Table of Contents

With the rise of technology and the Internet, retail traders have become increasingly active in the Forex market, with numerous Forex brokers offering various trading platforms, tools, and strategies to help traders succeed.

One of Forex traders’ most popular trading strategies is using managed accounts, also known as PAMM accounts.

PAMM stands for Percentage Allocation Money Management. In a PAMM system, an experienced trader (the “manager”) trades his own money along with the money of other people (the “investors”). Each investor’s funds are proportionally allocated to the manager’s trading account, and the profits or losses from the manager’s trading activities are shared among the investors according to the percentage of the total funds they contributed.

So, if you’re an investor in a PAMM account, you’re essentially putting your money in the hands of a professional trader. This can be beneficial if you lack the time or skills to trade forex, but it also comes with risks because the manager could lose money.

Please see my video related to HF Market’s (Hotforex) PAMM account:

You can learn more about PAMM on our page: Percent Allocation Management Module (PAMM)

The concept of the PAMM account was initially developed in Russia in 2008 by the Alpari Forex brokerage firm. Since then, many Forex brokers and traders have adopted this investment solution, providing a win-win situation for investors and fund managers.

The PAMM account is a convenient financial instrument that allows investors to diversify their portfolios while still having the flexibility to choose the risk level that suits them best. Furthermore, by pooling their funds into an account managed by an experienced trader, investors can benefit from the trader’s knowledge and expertise and the potential returns of their trading activities.

The best PAMM accounts Forex brokers list

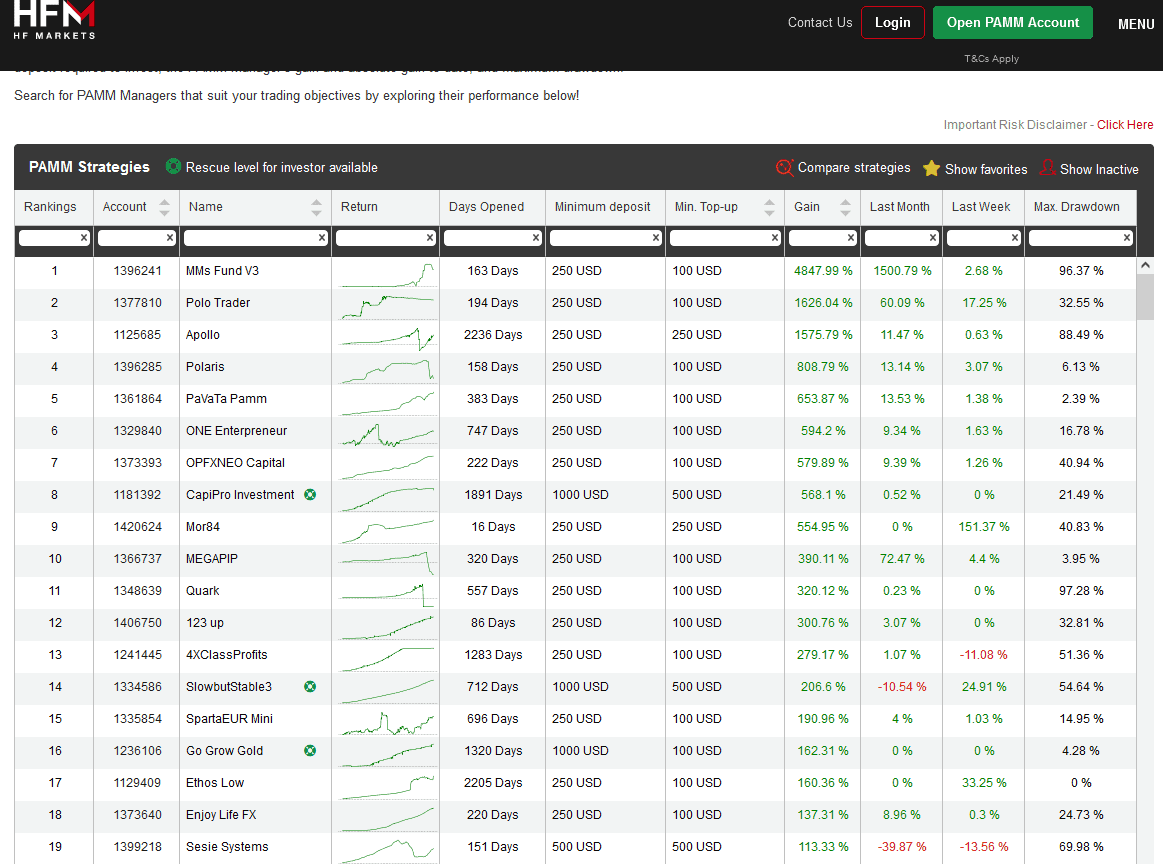

Below you can see HF markets PAMM performance page:

The key differences between the PAMM accounts offered by HF Markets, InstaForex, and Dukascopy are:

- Brokerage rules: HF Markets, InstaForex, and Dukascopy are different forex brokers, and each offers its own PAMM account with varying terms and conditions.

- Minimum investment: The minimum investment amount required to participate in a PAMM account varies among brokers. HF Markets requires a minimum investment of $100, while InstaForex has different minimum investment amounts for each PAMM account type. Dukascopy has a minimum investment of 1000 USD/CHF.

- Manager compensation: The fees managers charge for managing the PAMM account may differ among brokers. For example, HF Markets charges a performance fee of up to 50%, while InstaForex charges a commission of up to 50% of the profits earned by the manager. In addition, they depend on the account currency and type; Dukascopy charges a fixed commission per trade.

- Trading platforms: The PAMM account can be managed through different trading platforms, which may vary among brokers. HF Markets offers the MetaTrader 4 and 5 platforms, while InstaForex provides both MetaTrader and their own WebTrader platform. Dukascopy offers the JForex platform.

- Risk management: The risk management strategies managers use may differ among brokers. Some brokers may have stricter risk management policies than others.

Conversely, fund managers can benefit from PAMM accounts by accessing additional funds to trade with. As a result, fund managers receive a percentage of the profits they generate for investors, which incentivizes them to sell carefully and aim for higher returns. Furthermore, they can benefit from acquiring new clients, as PAMM accounts are an attractive investment option for many retail traders.

Participants in the PAMM system in forex trading include:

- Investors: individuals or organizations who invest their funds in the PAMM account of a chosen trader.

- Trader/Manager: a skilled and experienced forex trader who manages the PAMM account and trades on behalf of the investors.

- Broker: the intermediary providing the PAMM system and facilitating trades between investors and the trader/manager.

- Administrator: the individual or team responsible for the technical support and maintenance of the PAMM system.

- Regulator: the government agency or regulatory body that supervises and monitors the PAMM system to ensure compliance with the laws and regulations.

A practical example of PAMM trading

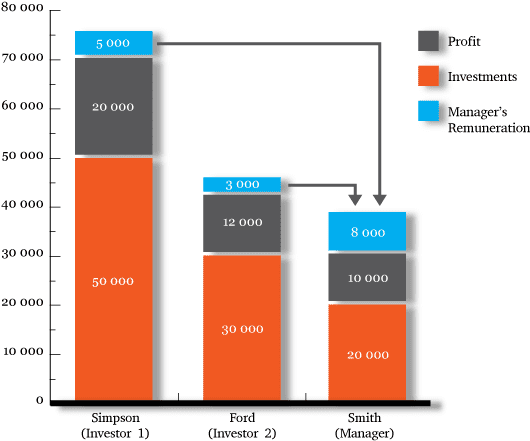

Let’s say a trader named John has a successful track record in forex trading and decides to join a PAMM system offered by a broker. He creates a PAMM account and sets the conditions for investors, such as the minimum investment amount and the fee structure.

Investors interested in John’s trading skills can select his PAMM account and invest their funds. John then trades on behalf of the investors, and the profits or losses are distributed proportionally based on the amount invested.

Suppose an investor named Jane invests $10,000 in John’s PAMM account, and John earns a profit of 20% in a month. The investor’s share of the gain would be $2,000 (20% of $10,000), and John would receive a portion of that as his fee. The investors would have had to bear a proportionate loss if John had incurred losses.

PAMM accounts can be highly beneficial for all parties involved, as they allow investors to benefit from the skills and knowledge of experienced traders. At the same time, fund managers can grow their client base and potentially increase profits. The transparency of PAMM accounts is also an advantage, as investors can monitor the trading activities of fund managers in real time and withdraw their funds at any time.

However, like all investment options, PAMM accounts carry certain risks. As with any managed account, there is always the risk of losing money due to market fluctuations or poor trading decisions made by the fund manager. Therefore, investors must carefully assess the fund manager’s track record and conduct thorough research before investing.

Through an Alpari PAMM account, you can make a profit in the forex world without any trading experience. All you need to do is select a manager of your choice, start putting your money into his account, and he will pay you great rewards.

PAMM is an exclusive account offered and developed by the high-level forex experts at Alpari. It is recognized as a breakthrough in forex account management. With the account currently at the introduction stage, it has already managed to catch various forex experts’ eyes and earn various quality awards.

PAMM brokers disadvantage

The world of investing has undergone a significant transformation with the advent of online trading platforms and solutions. PAMM, or Percent Allocation Management Module, is one such advancement that has gained considerable popularity among traders and investors over the years. This system allows investors to pool their funds and entrust a portfolio manager or money manager to execute trades. However lucrative and convenient the PAMM system may seem, it comes with a unique challenge that investors must know: the maximum drawdown risk.

To understand the PAMM system’s disadvantages in more detail, it is crucial to establish a maximum drawdown. Maximum drawdown refers to the most significant percentage decline in the total value of an investment from its previous high. This concept helps investors assess their risk tolerance and determine the potential risks involved in their investment. For instance, a trader with a 20% maximum drawdown means that the investment may lose 20% of its value from the highest point before a subsequent high is recorded. In the context of PAMM, investors entrust their funds to a portfolio manager who makes trading decisions on their behalf, which implies that they are exposed to the potential risk of maximum drawdown.

The primary flaw of the PAMM system is that most platforms do not track the maximum drawdown of equity. This crucial parameter is often neglected, and PAMM systems focus on profits instead, which can be deceptive. For instance, a fund manager who never closes a losing trade may have a perfect track record for several months, but the account is prone to depletion from accumulated losses. Moreover, not all profitable accounts can compensate for drawdowns that can wipe out an account quickly.

The ranking system of PAMM tends to prioritize traders with a high return rate, which can be misleading. The most crucial aspect that investors should consider is not the profit that the manager has made but the underlying risk involved in those trades. For example, suppose a portfolio manager acquires high returns with a simple stop-loss strategy. In that case, the investor must be aware that the trades can lead to massive losses, which can offset any potential profits. Tracking the maximum drawdown of equity is essential in identifying the risk a portfolio manager poses.

Drawdowns must be measured for current equity, not after managers close trades. This is because beThetrades are crystallized, and no risk is involved. On the other hand, the current equity represents the current market value of an investment, and therefore, it measures the recent exposure to potential risks. Since drawdown can accumulate over time, it is essential to regularly track the maximum drawdown of equity to keep the potential losses attached to the investment value under control.

The PAMM system’s primary disadvantage presents a significant challenge that investors must be aware of before entrusting their money to portfolio managers. While the system offers a convenient opportunity for diversification and profit-making, there is an underlying potential risk in maximum drawdown. Moreover, any increase in maximum drawdown implies an increasing threat to the overall investment. Therefore, investors must track this parameter regularly to evaluate the risk involved to make informed decisions.

Conclusion

In my personal opinion, drawdowns represent the most crucial factor investors must consider before investing in any PAMM system. The potential losses may seem minor initially but can accumulate and cause significant losses over time. Therefore, investors must ensure that the maximum equity drawdown is tracked regularly to evaluate the risk involved. While PAMM presents a convenient opportunity for profit-making, investors must bear in mind that it comes with an inherent risk that cannot be ignored.

PAMM accounts are an innovative investment solution providing many benefits for investors and fund managers. They offer a convenient way for retail traders to gain exposure to the Forex market and diversify their investment portfolio. Meanwhile, fund managers can benefit from additional funds to trade with and the potential acquisition of new clients. However, investors should always exercise due diligence and research the fund manager’s track record before investing.