Table of Contents

Alpari, a well-established name in the forex brokerage industry, has provided traders with a wide range of financial services since 1998. Alpari has a significant global presence with several international offices and caters to many traders, from beginners to professionals. This review will delve into the platform’s features, trading conditions, security measures, customer support, and more to evaluate Alpari comprehensively as a forex broker.

Alpari Security and Regulation

Alpari International operates under the corporate name Exinity Limited in the Republic of Mauritius, with “Alpari International” being the trade name used for business operations.

- Regulatory Body: Alpari International is overseen by Mauritius’s Financial Services Commission (FSC). The FSC is the integrated regulator for Mauritius’s non-banking financial services and global business sectors. Its role includes protecting financial services consumers and maintaining Mauritius’ reputation and integrity as a financial center.

- License: Alpari International is fully licensed by the FSC under license number C113012295. Holding this license means Alpari International must adhere to various standards and regulations to protect traders, including maintaining sufficient liquid capital to cover all client deposits and handling client funds per legal requirements.

- Codes: The provided codes FS-4.1 and SEC-2.1B indicate the company’s scope of operation under FSC regulation; each code refers to a specific category of financial service the company is authorized to offer.

Regulation ensures that Alpari maintains high ethical standards and transparency in its business operations and provides security for its clients’ investments. However, traders must always understand that trading carries risks and should only invest what they can afford to lose.

Alpari Trading Platforms and Tools

Alpari primarily offers two widely-used trading platforms – MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Many traders worldwide favor MT4 due to its user-friendly interface, variety of trading tools, and support for automated trading through Expert Advisors (EAs). It provides traders with rich resources, including numerous technical indicators, an extensive back-testing environment, and advanced charting capabilities.

In contrast, MT5 is a more advanced and feature-rich platform. It includes different timeframes, more technical and fundamental analysis tools, an economic calendar, improved order management capabilities, and the ability to trade a more comprehensive array of financial instruments.

Alpari also offers the Alpari CopyTrade platform, a social trading service where traders can copy the trades of experienced ‘Strategy Managers’, potentially accelerating their learning curve and helping them capitalize on the experience of successful traders.

Alpari Facts

- Alpari is a forex broker with a minimum deposit requirement of USD 100 for standard accounts.

- They charge a commission on selected accounts only.

- Alpari offers spreads from as low as 1.2 pips.

- They provide leverage from 1:1000, one of the highest in the industry.

- Order execution on Alpari is instant.

- Alpari includes a stop-out feature to limit losses.

- The forex broker is regulated by the Financial Services Commission (FSC).

- Alpari supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

- Crypto trading is available on Alpari.

- The broker provides 48 total currency pairs for trading.

- Alpari offers an Islamic account for traders following the Muslim faith.

- The company is known for low trading fees.

- Account activation time after registration is typically within 24 hours.

- Alpari does not provide a sign-up, welcome, or no-deposit bonus.

- The broker offers four account types: Standard, Micro, ECN, and Pro.

- Minimum deposit requirements vary depending on the account type: $100 for Standard, $5 for Micro, $500 for ECN, and $25,000 for Pro accounts.

- The account currency can be USD, EUR, GBP, or NGN across all account types.

- Leverage varies based on the account type, with fixed and floating leverage rate options.

- The commission is charged only on ECN accounts at a USD 1.5 lot per side.

- Spreads vary by account type, starting from 0.4 for ECN and Pro accounts and going up to 1.7 for Micro accounts.

- Each account type has a different margin call percentage, ranging from 50% for Micro accounts to 120% for Pro accounts.

- Swap-free options are available on all account types for MT4 but not for MT5 on ECN and Pro accounts.

Alpari Payment Methods

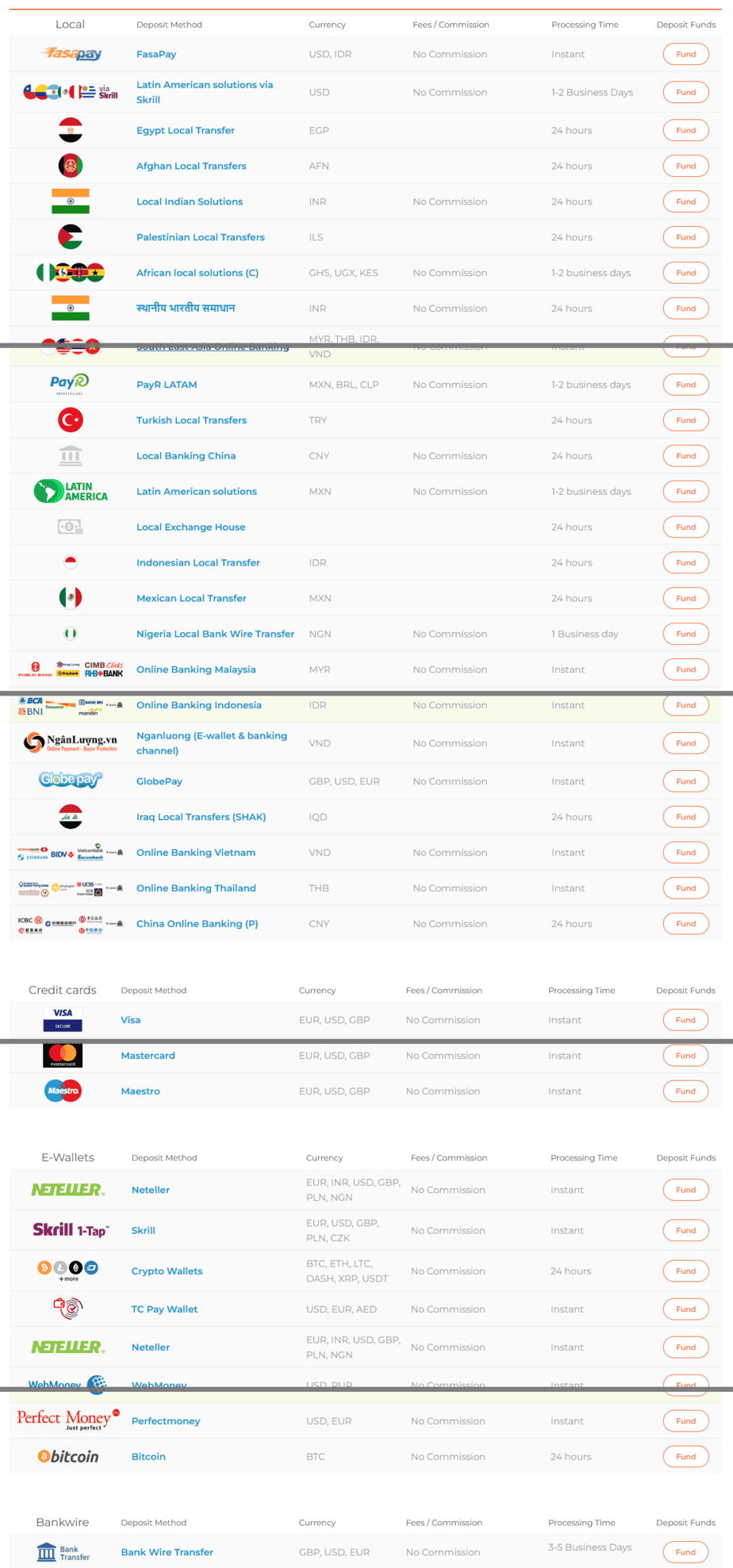

Alpari, a globally recognized forex broker, boasts a broad spectrum of payment methods tailored to meet the unique needs of traders worldwide. Whether in Latin America, Southeast Asia, Africa, or anywhere else, you can easily fund your Alpari account using local or international deposit methods, credit cards, e-wallets, or bank wire transfers. Let’s delve into Alpari’s payment ecosystem:

Local Deposit Methods

With a strong presence in various parts of the world, Alpari has embedded several local deposit methods into its platform:

- Instant Transfers: For traders in the USA, Indonesia, Malaysia, or Vietnam, Alpari provides immediate deposit options with FasaPay and South East Asia Online Banking. There’s no commission, and the transfers are processed instantly.

- 24-hour Transfers: Alpari facilitates 24-hour local transfers for countries such as Egypt, Afghanistan, India, Palestine, Iraq, Turkey, Indonesia, Mexico, and China.

- 1-2 Business Days: For Latin American and African traders, Alpari provides local solutions via Skrill and local African solutions (C), respectively, with no commission and a 1-2 business days processing time. Similarly, PayU LATAM and other Latin American solutions provide the same service in 1-2 business days for currencies like MXN, BRL, and CLP.

Credit Cards

For global traders seeking convenience, Alpari accepts credit card payments. With Visa, MasterCard, and Maestro Card options, traders can deposit in EUR, USD, or GBP without commission. The processing is instant, making it an excellent choice for traders who need quick access to trading funds.

E-Wallets

Alpari supports various e-wallets, a popular and convenient method for online transactions:

- Instant Transfers: Alpari accepts Neteller, Skrill, TC Pay Wallet, WebMoney, and Perfectmoney for instant transfers with no commission. They support a range of currencies, including EUR, INR, USD, GBP, PLN, NGN, RUR, and EUR.

- Crypto Wallets and Bitcoin: For crypto enthusiasts, Alpari also accepts deposits via Crypto Wallets and Bitcoin. It supports a variety of cryptocurrencies, including BTC, ETH, LTC, DASH, XRP, and USDT. While there’s no commission, the processing time may take up to 24 hours.

Bank Wire Transfer

Alpari also accommodates traditional bank wire transfers. This option supports GBP, USD, and EUR currencies. While this method has no commission, the processing time is longer, typically 3 to 5 business days.

In conclusion, Alpari’s multifaceted payment methods showcase the platform’s commitment to providing flexible, cost-effective, and convenient options to global traders. This range of payment options empowers traders to choose a deposit method that fits their location and preferences, enabling them to focus more on making profitable trades. As always, traders should consider the processing time and choose a deposit method that aligns with their trading plan and strategy.

Alpari Advantages

- Variety of Account Types: Alpari offers multiple account types to cater to the unique needs of different traders. These include Pro, Standard, Micro, and ECN accounts with varying initial deposit requirements, spreads, commissions, and leverage.

- Affordable Minimum Deposit: The minimum deposit requirement for starting trading ranges from as low as $5 (or ? 1,000) for a Standard account, making trading accessible to many.

- Competitive Spreads: Alpari provides competitive spreads starting from as low as 0.4 pips (Micro and ECN accounts), potentially allowing traders to increase their profitability.

- Commission-Free Trading: Alpari offers commission-free trading on selected accounts (Pro, Standard, and ECN accounts), which can lower the cost of trading.

- High Leverage: Alpari provides high leverage up to 1:1000 (Pro and Micro accounts), enabling traders to control more prominent positions with less capital. Remember, while high leverage can magnify profits, it can also increase the risk of significant losses.

- Instant Order Execution: Alpari provides instant order execution, ensuring traders can enter and exit trades efficiently, which is crucial in the fast-paced forex market.

Alpari Trading Conditions

- Minimum Deposit: Alpari has varying minimum deposits depending on the account type. For Standard accounts, the minimum deposit is $100. This decreases to $5 for Micro accounts, which is quite attractive for beginners. However, for ECN and Pro accounts, the minimum deposits, including r, respectively, and $25,000, cater more to professional or experienced traders.

- Commission: Commissions are not charged on all account types. The ECN account is designed for more advanced traders with USD 1.5s, a commission of USD 1.5 lot per side.

- Spreads: The broker offers competitive spreads starting from 1.2 pips for Standard accounts. Micro accounts have slightly higher spreads starting from 1.7 pips. However, the ECN and Pro accounts benefit from even tighter spreads starting from just 0.4 pips.

- Leverage: Alpari provides significant leverage for traders, which can maximize potential profits. The leverage starts from 1:1000 for Standard and ECN accounts, 1:400 for Micro accounts (fixed), and 1:300 (floating) for Pro accounts.

- Trading Platforms: Alpari supports the widely used MT4 and MT5 trading platforms, which provide advanced charting tools, indicators, and automated trading capaBesidesto Trading: In addition to forex, Alpari allows trading in cryptocurrencies, expanding the asset options for traders.

- Swap-Free Accounts: Alpari caters to Muslim traders by providing Islamic accounts that comply with Sharia law. These accounts are available for all types except MT5 on ECN and Pro accounts.

- Margin Call: The broker has varying margin call levels depending on the account type. For Micro accounts, the level is 50%. For Standard accounts, it’s 60%; for ECN accounts, it’s 100%; for Pro accounts, it rises to 120%.

- Trading Fees: Alpari is known for its low trading fees, making it affordable for traders who complete the registration process. After completing the registration process, Alpari typically activates accounts within 24 hours.

- Bonuses: Unlike some brokers, Alpari doesn’t offer a deposit, welcome, or no deposit bonus. This factor may be considered by traders comparing brokers based on promotional offers.

- Regulation: Alpari is regulated by the Financial Services ComC), providing traders with trust and security.

Alpari offers a range of trading accounts, including Nano, Standard, and ECN, each with unique trading conditions suitable for different trader requirements.

Nano accounts are ideal for beginners, with no minimum deposit requirement and smaller contract sizes. On the other hand, standard accounts offer tight spreads and a reasonable minimum deposit requirement, making them a good fit for intermediate traders.

Detailed Account Features:

- Pro Account: WiUSD 1.5itial deposit of $100 (or $20000), offers spreads starting at 1.2 pips, no commission, and high leverage up to 1:1000.

- Standard Account: This account requires an initial deposit of $5 (or ? 1 000), offers spreads starting from 1.7 pips, no commission, and leverage up to 1:400.

- Micro Account: With an initial deposit of $500 (or $ 20,000), users get low spreads starting from 0.4 pips, a commission of $1.5 per lot per side, and high leverage up to 1:1000.

- ECN Account: This account requires a significant initial deposit of $ 25,000 but offers low spreads starting from 0.4 pips, no commission, and leverage up to 1:300.

ECN accounts offer tight spBesidessmission per trade and are designed for advanced traders seeking fast trade execution and the ability to trade directly with liquidity providers.

Alpari also offers maximum leverage of up to 1:1000, one of the highest in the industry. While high leverage can increase profit potential, it’s important to remember that it can also significantly increase risk.

Alpari offers a substantial range of tradable assets, including over 60 currency pairs, precious metals, commodities, indices, and cryptocurrencies. This diversity allows traders to spread risk across different markets and asset classes.

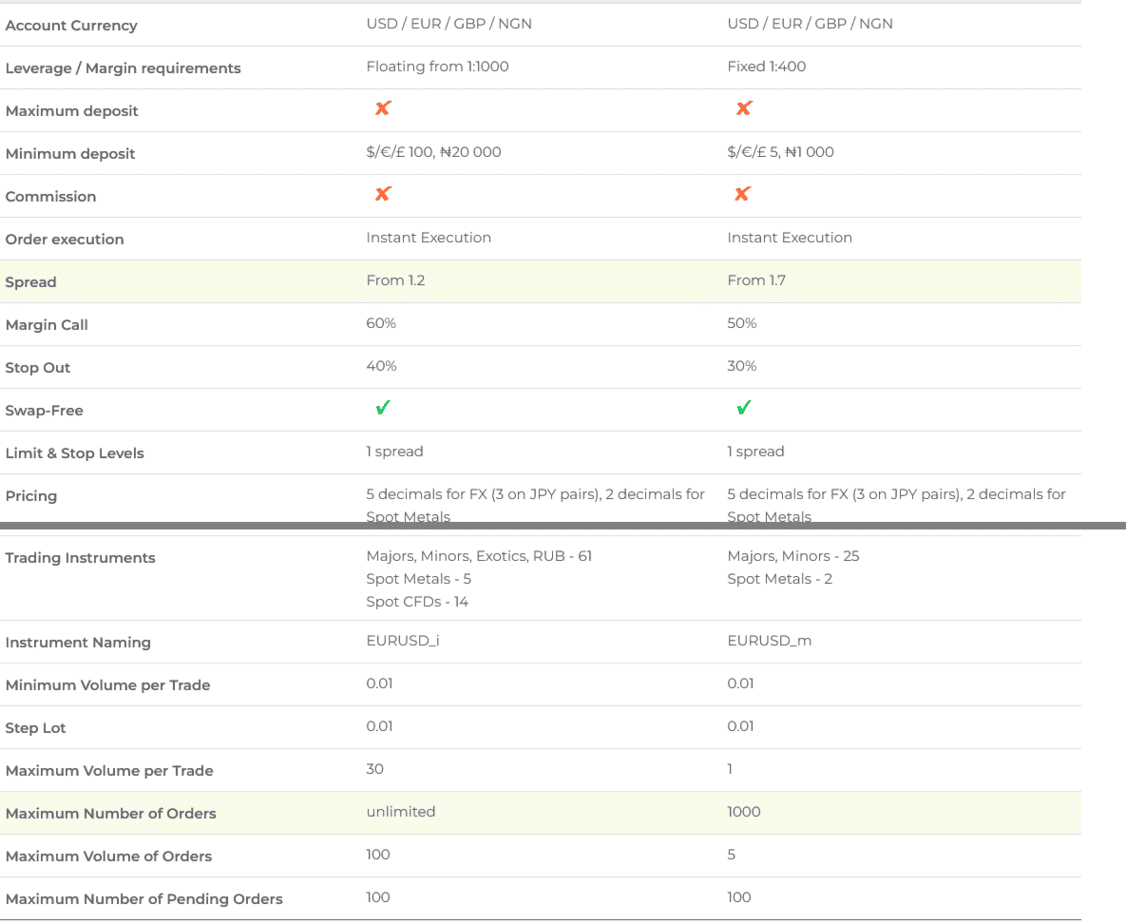

Alpari Standard Account vs. Alpari Micro Account

Forex Standard Account, MT4

- Account Currency: The account can be maintained in several currencies, including USD, EUR, GBP, and NGN.

- Leverage / Margin Requirements: Floating from 1:1000, offering potentially higher leverage but with increased risk.

- Minimum Deposit: The minimum deposit is higher, starting at $/€/£ 100, or $20,000 in Nigerian currency.

- Spread: Lower spread starting from 1.2.

- Margin Call / Stop Out: A higher level of equity is required before the margin call and stop out, set at 60% and 40%, respectively.

- Trading Instruments: This section provides more trading options, including majors, minors, exotics, and RUB, with 61 total options, as well as spot metals (5) and spot CFDs (14).

- Instrument Naming: Instruments are indicated with an “_i” suffix (e.g., EURUSD_i).

- Maximum Volume per Trade: Allows larger trade volumes of up to 30 lots.

- Maximum Number of Orders and Volume: Offers complete orders with a maximum volume of orders set at 100.

- Maximum Number of Pending Orders: Allows for up to 100 pending orders.

Forex Micro Account, MT4

- Account Currency: Similar to the Standard account, it can be maintained in USD, EUR, GBP, and NGN.

- Leverage / Margin Requirements: Fixed at 1:400, lower than the Standard account.

- Minimum Deposit: This is a lower barrier to entry, with a minimum deposit starting at $/€/£ 5, or $1 000 for Nigerian currency.

- Spread: Higher spread starting from 1.7.

- Margin Call / Stop Out: Lower equity levels are required before a margin call and stop out, set at 50% and 30%, respectively.

- Trading Instruments: There are fewer options for trading compared to the Standard account, with majors and minors totaling 25 and spot metals (2).

- Instrument Naming: Instruments are indicated with an “_m” suffix (e.g., EURUSD_m).

- Maximum Volume per Trade: Allows smaller trade volumes of up to 1 lot.

- Maximum Number of Orders and Volume: The limit is 1000 orders, with a maximum volume of orders set at 5.

- Maximum Number of Pending Orders: Similar to the Standard account, it allows up to 100 pending orders.

Alpari Customer Support

Customer support is a crucial aspect of Alpari’s services. Here’s what they offer:

- Availability: Alpari provides customer support 24 hours a day, five days a week. This means that traders can get help whenever the markets are open.

- Multilingual Support: To cater to its global customer base, Alpari offers support in multiple languages, making it easier for non-English speakers to get the help they need.

- Contact Methods: Customers can reach Alpari’s support team through various channels such as email, telephone, live chat, and even a call-back service. This makes it convenient for customers to choose the method they prefer.

- Quality of Support: Alpari’s customer service team is renowned for being responsive, knowledgeable, and professional. This means that customers can expect accurate and helpful answers to their queries.

Conclusion

Alpari has built a solid reputation over two decades of operation. The broker offers a range of account types, a wide variety of tradable assets, and flexible trading conditions. The comprehensive educational resources and responsive customer support make it a viable option for new and experienced traders.

However, it’s important to remember that trading with high leverage carries significant risk. Additionally, while Alpari has regulatory oversight, potential traders should understand the implications of trading with a broker regulated in a jurisdiction with less stringent regulatory standards.

In conclusion, Alpari offers a robust forex trading experience, but as with any investment, potential traders should carefully evaluate their risk tolerance and conduct due diligence before getting started.

Visit best forex brokers: