Precious metals, such as gold, silver, and platinum, have been traded on the global markets for centuries. They are seen as a store of value and a haven asset during economic and political uncertainty. As such, many investors have sought to diversify their portfolios by investing in precious metals. But are they a commodity? We must first define what “commodity” means to answer this question.

Are Precious Metals a Commodity?

Yes, precious metals such as gold, silver, and platinum are considered commodities because they are raw materials that can be bought and sold in standardized forms. However, like other commodities, their value is determined by supply and demand in the global market.

For example, stocks and currency pairs are not considered commodities because they do not have a physical form and are not raw materials that can be bought and sold in standardized units.

Precious metals are used for various purposes, such as jewelry, industrial applications, and investment. Their unique properties, such as high conductivity and resistance to corrosion, make them highly desirable and valuable. Furthermore, the prices of precious metals are subject to fluctuations based on market conditions and economic factors such as inflation, interest rates, and political instability. As such, they are traded on commodity exchanges worldwide, just like other commodities such as oil, wheat, and coffee.

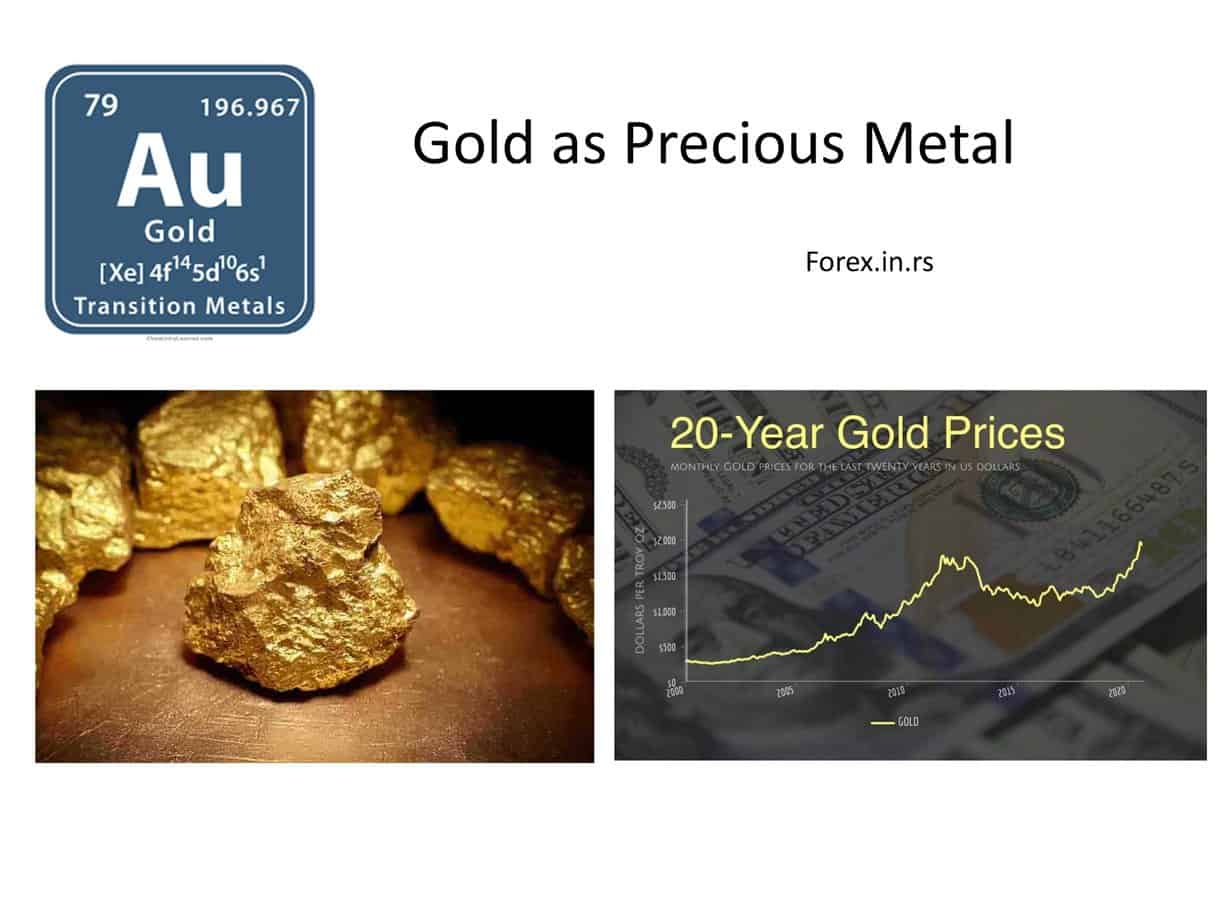

Gold as precious metal:

- Highly valued precious metal with unique physical properties

- Used in jewelry, investment, and industrial applications

- Limited supply, with most gold being held as reserves or in jewelry

- Prices influenced by global economic conditions, inflation, and geopolitical factors

- Highly liquid, with active trading on commodity exchanges

A commodity is any good or service that can be bought or sold at a market price. This includes agricultural products, energy sources like oil and gas, and metals like gold and silver. Precious metals qualify as commodities because they can be bought or sold at market prices. Additionally, these metals can be refined into coins or bars for ownership and exchange purposes. Therefore, it is accurate to say that precious metals are commodities like other commonly-traded assets are considered commodities.

In addition to being commodities, precious metals also share specific characteristics with other things. For instance, all commodities tend to move with the overall supply and demand direction in the global marketplace. When there is an increase in demand for precious metals due to investors seeking an alternative investment option during turbulent economic times, their prices tend to rise accordingly. On the other hand, when supply increases due to large-scale mining projects or new forms of technology which make it easier to refine gold or silver from ore deposits, prices may drop significantly over time as people sell off their holdings to take advantage of any profits made on investments before costs increase further down the line.

Another characteristic shared between many commodities is that their prices can be affected by external factors such as weather patterns and geopolitical events. For example, extreme weather events can interrupt the production of essential agricultural products like corn or wheat. At the same time, political instability in areas where significant resources are mined may lead investors away from buying those resources until the situation stabilizes again.

Similarly with gold or silver bullion – if there is unrest in countries where these metals are mined en masse, then this could affect demand levels among investors looking for safety from turbulence elsewhere in global financial markets leading to changes in pricing accordingly depending on how quickly production levels return following any disruption caused by external factors beyond anyone’s control.

Finally, it should also be noted that unlike stocks or bonds, which largely depend upon individual company performance for their performance over time–precious metals typically behave independently from the traditional stock market activities–so often, when stock markets plummet due to bearish news–investors will flock towards gold & silver investments as safe havens which helps protect them against losses incurred elsewhere within their portfolio mix making them much less risky than other standard long term investments options available today!

In summary, precious metals are considered commodities because they are raw materials with standardized forms bought and sold in the global market. Their prices are subject to supply and demand and other market conditions.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: