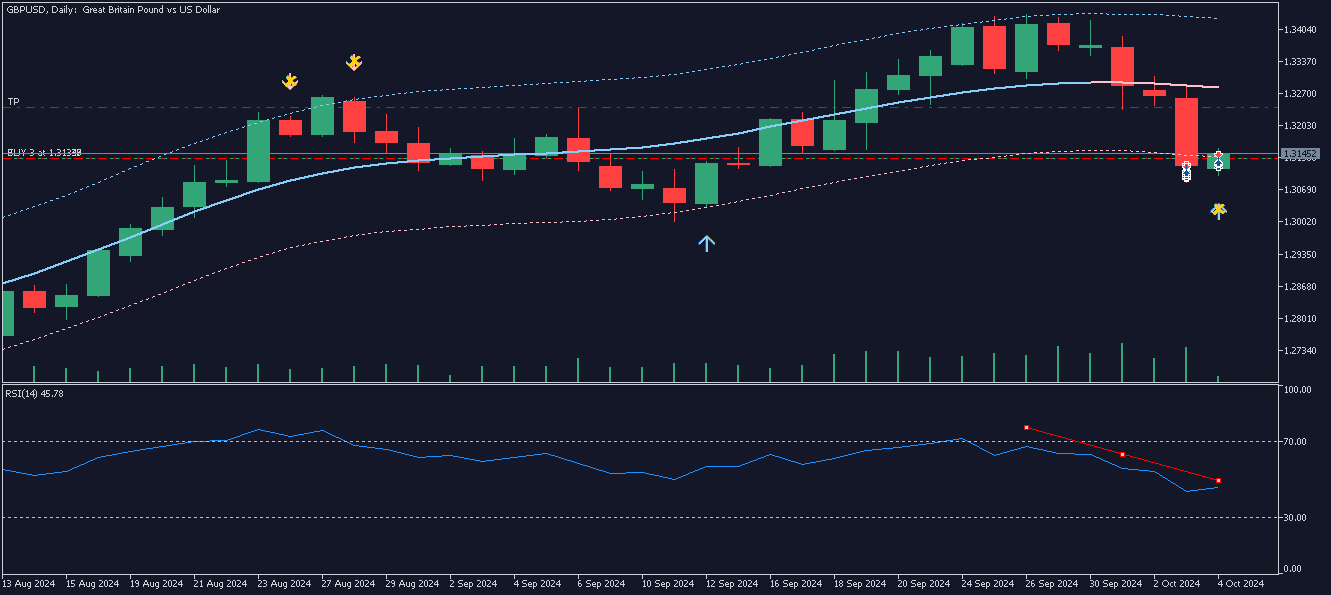

The GBP/USD pair experienced a significant drop from 1.328 on Thursday to a low of 1.309 later that day, mainly driven by critical factors influencing market sentiment. The decline was triggered by an interview with a prominent Bank of England (BoE) official, which sparked concerns about the possibility of more rate cuts for the British pound. Speculative rumors surrounding the future direction of the UK’s monetary policy only fueled these concerns, leading to heightened volatility in the forex market. As traders reacted to the potential for looser monetary policy, the pound lost value against the dollar, marking a sharp decline within a short period.

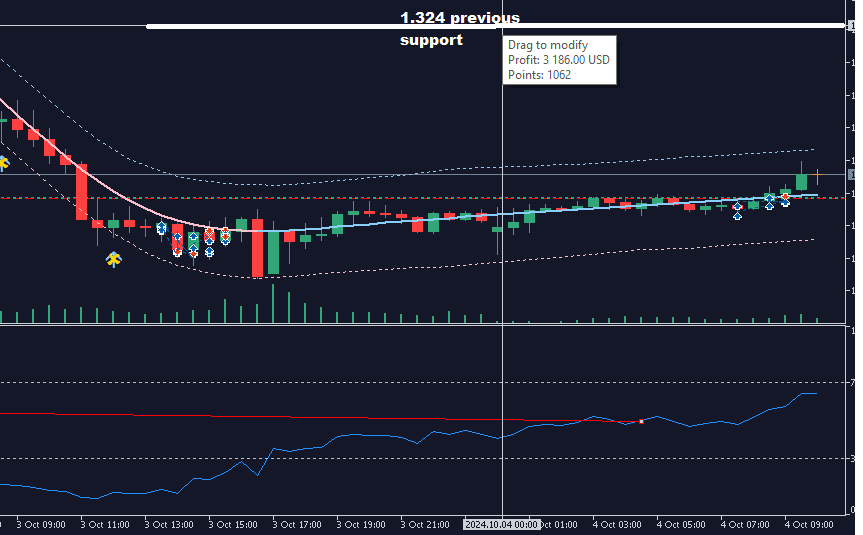

Please watch my video with my setup:

To capture the big moves, you must monitor fundamental inputs (economy data, interviews, and governors’ speeches) and catch swing trades at the low or high in the oversold and overbought markets. Of course, any price divergence can help to find a nice entry setup.

Sterling saw a sharp decline against the US dollar (GBP/USD) after Bank of England (BoE) Governor Andrew Bailey’s comments sparked significant market reactions. The British pound fell to a two-week low as investors swiftly adjusted their expectations based on potential changes in the UK’s monetary policy. The currency, trading at $1.328 on Thursday morning, tumbled to $1.309 by the end of the day. This rapid depreciation was primarily driven by Bailey’s hints at further interest rate cuts, compounded by global economic factors and heightened demand for safer assets.

Bailey Hints at More Aggressive Rate Cuts

In an interview with The Guardian, Bailey suggested that the BoE could take a “bit more activist” approach in cutting interest rates if inflation continues to slow. This marked a clear shift from his previous cautious stance. The possibility of a more aggressive monetary easing signaled to the markets that the central bank may take more decisive action to support the economy, further weakening the pound.

The timing of Bailey’s comments was critical, as inflation in the UK has shown signs of softening. The consumer price index (CPI) recently fell to 2.2%, just slightly above the BoE’s 2% target. The central bank is faced with balancing inflation control with maintaining economic stability. Bailey’s statements confirmed that interest rate cuts are imminent if inflationary pressures continue to ease.

The currency market reacted almost instantly, with GBP/USD dropping by 1.1% within hours of the interview. By the end of Thursday, the pair had shed more than 2% from its recent highs, a clear reflection of traders’ revised expectations about the BoE’s policy trajectory.

Bailey’s remarks triggered a significant reassessment of future interest rate expectations. Financial markets, which had previously been pricing in a gradual monetary easing cycle, now rushed to fully anticipate a rate cut by the BoE as early as next month. This shift in sentiment pushed the pound lower as traders responded to the increased probability of rate cuts in the near term.

Before Bailey’s interview, markets projected five rate cuts by the end of 2025. However, following his comments, this outlook was revised to six cuts. The growing belief that the BoE would engage in a more aggressive series of rate reductions dampened the pound’s appeal to investors significantly as the US dollar strengthened due to the Federal Reserve’s more hawkish stance.

Global Factors Influencing Currency Movements

While the BoE Governor’s comments were the primary catalyst for the pound’s sharp drop, broader global dynamics added further pressure. One major factor was the ongoing geopolitical tension in the Middle East, particularly the conflict between Israel and Iran. This conflict has fueled demand for safe-haven currencies like the US dollar, exacerbating the downward movement of GBP/USD.

Additionally, robust economic data from the US, particularly concerning job market growth, bolstered expectations that the Federal Reserve would maintain its higher interest rate policy for an extended period. Combining a more dovish outlook from the BoE and a more hawkish stance from the Fed widened the interest rate differential between the two economies, making the dollar more attractive relative to the pound.

Balancing Act for the Bank of England

Governor Bailey faces a complex balancing act as the BoE navigates economic uncertainty. With inflation showing signs of cooling and economic growth remains fragile, the central bank has to weigh the need for further rate cuts against the risks of undermining the currency. While the inflation rate is now closer to the BoE’s target, concerns remain about the overall health of the UK economy, particularly in light of weak growth forecasts and global economic headwinds.

The BoE’s next monetary policy committee meeting, scheduled for early November, will be crucial for determining the future direction of interest rates. Market participants will be closely watching Bailey and other policymakers for further indications regarding the central bank’s willingness to act swiftly in the face of declining inflation and slower growth.

Looking Ahead: Factors for Sterling’s Recovery

A few key developments would need to unfold for sterling to regain its recent strength. First and foremost, any unexpected improvement in UK economic data, particularly related to inflation or wage growth, could boost the pound. This would reduce the likelihood of aggressive rate cuts by the BoE and support the currency.

Moreover, de-escalating geopolitical tensions in the Middle East would likely reduce demand for safe-haven assets like the US dollar, offering further relief to GBP/USD. However, these factors remain highly uncertain, given the current global economic environment and ongoing risks.

As the BoE prepares for its next policy decision, investors will closely monitor domestic economic indicators and global developments. Any more aggressive monetary easing signals could extend the pound’s losses, while more positive news could offer a much-needed recovery for the currency.

In the meantime, sterling’s sharp drop on Thursday reminds us of the currency markets’ sensitivity to central bank communication and the broader global economic context. The pound’s ability to recover from this setback will depend heavily on the BoE’s actions and the evolving dynamics of the global economy.

My trading Setup