Table of Contents

The Chandelier Exit indicator is a fluctuating indicator that permits an investor to continue in a position until an apparent trend reversal has occurred. The explanation below will show how a trader can prevent closing the position at an early stage and achieve maximum price interest point returns with the help of the CE indicator.

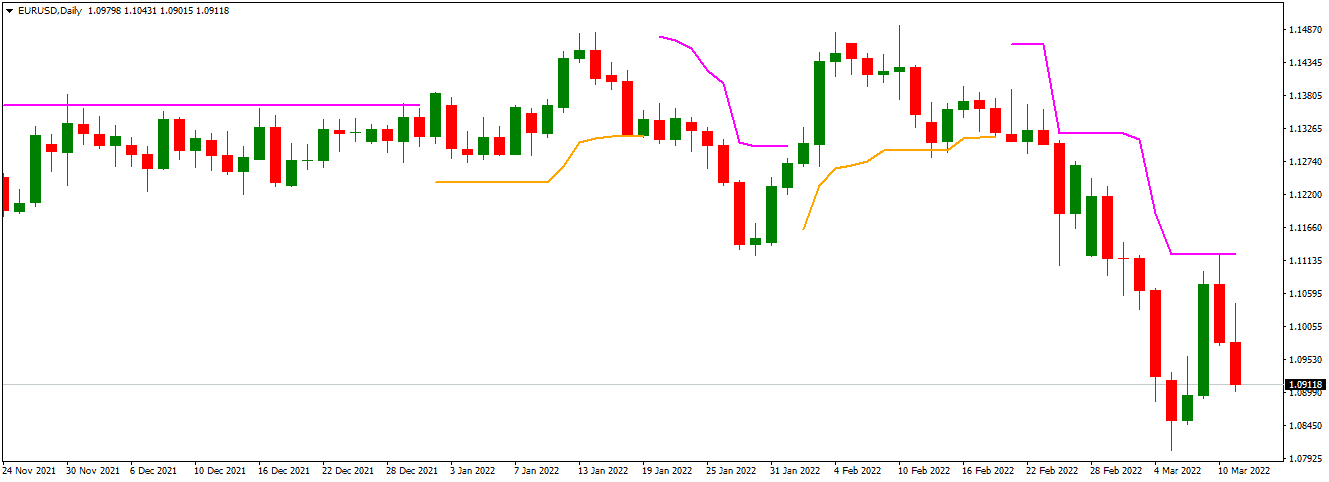

With the help of the CE indicator, the forex investor can prevent premature exits and keep the position secure for the required duration. The indicator operates on the Average True Range – ATR – to calculate the volatility and gives an accurate trailing stop-loss. In addition, when the indicator and price cross, the indicator indicates optimum entry points. Traders could, therefore, personalize the indicator by using the Average True Range – ATR calculator to accommodate various financial tools. The Chandelier Exit indicator, a MetaTrader indicator, gives all the resources required for effectively trading the trend.

Download the Chandelier Exit Indicator

Download Chandelier Exit Indicator

How to use the Chandelier exit indicator?

Chandelier exit indicator you can use to define stop loss for your trade. Usually, the best period to detect stop loss is H4, which is a daily or weekly chart time frame.

The trading indications provided by the Chandelier Exit Indicator for MT4 can be viewed on the GBPUSD H4 chart. Because the numbers are computed in real-time as per the ATR values, the indicator ranges give the optimum resistance and support ranges. Hence, the traders may regard a violation of these ranges as an access point.

In an upward crossover, buy signals are generated, whereas during a downward crossover, sell signals are generated.

Identifying the optimal exit levels with CE MetaTrader Indicator

The Average True Range multiplier and the Average True Range values used in the CE indicator variables influence the stop-loss values. Instantly adjusting the stop-loss allows a forex trader to hold the trend for a longer duration. This results in traders being able to manage the trend until it reaches its end. To safeguard the current trade, the changing stop-loss works as a trailing stop-loss level.

During a downtrend, the CE indicator shows levels above the values. During an uptrend, the stop-loss levels are displayed below the values.

This indicator is simple to comprehend for exit levels and entry signals for beginners and expert forex traders. Thus, it has become quite reliable for traders.

Final verdict

The Chandelier Exit MT4 indicator is a trailing stop-loss instrument. It assists the trader in determining the trend. The indicator calculates the exit levels using the Average True Range – ATR values, which gives the trader the ideal stop-loss levels. Traders also use it for trend detection indicators and to follow trends. Altogether, the Chandelier Exit indicator for MT4 provides the finest outcomes for a trend trader who is looking to spot fresh trends, follow them, and close a position at the finest level.