Table of Contents

Scalping is a trading technique that involves taking small profits on many trades. It is popular among forex traders because it can generate consistent profits. Scalpers aim to profit from small price movements in the forex market by executing trades quickly and frequently. The goal is to make several small profits that add up to a significant profit.

One factor that scalpers consider when choosing their trading instruments is the spread. The spread is the difference between the bid price (the price at which a trader can sell a currency pair) and the asking price (the price at which a trader can buy a currency pair). A low spread is ideal for scalpers as it means they can enter and exit trades at a lower cost, increasing their profits.

Low-spread forex brokers are popular among traders who employ scalping strategies. Low-spread brokers offer tight spreads, meaning the difference between the bid and ask price is minimal. This is particularly advantageous for scalpers, as it allows them to execute trades quickly and with minimal slippage. A low spread also means traders can enter and exit trades more frequently, increasing their profit chances.

Pure ECN accounts in the forex industry do not exist anymore. Most brokers are market makers, and they use a combination of ECN and STP brokerage.

But what should scalpers do?

What is the Best Forex Broker for Scalping?

The Best Forex Brokers for scalping are HF Markets and Exness because they offer Zero Spread accounts. Additionally, these brokers are rare brokers that allow scalping strategies and do not prohibit expert advisors’ scalping systems.

Please watch my YouTube channel about these 2 brokers’ accounts:

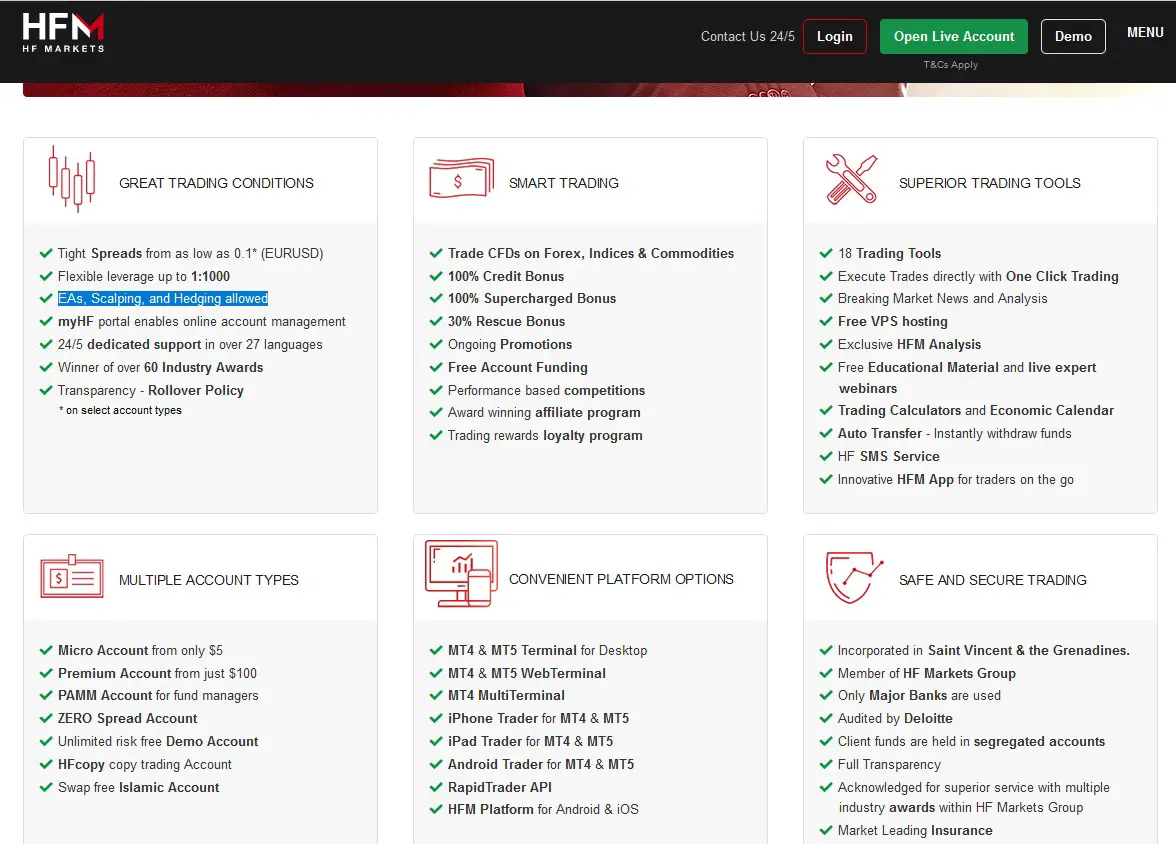

Below, you can see proof from the HF Markets website where they allow scalping:

HF Markets ECN account low spread for scalping Table

| Currency Pair | Limit and Stop Levels Spread | Typical ZERO Spread |

|---|---|---|

| EURUSD | 2 | 0.1 |

| USDJPY | 2 | 0.2 |

| GBPUSD | 2 | 0.4 |

| EURGBP | 2 | 0.4 |

| USDCAD | 2 | 0.6 |

| EURJPY | 2 | 0.8 |

| USDCHF | 2 | 0.8 |

| AUDUSD | 2 | 0.8 |

| CADJPY | 2 | 0.9 |

| EURCHF | 2 | 0.9 |

| AUDJPY | 2 | 1 |

| NZDUSD | 2 | 1 |

| USDSGD | 5 | 1 |

| USDHKD | 7 | 1.1 |

| EURCAD | 2 | 1.2 |

| CADCHF | 3 | 1.3 |

| GBPJPY | 3 | 1.4 |

| AUDCAD | 2 | 1.4 |

| NZDJPY | 2 | 1.4 |

| AUDCHF | 2 | 1.5 |

| CHFJPY | 2 | 1.6 |

| EURAUD | 2 | 1.6 |

| GBPCHF | 3 | 1.8 |

| AUDNZD | 3 | 1.9 |

| GBPCAD | 3 | 1.9 |

| EURNZD | 3 | 2 |

| GBPAUD | 3 | 2.3 |

| ZARJPY | 3 | 2.3 |

| NZDCHF | 3 | 2.3 |

| NZDCAD | 3 | 2.3 |

| EURDKK | 10 | 3.3 |

| GBPNZD | 4 | 4.5 |

| USDDKK | 3 | 5 |

| USDCNH | 2 | 5.4 |

| EURPLN | 20 | 6.8 |

| USDSEK | 20 | 9 |

| USDTRY | 5 | 9.6 |

| USDPLN | 20 | 9.8 |

| USDHUF | 50 | 12.5 |

| USDCZK | 20 | 12.6 |

| EURNOK | 20 | 14.1 |

| EURCZK | 30 | 15 |

| USDNOK | 20 | 15.5 |

| EURHUF | 20 | 18.4 |

| USDZAR | 50 | 29 |

| EURZAR | 3 | 55 |

| USDRON | 70 | 60 |

| EURRON | 80 | 70 |

| GBPZAR | 5 | 80 |

| USDRUB | 200 | 810 |

- Zero Spread Account: This type of account typically refers to a Forex account where the difference between the bid price and the asking price (the spread) is zero. This implies that trades can be executed at the exact market price. Usually, brokers compensate for zero-spread accounts by charging a commission on each trade.

- Low Commission Rate: USD 0.03 per 1K lot is lower than many brokers charge. A lot in forex trading is a unit measuring the trade size, and one standard lot is typically 100,000 units of the base currency. So, in this case, the commission refers to the fee charged by the broker for a trade size of 1000 units of the base currency.

HF Markets, also known as HotForex, is a well-known forex and commodities broker. Below are some benefits associated with HF Markets:

- Variety of Trading Instruments: HF Markets offers various trading instruments such as forex, commodities, indices, shares, bonds, and cryptocurrencies.

- Multiple Trading Platforms: They provide various trading platforms, including MetaTrader 4, MetaTrader 5, and their proprietary HF App for mobile trading.

- Educational Resources: HF Markets provides a variety of educational materials for traders, including webinars, e-courses, video tutorials, and market analysis. This can be particularly beneficial for novice traders.

- Regulatory Oversight: As of 2021, HF Markets is regulated by multiple financial authorities globally, providing traders with a layer of security.

- Customer Service: They have a reputation for good customer service, providing 24/5 customer support.

ENC Scalping Account

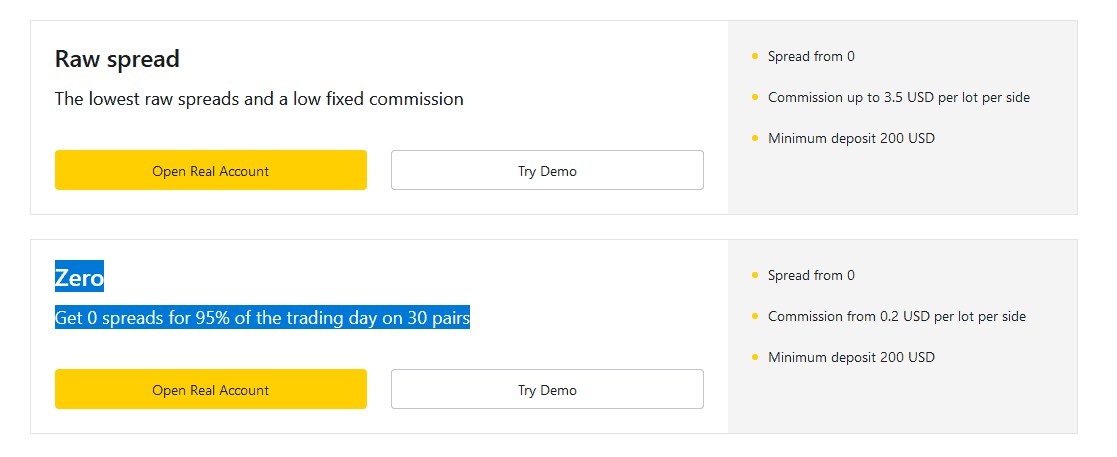

Exness is another well-known forex broker offering various accounts, including a zero-spread trading account. Here’s a general breakdown of the specifications you provided:

- Zero Spread Account: In Exness’s zero spread account, the spread, which is the difference between the bid price (the price you sell at) and the asking price (the price you buy at), starts from 0. This means that trades can be executed at the exact market price without the typical difference between buying and selling prices that many brokers include.

- Commission: The commission on this account starts from 0.2 USD per lot per side. In forex trading, a “lot” is a standardized unit of a particular currency pair, and one standard lot is usually 100,000 units of the base currency. So, in this case, if you were to buy or sell one lot of a currency, you would be charged a commission of 0.2 USD.

- Minimum Deposit: The minimum deposit to open this account type is 200 USD. This is the smallest amount you need to deposit into your trading account before you can start trading.

Below, you can see a zero spread account from the Exness webpage:

Exness offers several advantages:

- Variety of Trading Instruments: Exness offers various trading instruments, including forex, metals, cryptocurrencies, energies, indices, and stocks.

- MetaTrader Platforms: Exness provides MetaTrader 4 and MetaTrader 5, both famous and sophisticated trading platforms that offer advanced charting tools, trading robots, and the ability to handle multiple orders.

- Competitive Spreads: Exness is known for offering competitive spreads on various currency pairs, which benefits traders.

- High Leverage: Exness offers high leverage, which, while risky, can significantly increase potential profits if trades go well.

- Regulation: Exness is regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK, which provides an additional layer of security for traders.

- Customer Support: They offer robust customer support, assisting 24/7 in multiple languages.

- Education and Research: Exness offers various educational resources, including training courses, webinars, tutorials, and market analysis.

Conclusion

Scalping is a strategy that requires discipline, experience, and the right tools to succeed. Low-spread forex brokers provide an ideal environment for scalping, as they offer tight spreads that allow traders to execute trades quickly and frequently. While scalping can be challenging, the potential profits that can be generated make it an attractive trading technique for forex traders.

Scalping is too risky, in my opinion. However, if you use scalping strategies to reduce commissions, you should use Zero S spread accounts.