Swap-free accounts in forex trading are designed to accommodate traders who must comply with Islamic finance principles, which prohibit transactions involving interest. These accounts eliminate the swap or rollover interest on positions held overnight, a common practice in conventional forex trading that can conflict with Sharia law. Instead of earning or paying interest, traders with swap-free accounts might incur a fixed commission or administrative fee for holding positions for an extended period. Many brokers offer these accounts as an alternative to regular trading accounts to ensure inclusivity for all traders regardless of their religious beliefs.

Many non-religious traders seek to trade without overnight fees to optimize their trading costs and enhance profitability. For this reason, swap-free accounts, initially designed for those following Islamic finance principles, have gained popularity among the broader trading community. By avoiding the swap or rollover interest on positions held overnight, traders can execute long-term strategies without the burden of additional costs. This approach allows for a more predictable cost structure and can be particularly appealing for traders focusing on markets with minor margin differences.

Forex brokers With No Overnight Fees do not exist because even Islamic accounts ( without swap fees or rollover fees) charge carry charges (fixed commission). However, in exceptional circumstances, some brokers like HFM offer periodic trading with a swap fee for specific instruments.

You can read the detailed HFM Broker Swap Rollover trading Policy with examples.

I will try to explain.

Rollover fees are essential for traders to understand as they directly impact the cost of holding positions overnight. Here’s a simplified breakdown using the provided examples:

- Rollover Fee Overview: Rollover, swap, or overnight fees are interests paid or earned for holding a derivative position overnight. HFM’s rollover policy ensures fairness in fees across tradable securities and asset classes, incorporating internal interest fees and those collected from counterparties, along with a market and risk analysis for specific volatile instruments.

- Rollover Debit Example (Nasdaq—USA100): For an account with the base currency in EUR, buying 1 lot of USA100, the rollover fee is calculated using the formula provided, incorporating both counterparty and internal interest fees. With specific values (-0.70 for the counterparty fee, 1.30 for the internal interest fee, and a currency rate of 1.1610 EUR/USD), the calculation results in a rollover debit of—$0.78. This means the trader would pay this amount for holding the position overnight.

- Rollover Credit Example (GBPUSD): Conversely, for an account with the base currency in USD, selling 0.50 lots of GBPUSD, the rollover calculation also takes into account the counterparty fee, internal interest fee, and pip value without needing to adjust for the currency rate since it’s already in USD. The provided numbers (0.45 for the counterparty fee, 0.70 for the internal interest fee, and a pip value 10) result in a rollover credit of $1.57. This means the trader earns this amount for holding the position overnight.

- Adjustments and Considerations: It’s important to note that overnight fees for indices CFDs (Contracts for Difference) may be adjusted for corporate actions, such as dividends and bonus issues, affecting the underlying equity indices’ underlying stocks. This indicates that traders should be prepared for frequent swap adjustments when trading indices CFDs.

See my video about swap fees and Islamic accounts:

This breakdown illustrates the complexity and variability of rollover fees, highlighting the need for traders to understand how these fees are calculated and applied to their trades, especially when holding positions overnight.

I will try to explain how HFM offers swap-free trading:

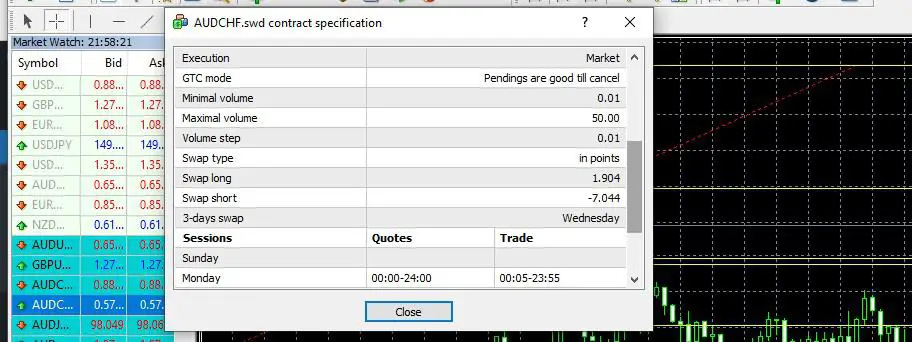

HFM offers tailored trading solutions to meet the diverse needs of its clientele, including swap-free trading accounts. These accounts are designed for clients who adhere to Sharia law, which prohibits engaging in transactions involving interest payments. To comply with these principles, swap-free accounts eliminate the traditional swap or overnight interest charges that accrue when a position is left open overnight. Yet, it’s important to note the introduction of Carry Charges for specific instruments if they are held open and rolled over for a sequence of days, ensuring the financial sustainability of these accounts.

Expanding accessibility beyond those observing Sharia law, HFM also provides swap-free trading options on specific accounts and for a particular set of financial instruments. This offering includes various currency pairs and commodities, catering to various trading preferences. Significant pairs like EURUSD, GBPUSD, and USDJPY are among the supported currency pairs, minor pairs such as AUDNZD and NZDCAD, and commodities like USOIL and UKOIL. This diversity allows traders from all backgrounds to engage in trading without incurring overnight fees, aligning with a wide range of trading strategies and ethical considerations.

HFM advises traders utilizing swap-free accounts to predominantly engage in day trading, aiming to reduce the number of positions held overnight. This recommendation is designed to prevent misuse of the swap-free conditions and ensure that the accounts serve their intended purpose effectively.

I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or haram (personal view) and whether stocks are trading haram. I also tried to answer a similar question about whether investing in stocks is haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.