Table of Contents

The global economy is always at the mercy of the stock market. The stock market is constantly influenced by factors that can either trigger growth or a slowdown. As a result, most Americans are always on the lookout for signs of an impending recession. During such moments, people start to panic and rethink their investment decisions. If you have a 401k retirement account, you may be wondering whether or not to cash out before a recession. This article will explore the benefits and drawbacks of cashing out your 401k before a recession.

What is a 401k?

A 401k is an investment account typically used for retirement savings offered by most employers in the United States. It allows you to invest pre-tax income into mutual funds or other investment options. The funds are then held in the account and grow tax-free until you withdraw the money after retirement.

- A 401(k) plan is an employer-sponsored retirement plan in the United States.

- Employees contribute pre-tax earnings to their 401(k) accounts, which are then invested in various funds or other investment vehicles.

- Employers can match employee contributions up to a certain amount, providing an additional incentive for employees to participate.

- 401(k) plans have contribution limits, with the maximum contribution amount typically adjusted annually for inflation.

- Withdrawals from a 401(k) account are generally taxed as income and are subject to penalties if made before the age of 59 and a half unless an exception applies.

- The funds in a 401(k) account can be rolled over to another employer’s plan or an individual retirement account (IRA) when an employee leaves or retires.

- 401(k) plans have become increasingly popular since their creation in the 1980s, and many employers now offer them as a critical benefit to attract and retain employees.

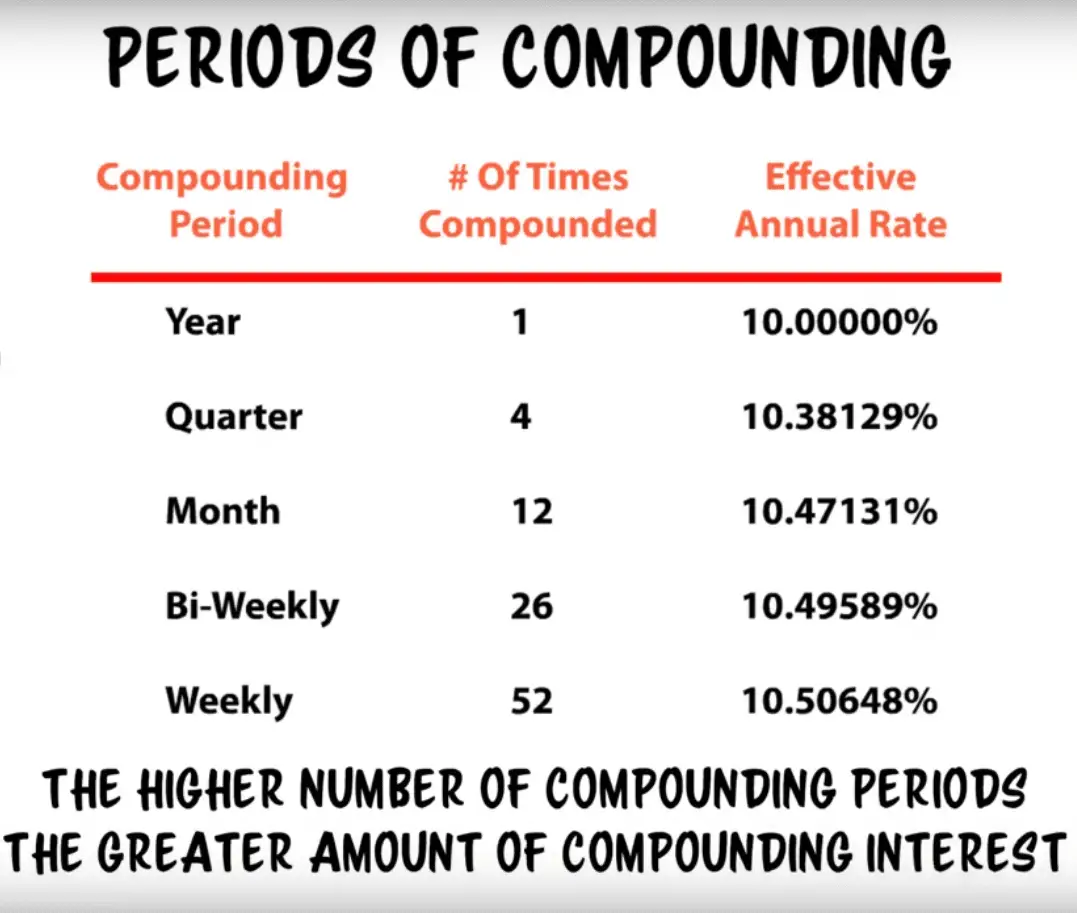

One of the main benefits of a 401k is that it allows you to grow your money over time through compounding interest. Your money earns interest over previous earnings, leading to a snowball growth effect.

What is a Recession?

A recession is a period of economic decline characterized by a persistent and widespread reduction in economic activity, leading to a decrease in the Gross Domestic Product (GDP) for two or more consecutive quarters. The stock market is often a leading indicator of a recession.

- A recession is a period of economic decline characterized by a decrease in Gross Domestic Product (GDP) for two or more consecutive quarters.

- Recessions typically lead to high levels of unemployment as companies reduce their workforces in response to declining demand and revenues.

- During a recession, consumer spending declines as individuals and families cut back on nonessential purchases.

- Business investment declines as companies delay or cancel capital projects and other expenditures.

- Recessions can lead to deflationary pressures as prices fall in response to weak demand, further exacerbating the economic decline.

- Recessions can also lead to financial stress and instability, with bankruptcies and defaults becoming more common as individuals and businesses struggle to meet their financial obligations.

- Government policy responses to recessions may include fiscal stimulus programs, such as tax cuts or increased government spending, and monetary policy interventions, such as interest rate cuts or asset purchases.

- The length and severity of a recession can vary widely depending on various factors, including the underlying cause of the downturn and the effectiveness of government policy responses.

Should I Cash Out my 401k Before a Recession?

No, usually, cashing out 401K before the recession is not a financially proper decision because it is tough to calculate the correct timing of the recession, and you can get substantial tax penalties. Additionally, you can lose the opportunity for compound interest in the long run.

Remember, after each recession, stocks can be cheap, and then by purchasing major stocks at a low price, you can make compound interest profit in the long run.

It is generally not a bright idea to cash out a 401(k) account before a recession for several reasons:

- Tax Penalties: Withdrawing funds from a 401(k) before 59 ½ can result in a penalty of 10% of the amount withdrawn and the income tax owed on the withdrawal. This means that a significant portion of the account balance may be lost to taxes and penalties.

- Long-Term Impact: Cashing out a 401(k) account prematurely can impact retirement savings long-term. By removing funds from the report, individuals are missing out on the opportunity for compound interest, which can significantly increase the account balance over time.

- Market Timing: It can be difficult to accurately predict a recession’s timing and impact on investment portfolios. Cashing out a 401(k) account before a recession could mean missing out on potential gains if the market rebounds quickly.

- Retirement Income: A 401(k) account is designed to provide retirement income, and cashing out early can jeopardize an individual’s ability to support themselves in retirement. This is particularly important for individuals who may not have other sources of retirement income, such as a pension or Social Security benefits.

It is generally recommended to avoid cashing out a 401(k) account before a recession and instead considers other options, such as rebalancing the investment portfolio or adjusting contributions. It is also essential to consult with a financial advisor before making significant financial decisions.

You are cashing out your 401k before a recession may seem like a good idea, especially if you fear losing your retirement savings. However, there are several reasons why this decision may not be the best move for your finances in the long run.

Firstly, cashing out your 401k before a recession means you will be taxed immediately on the money you withdraw. This can add to a significant amount of money owed to the Internal Revenue Service (IRS). In addition, if you cancel before 59½, you may also be subject to a 10% early withdrawal penalty.

You are, secondly, withdrawing your 401k before a recession and missing out on the benefit of compounding interest. By staying invested in the market, you can reap the benefits of compound interest, which can help you grow your money significantly over time. If you cash out your 401k, you will miss these gains.

Lastly, the decision to cash out your 401k before a recession may be a product of market timing, which is notoriously difficult to predict. Trying to time the market can be dangerous, leading to missed opportunities and significant losses.

What Are the Alternatives to Cashing Out Your 401k?

- Adjust your investment strategy to minimize losses during the recession.

- Increase your 401K plan contributions to take advantage of the lower stock prices.

- Consider rebalancing your 401K portfolio to reallocate your investments into sectors expected to perform well during the recession.

- If you have a target-date fund, review the asset allocation to ensure it aligns with your risk tolerance and investment goals.

- Review your 401K fees and expenses and make sure they are reasonable.

- Consider taking a loan from your 401K if you need short-term cash, but be aware of the risks and potential tax implications.

- Consider converting your traditional 401K to a Roth 401K if you believe your tax bracket will be lower during the recession, as this may be an excellent time to pay taxes on the conversion.

- Stay informed about the economic conditions and their impact on 401K investments.

- Consult with a financial advisor to develop a plan considering your financial situation and goals.

If you are concerned about losing your retirement savings during a recession, there are better alternatives to cashing out your 401k. One option is to stay invested during the recession simply. History shows that markets can recover from downturns and even become more robust in the long run. So by visiting invested, you can reap the benefits when the market recovers.

Another option is to rebalance your portfolio. This means you can adjust your investments to minimize risk during a recession. For instance, you can invest in bonds, which carry less risk than stocks during a downturn.

It is also crucial to note that financial advisors can provide invaluable guidance and insights into market trends during a recession. Seeking professional advice is a great way to stay informed and make informed financial decisions.

Gold IRA as soluiton for 401K during Recession

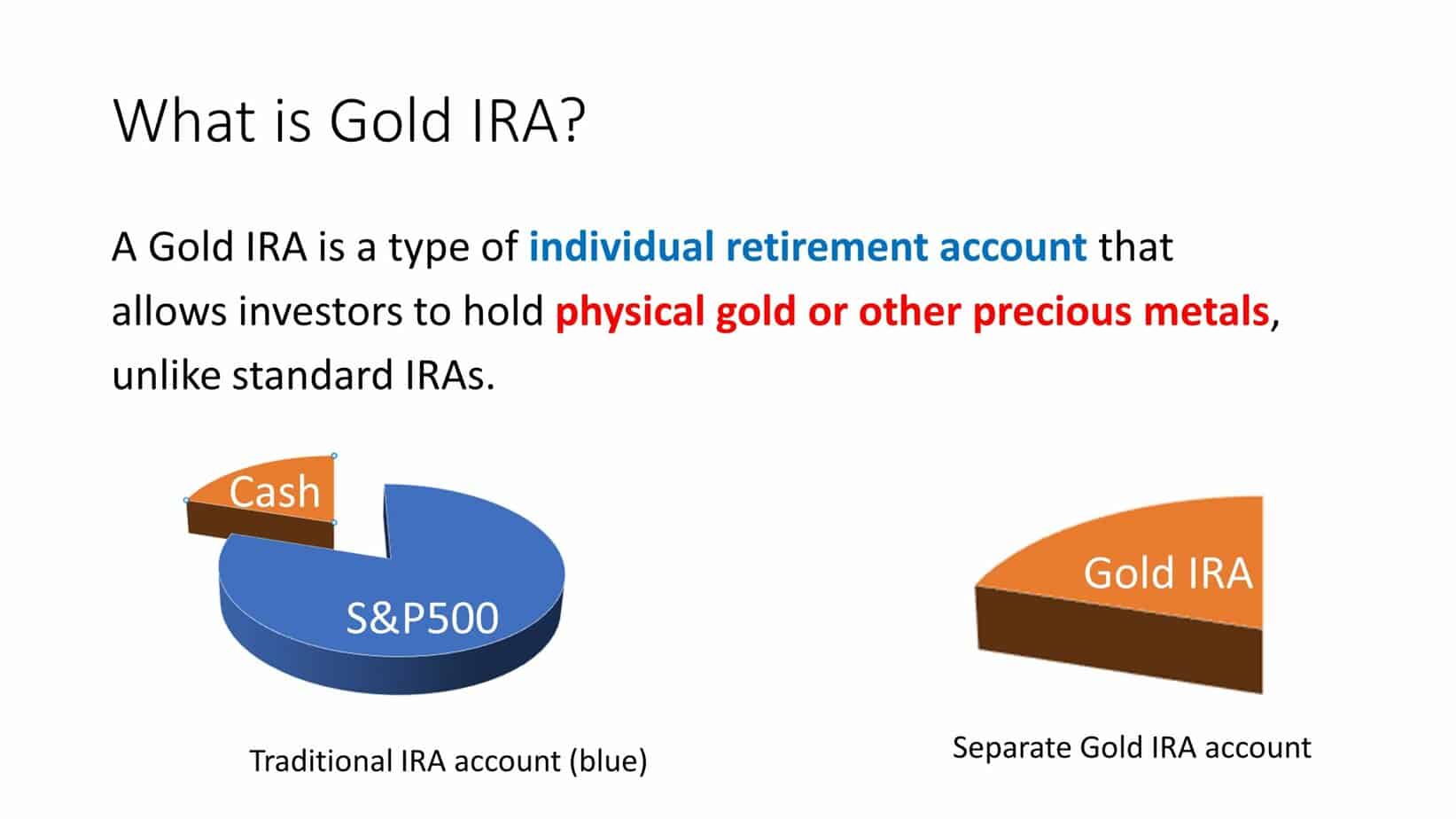

Gold IRA, a type of Individual Retirement Account that allows you to invest in physical gold or other precious metals, can be a good solution for your 401K during a recession. This is because gold is golden as a haven asset that can provide a hedge against inflation and economic uncertainty. During a recession, traditional investments such as stocks and bonds may experience significant volatility and decline in value, while gold may hold value or increase in value. By diversifying your 401K portfolio with a Gold IRA, you may be able to mitigate some of the risks associated with a recession and potentially preserve your retirement savings. However, it’s essential to consider the potential risks and benefits of investing in gold with a financial advisor before making investment decisions.

- Gold IRA can hedge against inflation and economic uncertainty during a recession.

- Gold is often seen as a haven asset that may hold its value or even increase during a recession, while traditional investments such as stocks and bonds may decline in value.

- Diversifying your 401K portfolio with a gold IRA mitigates some recession risks and potentially preserves your retirement savings.

- Gold IRA allows you to invest in physical gold or other precious metals, a tangible asset you can physically possess.

- Gold IRA can offer tax advantages similar to traditional 401K plans, such as tax-deferred growth and the ability to contribute pre-tax dollars.

- Gold IRA can offer flexibility in terms of investment options, allowing you to choose from various gold and metal products and storage options.

- Gold IRA can provide peace of mind by diversifying your retirement portfolio and potentially reducing overall investment risk.

- Gold IRA can be a good solution for those with a long-term investment horizon and who are willing to accept the risks of investing in gold and precious metals.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

Conclusion

In summary, cashing out your 401k before a recession may seem like a good idea, but it is often not the best financial move. Fortunately, there are alternatives to help you safeguard your retirement savings. By staying invested, rebalancing your portfolio, and seeking professional advice, you can better prepare for a recession and save for retirement. Remember, compound interest is critical to growing your retirement savings and cashing out your 401k prematurely can cause significant losses in the long run.