Table of Contents

Social trading platforms for automated trading allow traders to follow and replicate the strategies of successful traders, democratizing access to expert insights. These platforms enhance trading opportunities for beginners by allowing them to mirror the trades of seasoned professionals.

Traders appreciate the transparency and real-time performance data, enabling them to make informed decisions about whom to follow. The automated nature of these platforms ensures that trades are executed swiftly and efficiently, aligning closely with the chosen strategy. Social trading platforms foster a collaborative trading environment where success is shared and accessible to a broader audience.

The best-automated trading platform is HFM COPY because of its tight spreads. All automated signals come from one HFM broker, and traders can choose coping trading positions from conservative to high-risking traders.

Please see my video about platforms:

Let us discuss all these automated trading social platforms.

HFM Copy

HFM offers a copy trading service through its HFcopy platform, enabling traders to follow and replicate the trades of successful Strategy Providers (SPs). Here’s an overview of the conditions and features of the HFcopy platform:

Conditions and Features:

- Account Types:

- HFcopy Account for Followers: This account is designed for traders who want to follow and copy SPs’ strategies. Followers can set their risk parameters and the percentage of capital they wish to allocate to copying each SP.

- HFcopy Account for Strategy Providers: Intended for experienced traders who want to share their strategies and earn performance fees from their followers. SPs can attract followers based on their performance and risk management.

- Minimum Deposit:

- The minimum deposit for followers is generally around $100. For SPs, the minimum deposit is typically higher, starting at $500.

- Performance Fee:

- SPs set a performance fee, which is a percentage of the profits generated for their followers. This fee is only paid if the SP generates a profit for the follower, aligning the interests of both parties.

- Risk Management:

- Followers can customize their risk settings, such as the percentage of their capital allocated to each SP and maximum drawdown limits, providing control over their exposure.

- Transparency:

- The platform provides detailed performance statistics for each SP, including historical performance, drawdown, and risk level. This transparency helps followers make informed decisions about which SPs to follow.

- Automated Trading:

- Once a follower selects an SP, trades are copied automatically in real-time, ensuring that followers benefit from the SP’s trading activity without manual intervention.

- Platform Integration:

- HFcopy is integrated with HotForex’s MetaTrader 4 (MT4) platform, providing a familiar trading environment with advanced charting tools and indicators.

How It Works:

- Choosing a Strategy Provider:

- Followers browse the list of SPs, reviewing their performance metrics and trading styles. They can filter SPs based on profitability, drawdown, and trading frequency criteria.

- Allocating Funds:

- Followers decide how much capital to allocate to each SP. They can diversify by following multiple SPs, spreading their risk across different strategies.

- Automatic Copying:

- Once set up, the HFcopy system replicates the SP’s trades in the follower’s account. This automation ensures that trades are executed promptly and accurately.

- Monitoring Performance:

- Followers can monitor the performance of their copied trades in real time, making adjustments to their allocations or risk settings as needed.

- Paying Performance Fees:

- Performance fees are deducted automatically from the follower’s account based on the profits generated by the SP. These fees are typically paid every month.

Advantages:

- Accessibility: HFcopy makes it easy for novice traders to benefit from the expertise of experienced traders.

- Automation: The platform handles trade execution automatically, freeing followers from the need to monitor the markets constantly.

- Customization: Followers can control risk settings and diversify their investments across multiple SPs.

- Transparency: Detailed performance metrics and historical data help followers make informed decisions.

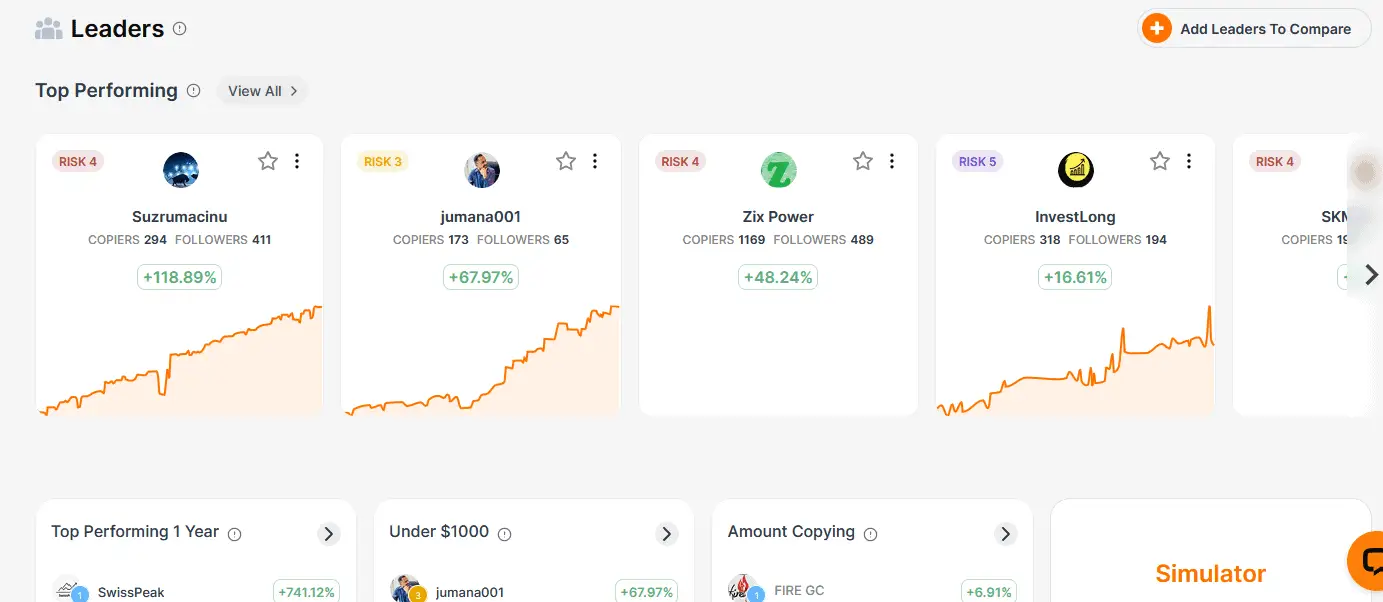

eToro automated social platform

eToro is one of the leading social trading platforms, offering an automated copy trading service called CopyTrader. Here’s an overview of the conditions and features of the eToro CopyTrader platform:

Conditions and Features:

- Account Types:

- Retail Investor Account: Suitable for individual traders looking to follow and copy other successful traders.

- Professional Account: This account is for experienced traders who qualify for professional status under eToro’s criteria. It offers higher leverage and additional features.

- Minimum Deposit:

- The minimum deposit to use eToro’s platform varies by region, but it generally starts at $200. For CopyTrader, the minimum amount to allocate to copy a trader is $200.

- Copy Amount:

- The minimum amount to copy a single trader is $200, and the maximum is $500,000. A follower can copy up to 100 different traders simultaneously.

- Performance Fee:

- Unlike some other platforms, eToro does not charge performance fees. Instead, eToro generates revenue through spreads on trades.

- Risk Management:

- Followers can set Stop Loss and Take Profit levels to manage risk. eToro also offers a feature called Copy Stop Loss (CSL), which allows followers to set a specific value at which copying will stop to protect their investment.

- Transparency:

- eToro provides extensive statistics for each trader, including historical performance, risk score, portfolio composition, and trading style. Followers can also see the number of copiers and the trader’s activity feed.

- Automated Trading:

- Trades are copied automatically in real time. Followers benefit from the duplicate entry and exit points as the traders they follow, ensuring the copying process is seamless and accurate.

- Platform Integration:

- eToro’s platform is web-based and also available as a mobile app. It provides an intuitive interface with advanced charting tools and social features.

How It Works:

- Choosing a Trader to Copy:

- Followers can browse a comprehensive list of traders, filtering by various criteria such as profitability, risk score, and trading style. Detailed profiles and performance metrics help followers make informed choices.

- Allocating Funds:

- Followers decide how much capital to allocate to each trader they wish to copy. They can diversify their investment by copying multiple traders.

- Automatic Copying:

- Once a trader is selected and funds are allocated, the CopyTrader system automatically replicates the trader’s trades in the follower’s account, including opening, managing, and closing trades.

- Monitoring Performance:

- Followers can monitor the performance of their copied trades in real-time. They can adjust their allocation, stop copying a trader, or change risk settings.

- No Additional Fees:

- Followers only pay the spreads on trades. Using the CopyTrader feature does not incur additional performance fees.

Advantages:

- Accessibility: eToro’s platform is user-friendly, making it easy for beginners to copy successful traders.

- Automation: The CopyTrader feature handles trade execution automatically, ensuring followers replicate the exact trades of the traders they follow.

- Diversification: Followers can spread their investment across multiple traders, reducing risk.

- Transparency: Comprehensive performance data and risk metrics allow followers to make informed decisions.

- Community Interaction: eToro’s social features enable followers to interact with traders, ask questions, and gain insights from the community.

Zulutrade Copy Platform

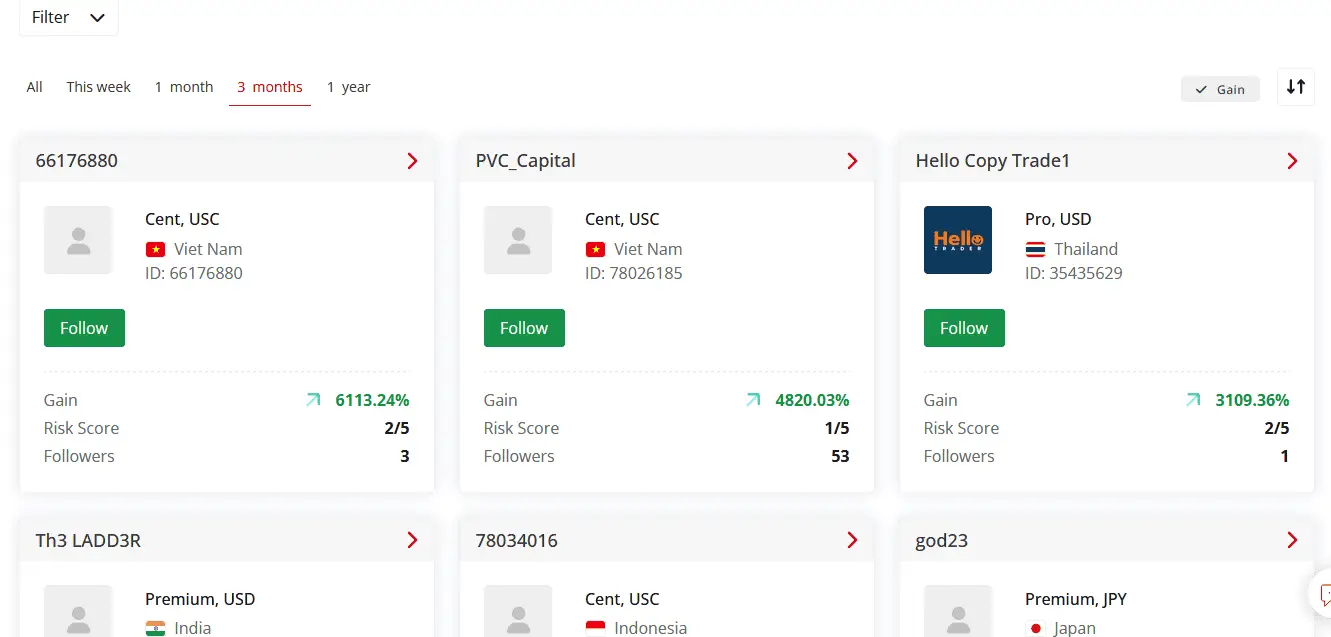

Zulutrade is a popular social trading platform that allows users to automatically copy the trades of professional traders, known as Signal Providers. Here’s a detailed description of the ZuluTrade automated copy signals platform:

Conditions and Features:

- Account Types:

- Classic Account: Suitable for traders who prefer a more traditional trading experience with manual intervention if desired.

- Profit-Sharing Account: This account is ideal for those who want to follow Signal Providers and share a percentage of their profits as a performance fee.

- Minimum Deposit:

- The minimum deposit required to open a ZuluTrade account varies depending on the user’s chosen broker. Typically, it starts at around $300.

- Signal Providers:

- Signal Providers share their trading strategies and signals on the ZuluTrade platform. They earn a commission based on the number of followers and the volume traded.

- Performance Fee:

- In profit-sharing accounts, followers pay a performance fee to signal providers, a percentage of the profits generated. This fee aligns with the interests of both parties, as signal providers are incentivized to perform well.

- Risk Management:

- ZuluTrade offers advanced risk management tools, including ZuluGuard, which protects followers by automatically turning off a Signal Provider’s trading if their strategy becomes too risky.

- Followers can also set stop-loss limits, control their maximum drawdown, and customize their trade size.

- Transparency:

- The platform provides detailed statistics and performance metrics for each Signal Provider, including historical performance, drawdown, risk level, and trading style. Followers can use this data to make informed decisions.

- Automated Trading:

- Trades from Signal Providers are copied automatically in real-time to the follower’s account, ensuring that followers benefit from the same trading opportunities as the Signal Providers.

- Platform Integration:

- ZuluTrade is compatible with multiple brokers and integrates seamlessly with popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

How It Works:

- Choosing a Signal Provider:

- Followers can browse a comprehensive list of Signal Providers, filtering by various criteria such as profitability, risk score, and trading style. Detailed profiles and performance data help followers select the best providers to follow.

- Allocating Funds:

- Followers decide how much capital to allocate to each Signal Provider. By following multiple signal providers, they can diversify their investment.

- Automatic Copying:

- Once a Signal Provider is selected and funds are allocated, the ZuluTrade system replicates the provider’s trades in the follower’s account, including opening, managing, and closing trades.

- Monitoring Performance:

- Followers can monitor the performance of their copied trades in real time through the ZuluTrade dashboard. They can adjust their allocation, stop copying a Signal Provider, or modify risk settings.

- Paying Performance Fees:

- In Profit-Sharing Accounts, performance fees are deducted automatically based on the profits generated by the Signal Provider. These fees are typically paid every month.

Advantages:

- Accessibility: ZuluTrade makes it easy for beginners to benefit from the expertise of experienced traders.

- Automation: The platform handles trade execution automatically, ensuring followers replicate the exact trades of the Signal Providers they follow.

- Diversification: Followers can spread their investment across multiple Signal Providers, reducing risk.

- Transparency: Detailed performance metrics and historical data help followers make informed decisions.

- Risk Management: Advanced tools like ZuluGuard and customizable risk settings give followers control over their investments.

Darwinex

Collective2 automated social platform

Collective2 is designed for the part of your portfolio where you’re willing to take risks and try something new. This innovative platform lets you activate automated trading strategies within your regular brokerage account, offering a hands-off approach to alternative investments.

- Choose from a diverse range of strategies created by various quants, traders, and independent strategists.

- Input your brokerage account number to connect directly, ensuring your funds remain secure within your account.

- Watch trades unfold in your brokerage account, providing unparalleled transparency and control.

With 2,166 trading strategies tracked and 1,310 brokerage accounts using Collective2, the platform offers a vast selection for investors. Collective2 has evaluated 52,486 strategy managers, ensuring that you have access to a wide range of strategies with varied risk and return profiles. Unlike traditional hedge funds, your money never leaves your brokerage account. This unique approach emphasizes security and control over your investments. All results on Collective2 are hypothetical, and while they highlight top-performing strategies, full transparency about successful and unsuccessful strategies is provided.

Explore strategies with impressive returns:

- Systematic_Trader (MNQ combo): +47.1% Annual Return since Dec 08, 2020 (Futures)

- MarkEriksson (UnicornIndex): +45.7% Annual Return since Jun 16, 2020 (Stocks)

- Richard_Hom (moneylinetrader): +66.9% Annual Return since Apr 17, 2023 (Forex)

- BlackBoulderTrading (Leveraged ETF Trading): +96.2% Annual Return since Oct 17, 2022 (Stocks)

- YBHD (YBH FUND): +109.1% Annual Return since Jan 31, 2023 (Stocks)

Collective2 offers automated strategies that trade stocks, options, futures, and forex. Unlike hedge funds, Collective2 charges a flat monthly fee for strategy access, with no extra costs if profits are generated. The platform instantly provides flexibility to start and stop strategies based on your preferences. Full transparency lets you view all good and bad strategy results and make informed decisions.

TCdn says, “Collective2 is the best platform for vetting and following alternative investment strategies. Their support is quick and effective.” Alex Y comments, “Collective2 accurately reflects the private trading industry. It allows for creating a profitable and flexible portfolio with proper strategy selection.” Max adds, “C2 is a reliable platform with accurate information and effective auto-trading technology. It’s essential to vet trade leaders and understand the math around trading.”

Create your account today and start exploring Collective2’s diverse strategies. Join a community of investors leveraging innovative automated trading strategies within the safety of their brokerage accounts.