Table of Contents

Most people who save for retirement do so to achieve financial stability and reassurance that their money will be there when they need it.

Because they believe gold is a reliable and stable investment, several investors seek the best gold IRA corporations. These companies may be able to assist you in acquiring gold for your IRA and maintaining its holdings, preserving the security of your retirement assets.

Augusta Precious Metals is among the most reputable businesses in this trade, and they provide a comprehensive series of amenities to the people who do business with them. After looking at their services and what they offer, I will explain why Augusta Precious Metals suits your requirements.

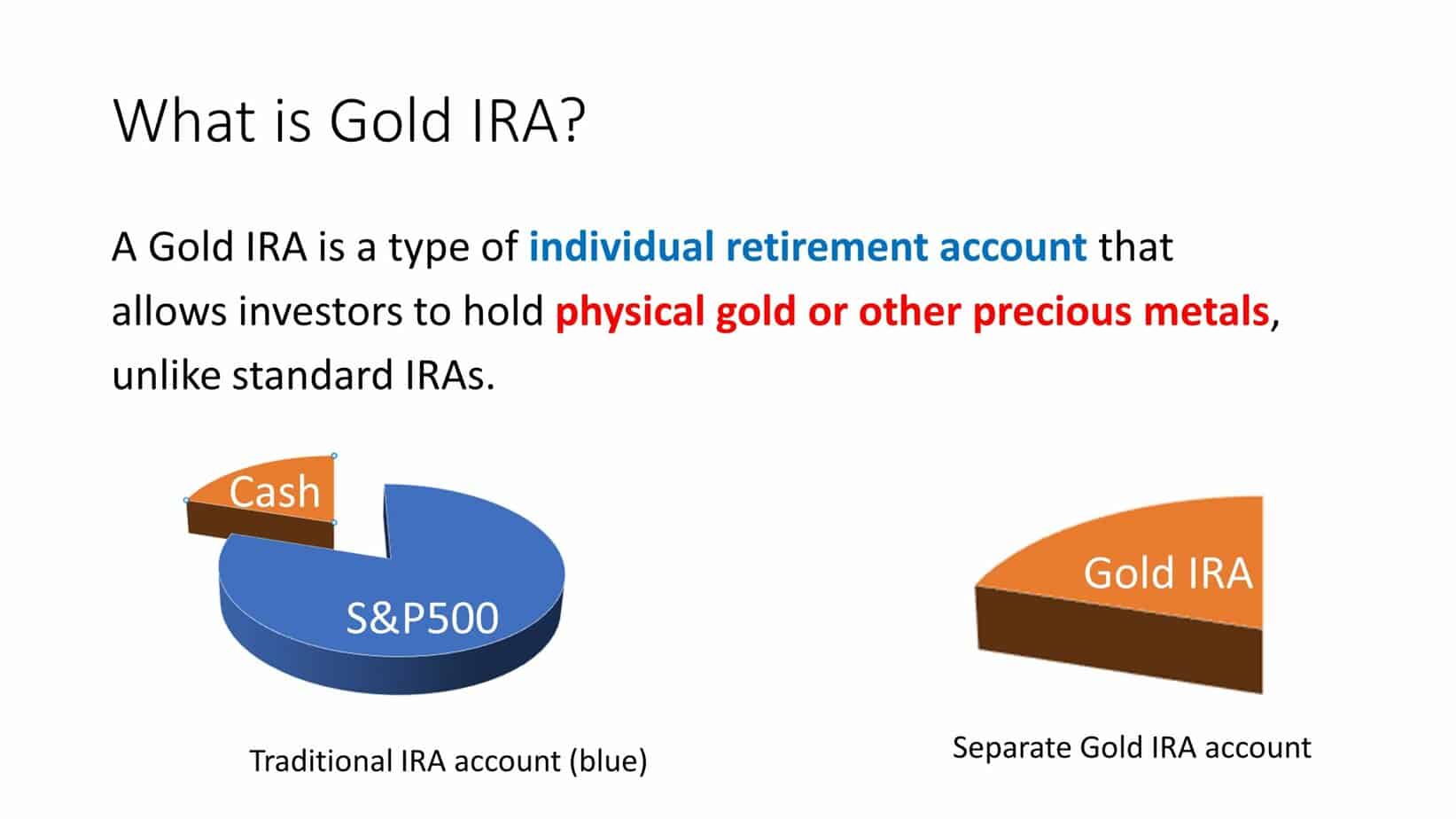

What is a Gold IRA?

Gold IRAs are specialized individual retirement accounts that allow investors to hold gold as a qualified retirement investment. They offer diversification for your investment and protection from potential recessions.

(Read our article What is Gold IRA? to learn more about this topic.)

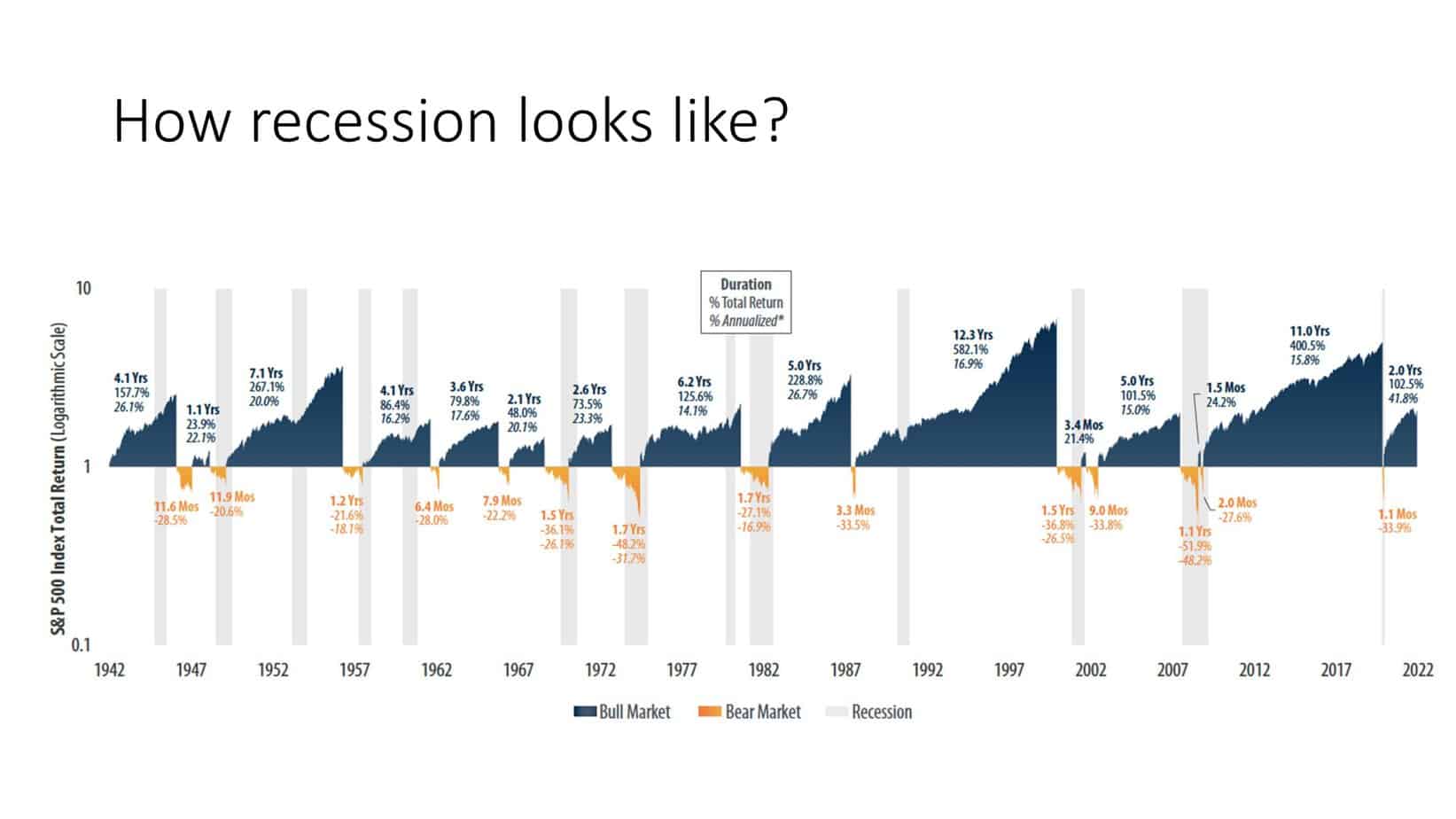

During the recession, the S&P500 index price went down. Because of that, investors diversify their portfolios.

If you want to learn practical examples of protecting 401K using IRA gold rebalancing, read our article.

Let us see a practical example:

When the stock market is in a bullish trend, everything is fine. Retirement funds compounded over the years. However, the market is expected to go into recession every 10-20 years. Usually, a typical recession starts with inflation. Inflation is a price rise when we can spot a decline in purchasing power over time.

Then, governments increase the interest rate, and the U.S. dollar becomes more robust. But usually, the whole industry slows down.

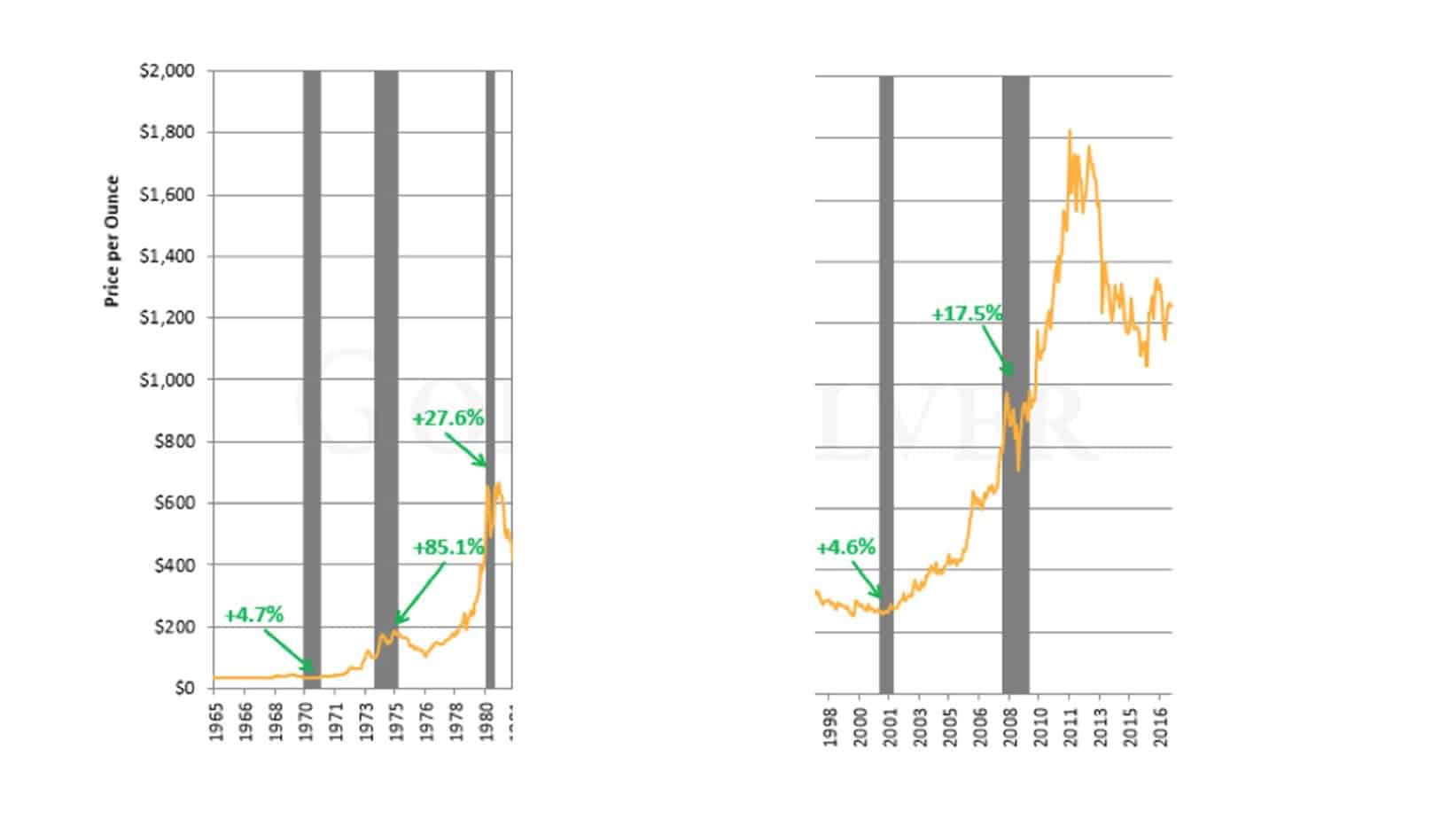

Usually, in most cases in the last 100 years, gold and precious metals went bullish during the recession:

Recession history shows substantial precious metals price increases:

A recent example of a gold price increase was during the last crisis, 2008-2012. During the previous crisis, gold prices increased by 27.4% in 2010 and 32.8% in 2011.

U.S. residents can invest in a Roth IRA or Gold IRA to protect assets from recession or diversify their portfolios.

What is Augusta Precious Metals?

Augusta Precious Metals is a company offering specialized individual retirement accounts that allow investors to hold gold as a qualified retirement investment. Augusta helps retirement savers diversify their savings with gold and silver, thereby gaining and protecting their assets.

Where is Augusta Precious Metals located?

Augusta Precious Metals, a precious metal IRA dealer, is in the United States in Augusta, Georgia.

The company’s excellent attention to the needs of its clients and the caliber of its sales reps have earned it a solid reputation in the Greater Los Angeles region. It is projected that Augusta Precious Metals has 97 workers and makes a yearly revenue of $18.7 million for the gold and silver bullion trade.

They focus on serving the individual retirement account (IRA) market for gold and silver. However, you are free to purchase on your behalf. Augusta Precious Metals has a variety of gold and silver bullion coins, including the American Gold Eagle. Silver Eagles are also available.

People who love collecting may purchase gold and silver bullion goods, such as evidence and excellent uncirculated coins. These items are available for purchase. As a precious metals company and an IRA provider, they are proud of the “high-touch” service they provide to customers.

Clients and potential investors are strongly urged to regularly meet with the company’s trades and purchaser facility groups to learn about holding gold and silver bullion in their retirement accounts (IRAs).

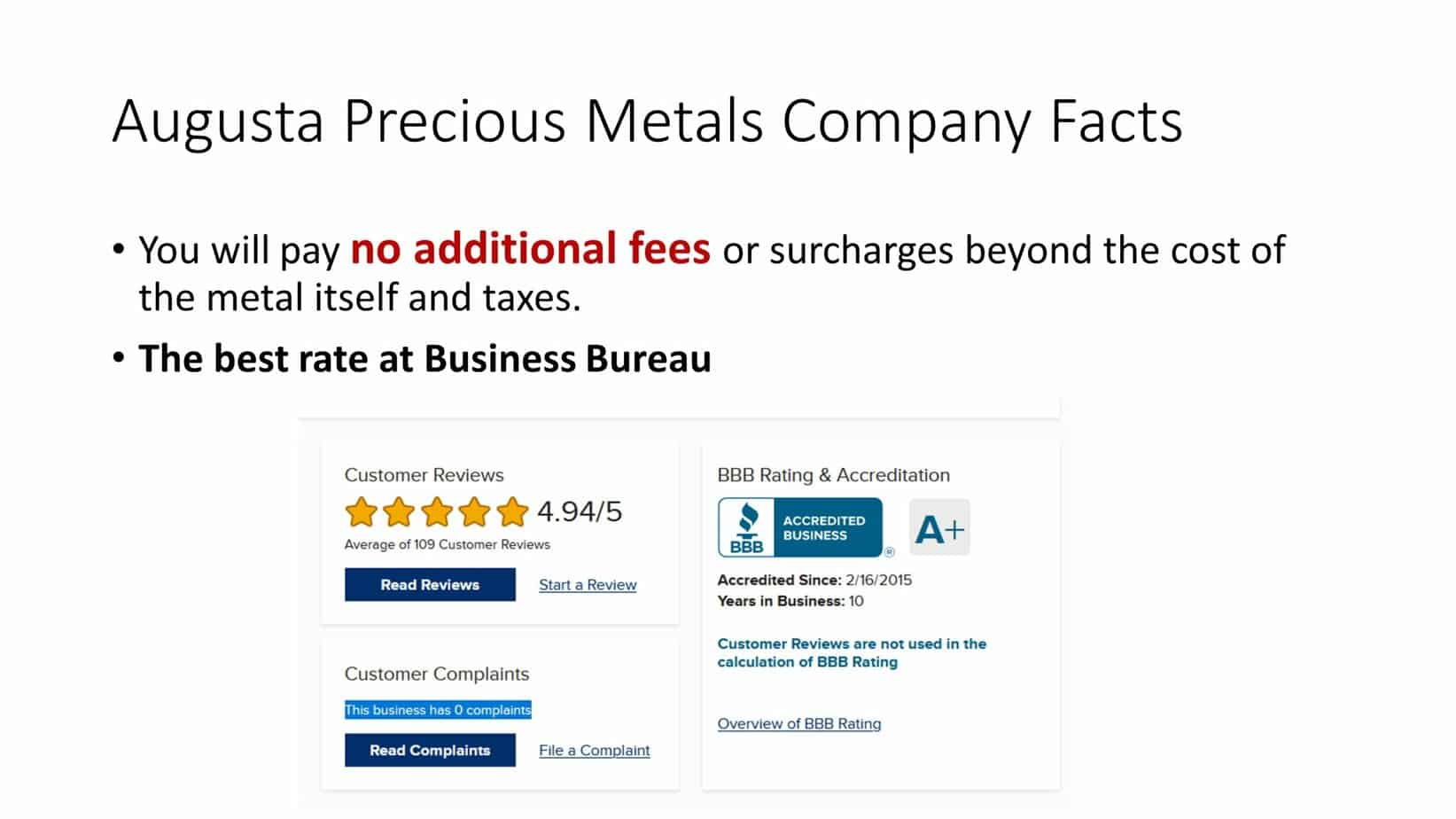

As this article was written, the Better Business Bureau has not received a solitary objection about Augusta Precious Metals (June 2023). Augusta does not charge any secreted dues or charges, making it an excellent choice for customers who wish to buy real silver and gold at low prices compared to other vendors.

Investing in gold and silver and the method for rolling over a gold IRA may be complex, and it may be challenging to determine where to turn for assistance.

Who owns Augusta Precious Metals?

Isaac Nuriani owns Augusta Precious Metals company. Isaac Nuriani is Augusta’s founder and CEO. He studied economics at the University of California Los Angeles. Intending to help individuals branch out their superannuation precious metals portfolios by financing in genuine silver and gold, he launched his firm back in 2012. Nuriani is a significant player in the precious metals sector.

He participates in the National Ethics Association and the Industry Council for Tangible Assets (ICTA) and is a PCGS-certified coin dealer. Devlyn Steele, a seasoned financial sector professional, assists Nuriani as the company’s Director of Education.

Steele has a long history of working in the investment and analytics industries. He specializes in alternative asset classes and participates in the Harvard Business Analytics Program. Augusta devotes a lot of resources to educating investors.

Customer service and command counter workers are urged to spend many intervals with clients to ensure they realize the benefits and hazards of investing in precious metals and the complete process.

Numerous reviewers have praised the professionalism of the sales and customer support professionals they encountered on various reputable online review sites. Augusta has a no-objections BBB track record extending back over the years, and this time commitment sets Augusta apart from many rivals.

Augusta Precious Metals’ advantages over the competition

Augusta Precious Metals offers a few benefits over contending gold IRA providers, even though not everyone is a good candidate for their services.

We can see zero complaints if we analyze Augusta Precious Metals BBB complaints on the Business Bureau website (screenshot below). Augusta works with individuals, and having such a reasonable rate in the precious metals business is incredible.

- Individualized learning experiences

They give a one-on-one online conference for new investors to understand better whether investing in actual gold and silver is a wise investment for them.

The online conference directly resulted in customers’ comprehensive understanding of the course quality and the particulars of the transfer or delivery procedure.

2. Augusta does not charge additional hidden costs

Companies that act as custodians and depositories for gold IRAs often charge customers storage fees and an uncertain once-a-year charge; however, the company does not impose any further costs.

Purchase gold, not for an individual retirement account but for private use, and accept personal delivery. You won’t be subject to any extra charges regarding the metal’s price and applicable taxes.

Even the delivery is often free of charge.

3. Augusta Gold IRA price is reasonable.

Investors who can afford the minimum investment of $50,000 often find Augusta Precious Metals an excellent value.

Even though it is a gold miner, purchasing it is not necessarily the most cost-effective choice. However, for the majority of investors, this level of investment is considered to be relatively competitive.

If you visit their website, you can get a free copy of Augusta’s conductor to gold IRAs and learn about alternative methods of investing in actual gold and precious metals.

Gold IRA advantages

- Process Improvement.

Each of Augusta’s clients is provided with the assistance of a specialist account representative for their business relationship with the company. This representative is available to the client at all times. As a direct consequence, investing is made more accessible, and transactions are completed with less friction.

IRA handling is simplified since customers do not have to interact with several different account agents while rolling over their accounts or receiving distributions.

- A storage facility for audio and video recordings.

Under Devlyn Steele’s direction, Augusta has invested significantly in an extensive video library of educational content, which may be viewed via the company’s website. Gold is a desirable commodity, but why should you invest your money in it? Investors are interested in purchasing precious metals such as silver, gold, platinum, and palladium for several reasons.

• Defense counter to price rises via diversification

• Confidentiality

Let’s take a more in-depth look at every single one of them, shall we?

- Gold IRA as a Diversification Tool

Gold and silver have an extensive history of preserving value in periods of ambiguity and calamity. This trend has continued throughout history. Gold and other precious metals have increased in worth during fiscal or administrative instability and significant stock market value reductions. However, this is not always the case.

Gold and other precious metals should make up a portion of your investment portfolio to protect yourself against potential losses if the global economy experiences a calamity. Inflation is another aspect that you should take into account.

More than ninety percent of the dollar’s purchasing influence has been eroded since the Central Backup was first formed in 1913. The dollar’s worth has slowly decreased for the past century; meanwhile, the head of state, Nixon, abolished gold stock in 1972. The process has also been significantly sped up by out-of-control fiscal practices, such as spending over what is available and producing a tremendous amount of new money.

- Gold IRA as protection against inflation.

According to the Bureau of Labor Statistics, inflation is expected to hit its highest point since 1982 by the beginning of 2023. The Consumer Price Index (CPI) grew to 10.2% in 2023 Q1.

If current trends continue, the dollar’s purchasing power will be halved every decade. Throughout a 25-year retirement, your rise-accustomed stepping-down income from sources other than Social Security might drop by 75% if you do not have inflation protection.

Investing in actual gold may safeguard your retirement income against inflation. Inflation is a cancerous tumor that slowly eats away at your financial stability. Gold, silver, platinum, and palladium may alleviate some of your worries about inflation if you want to retire for a long time.

- Privacy.

Nobody desires to recognize that you have gold or silver bullion, and no third party must keep a record of your possessions.

No bank or government organization can freeze or confiscate physical gold. Profits from the sale of a business are still subject to resource advance dues. However, you don’t have to register your gold coins or bullion in any other database.

No online search can uncover this plethora of information for a trial lawyer. Physical bullion is one of the few retirement investments you may hold fully anonymously.

In the case of a gold IRA, anonymity isn’t guaranteed: Your precious metals IRA defender will be aware of your gold and silver holdings. Your transactions will be reported to the IRS annually through 1099.

Your assets, on the other hand, will be completely safe. Gold and silver IRAs, on the other hand, provide excellent asset protection. Customary and Roth IRAs, except inherited IRAs, are protected against creditors’ claims.

Augusta is different

Augusta Precious Metals distinguishes itself in the gold IRA industry through its unique approach and values, emphasizing customer education, service, and long-term relationships. Here are eight sentences explaining why Augusta is different:

- Industry Commitment: Augusta Precious Metals demonstrates a deep commitment to its clients, aiming to be the best in the industry by offering comprehensive support in diversifying retirement savings with gold and silver.

- Dedicated Team: Every Augusta team member is focused on assisting customers with gold and silver investments, ensuring personalized and knowledgeable service.

- Streamlined Process: The company simplifies the purchasing process for its customers, assisting with product selection, paperwork, and an overall streamlined buying experience.

- Transparency and Integrity: Augusta values transparency and integrity, distinguishing itself from others in the industry by being open and honest in all its dealings.

- Educational Resources: Led by a Harvard-trained economic analyst, their education department provides valuable insights on how gold and silver IRAs can enhance savings and act as a hedge in economic transitions.

- Long-Term Support: Unlike some companies that view customers as one-time transactions, Augusta focuses on long-term relationships, offering ongoing support and guidance.

- Comprehensive Assistance: Augusta helps customers not only with initial purchases but also with understanding precious metals, adding to holdings over time, managing distributions, and building a legacy for their families.

- Customer-Centric Service: Augusta Precious Metals prioritizes its clients’ needs, always being available to answer questions and provide professional service. This makes it a reliable partner for long-term wealth diversification.

Can a self-directed IRA hold gold coins?

Yes, you can hold gold coins in your self-directed IRA. The IRS accepts various assets, including gold, silver, platinum, and palladium bullion bars and premium coins that fulfill certain purity and provenance specifications.

Platinum and palladium must both be at least a 999 percent fine. Silver should be at least a 999% fine (save for American Eagle coins). A refiner, assayer, or national mint must be NYMEX or COMEX-certified to provide the metals in the types of bullion (not just coin collection).

What’s the Purpose of a Precious Metals Individual Retirement Account?

Investing in gold, silver, platinum, and palladium bullion bars and coins that fulfill the IRS’s strict fineness and provenance requirements is entirely legal. Platinum and palladium must be at least 999 % fine (except Gold American Eagle coins), and silver must be at least 999% fine (save for American Eagle coins).

As with any conventional IRA, you may profit from owning actual bullion in an independent IRA account. Tax-deferred growth is the norm for gold IRA assets. You are subject to taxation only when you withdraw the money from the account and pay taxes on it at regular income rates. Depending on your financial status and income, you may be able to deduct contributions to a conventional IRA from your taxable income. Starting at 72, you must take the required minimum distributions, meaning you’ll have to pay taxes on your money.

Can you put metals in a Roth IRA?

Yes, you can invest in metals using your self-directed Roth IRA. You can use your IRA Roth to invest in tangible assets such as gold, silver, art, antiques, collectibles, and even real estate. If you choose, your IRA assets may rise without the tax for the rest of your life and your partner’s life.

This has the potential to be a considerable duty value. You must keep your Roth IRA assets for at least five years to qualify for the tax benefits.

Augusta Precious Metals’ fees

Augusta’s gold and silver bullion coins are estimated to be 5 percent above the company’s cost. Generally speaking, Augusta does not charge a markup on profit-sharing from current clients.

Augusta Precious Metals customers benefit because they may sell their metals to Augusta Precious Metals for a higher price than they can obtain from another dealer that recompenses general charges instead of spot pricing.

An Individual Retirement Account for Gold or Silver with Augusta Precious Metals. Retirement investors may possess various IRA assets, thanks to IRS permissions. Life insurance and collectibles are not allowed investments in an IRA, and you can’t take physical ownership of your IRA’s gold and silver bullion.

It would help if you had an IRS-approved custodian to store actual gold coins or other precious metals in a due-honored retirement plan like an IRA or Solo 401(k). Some retirement account custodians aren’t equipped to handle precious metals.

The vast majority of these companies are only able to store paper assets. Shares, bonds, joint reserves, exchange-traded funds, certificates of deposit, money fair accounts, and annuities are all examples of investments.

This is deliberate on their part. Trading in securities and earning a commission on sales are the primary sources of revenue for conventional warehouses, safety agent traders, and new economical amenities firms. They don’t profit from the sale of gold or silver coins. As a result, they’d prefer not to bring up the subject of possessing gold or silver bars.

Ask a typical broker or adviser about gold and precious metals, and they will likely attempt to offer you an ETF, common shares, and reserves in a gold withdrawal company. Gold and precious metals are excellent ways to diversify your investment portfolio.

Even if you acquire and hold actual gold in your designation or an independent retirement proposal, they don’t want to tell you how simple it is to accomplish. And they won’t carry out the deal for you if they already know about it. A new account with a gold IRA supplier must be set up for you.

Adding new money to an IRA account

By 2022, married couples filing jointly can invest a combined total of $13,000 in Roth and standard IRA accounts, with a single IRA contribution limit of $6,500.

A “catch-up” payment of $500 is available to taxpayers over 50. A $50,000 minimum purchase for Augusta Precious Metals is a lot for a year’s investment in an IRA. However, high-earners could finance their own fixed 401(k)s or SEP IRAs with that money.

Instead of the fifty thousand dollars for most minor assets, you may designate up to $6,500 in precious metals to your Individual Retirement Account (IRA) ($13,000 for spouses, excluding “catch-up” contributions).

You should never accept physical delivery regarding gold coins, silver coins, bullion, or any other resources you want to store in a retirement proposal or retirement account.

Gold IRA rollover steps

You may also make a Gold IRA rollover from a qualified retirement account, which is the second choice. Said, this is a three-step procedure:

- Open an IRA account.

Make sure your custodian supports self-directed retirement plans by opening an IRA account.

In the self-directed IRA market, Augusta Precious Metals often collaborates with Equity Trust, a well-known and established company.

- The account must be funded.

If you have some money in your current IRA, 401(k), or other qualifying account, a direct trustee-to-trustee rollover is an option. In other words, you may sign a paper allowing money to be transferred from your old retirement account to your new IRA.

You may have the money sent to your private account as an alternative to receiving a cheque or a wire transfer from your former employer. Afterward, you’ll have 60 days to deposit the funds into your new Individual Retirement Account (IRA).

The IRS will assess taxes and penalties if it determines that the transfer was, in fact, a distribution after sixty days. In addition, your previous company will hold back 20 percent of the money you take out and transmit it to the IRS to pay any taxes you may owe.

However, you also must deposit all the money you have removed into your new account. The straight agent-to-agent transfer is the most common method of transfer.

Numerous 401(k) procedures will not allow you to transfer money while employed. In other words, employees cannot take money out of their 401(k)s while still employed.

- Buy gold or silver coins.

You may buy gold and silver for your gold IRA account in minutes. They strive to make the procedure as straightforward, fast, and transparent as possible at Augusta Precious Metals. In a precious metal IRA, you choose the metals and assets you wish to own.

Your account manager at Augusta Precious Metals would be happy to help you plan your approach. Once selected, you’ll provide them with written instructions on buying actual gold or silver bullion in your name at a specified price.

If you want, Augusta can transport or transfer the metals to a safe storage location at no additional fee. Once you’ve approved the transaction, your precious metals will be delivered to the treasury facility in 7 to 10 days. In addition to free gold shipment, Augusta clients do not have to worry about their precious metals being stolen or lost.

Storage of Gold IRAs

Augusta Precious Metals highly recommends Delaware Depository, a gold IRA and precious metals storage company, as one of the industry’s most secure vault providers.

However, there are alternative options available to you. Augusta’s website offers a comprehensive directory of safe and secure alternatives nationwide. Here are the places where you may find these sites:

- Dallas, Texas

- Los Angeles, California

- Springfield Gardens, New York

- Nampa, Idaho

- New Castle, Delaware

- Wilmington, Delaware

- Shiner, Texas

- Las Vegas, Nevada

- South Fargo, North Dakota

- Salt Lake City, Utah

- Bridgewater, Massachusetts

Fees and Minimum Balances

It acquires gold and silver coins from wholesalers and then sells them to customers at retail rates. It makes all of its money from the general selling pricing spread. At the corporate level, there are no yearly fees or extra charges.

On the other hand, Augusta Precise Metals charges a small fee for the custodian of your retirement account (a different firm) and the gold storing capacity or Stock Corporation you select to retain your physical gold and silver coins and bullion in your name.

Fees for Gold IRA storage and guardianship

If you choose Augusta Precious Metals as your custodian for your Gold IRA and Equity Trust as your defender, you may anticipate paying $50 to establish your account.

There is also a yearly cost of $80 for the upholder and a storage fee of $100 for the depository firm holding and protecting the gold. However, you won’t have to pay any storage or custody costs if you buy gold and silver coins in your name rather than in the tag of a superannuation account.

You are only responsible for the bullion’s face value. A $50,000 purchase is required to open a new account. Purchases made with IRA funds, cash, or any grouping may be included in the $50,000.

In the event of a return, there is a buy.

Bullion buyers of gold and silver need to identify how easy it will be to sell their metals in a financial emergency. When it approaches offering a subordinate marketplace for gold and silver bullion, Augusta Precious Metals is one of the top gold IRA firms.

As a universal regulation, Augusta is willing to pay the current price of precious metals for buybacks and swiftly wire the money to your bank account or IRA. Many gold and silver stockholders favor them because of their low repurchase prices.

Transport and Shipping Regulations

In addition to free delivery and shipment insurance, Augusta Precious Metals offers a money-back guarantee. After the customer signs the shipment, they are responsible for theft or damage.

There will be no evidence on the package that the contents are precious metals from Augusta, so you and your house won’t be a target for thieves. Even the postal carrier won’t be able to tell you’re getting gold or silver in the mail.

Reviews of Augusta Precious Metals

Every reliable review source for the gold IRA business has given Augusta an excellent rating. Some of the most popular review sites they have a good track record:

A+ Rating from the BBB

Augusta has a BBB rating of 4.97 out of 5 based on more than 100 reviews, making it one of the finest in the market. Most importantly, according to the Better Business Bureau statistics, no complaints have been filed against the company’s decade-long existence.

The Business Consumer Alliance (BCA)

The Business Consumer Alliance has given Augusta a AAA rating based on 85 analyses.

TrustLink

TrustLink has given Augusta a 5-star ranking based on 279 reviews as of this writing. For many years running, Augusta has surpassed the Top Gold IRA Business rankings for the gold IRA corporation industry.

My Business on Google

This is one of the best-rated precious metals IRAs on GoogleMyBusiness, with an excellent rating centered on 235 assessments. Augusta is a top performer in this area.

Accolades of note

It is a great honor for Augusta Precious Metals to be named the “Best Reliable Gold IRA Corporation in the U.S.” by IRAGoldAdvisor.com, a self-governing gold IRA website.

Several years in a row, TrustLink readers selected them as one of the industry’s top gold IRA providers, naming them to their annual “Best Of” list.

Augusta Precious Metals’ Drawbacks

The city of Augusta has twofold drawbacks that may deter customers:

- Some clients may find $50,000 for most minor stocks prohibitive.

- There is a minimal supply of coinage other than gold and silver bullion. There is no valuable metal that Augusta cannot get. However, it focuses on gold and silver and has no record of palladium or palladium in stock. You may want to explore elsewhere if you are looking for palladium, platinum, or base metal coins.

What Kind of Reputation Does Augusta Precious Metals Have?

If you have at least $50,000 in resources and want to diversify your superannuation or private reserves into metals such as gold and silver bullion, you should consider Augusta Precious Metals. It is an authentic and practical solution.

If you can make the required minimum investment and are interested in retirement savings or precious metals, you should put Augusta Precious Metals at the top of your list of gold firms to contact.

You need to be aware of Gold IRA scams on the internet.

Conclusion

Augusta Precious Metals is a worthy option if you are searching for a company with a proven track record and many satisfied customers.

Even though entering the gold and other precious metals market might be scary, Augusta’s features make the process straightforward. Before making any selections, it is essential to research the facilities of the most significant interest to you and consider how the investments being considered may be suitable for your ongoing economic strategy.