Table of Contents

Amazon’s stock, listed under the “AMZN” ticker symbol, has been among the most successful stocks in recent years. The company was founded in 1994, and its initial public offering (IPO) was in 1997. Since then, the stock has grown incredibly, increasing in value by more than 20,000% over the past two decades.

One reason for Amazon’s success is its relentless focus on innovation and customer satisfaction, which has led to the company dominating the e-commerce industry. Another factor is Amazon’s diverse portfolio of businesses, including cloud computing, advertising, and streaming media services.

Despite its meteoric rise, Amazon’s stock has experienced significant volatility over the years, with occasional drops of more than 10% or 20%. However, investors who held onto the stock through these downturns have been richly rewarded, as Amazon’s stock price has consistently rebounded to new heights.

Amazon’s stock price today USD chart

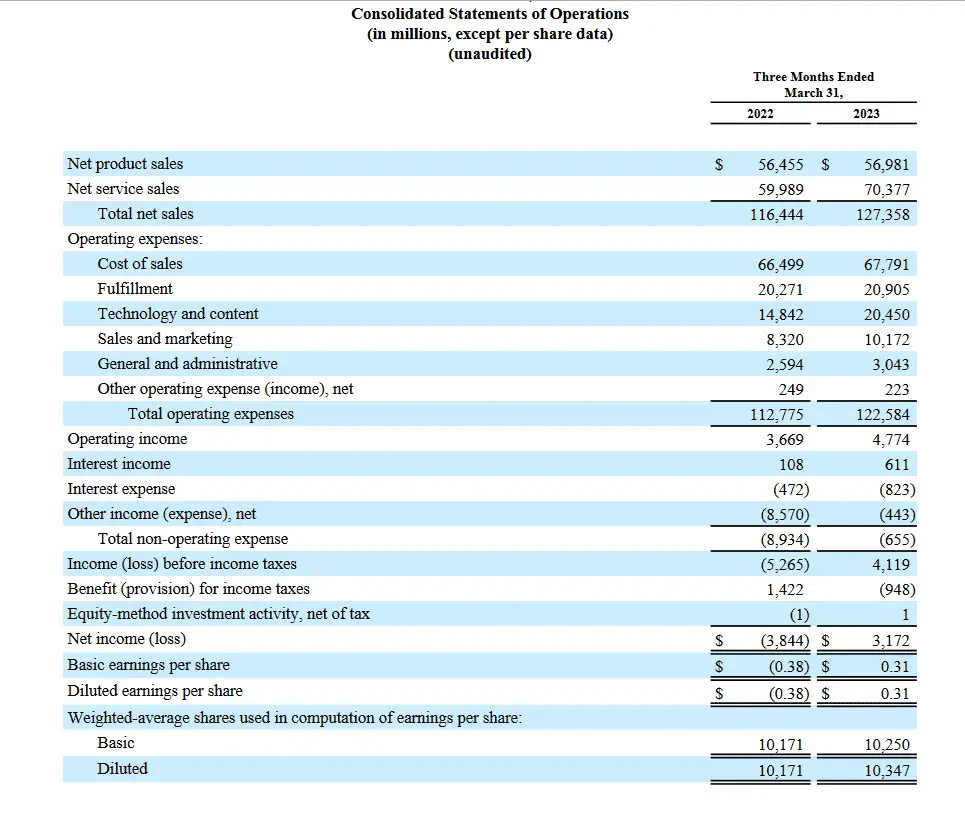

Amazon stocks fundamentals 2023

Amazon Stock Forecast 2030

Based on Amazon’s 1997-2023 forecast using the CAGR method, Amazon’s stock price prediction for 2030 is $333 (end of the year). The price of Amazon stock has excellent growth potential in 2030. However, after the first dramatic growth, Amazon will have an average growth percentage of around 12% (50% above average S&P500) in the next six years.

Based on the CAGR calculation, the Compound Annual Growth Rate for Amazon’s stock price from 2024 to 2030 is approximately 11.97%. This aligns closely with the forecasted average growth percentage of around 12%, indicating a robust growth trajectory for Amazon’s stock over this period. This growth rate significantly exceeds the average performance of the S&P 500, showcasing Amazon’s strong growth potential and positive outlook for the future.

Amazon has been a significant player in the e-commerce and technology industries, and its stock price has shown remarkable growth in the past few years. However, it is essential to note that stock price prediction is subject to various uncertainties and external factors that could significantly impact the stock price in the long term.

One of the main factors that will impact Amazon’s stock price in 2030 is the company’s growth potential. Amazon has excellent growth potential in 2030 due to the increasing popularity of e-commerce and the growth of the technology industry. In addition, the company has invested heavily in its cloud computing division and expanded into new markets such as healthcare and home security. If Amazon continues to experience growth in these areas, it is reasonable to predict that the stock price will continue to rise.

However, after the first dramatic growth, Amazon’s stock price may experience an average growth percentage, which will follow the S&P500 growth. In addition, the market is susceptible to uncertainties and external factors that could impact the stock price. For example, global events such as pandemics, natural disasters, or political instability could affect Amazon’s stock price. Changes in government policies, regulations, or tax laws could also affect the company’s stock price.

Furthermore, Amazon’s competition in the e-commerce and technology industries could evolve, impacting the company’s stock price. New competitors could enter the market, or existing competitors could innovate and disrupt the market. The company’s ability to stay ahead of the competition and continue to innovate will be a critical factor in determining its stock price in 2030.

Amazon Price Prediction 2030 Methodology

The Compound Annual Growth Rate (CAGR) is a way to measure how much an investment grows annually, assuming the growth happens at a steady rate. This is particularly useful when looking at a stock price, which can increase daily.

To figure out the CAGR, you take the value of the stock at the end of your investment period and divide it by what it was worth at the start. Then, you raise this result to the power of one divided by the number of years you held the investment. Finally, you subtract one from this number. The idea is to see the average annual growth rate if the stock grows consistently, even though stock prices fluctuate constantly.

Using CAGR for stocks helps investors get a clearer picture of how a stock has done over time, smoothing out all the volatility and giving you a single growth rate that’s easier to understand and compare. It tells you, “If my stock grew at the same rate yearly, this is how much that growth would be.” This makes it a handy tool for comparing the performance of different investments over the same period, even if they had very different paths of ups and downs.

Assuming that Amazon will continue to experience growth in revenue and earnings and maintain a manageable level of debt, it is reasonable to predict that the stock price will continue to rise in the long term. Economic indicators such as GDP growth, inflation, and interest rates will also play a role in determining the stock price.

Using a hybrid model that combines ARIMA, support vector machines regression, and Random forest, it is possible to cure both linear and nonlinear relationships in the data and handle improving the static nature of stock prices. The ensemble method can also help to reduce the impact of any individual model’s weakness. Still, the biases lead to improved accuracy and reliability.

Conclusion

The forecast using the CAGR method from 1997 to 2023 suggests that Amazon’s stock price could reach $333 by the end of 2030, indicating a strong growth trajectory. This prediction underscores Amazon’s potential to maintain an impressive growth momentum into the future. With an expected average growth rate of around 12% over the next six years, Amazon is poised to significantly outperform the average S&P 500 growth, highlighting its robust market position. The anticipated growth reflects confidence in Amazon’s ability to innovate and expand in a dynamic market environment. Overall, this forecast points to Amazon’s stock as a potentially lucrative investment, with the company continuing to build on its historical success.