Table of Contents

We have moved away from traditional trading. Several instruments and securities at our disposal and technological development have positively altered how traders, investors, and brokers interact. Even if you prefer to trade stock market indices, the way it can be done now is very different from what it used to be two decades ago. If you wish to invest in the stock market, you must gain some exposure to a stock index. This is a cost-effective and easy way that offers instant diversification.

You can benefit more from trading indices than individual stocks, as indices introduce you to the entire industry. However, trading individual stocks is more demanding because you must read companies’ reports and compare them to identify trends.

Not everyone is comfortable directly investing in an index, especially new traders. If you belong to this lot, you can consider an indirect investment. This can be done in the form of CFDs and ETFs. Let’s explore the two alternatives individually to conclude which one is better.

What are ETFs?

ETFs, or Exchange-Traded Funds, are investment funds based on a portfolio of assets such as stocks, bonds, commodities, or currencies. The value of the underlying assets determines the price of the ETF.

- ETFs are investment funds traded on an exchange, just like stocks.

- ETFs invest in a portfolio of assets such as stocks, bonds, commodities, or currencies, and the value of the underlying assets determines the price of the ETF.

- ETFs are passively managed and track a specific market index or sector, such as the S&P 500 or the technology sector.

- ETFs offer diversification and lower costs compared to actively managed funds.

- ETFs can be bought and sold at the current market price throughout the trading day.

- ETFs may pay dividends to investors.

ETF example:

Traders are supposed to choose sector-specific ETFs, and one of the underlying assets determines the price of the ETF’s daily liquidity. This is why more investors are drawn toward ETFs.

Index ETFs do not give ownership of the asset to the investors. Instead, they are supposed to speculate on the movement related to the said index. As a result, index ETFs are more likely to make a short-term profit throughout the trading days, though they involve a higher risk than long-term ETF investments.

Index ETFs offer diversity, which today’s investors appreciate. They offer high liquidity at a relatively low fee, as they are traded on a public stock exchange. The list of benefits doesn’t end here. You also get capital gains. Instead, the exemption is because of their general disposition, reasonable liquidity, and special dividend treatment. Finally, you can expect a lower commission from brokers if you are an ETF trader.

Investing in an ETF will be your best option if you have sufficient capital and don’t need high leverage. You can utilize your capital without taking a considerable risk completely. Their components balance eTFs because when the value of one instrument goes down, the other is appreciated.

Dollar-cost averaging, asset allocation, betting on seasonal trends, hedging, Finallif swing trading, sector rotation, and short-selling are some ETF features of ETF trading strategies news, and novice traders will find this helpful.

What are CFDs?

CFD stands for “Contracts for Difference.” It is a financial derivative instrument that allows traders to speculate on the price movements of an underlying asset, such as stocks, indices, currencies, or commodities, without actually owning the asset.

- CFDs are financial contracts between a buyer and helpful that allow traders to speculate on the price movements of an underlying asset, such as stocks, indices, currencies, or commodities.

- CFDs don’t involve ownership of the underlying asset but rather a contract paying the difference between the asset’s opening and closing prices.

- CFDs can be leveraged, meaning traders can take a more prominent position with less capital.

- CFDs can be traded on margin, which means traders can borrow money to increase their position size.

- CFDs can be bought or sold anytime during trading hours, and traders can go long or short on the underlying asset.

- CFDs don’t pay dividends to investors.

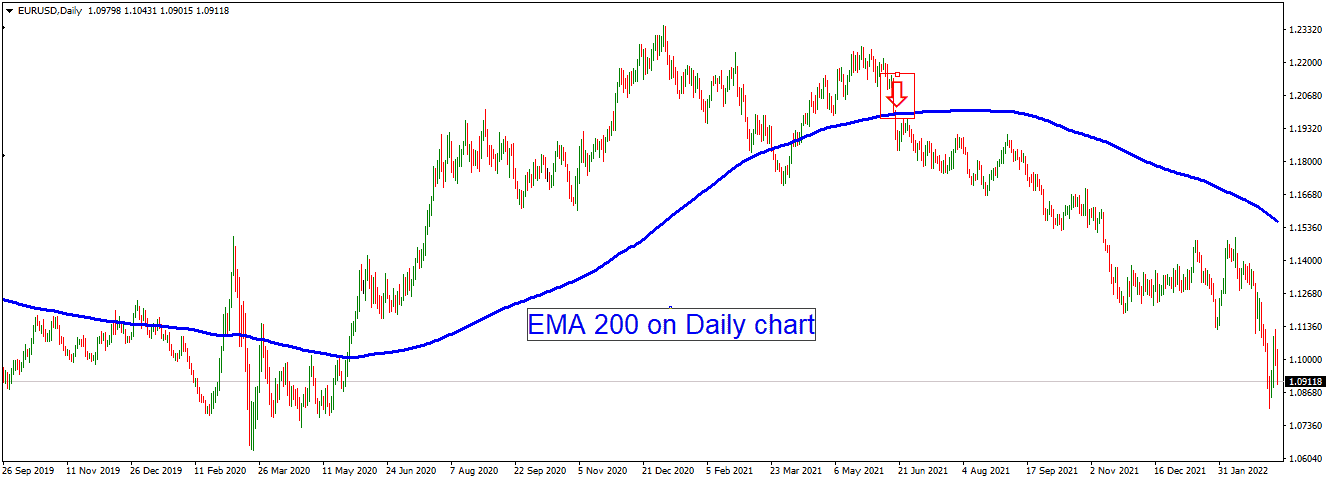

CFD example – EURUSD asset chart:

This allows traders to profit from rising and falling prices. In addition, CFDs are often purchased with leverage, meaning traders can take a more prominent position with fewer CFDs. However, due to high leverage, CFDs also carry a high level of risk, as traders can lose more than their initial investment.

The investor is asked to pay 5-10% of the underlying asset when they open a position. A CFD contract does not expire. You can renew it after each trading day if you feel the position benefits addition to you.

Investors prefer CFDs as these instruments minimize the risk, and fin acts more prominent, spreading the investment across an entire segment instead of concentrating it on a particular company. As your investment is diversified, most factors that could impact your investment are taken care of. You will get both market and instant execution options with CFDs. You will get fast and easy trading as your orders are executed on time.

Based on these speculations, the investor signs the contract to exchange the gap in the assets’ initial and final prices. Speculation can be made about both falling and markets. Since the CFD collection is one of the most extensive registered stocks on a stock exchange, you get global market access, higher leverage, lower transaction costs, and non-stop trading.

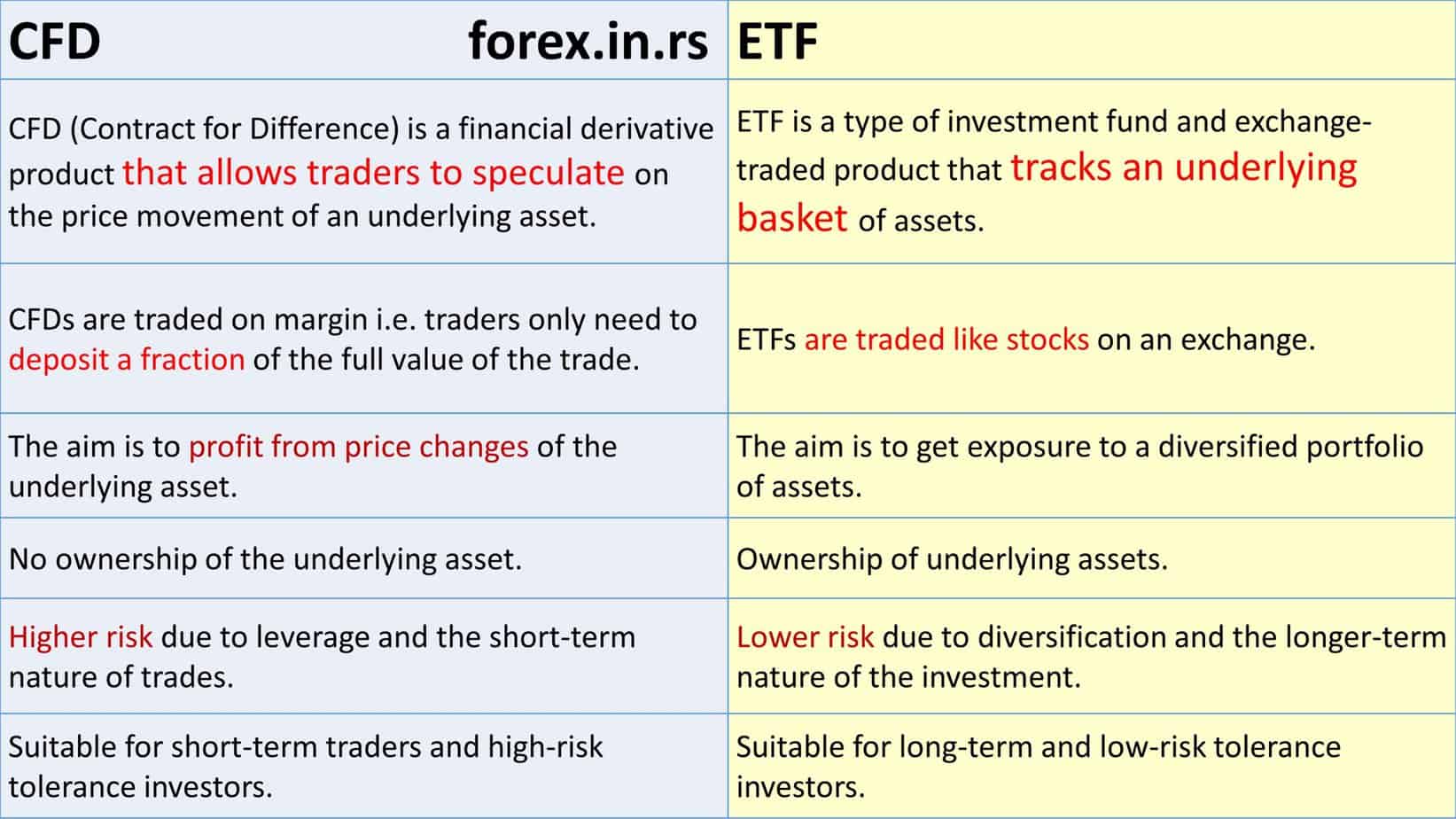

CFD vs. ETF

- When you trade CFDs, you do not own the asset; while trading ETFs, you own underlying assets.

- CFDs can be one asset, such as EURUSD, GBPUSD, or Gold, while ETFs are a basket of securities, such as the technology sector in the S&P500, or a Metals basket (gold, silver, palladium, etc.).

- CFDs speculate price movement, while ETFs are usually investment funds where you track several assets.

- CFDs are usually high-risk short-term assets, while ETFs are low-risk long-term baskets of assets.

CFDs and ETFs Example

CFDs: Let’s say you want to trade CFDs on the stock of tech should, XYZ Corp. You believe the stock price will increase in the short term, so you decide to open a long position on XYZ Corp CFDs. You invest $1000 and use the leverage of 10:1, which allows you to take a job worth $10,000.

If the price of XYZ Corp stock rises as you predicted, and you close your CFD position at a profit, you will earn the difference between the opening and closing prices minus any fees and commissions. However, if the price of the stock drops, you could lose more than your initial investment, depending on the leverage used and market conditions.

Trading ETFs: You want to invest in the technology sector through an ETF. Your research and invest in a technology ETF that tracks the NASDAQ Composite Index. You purchase shares of the ETF at the current market price using a brokerage account.

As the ETF is passively managed, its value will rise and fall in line with the performance of the underlying index. If the technology sector performs well and the value of the NASDAQ Composite Index increases, your ETF investment will also increase. If the technology sector performs poorly, the value of your ETF investment will decrease. You can hold the ETF long-term, sell it for a profit, or sell it at a loss if necessary.

Conclusion

Before you choose one of the above instruments, you must educate yourself about the underlying assets. Index ETFs and Index CFDs are both popular and have pros and cons. Your expectations from your investment will tell you which is more appropriate for you.