Table of Contents

Charles Schwab is a full-service brokerage offering a wide range of services, including investment advice, wealth management, banking, and trading services. It caters to all types of investors, from beginners to advanced traders, offering accounts without minimum balance requirements and providing commission-free trades on stocks, ETFs, and options (though options contracts do incur a fee).

You need to close your Schwab account because you’ve found better alternatives and want to further deepen your investment and trading portfolio. You can achieve this objective in various ways. First, you must reach out to your broker and use the ways Schwab allows and are legitimate.

Cost of closing the Charles Schwab Account

You would not be obligated to pay a fee for closing any Charles Schwab IRA or brokerage account.

Closing your Charles Schwab account involves several steps and options, depending on your account type (investment, bank, or robo-account) and your preferences for handling the assets within it.

- Transferring to Another Brokerage (ACAT Transfer): If you have an investment account, you can transfer it to another firm via the Automated Customer Account Transfer Service (ACAT). Once the transfer completes, this method automatically closes your Schwab account, but a $50 ACAT fee applies. Some investment firms may reimburse this fee under certain conditions. This method avoids selling positions, which can be advantageous if you wish to maintain your investments???.

- Closing a Bank Account or Investment Account by Withdrawing Cash: To close a bank or an investment account, you must first liquidate your assets (if any) and then withdraw the cash balance, bringing the account to a $0 balance. This can be done through Schwab’s website or mobile app using the transfer tool under the “Move Money” tab. After withdrawing your funds, you can request an account closure via phone or online chat with a human representative. This method avoids the ACAT transfer fee???.

- Internal Transfer to Another Schwab Account: An internal transfer can be performed if you’re moving assets within Schwab, such as to a different type of Schwab account. After transferring, you must contact customer service to close the original account. This method is instantaneous and free, but you must ensure the original account is closed by contacting customer service.

- Understanding Fees and Tax Implications: Regardless of your chosen method, be aware of potential fees and tax implications. The ACAT transfer fee is one example, but liquidating positions or withdrawing funds may also have tax consequences, especially for taxable brokerage accounts??.

- Customer Service and Account Closure Requests: You can request account closure through several channels, including Schwab’s chat service (requiring a human operator), branch visits, secure message systems on the website, phone calls, faxes, or mail. The specific steps and required information can vary, so contacting Schwab directly through one of these channels is recommended for detailed instructions??.

Before initiating the closure, ensure all positions are closed or transferred, all cash is withdrawn, and you have no pending fees or services. The process may take several weeks, and it’s advisable to consult a tax professional regarding the potential tax implications of closing your account or liquidating assets??.

For specific guidance and to ensure compliance with the latest procedures and fees, directly contacting Charles Schwab customer service or visiting their official website is recommended.

What about the promotions?

If you are considering taking your investment account at the current Schwab Bank to another bank, you should ensure that you get any offers or promotions for creating that account.

How to delete Charles Schwab’s account?

You can follow several methods to delete a Charles Schwab account without incurring any costs. Each method offers a different approach depending on your preference or convenience:

- Close Charles Schwab’s Account Using the Website: You can initiate the account closure process through Charles Schwab’s website. This might involve logging into your account, navigating to account settings, and finding the option to close your account. This process may vary depending on the specific interface of the website at the time you attempt it.

- Go to the Local Branch and Close the Account: Visiting a local Charles Schwab branch allows you to speak directly with a representative who can assist you with closing your account. This method ensures any questions you have can be answered on the spot.

- Use the Mobile App to Close Charles Schwab’s Account: Similar to using the website, you can use Charles Schwab’s mobile app to close your account. The app should have a section for managing your account settings, where you may find the option to close your account.

- Use Phone Number: Charles Schwab provides customer service phone numbers that you can call to request an account closure. Speaking directly with a customer service representative can provide a guided and personalized approach to closing your account.

- Use Snail Mail: If you prefer, write a letter requesting account closure and mail it to Charles Schwab. This method may be slower than the others, but it is an option for those who prefer written communication.

- Use Cheques Through the Mail: In some cases, if you’re closing an account with a remaining balance, you may be able to request a check for the remaining funds to be mailed to you as part of the closure process.

Each method offers a way to close your Charles Schwab account without any cost, but ensuring that all assets within the account are adequately handled before closure is essential. This might include selling off investments or transferring them to another institution. Additionally, checking for any potential tax implications or fees associated with account closure or asset liquidation is wise.

How to clear your request through the website?

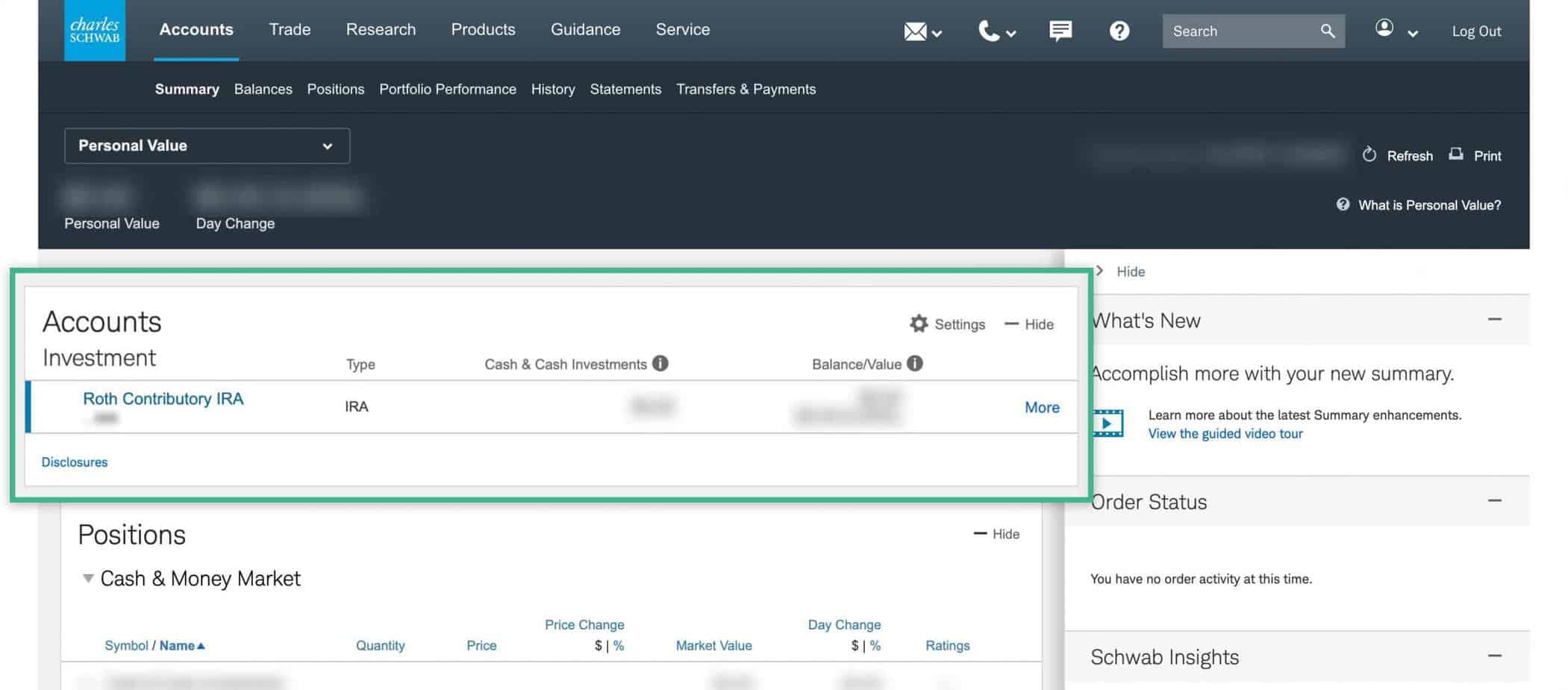

Once you have decided to close your account at Charles Schwab Bank online, you must contact your broker and let them know. It would help if you considered doing this in writing to have undisputed proof. The first step you need to do here is to log in to Schwab’s website and use the chatbox or messaging system to deliver an online message to them.

You can do this by selecting the “Service” tab and clicking on the “Message Center” from the drop-down list. You will see a new page that will start loading, which has several options to choose from. You must select “Messages” and “Compose a new message,” which come as a link on the same page. If you click on that link, the pop-up window will come on your screen with pre-populated data.

A critical piece of data relates to the number of accounts you hold. If you see multiple account numbers you want to choose from since you have multiple accounts, do it carefully and select the option that reflects the account you want to shut down. Then, please write a message and send it once you complete it. You also have the option to attach files. Remember, attaching files means more processing time for your message.

If you prefer not to write a message, the online chat box is open 24/7. To access this function, go to the messaging option and select the “Live chat” option on the right. A window will pop up where a representative will address your request.

Go to your local branch.

If you are not a message person and believe in face-to-face meetings, there are 300 brick-and-mortar branches of Schwab that you can visit all over America. Most states have some branches, including smaller towns like Tennessee. The only disadvantage here is that you won’t get the 24/7 facility.

Through the mobile application

If you cannot go to a branch due to your schedule but trust your smartphone, you can use the Schwab app to contact the bank. You can access this app through Kindle Fire, iOS, and Android. If you go to schwab.com on the browser, you will be transported to the broker’s mobile website.

Once you sign in to the app or the website, you can select from the various customer options. You will come across a messaging area from where you can contact the company associate through a message. You will also see some numbers, and clicking will redirect you to a phone call. You can also locate the branches through this app.

Use cheques through the mail.

If you don’t find any of the options mentioned above, and you are more of a vintage person, and you have a fax machine up for work anytime, you can use it to draft a message and send it to the bank. The toll-free fax number of Schwab is (1-888-526-7252), and this is a cost-free method.

Snail Mail

Snail mail is also a valid option to close your account at Schwab. However, as the name suggests, it will also be the slowest alternative. The addresses for all states are different; hence, the first step would be to find the address for your state. Select “Service” and “Contact us” from the top to find that. A drop-down menu will come with the 50 states; you must choose your state, and the mailing address will come. If your business is urgent, you can also find the overnight address. Most states will send the mail to El Paso or Florida.

Through phone

This option will require you to call the broker and lodge your request to close the account. This is not preferable as there will be no written evidence of the request. However, you can contact the brokers’ agents 24/7. You can reach them at 1-800-435-9050. People out of the U.S. can call at +1-317-596-4501.

Close your account through a transfer.

An efficient way of closing your account is to transfer it to another account. You also don’t need to connect with the broker in this method. If you do this, you will close your account without much of a hassle. You also would not need to contact Charles Schwab Bank for this. You can utilize the ACAT or the Automated Customer Account Transfer by contacting the broker where you will open the new account. All you have to do is open the account, sign in, find the e-form, and transfer your account from there. The processing time for this process is a few weeks.

Conclusion

Closing an account on Charles Schwab is not a very difficult task. You can do this through the ways above; you only have to select the option that best suits your needs. It would help if you remembered to move your cash and the securities out of there. This will reduce your balance to zero; hence, there will be no balance.