Day trading is among the fast-paced financial market’s most exciting and dynamic segments. Compared to long-term investment strategies, day trading involves buying and selling financial instruments within the same day. Day traders, often active traders, seek to profit from short-term price fluctuations. This strategy requires a keen understanding of the market and a meticulous approach to executing trades.

At its core, day trading is a practice that capitalizes on the financial markets ever-changing nature. It takes advantage of the small yet often significant price movements within a single day, with traders aiming to close their positions by the end of the day. This technique eliminates potential risks of holding positions overnight, such as price gaps due to news or events occurring after market hours.

One of the critical tools day traders utilize is a 30-minute chart. This chart provides a detailed visual representation of price movements for a specific financial instrument, updated every half hour. Compared to shorter time frame charts, the 30-minute chart balances capturing intraday trends and avoiding market noise. It delivers a comprehensive yet precise picture of price activity, helping traders to spot trends, identify potential entry and exit points, and manage risk effectively.

Day traders typically execute a few trades per day, with each trade lasting anywhere from a few hours up to an entire day.

What is The Best Forex Broker For Day Trading?

IC Markets and HF Markets are the best forex brokers for day trading because they offer tight spreads and allow short-time trades. Additionally, these brokers offer zero spread accounts for day traders with minimal commissions of $3 per lot.

VISIT HFMHF Markets’ Zero Spread Account offers an attractive trading platform for day traders. The account does not require a minimum opening deposit, making it accessible to traders of all levels. High leverage of up to 1:2000 allows traders to manage more prominent positions with less capital. This feature can amplify gains and losses, so it must be managed carefully.

The Zero Spread Account promises raw, super-tight spreads from leading liquidity providers, ensuring traders can enter and exit trades with minimal slippage. These accounts are perfect for day traders with high commission costs because of tighter stop loss. This is especially important for day traders who make numerous daily trades and must keep transaction costs as low as possible.

Moreover, the Zero Spread Account is swap-free, which can be an advantage for traders holding positions overnight, as they won’t incur interest fees. Commissions start from a low $0.03 per 1k lot, keeping the trading costs down and making it an excellent option for high-volume traders.

Please see HF Markets Zero spread commission for day traders below:

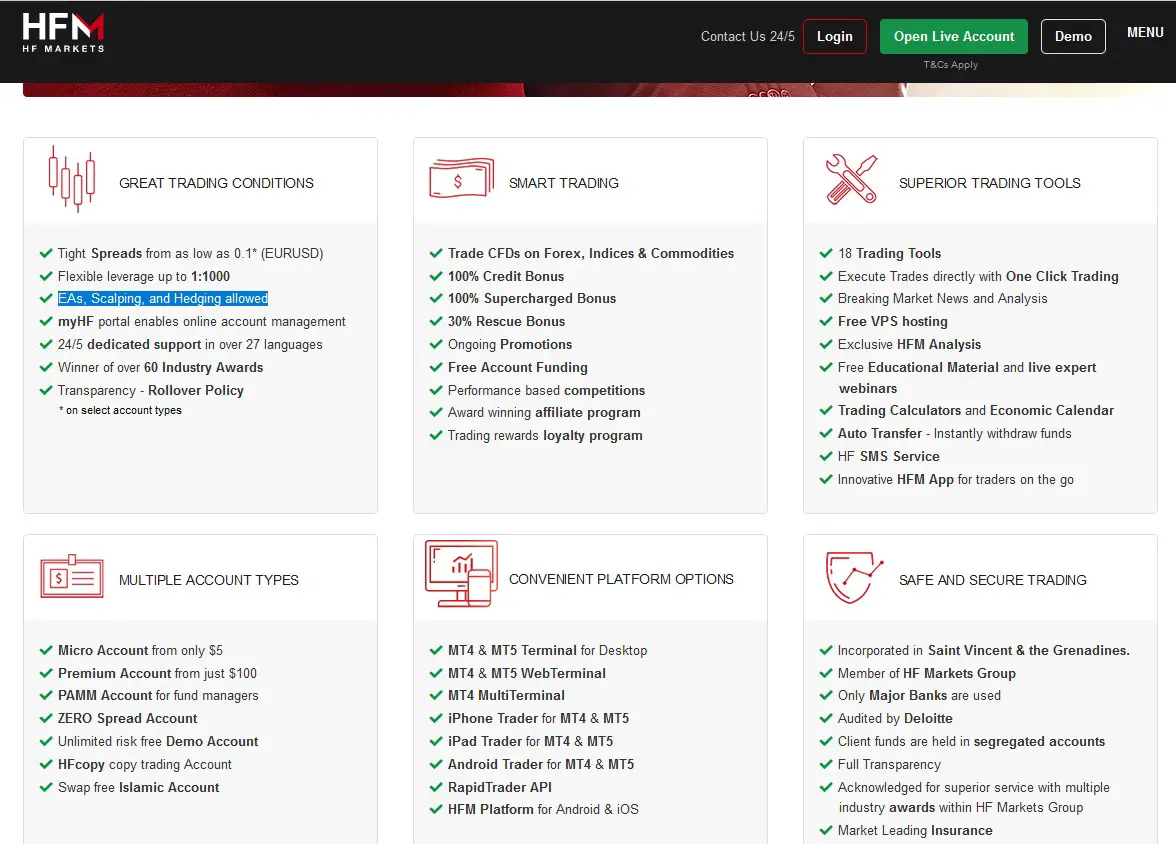

HF Markets Allows Scalping for Day Traders. Please see proof in the screenshot below:

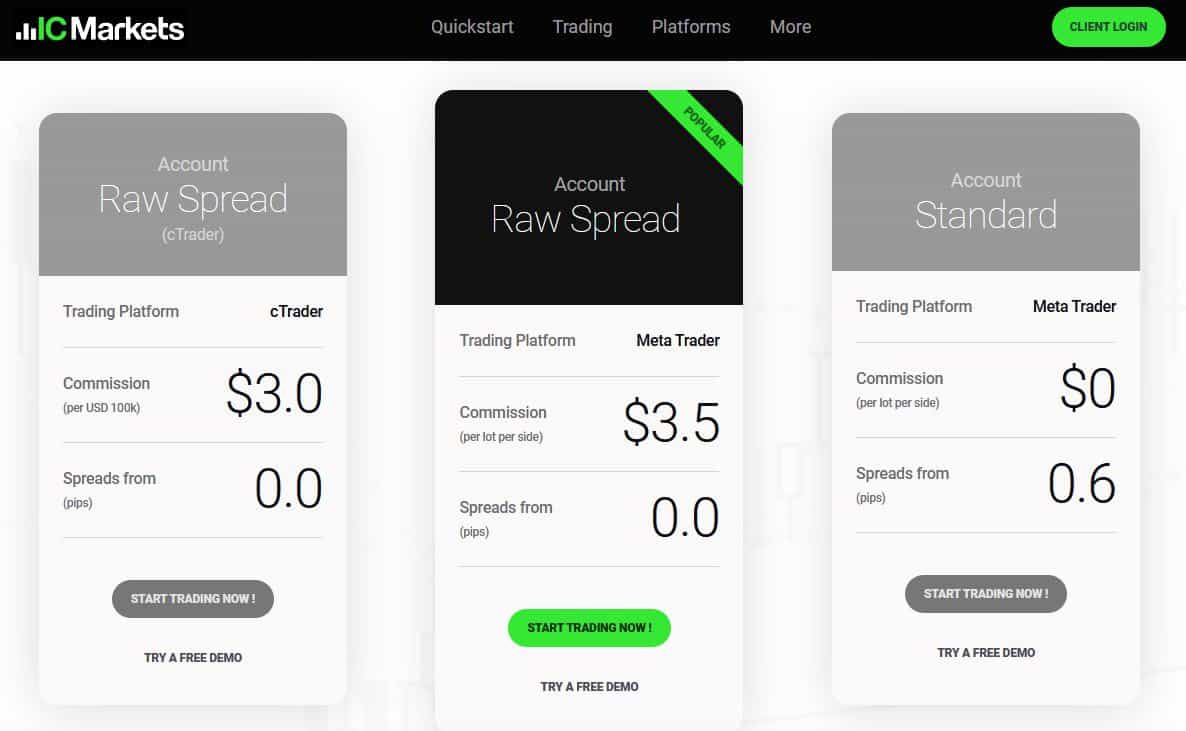

IC Markets’ Raw Spread Account offers highly competitive conditions for active and high-volume traders. The account boasts some of the lowest spreads in the industry, with an average EUR/USD spread of just 0.1 pips. Coupled with a small commission of $3.50 per lot payable per side, it provides an effective low-cost trading solution for day traders.

The critical advantage of IC Markets’ Raw Spread Account is its deep liquidity and fast execution. Such features are vital for day traders and scalpers who must get in and out of trades quickly and at the best possible price. These attributes also make it suitable for expert advisors and automated systems that can place trades on a trader’s behalf.

Please see a screenshot of the RAW spread account:

List of Day Trading Brokers

| Forex broker Review | Visit | Min. lot size | Max. leverage | Min. deposit |

|---|---|---|---|---|

HFM | VISIT HFM | 0.01 | 1:1000 | $1 |

Avatrade | VISIT AVATRADE | 0.01 | 1:400 | $1 |

Instaforex | VISIT INSTAFOREX | 0.0001 | 1:1000 | $10 |

FxPro | VISIT FXPRO | 0.01 | 1:500 | $100 |

IC Markets | VISIT IC MARKETS | 0.01 | 1:500 | $200 |

XM.com | VISIT XM | 0.01 | 1:1000 | $5 |

| VISIT EXNESS | 0.01 | 1:2000 | $10 | |

| Octafx review | VISIT OCTAFX | 0.01 | 1:400 | $50 |

What do Day traders need?

Day traders typically look for specific trading conditions that can increase their chances of making profits within a short time frame. While individual preferences may vary, here are some trading conditions that are generally considered favorable for day traders:

- High volatility: Day traders thrive on price movements, so higher volatility provides more opportunities for quick gains. Increased price swings allow for more frequent entry and exit points, enabling traders to capitalize on short-term fluctuations.

- High trading volume: Active trading markets with high liquidity are preferred by day traders. Higher trading volume ensures that positions can be entered and exited swiftly without significant slippage or price gaps. This liquidity is crucial for executing trades quickly and efficiently.

- Tight bid-ask spreads: Day traders seek markets with narrow spreads, meaning there is minimal difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is asking for (ask). Tight spreads reduce transaction costs and improve the likelihood of capturing small price movements.

- Clear trend or range-bound markets: Day traders may focus on trending markets, where the price moves consistently in one direction, allowing them to ride the trend and profit from it. Alternatively, they may also look for range-bound markets characterized by price oscillations between defined support and resistance levels, enabling traders to buy low and sell high within the range.

- Active news and catalysts: Day traders often rely on news and market events that can cause significant price fluctuations. News releases, economic data, earnings reports, and geopolitical events can create volatility and present opportunities for quick profits. Staying informed about such catalysts is crucial for day traders.

- Shorter timeframes: Day traders typically operate on short timeframes, such as minutes or hours, aiming to capitalize on rapid price movements. They often use technical analysis tools and indicators to identify patterns and make short-term trading decisions.

- Reliable execution and fast market access: Day traders require reliable trading platforms that offer fast and accurate order execution. Delayed or unreliable execution can lead to missed opportunities or adverse outcomes. Fast market access is also crucial to react quickly to changing market conditions.

While HF Markets and IC Markets may offer attractive features and conditions to day traders, traders must research and consider multiple factors before selecting a brokerage firm. Some aspects to consider include trading fees and commissions, platform reliability and functionality, customer support, available markets and instruments, regulatory compliance, and the company’s overall reputation.