The Dow Jones Industrial Average (DJIA), colloquially known as the US30 index, stands as one of the pillars of global finance. Established by Charles Dow in 1896, this venerable index traces the fortunes of 30 major U.S. companies, offering a snapshot of America’s corporate and economic health. Over the decades, it has been eyed keenly by investors, analysts, and traders for insights into market trends and broader economic movements.

In modern financial markets, the US30’s reach has been amplified by the advent of Contract for Difference (CFD) trading. CFDs allow individuals to speculate on the price movement of an asset, in this case, the US30, without actually owning the underlying equity index. Essentially, it’s a contract between the buyer and the seller, wagering on the rise or decline of the US30’s value over a specified period. This form of trading offers the advantage of leveraging, where traders can control a significant position with a relatively small amount of capital. However, the double-edged sword of leverage also carries the risk of magnified losses.

Forex brokers play a pivotal role in facilitating CFD trading. These platforms not only provide access to traditional currency pairs but have expanded their offerings to include CFDs on major indices, commodities, and even cryptocurrencies. For those looking to trade the US30 index, several reputable forex brokers offer CFDs on this blue-chip index. These brokers provide the necessary tools, charts, and leverage options for traders to engage with one of the world’s most recognized indices. Whether one is looking to go long, anticipating a rise in the US30, or short, forecasting a decline, these platforms serve as the gateway.

What is The Best Forex Broker to Trade US30?

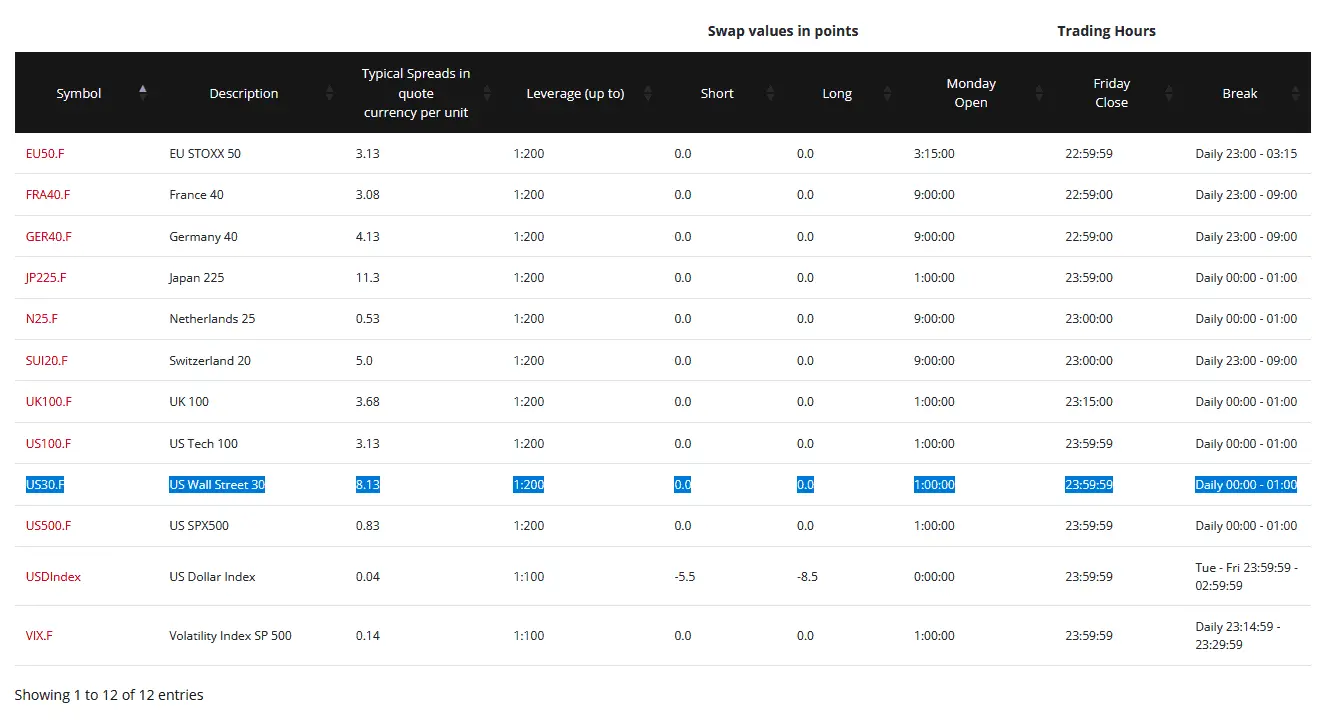

The best forex broker to trade the US30 index is HF Markets because of the low average spread of 8.13 per unit and high leverage up to 1:200. Additionally, you can trade from Monday open up to Friday close except for only a tiny one-hour break between 00:00 and 01:00.

Please see a screenshot of significant characteristics of indices trading instruments at HF Markets:

1. Company Overview: HF Markets, often referred to as HotForex in the trading community, is a well-established and popular forex broker known for its diverse range of trading instruments, advanced platforms, and commitment to providing a reliable trading environment.

2. Low Average Spread of 8.13 per unit: The spread is essentially the difference between the buying price (ask) and the selling price (bid) of an instrument. A lower spread indicates a minor difference between these prices, which means less cost to the trader. When trading CFDs on the US30 index, the average spread at HF Markets is 8.13 per unit, which is comparatively low. This benefits traders as it means reduced trading costs and the potential for higher profitability.

3. High Leverage up to 1:200: Leverage is a feature that allows traders to control a more prominent position size with a relatively minor amount of capital. At HF Markets, traders can access leverage up to 1:200 for the US30 index. This means that for every $1 of their own money, they can control $200 in the market. High leverage can amplify profits, but it also comes with the risk of amplified losses if the market moves against the trader’s position. Thus, while this high leverage is advantageous, it should be used judiciously and in line with one’s risk management strategy.

4. Extensive Trading Hours: A notable advantage with HF Markets when trading the US30 is the almost uninterrupted trading hours. Traders can access the market from the opening bell on Monday until the closing bell on Friday, except for a brief one-hour break between 00:00 and 01:00. This accessibility allows traders to respond quickly to market events, news, and economic releases, potentially taking advantage of more trading opportunities.

Conclusion

A forex broker is a critical decision for traders, as it can significantly influence their trading experience, costs, and potential profitability. When considering the specific needs of trading the US30 index, HF Markets appears to stand out, offering a combination of competitive spreads, high leverage, and extended trading hours. However, traders should always conduct their research and due diligence when selecting a broker to ensure it aligns with their trading style, risk tolerance, and financial goals.