In trading, sometimes traders face losses when markets exhibit extreme volatility and lack a clear trend. These scenarios are characterized by sudden and sharp price spikes, making it challenging to predict market movements accurately. Traders often find themselves caught in rapid transitions between bullish and bearish micro trends, which can occur within very short timeframes. This unpredictability and rapid price fluctuation often lead to unexpected losses, even for experienced traders.

In trading, “choppy price” refers to a market condition where prices move erratically in a tight range, lacking a clear direction or trend. This leads to frequent, abrupt changes in price levels, making it difficult for traders to establish consistent and profitable positions.

See my video about choppy prices:

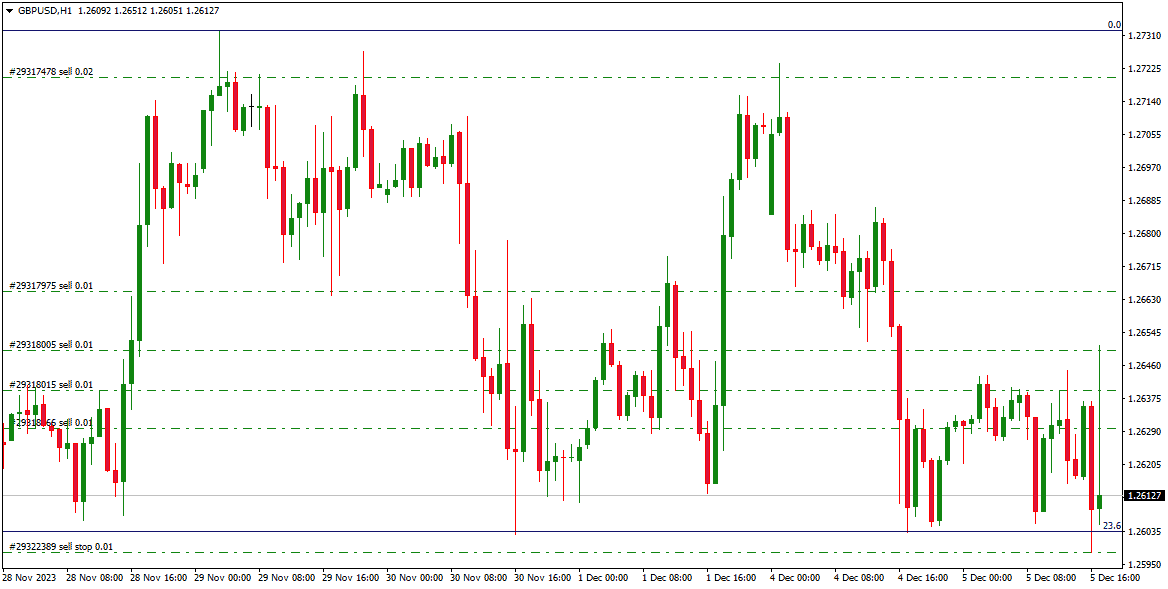

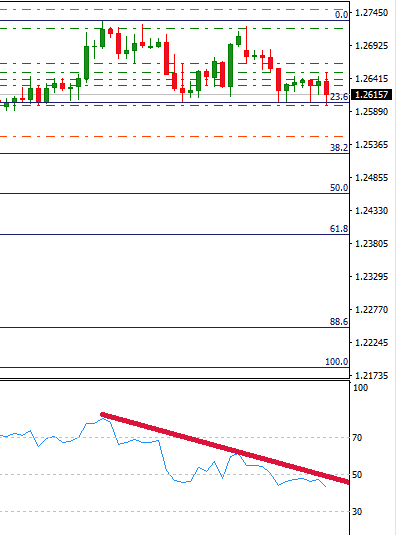

The GBPUSD currency pair recently demonstrated a classic example of choppy price action, oscillating between the 1.2602 and 1.2660 price levels. Over several days, the pair’s price rapidly moved up and down within this narrow range, exhibiting no clear directional trend. Despite this choppiness, careful analysis of the Relative Strength Index (RSI) and the 4-hour (H4) chart began to show early indications of a developing bearish trend.

These technical indicators suggested that a downward movement was gaining momentum. Consequently, traders started to anticipate a potential breakout below the 1.2603 level. If it materialized, this breakout would pave the way for the GBPUSD to target a new lower level, possibly around 1.255.

How to Avoid Choppy Prices in Trading?

Always trade around important price levels and follow the main larger (H4 or daily) trend to avoid choppy price trading. Waiting to see the break of important price levels is usually the best strategy to avoid choppy prices. Additionally, you can set a wider stop loss to avoid choppy price movements.

So remember:

- Trade Around Important Price Levels: Focus on trading near key price levels to avoid getting caught in choppy price movements.

- Follow the Larger Trend: Pay attention to the primary trend on higher timeframes, such as the 4-hour (H4) or daily charts, to align with the overall market direction.

- Wait for Breaks of Key Levels: Adopt a strategy that involves waiting for clear breaks of important price levels, which can help avoid entering trades during choppy conditions.

- Set Wider Stop Losses: Consider using wider stop losses to accommodate the increased volatility and prevent being prematurely stopped out in choppy markets.

When trading US currency pairs, an effective strategy to protect against choppy prices involves monitoring the performance of the US dollar against a range of other currencies. By keeping an eye on how the US dollar is faring against pairs like EURUSD, GBPUSD, AUDUSD, and NZDUSD, traders can gauge the overall strength or weakness of the dollar.

If there is a consistent pattern where the US dollar is appreciating and these pairs exhibit bearish trends, it’s a strong indicator of a major advance in the US dollar. This comprehensive analysis helps understand broader market sentiments and avoids getting caught in deceptive price movements of individual pairs. Identifying such trends can enable traders to make more informed decisions, aligning their trades with the dominant movement of the US dollar. As a result, this strategy can serve as a safeguard against the risks posed by choppy and unpredictable price fluctuations in individual currency pairs.

Conclusion

To avoid the pitfalls of trading in choppy price conditions, traders should focus on several key strategies. Firstly, trading around significant price levels and aligning with the main trend on higher timeframes, like H4 or daily charts, can provide a clearer direction. Waiting for clear breaks of important price levels before entering a trade helps avoid the uncertainty of choppy markets.

Setting wider stop losses can also be beneficial to accommodate the volatility and avoid premature exits. Additionally, monitoring the US dollar’s performance against various other currencies can offer insights into broader market movements for those trading US currency pairs. This holistic approach, which includes both technical analysis and market sentiment, can significantly aid in navigating and potentially avoiding choppy price environments in trading.