Three exciting prop trading companies offer instant funding. I was skeptical about the whole process and tried to test them.

But let me answer right now on the central question:

What is The Cheapest Instant Funding Prop Firm?

Fund Your FX is the cheapest instant funding prop firm because it offers a $30,000 instant funded account for $488 with a discount (or $697 total price). However, this company offers instant funding for traders who can reach 10% in a maximum of 90 days, which can be challenging for conservative, low-risk traders.

The price for a $30K instant funding account varies from $400 to $700.

Here, you can visit the cheapest instant funding company!

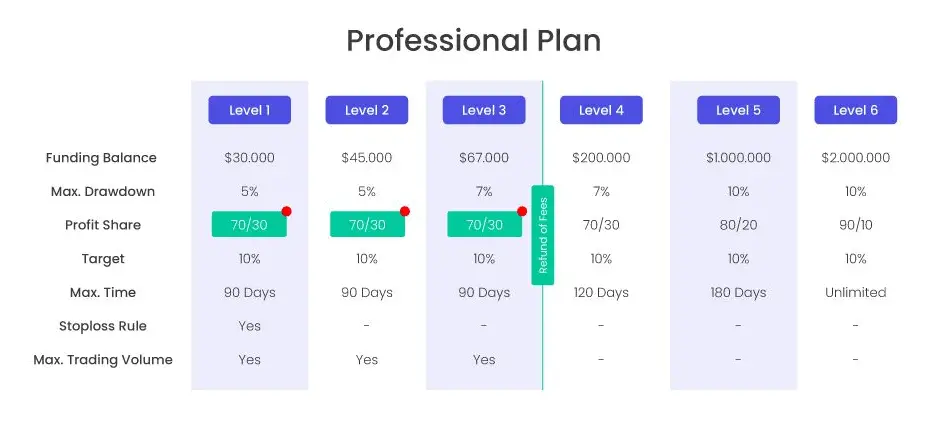

Below is presented professional plan ($ 30,000 instant funding) with rules:

The funded trading program offers participants live-funded trading accounts with specific rules and opportunities for profit and capital growth. Each plan, “Origin Funded” and “Evolution Funded,” has guidelines concerning daily and total drawdown limits, trading size restrictions, and caps on single-day profits relative to set profit targets. Additionally, both plans prohibit specific trading strategies like tick speculation, martingale, hedging, and high-frequency trading (HFT) bots, with violations leading to account cancellation.

I described all the traps that I do not like in instant funding:

Navigating the rules of instant funding proprietary trading firms requires careful management of lot sizes and targets to avoid pitfalls. If traders set their profit targets too high, they risk violating the terms set by these firms, which are designed to curb overly risky behaviors. Such firms may implement rules to prevent traders from achieving their targets through one or two high-stake positions, promoting more consistent and risk-aware trading strategies.

One significant rule is the VTS Rule, which restricts a single day’s profit to no more than 25% of the overall profit target. For instance, with an account balance of $15,000 and a profit target of $1,500, the maximum profit allowed in one day would be $375. This rule aims to deter aggressive trading tactics that could result in large balance fluctuations, encouraging a steadier approach to trading. However, it can be frustrating for traders experiencing a run of successful trades, as it forces them to pull back and potentially miss out on further profitable opportunities.

Another crucial regulation is the Maximum Trading Size, which caps the total lot size traders can hold at any time based on their account balance. Expressly, traders are limited to trading 0.2 lots for Forex and Cryptocurrency and 0.02 lots for Commodities and Indices per $2,000 account balance. This cumulative limit is designed to manage exposure and mitigate the risks of high leverage in volatile markets. While it protects the trader and the firm from dramatic losses, it also restricts traders from taking full advantage of market conditions that may favor more prominent positions, thus limiting potential profits.

Many traders feel these rules are overly restrictive, limiting their ability to trade flexibly and effectively according to their strategies. A possible alternative could be for brokers to set a fixed leverage ratio, like 1:10, which would inherently cap risk while allowing traders more freedom in choosing their lot sizes. Such a setup would help maintain risk control without the rigidity of fixed lot sizes, especially at higher leverages like 1:100 that amplify gains and losses significantly. This approach could balance the need for risk management with traders’ desires for operational flexibility.

Instantfunding.io offers higher prices.

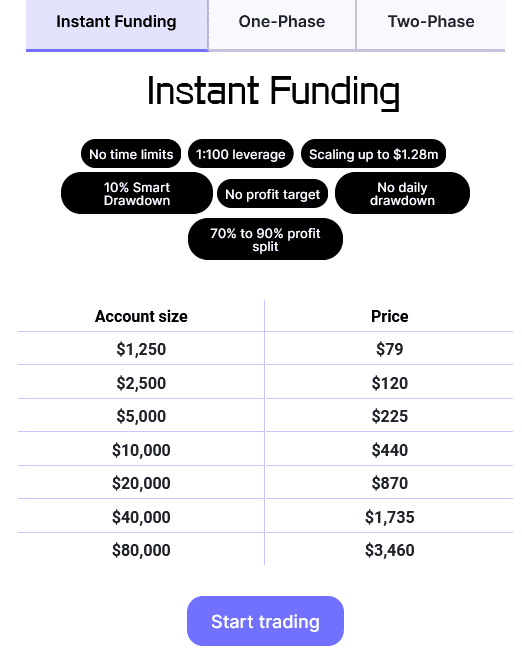

The website instantfunding.io offers trading accounts with varying capital limits, ranging from $1,250 to $80,000, at prices from $79 to $3,460, respectively. The higher prices associated with these accounts can be attributed to several key features and benefits they provide traders.

Here’s how each feature potentially justifies the pricing:

- Instant Funding: Traders receive immediate access to trading capital, which is highly valuable for those looking to capitalize on market opportunities without the delay of traditional funding processes.

- No Time Limits: The trading period is not restricted, so traders can hold positions as long as needed to achieve optimal results, adding to the account’s value.

- 1:100 Leverage: High leverage allows traders to control prominent positions with a relatively small amount of actual capital. This amplifies potential profits and risks, but it significantly increases the trading capacity of each dollar invested.

- Scaling up to $1.28m: The ability to scale up to a much larger balance ($1.28 million) provides a pathway for growth within the same trading framework, encouraging long-term engagement and higher initial investment.

- 10% Smart Drawdown: This feature allows more flexibility in trading strategies by setting a relatively generous drawdown limit compared to industry standards. This means traders can withstand more significant losses before breaching account rules, which is a substantial benefit.

- No Profit Target: The absence of a profit target removes the pressure to reach specific earnings, thus enabling traders to focus on sustainable trading strategies rather than short-term gains.

- No Daily Drawdown: Without daily drawdown limits, traders have more freedom to manage trades according to market conditions rather than calendar days, which can be particularly advantageous during high volatility periods.

- 70% to 90% Profit Split: Offering a high percentage of profits to traders makes these accounts very attractive, as traders can retain a substantial portion of the profits they generate.

- Account Size Options: The range of account sizes with corresponding prices allows traders to choose an investment level that suits their risk tolerance and financial capacity, which can be a more tailored approach than one-size-fits-all solutions.

Visit the cheapest instant funding company!