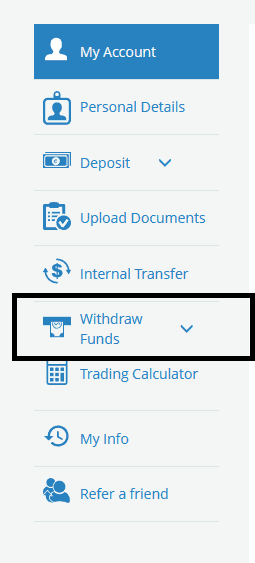

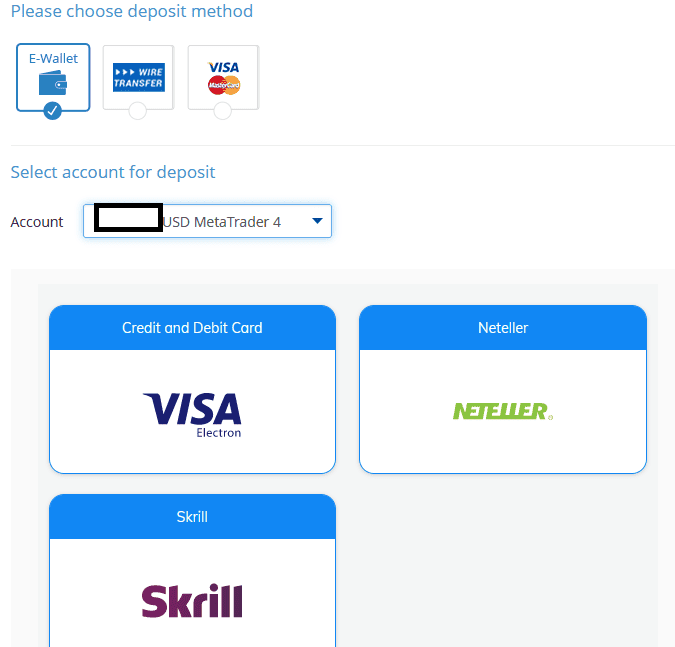

AvaTrade, a renowned broker in forex and contracts for differences (CFDs), has announced a significant service expansion by selecting Worldpay as its new payment partner. This strategic move aims to enhance the broker’s payment processing capabilities, ensuring swift and secure transactions for its global customer base.

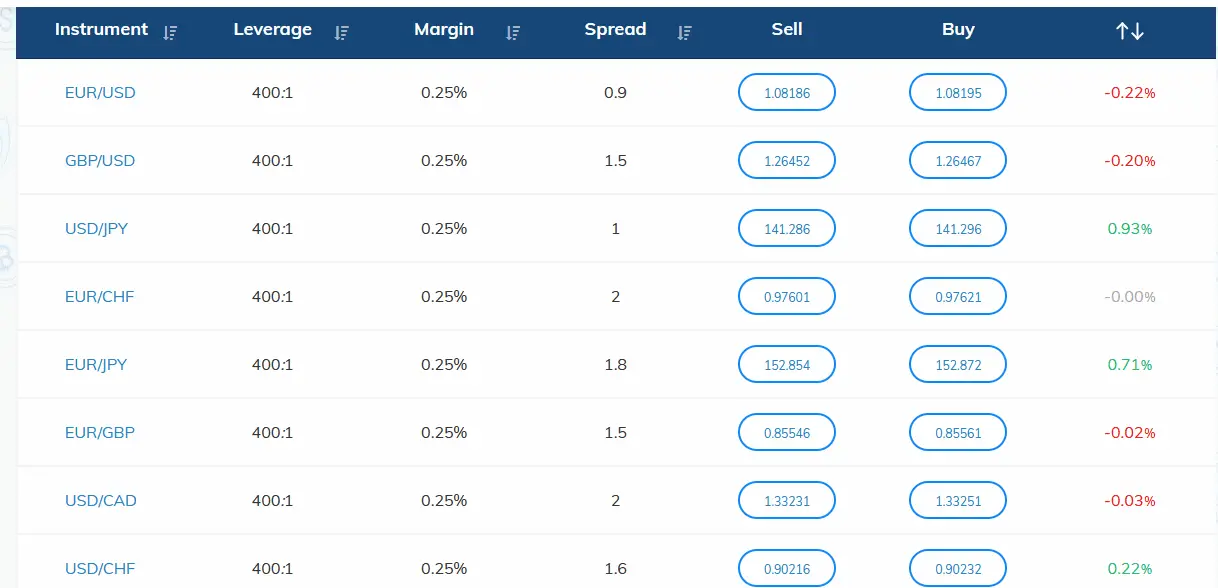

AvaTrade is a globally recognized brokerage company established in 2006 and headquartered in Ireland. It is regulated by multiple authorities, including those in Ireland, the British Virgin Islands, Australia, South Africa, Japan, the UAE, Cyprus, and Israel. AvaTrade offers a wide range of trading services, including forex, CFDs, and now futures, through its new platform, AvaFuture. One of its key advantages is its comprehensive regulatory compliance, ensuring a secure trading environment for clients. Additionally, AvaTrade provides competitive pricing, advanced trading tools, and diverse asset classes, making it a preferred choice for retail traders.

Avatrade Expanding Payment Options

Worldpay’s solutions will now handle AvaTrade’s payment processing requirements. This partnership is expected to streamline transactions and provide a seamless user experience. Worldpay recently completed its sale and is now operating independently under GTCR’s majority ownership (55%), with FIS retaining a 45% stake. Charles Drucker has resumed his role as CEO to drive the company’s performance and strategic growth.

The company’s focus will be on enhancing client value through increased investment in product development and technology and pursuing strategic acquisitions across various industries and regions. GTCR has pledged up to $1.3 billion in additional equity capital to support these initiatives.

Introducing AvaFuture for Futures Contracts Trading

AvaTrade has further diversified its offerings by launching AvaFuture, a specialized futures trading platform. AvaFuture provides micro, mini, and standard futures contracts across various asset classes, including indices, commodities, currencies, treasuries, cryptocurrencies, and metals. The pricing for these contracts is competitive, set at $1.75 per standard per trade.

Established in 2006 and headquartered in Ireland, AvaTrade has a reputation for offering retail forex and CFD trading services covering stocks, ETFs, cryptocurrencies, and other assets. The addition of futures trading through AvaFuture complements its existing services, such as options trading via AvaOptions.

AvaTrade operates under the regulatory oversight of authorities in multiple jurisdictions, including Ireland, the British Virgin Islands, Australia, South Africa, Japan, the UAE, Cyprus, and Israel. This regulatory framework ensures the broker’s adherence to operational standards. While the specific regulatory details for the new futures platform have not been disclosed, AvaTrade can leverage its existing licenses to operate the platform in various regions.

Moreover, AvaTrade is actively exploring regulatory licensing in Spain to enhance its services within the European Union. This move reflects the broker’s commitment to expanding its regulatory footprint and providing comprehensive trading solutions to its clients.

With these strategic developments, AvaTrade continues to solidify its position as a leading broker in the financial markets. Through its partnership with Worldpay, it offers a diverse range of trading options and robust payment solutions.