Table of Contents

Developers use APIs in trading primarily for automation and integration purposes. APIs provide a standardized way to access platform features, enabling developers to build custom trading applications tailored to specific strategies or requirements. Through APIs, algorithmic and high-frequency trading becomes possible, allowing for rapid and precise execution of trades based on real-time data. Furthermore, APIs facilitate the integration of multiple data sources and trading platforms, creating a cohesive and efficient trading ecosystem.

What is Broker API?

Broker API or Application Programming Interface allows developers to create software or applications that interact directly with the broker’s platform. A broker API provides a set of programming protocols and tools for developers to build applications that can directly communicate with and execute actions on the broker’s trading platform.

The best offer for companies has HFM Broker FIX API, while I recommend Alpaca and Currencylayer as cheap solutions for individual developers!

Before hiring a broker who uses API for Forex trading, let us discuss what API trading means. Every investor or trader needs to stay connected with their broker. That does not mean that you need to visit their office every day. This can be done using various trading platforms.

API software programs are mainly used for trading instruments like Forex and CFD.

Some traders might be worried about their conversations with their brokers as these things are susceptible and confidential. An API software will make communicating with your broker smoother and safeguard the entire channel by encrypting it. API tradings are highly regulated and thoroughly tested.

Since the link between you and your broker will be safe, you can use it to conduct trade orders, verify settlements, and more. All the data is securely stored, and you can access market data for the last month, years, and even months if needed. Viewing live prices is also one of the features of this software.

How Broker API Works

- Authorization & Authentication:

- The API requires secure authentication, often API keys or OAuth tokens, to ensure only authorized access.

- Request & Response:

- The developer’s application sends a request to the broker’s platform using the API.

- The broker’s server processes the request and sends back a response.

- Functionality:

- Provides real-time market data: prices, volumes, historical data, etc.

- Enables order placement: buying, selling, setting stop losses, etc.

- Allows account management: checking balances, margin levels, transaction histories, etc.

- Integration:

- The API integrates with trading platforms, custom software, and other third-party tools.

- Standardized Communication:

- APIs typically use standardized formats, JSON or XML, to send and receive data.

How Forex Trading API Works:

- Data Access:

- Provides access to live forex rates, historical price data, and bid/ask spreads.

- Trading Automation:

- Allows for automated trading strategies, executing trades based on predefined criteria.

- Order Management:

- Create, modify, or cancel forex orders directly through the API.

- Risk Management:

- Offers tools to monitor account balances, margin usage, and manage risk exposure.

- Reporting:

- Access detailed transaction histories, profit/loss calculations, and other account-related reports.

HFM Broker FIX API

HFM Broker FIX API is an innovative product that bridges the gap between traditional trading platforms and modern technological advancements in the trading world. Built on the robust FIX (Financial Information eXchange) protocol, it is explicitly tailored for traders demanding direct market access and features that facilitate manual and automated trading strategies.

The product particularly stands out for those who utilize:

- Advanced Order Types: Catering to intricate trading strategies that go beyond the primary market and limit orders.

- Automated Quotes Engines: Providing live and continuous quotes for a seamless trading experience.

- Automated Trading Systems outside of MT4: For those traders who prefer platforms other than the popular MetaTrader 4 or have bespoke systems in place.

- Order-Routing Management Systems: Offering efficient and streamlined order execution, ensuring that trades are executed at optimal prices.

Moreover, for those seeking an integrated trading environment that is both dynamic and fluid, HFM introduces the RapidTrader API. This is tailor-made for professional traders who demand high performance, flexibility, and integration capabilities.

The Audience for API Forex Trading

The advent of API (Application Programming Interface) Forex Trading has revolutionized how different market participants engage with the forex markets. The HFM fxTrade system, through its API, has attracted a diverse group of users, including:

- Corporations and Large Entities: These include brokers, hedge funds, and money managers who need consistent and real-time forex trading capabilities, ensuring they remain competitive and responsive in the fast-moving currency markets.

- Treasury Integrators: Companies that seamlessly merge forex trading into their treasury systems to manage and optimize their global cash flows and hedging strategies.

- Brokers with Exposure Hedging Needs: Specifically, those needing to mitigate the exchange rate risks inherent in their equity positions ensure that currency fluctuations do not adversely impact their portfolios.

- Custom Interface Developers: Clients who prioritize a tailored trading experience create user interfaces customized to the nuances of the HFM fxTrade system.

- Retail Trading Innovators: These are individual traders or small groups developing proprietary trading models, seeking to gain an edge in the markets by leveraging advanced technologies.

It’s essential to note that while the HFM Broker FIX API opens a world of opportunities, it’s designed for serious and professional traders, underscored by the minimum deposit requirement of 200,000 USD for the FIX/API account.

Alpaca Trading API

Alpaca Trading API – A Python library in Alpaca API handles authentication and error checking while simplifying sending requests and receiving information. Below is a video where you can learn how to code a Python Stock Trading bot with Alpaca.

Alpaca offers a Market Data API that provides access to real-time and historical data for equities and cryptocurrencies. The API has been designed to cater to user segments, from individual traders to professional brokerages.

Getting Started:

For developers and traders keen to tap into the potential of this Market Data API, Alpaca provides a comprehensive “Getting Started” guide. The guide is designed to handhold users through the various functionalities and features of the API, ensuring a smooth onboarding process.

Technical Overview:

- Version & Access Method: The Alpaca Market Data API v2 is the current offering. Users can fetch historical data through an HTTP API, while real-time data is available via a web socket.

- SDKs: Alpaca has catered to many developers by providing SDKs in multiple languages, including Python, Go, NodeJS, and C#. This wide range ensures that developers across different platforms and preferences can seamlessly integrate with the API.

- Postman & GitHub Integration: To further ease the development and testing process, Alpaca offers Postman collections. Developers can access these directly on the Postman public workspace or through GitHub, making API testing more straightforward.

Subscription Plans:

Alpaca’s Market Data API v2 is segmented into three distinct plans:

- Free Plan:

- Pricing: Complimentary.

- Securities Coverage: US Stocks & ETFs.

- Real-time Market Coverage: Data from IEX (Investors Exchange LLC).

- Websocket Subscriptions: Limited to 30 symbols.

- Historical Data: Access up to 7+ years with a 15-minute delay.

- API Call Limit: 200 calls per minute.

- Trader Professional Plan:

- Pricing: $99 per month.

- Securities Coverage: US Stocks & ETFs.

- Real-time Market Coverage: Direct feeds from both CTA (administered by NYSE) and UTP (administered by Nasdaq) SIPs. Combined, these feeds account for 100% of market volume.

- Websocket Subscriptions: Unlimited.

- Historical Data: Access up to 7+ years without any delay.

- API Call Limit: 10,000 calls per minute.

- Broker Professional Plan:

- Pricing: $99 per month per device.

- Features: Similar to the Trader Professional plan but is more tailored for Broker API partners looking to leverage market data.

Exchanges Supported:

Alpaca supports a myriad of stock exchanges. Each exchange is associated with a unique ‘tape ID,’ returned in all market data requests. This ensures that users can quickly identify the source of their data. Some of the supported exchanges include:

- A: NYSE American (AMEX)

- B: NASDAQ OMX BX

- N: New York Stock Exchange

- P: NYSE Arca

- Q: NASDAQ OMX

- V: IEX

- W: CBOE … and many more.

Interactive Brokers API

Interactive brokers trading API offers various applications that traders can download for free. Please see below How to use IBPy Python with Interactive Brokers TWS API For Automated Trading:

For example, the Download Trader Workstation (TWS) API

The Interactive Brokers (IB) API provides a comprehensive set of programming interfaces that empower users to programmatically access their IB trading accounts, manage trades, and retrieve account data. Developers and traders can harness the API to construct custom trading applications, algorithms, or platforms tailored to their requirements. Offered in multiple languages, such as Java, C++, and Python, the API is accessible to a vast spectrum of developers. It seamlessly supports the Trader Workstation (TWS) platform and the IB Gateway, allowing users to select the interface that aligns with their operational demands.

This versatile tool allows users to tap into real-time market data, execute trades, oversee their account portfolio, and collect historical market insights. To assist users in navigating its functionalities, Interactive Brokers furnishes exhaustive documentation encompassing detailed guides, sample codes, and troubleshooting resources. Algorithmic or high-frequency traders, in particular, will find the IB API to be a robust and reliable platform, perfect for deploying intricate strategies. One of its salient features is the support for streaming data, ushering in the capability for users to receive continuous updates on market shifts.

Additionally, with its provision for advanced order types and multifaceted trading functions, traders have unparalleled flexibility in carving out their trading strategies. Given the global footprint of Interactive Brokers as a brokerage, the API paves the way for access to markets spanning North America, Europe, and Asia. Prioritizing user security, encrypted connections are embedded within the API, ensuring safe order transmissions and data receipt without jeopardizing account integrity. Although endowed with vast capabilities, the API does possess a learning curve, and novices might need to allocate considerable time to master its features. It’s worth noting that Interactive Brokers consistently refines and augments the API with the ever-evolving demands of the trading community and technological progressions. Some users might need a market data subscription based on their specific needs to unlock the full spectrum of the IB API’s capabilities. The Interactive Brokers API stands out as a formidable asset for traders and developers, bridging the gap between trading aspirations and technological prowess.

API is usually some programming script, and each script has some goal.

See how broker API works:

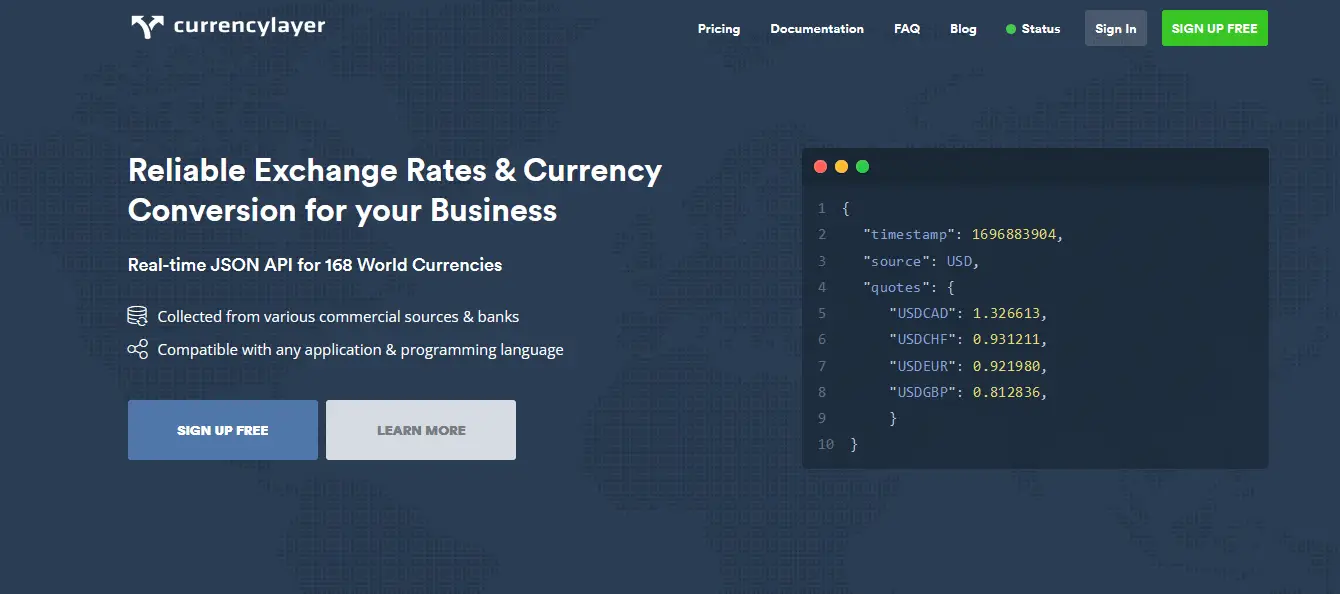

CurrencyLayer JSON Forex Trading API

CurrencyLayer offers businesses a potent tool for seamless currency conversion and accessing reliable exchange rates. Positioned as an essential utility for global enterprises, it streamlines financial transactions by providing up-to-date data on 168 world currencies. Operating as a real-time JSON API facilitates easy integration into existing systems, allowing businesses to fetch and process data efficiently. The architecture of CurrencyLayer is designed to ensure the highest level of accuracy, sourcing its data from reputable financial institutions and market feeds.

The platform is underpinned by its promise of reliability, ensuring businesses can confidently base their financial decisions on the data provided. With the increasing globalization of commerce, the ability to transact in multiple currencies has become paramount. CurrencyLayer steps into this role, bridging the gap between diverse markets by offering a unified view of global currency values. The API’s JSON format ensures compatibility with various platforms, from web applications to mobile systems, enhancing its versatility.

- Free Plan:

- Cost: $0 (No hidden fees)

- Features:

- 1,000 API calls per month

- Daily updates

- Historical rates

- No support or credit card is required.

- Basic Plan:

- Cost: $13.99/mo or $161.99/year (10% discount)

- Features:

- Up to 10,000 requests (+ $0.0017988 for each additional request)

- Hourly updates

- Historical rates

- Standard support

- HTTPS encryption

- Source currency switch

- Currency conversion

- Pro Plans:

- Cost: $50.99/mo or $611.99/year (15% discount)

- Features:

- Up to 100,000 monthly requests (+ $0.00071988 for each extra request)

- 10-minute updates

- Historical rates

- Standard support

- HTTPS encryption

- Source currency switch

- Currency conversion

- Time-frame queries

- Business Plus Plan:

- Cost: $79.99/mo or $959.99/year (20% discount)

- Features:

- Up to 500,000 requests (+ $0.000239976 for each additional request)

- 60-second updates

- Historical rates

- Standard support

- HTTPS encryption

- Source currency switch

- Currency conversion

- Time-frame queries

- Currency-change queries

- For higher volumes or specific needs, CurrencyLayer offers customized quotes upon contact.

One of the standout features of CurrencyLayer is its real-time data retrieval capability, ensuring that businesses always have access to the latest market fluctuations. This immediacy is invaluable for sectors such as e-commerce, where dynamic pricing based on current exchange rates can significantly affect profitability. Furthermore, its expansive coverage of 168 world currencies caters to significant global currencies and more niche regional ones, ensuring comprehensive global market reach. By prioritizing ease of use and accuracy, CurrencyLayer is an indispensable asset for businesses aiming to thrive in the international market. CurrencyLayer simplifies the complexities of global financial transactions and instills confidence in businesses to venture into new markets with precise and updated currency insights.

CurrencyLayer offers four distinct pricing tiers for its services. The Free plan allows users 1,000 API calls per month with daily updates and historical rates but lacks support, and no credit card is required for access. The Basic plan costs $13.99 per month (or $161.99 annually with a 10% discount) and provides up to 10,000 requests, with additional requests charged at $0.0017988 each, along with features like hourly updates, standard support, and HTTPS encryption. The Pro Plans are priced at $50.99 monthly (or $611.99 annually with a 15% savings) and offer up to 100,000 monthly requests, more frequent 10-minute updates, and additional features like time-frame queries. For higher volume needs, the Business Plus plan is available at $79.99 per month (or $959.99 annually with a 20% discount), offering up to 500,000 requests, rapid 60-second updates, and advanced features like currency-change queries; businesses needing even more can directly contact CurrencyLayer for a customized quote.

FIX API trading software

FIX API, or Financial Information eXchange (FIX) protocol, helps traders connect with liquidity providers to get streaming quotes. It represents a set of clearly defined rules and methods designed specifically for the electronic transfer of financial data. FIX API facilitates the transfer of Pre-trade information, Trade-related information, and Post-trade data.

Pre-trade information includes levels of liquidity, order flow, and depth-of-market statistics streaming directly from exchange or market servers.

Trade-related information implies order entry, confirmation, and execution functions involving data transfer through FIX: post-trade data records, processes, and asset ownership transfers involved with market-based transactions.

Advantages of APIs in Trading

There are various advantages of using API software for trading, the most critical being data storage. If you have been trading for a long time, you know how difficult it is to manage data accumulated over the years. With this software’s help, you can easily store, manage, and access all the data prices. API also tracks live market data that the traders can use to understand the price movement and conduct trades.

Some features are exclusive to institutional trading account holders, but you can access them using API software. For example, you can enable automatic stop losses. This will reduce the risk to a certain level. You can immediately execute and trade and receive confirmation, too. You can even trade anonymously if you don’t want your data to get stored on the platform.

Disadvantages of APIs in Trading

Let’s acknowledge the elephant: not everyone will be comfortable using API-enabled trading platforms. One needs to have at least some knowledge about using this application.

From the broker’s point of view, developing and maintaining an API-enabled trading platform requires investment in time and capital. This will not sit well with new brokers. Another disadvantage is that an API application can be hacked if you don’t have a good team.

Our verdict on API Brokers

Everything comes with its fair share of advantages and disadvantages. The same is the case with API trading. What needs to be contemplated here is if the positives overtake the negatives.

API trading is a sync between traders/investors and brokers by linking their back-end and front-end windows. It offers many features that make maintaining data and minimizing losses possible. It also aids customer support in connecting with investors and traders.

On the downside, it is prone to hacking. However, having an excellent technical team can deal with this. While there are higher chances that you will lose your physical data, the chances of API getting hacked are lower.

How to Compare API Brokers?

Broker API comparison can be confusing if you are unaware of the starting point. However, with the help of the following points, you will be able to compare API brokers and choose the one that is the best for you:

- Their technical team

An API broker will need a better technical support team than other brokers. This is because API-enabled trading platforms need to be constantly upgraded and encrypted. A single glitch can make confidential data unsafe. Thus, research and check how adept your broker’s technical team is.

- Their user interface

API software is used to link traders/investors to brokers. While there are chances that brokers will find it easier to understand its usage, it can be a little challenging for the traders/investors. However, if the technical team can make the transition more accessible for the traders/investors by developing a user-friendly interface, create a demo account to check if you can understand everything.

- Their regulatory body

Irrespective of how your broker uses advanced software programs, your trade, and funds will never be secure if an authority does not correctly regulate them. In case of disputes, it is the regulating bodies that can intervene and help you. You will be alone if you are not working with a broker under their jurisdiction. These regulatory bodies will also prevent the brokers from using your deposit if they go bankrupt.

- Their customer support

Good customer support should always be on your priority list for a suitable API broker. Customer support will help you understand the platform and guide you through the glitches and issues. It is always important to check if the services are available 24/7 and in your regional language.

- Their commission and fees

It is given that if you opt for a more advanced platform, you are expected to pay a little more. Since maintaining API software is not cheap, it is reasonable that the brokers would want to share the cost with you. This will affect their regular fees and commission. Therefore, it is ideal to discuss such things before joining the platform.

Conclusion

We are moving towards automated trading, and API is becoming integral. With time, more brokers and traders are joining this wagon. Yes, there are some problems, but they are still manageable. We believe the application will improve with time, and more people will use API-enabled trading platforms.

Trading APIs provide a streamlined interface for accessing financial markets, enabling automated trading and real-time data retrieval. These APIs empower individual traders and institutions to integrate their strategies and tools efficiently with market platforms. With the rise of algorithmic and high-frequency trading, APIs have become indispensable in the modern trading ecosystem. However, as with all technologies, users must ensure security and proper understanding before integrating trading APIs into their systems.