Roth IRAs have captured the investing public’s attention ever since they were introduced in 1997. They have become increasingly popular over the years due to their tax-free withdrawals and their versatility in investment options. However, one question often arises regarding Roth IRAs and whether investors can trade options in these accounts.

Roth IRA portfolio trading refers to managing the investments in a Roth IRA account by buying and selling various assets, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs), to maximize returns and minimize risk.

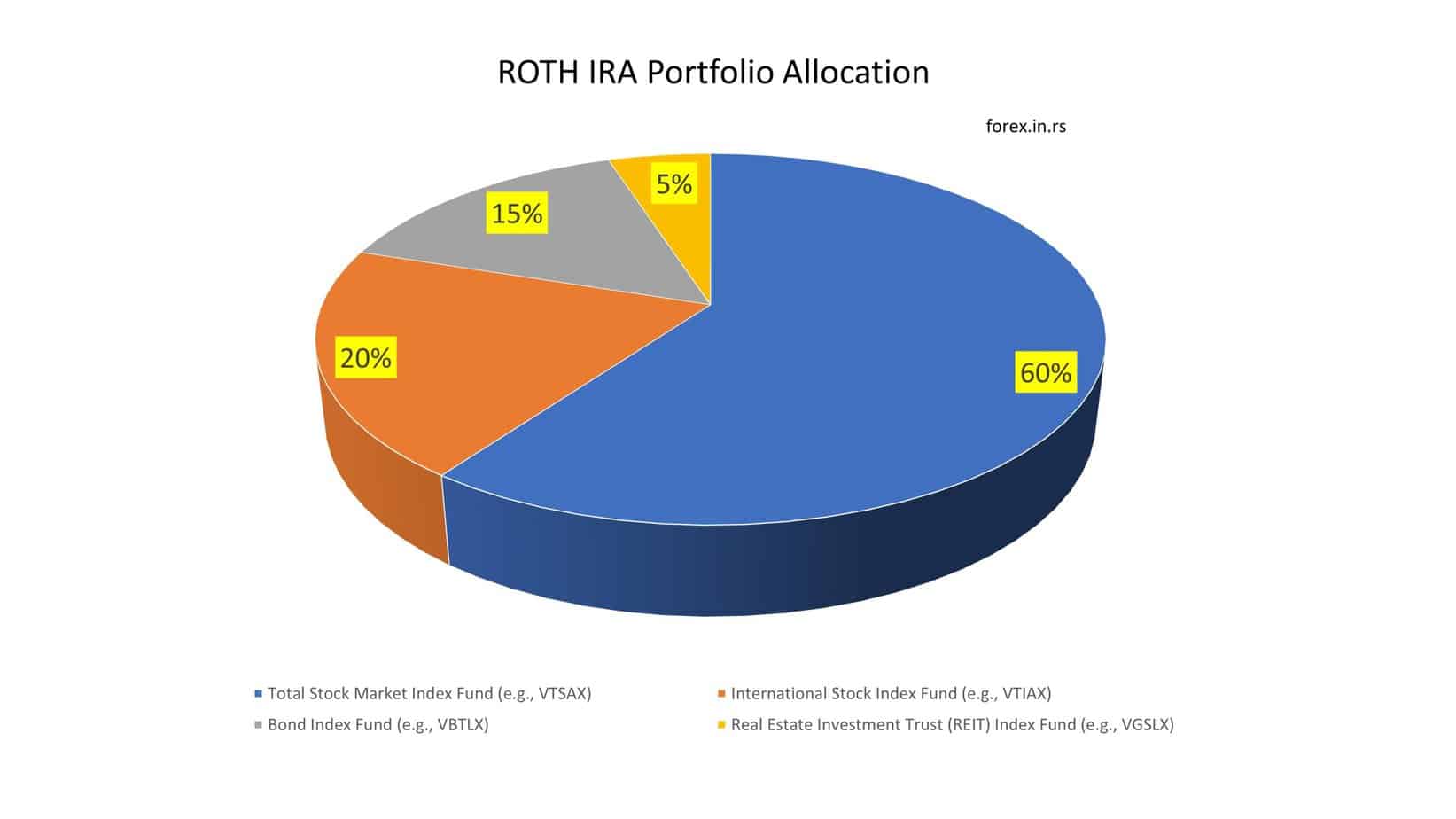

Portfolio trading in a Roth IRA account is typically based on a specific investment strategy or set of investment goals, such as asset allocation, diversification, or active management. The goal is to construct a portfolio that meets the account holder’s investment objectives while also considering their risk tolerance, time horizon, and other factors.

There are many different approaches to Roth IRA portfolio trading, and the specific strategy used will depend on the account holder’s goals and preferences. Some standard methods include:

- Passive index investing involves buying and holding a diversified mix of index funds or ETFs that track various markets or asset classes.

- Active stock picking: This involves researching and selecting individual stocks or mutual funds to buy and sell based on company or market trends analysis.

- Tactical asset allocation: This involves periodically adjusting the mix of assets in the portfolio based on current market conditions or other factors.

Regardless of the specific approach used, it’s essential for Roth IRA account holders to carefully monitor their portfolios and periodically rebalance their investments to ensure they remain aligned with their investment goals and risk tolerance.

Can you Buy Options in a Roth IRA?

Yes, you can buy options in a Roth IRA account. However, you can not use options strategies such as margin trading, covered call writing, naked call, spreads, straddles, or other complex systems. Instead, you can use options trading to increase your income and hedge against stock price declines.

There is no specific limit on how much you can buy options in a Roth IRA account, but it is essential to understand the rules and risks involved with trading options in a retirement account.

According to the IRS rules, a Roth IRA account can engage in options trading if the account is set up to allow it and the brokerage firm approves the account holder to trade options. However, options trading must also be done to avoid violating the IRS rules for prohibited transactions, such as using the Roth IRA to benefit the account holder or any disqualified persons.

The amount you can invest in options will depend on the available funds in your Roth IRA account and the minimum investment amount required by the brokerage firm. It’s important to remember that options trading can be risky. It may result in substantial losses, so it’s essential to thoroughly research and understand the strategies and risks involved before investing. It’s also a good idea to consult with a financial advisor before making investment decisions in your Roth IRA account.

First and foremost, it is essential to note that Roth IRAs are designed to be long-term investment vehicles, which makes them unsuitable for active trading strategies. However, experienced investors can use stock options to hedge positions or generate extra income, which can be valuable to any long-term investment strategy.

One advantage of trading options in a Roth IRA is the tax-free nature of the account. When you hold options in a traditional brokerage account, you are subject to capital gains taxes on any profits you earn from those options. However, with a Roth IRA, all gains are shielded from taxation, making them an attractive option for investors seeking to minimize their tax liability.

Another advantage of trading options in a Roth IRA is its flexibility. Investors can choose from various options strategies, including covered calls, protective puts, and spreads. Each strategy offers a unique way of generating income or hedging risk, depending on the investor’s objectives.

Before diving into options trading in a Roth IRA, it is essential to understand the rules and restrictions surrounding these accounts. For example, the IRS has strict guidelines regarding the types of assets that can be held in a Roth IRA. Additionally, not all brokers offer options trading within Roth IRAs, so thoroughly researching your options before selecting a brokerage firm is essential.

It is also essential to understand the risks involved with trading options. Options are complex financial instruments that require a deep understanding of the underlying asset and the potential risks and rewards of each strategy. As a result, potential investors should be willing to invest the time and effort required to become proficient in options trading before attempting to trade in a Roth IRA.

IRS rules for prohibited transactions

The IRS rules for prohibited transactions are designed to prevent Roth IRA account holders from using their accounts to benefit themselves or other disqualified persons. The rules prohibit certain transactions between a Roth IRA account and a disqualified person, including the account holder, their spouse, their lineal descendants, and specific business entities.

Some examples of prohibited transactions include:

- Selling property to a Roth IRA account or buying property from a Roth IRA account

- Lending money to or borrowing money from a Roth IRA account

- Using the assets of a Roth IRA account as security for a loan

- Paying excessive compensation to a disqualified person for services provided to a Roth IRA account

These rules are in place to ensure that Roth IRA accounts are used for their intended purpose, which is to provide tax-advantaged retirement savings. Violating these rules can result in significant penalties and taxes, including disqualifying the entire Roth IRA account.

It’s essential for Roth IRA account holders to understand the rules for prohibited transactions and to avoid any transactions that could be considered a violation. If in doubt, it’s a good idea to consult with a financial advisor or tax professional before making any investment decisions or transactions in your Roth IRA account.

In conclusion, while Roth IRAs are not designed for active trading, they offer investors the flexibility to trade options as part of a long-term investment strategy. Trading options in a Roth IRA can be a powerful way to generate income or hedge investment risk while taking advantage of the tax-free nature of these accounts. Investors interested in this type of investing should do their homework, understand the risks involved, and select a broker that offers options trading within a Roth IRA.

Roth IRA accounts trading restrictions.

Certain restrictions exist in a Roth IRA account on the types of investment strategies that can be used. For example, some options strategies are prohibited because they involve excessive risk or speculative activities, which are not permitted under U.S. tax laws. These include:

- Margin trading: Using borrowed funds to buy or sell securities is not allowed in a Roth IRA account, as it involves excessive risk and can lead to significant losses.

- Naked call or put options: Selling call or put options without owning the underlying securities are considered speculative and not allowed in a Roth IRA account.

- Covered call writing: Writing covered calls, where an investor sells call options on stocks they already own, is allowed in a Roth IRA account, but there are limits on how many calls can be written and at what strike price.

- Spreads, straddles, and other complex options strategies: These strategies involve multiple options contracts with different strike prices and expiration dates, and they can be complicated to manage. Roth IRA investors are limited in the types of complex options and strategies they can use.

Investors are encouraged to consult with a financial advisor and carefully review the terms and conditions of their Roth IRA account to ensure compliance with U.S. tax laws and Islamic finance principles. It is important to note that the rules and regulations governing Roth IRA accounts may vary depending on the financial institution and the country where the account is held.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE