Table of Contents

You can easily invest in stocks if you have a social security number or ITIN (Individual Taxpayer Identification Number). As per the Department of Homeland Security, people who are not citizens have an SSN if they stay in the U.S. for work. However, if you don’t get an SSN, you can get an ITIN and open a trading account with a broker.

How to Buy Stocks Without SSN?

To buy stocks without SSNs in the US, you must provide your broker with an Individual Taxpayer Identification Number (ITIN). You can get ITIN from the IRS (Internal Revenue Service) if you mail your W-7, tax return, proof of identity, and foreign status documents to the IRS Austin Service Center.

Many traders outside the US think they can not trade US stocks and use US brokers if they do not have US citizenship. It is a mistake. You do not need an SSN; you need ITIN to trade using a US broker. Investing with an ITIN Number in the US means you are covered for later tax purposes and gives your trading and supporting legal aspects.

How to invest in stocks without a Social Security Number (SSN):

- Use an Individual Taxpayer Identification Number (ITIN): To invest in the US stock market without an SSN, you need an ITIN, which can be obtained from the IRS by submitting Form W-7, tax return, proof of identity, and foreign status documents.

- Investing as an undocumented immigrant: Undocumented immigrants can invest in the US stock market since no law prohibits noncitizens from trading. They can use US brokers offering non-US citizens’ accounts or international brokers providing access to US stocks.

- Brokers and ITIN: Not all brokers require an SSN; some accept an ITIN. For example, Webull allows trading with an ITIN instead of an SSN. However, Robinhood requires an SSN and does not accept ITIN for account creation.

- Opening an account with a US broker: After obtaining an ITIN, you can open an account with a brokerage by providing necessary documents like a passport, driver’s license, or government-issued ID, along with financial information.

- Choosing the type of account: Decide whether you want a cash account, where you pay upfront for trades, or a margin account, which allows borrowing against your portfolio but involves interest charges and higher risks.

- Understanding the legal and tax implications: It’s crucial to know the tax obligations and legal requirements, such as reporting profits to the IRS using your ITIN or SSN and complying with regulations under the Securities and Exchange Commission, Financial Regulatory Authority, and the Patriot Act.

- Safety and verification: Providing your SSN to reputable financial institutions like Robinhood and Gemini is safe, as it’s required for client verification and tax purposes.

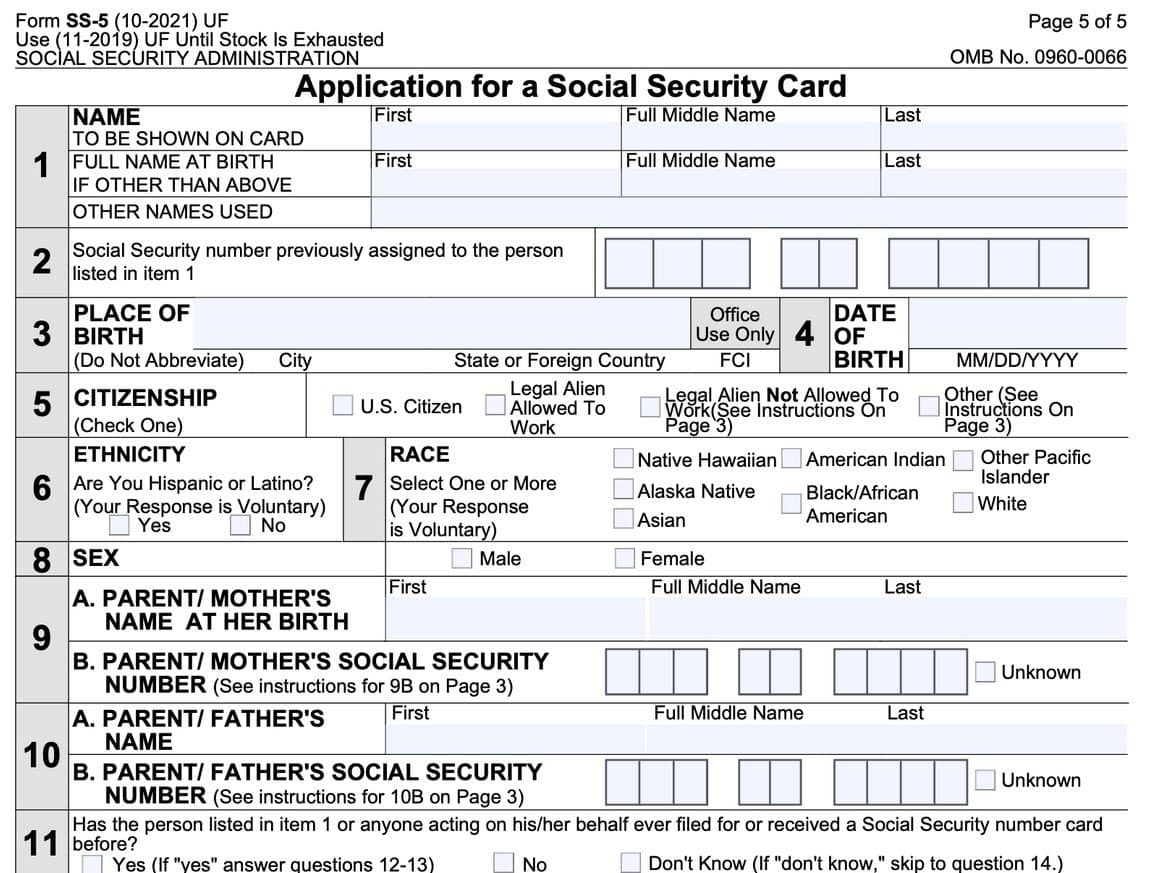

Here is an application for SSN looks like:

Can undocumented immigrants invest in the stock market?

Yes, suppose you are an undocumented immigrant in the US. In that case, you can invest in the stock market because no law forbids individuals (immigrants) who are not citizens of the U.S. from participating in the US stock market. However, some US brokers will ask you to provide an SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number).

If you are an undocumented immigrant in the US, you can do two things:

- You can trade and invest using US brokers offering non-US citizen accounts, such as Charles Schwab International, TD Ameritrade, etc.

- You can trade and invest using a non-USA broker that offers US stocks such as HF, Avatrade, Capital, etc.

How to get an ITIN?

If you are not qualified or do not have the right to work in the U.S. and do not have an SSN, you can get an ITIN. This number makes the taxpaying process for noncitizens and non-permanent citizens easier. Moreover, you must pay taxes if you are a trader who invests online. To get this number, fill out an IRS Form W-7 or IRS acceptance agent. You need to attach an ID or legible documents to verify your identity.

Can I use Robinhood without an SSN?

No, you can not use Robinhood without SSN. Social Security Number is something that each member of the Robinhood trading broker needs to have.

Can you use ITIN for Robinhood?

You can not use ITIN for Robinhood trading broker because you need to be a US citizen with an SSN. Many non-US residents use ITIN to trade using US brokers, but Robinhood does not allow that. However, you can have a valid U.S. visa and SSN if you do not have permanent US citizenship.

So, there is an exception for some traders: you can use Robinhood if you do not have permanent US citizenship. However, you need to provide an SSN to Robinhood. Remember, If You Requested an SSN When You Applied for Your Visa, you could get an SSN without permanent US citizenship.

Why does Robinhood need my SSN?

Robinhood needs your SSN because they need to cover their business to the IRS and make clear proof that you are a US citizen or a person who has a US visa and is given an SSN for tax purposes. SSN is essential for Robinhood for client verification and later tax purposes.

Is it safe to give Robinhood your social security number?

Yes, it is safe to give Robinhood your social security number (SSN) because financial institutions need to verify clients and cover their business for later tax purposes – either client or broker.

Do you need an SSN for Webull?

No, you do not need an SSN for Webull. If you are not a US citizen or do not want an SSN, you can provide an Individual Taxpayer Identification Number (ITIN) to a Webull broker. You can get ITIN from the IRS (Internal Revenue Service) if you mail your W-7, tax return, proof of identity, and foreign status documents to the IRS Austin Service Center.

Webull represents a US broker that allows investors and traders to provide SSN or ITIN numbers. In that case, you do not need to be a US citizen. You can provide your ITIN and pay only tax as an alien later.

Why does Gemini ask for SSN?

US law states that companies like Gemini must ask for SSNs and verify clients. In this case, the US can monitor tax payments for companies and clients. It is safe to provide your SSN and verify your identity with Gemini.

How to open an account using a US broker?

If you have acquired your ITIN or SSN, you can start trading by opening an account at a brokerage. You can determine your needs and choose from many available brokerages. You can also compare and contrast the features of different brokerages from trusted websites like Barrons.com or Kiplinger.com, which rank them based on factors like technology, fee, etc. It would help to open an account if you also have a passport, driver’s license, employment status, government-issued ID, and financial info.

How do you choose the type of account?

After opening an account with the brokerage, you must define how to pay taxes, use the uninvested money, and if anyone else will be trading on your behalf. You have to decide between a cash or margin account, too. You must pay the total amount for your trades in a cash account. Meanwhile, in margin accounts, you can borrow from your brokerage kee, use your current stocks as collateral, and pay them back in full. Since you are borrowing in this account, you must pay interest on the outstanding balances. The latter is a risk for new investors and not recommended.

Rules and regulations

Securities and Exchange Commission and Financial Regulatory Authority direct you to report the profits you make on your investments. You must utilize the ITIN or SSN as an identifier to file the taxes. Additionally, per the Patriot Act of 2001, criminals with a history of fraud will be barred from opening an account or using SSNs or ITINs.