401(k) plans offer automatic rebalancing features. You can set your portfolio to rebalance automatically regularly, saving time and ensuring your portfolio stays on track.

- Stay disciplined: Rebalancing can be emotional, especially when markets are volatile. So it’s crucial to stay disciplined and stick to your long-term investment strategy, even when short-term market movements tempt you to make changes.

Rebalancing your portfolio often involves selling some assets that have performed well and buying ones that have underperformed. This strategy helps maintain your targeted allocation while taking advantage of market fluctuations in cost.

Think Long-Term

During recessions, the stock market might incur significant losses. However, stock market crashes, corrections are relatively common occurrences, and the market often recovers eventually. Thus, it’s essential to maintain a long-term perspective and not make panic-stricken decisions that hurt your future.

In conclusion, it’s crucial to approach reallocating your 401k during a recession with care and caution. Before making significant changes to your investments, take time to understand your risk tolerance, review your portfolio, and consider rebalancing it to align with your investment goals. Furthermore, with the help of a financial advisor, it’s possible to develop a long-term investment strategy that will buffer you against economic shocks and set you on the path toward a secure future.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE