Difference Between Forex and Commodity Trading

Many traders would like to determine if commodity trading is better than trading in foreign exchange (forex). The products or tradable securities are the main Difference Between Forex and Commodity Trading. Commodity markets trade in agro products like cocoa, coffee, cotton, and mined products like oil and gold. The forex market, which is often further abbreviated to FX, trades in different countries’ currencies like dollars, euros, yen, and is global. The approach to trading and analysis in these markets are similar. However, some of the factors that can help the trader decide which market he prefers to trade in are discussed below.

Personal preference

Some traders are more comfortable dealing in specific kinds of markets. These traders prefer commodities since they are physical products that they understand better. Many of these commodities are also being used daily so that traders can get information more easily. I know my college traders who are experts for EURUSD; some know excellent British economy and trade only GBPUSD, and some like to trade oil or only gold.

Forex or Commodities

Forex trading advantage above commodities trading is in better liquidity, less impact of fundamental analysis than commodity trading. Unexpected news related to raw products and strong volatility can create a greater risk for commodities trading.

What is the difference between Stock, Commodity, Forex?

Stocks traders trade equity securities, and they purchase and sell shares of different companies and try to profit off from stock price fluctuations. Commodity traders trade and invest in physical substances. Forex or foreign exchange is a global marketplace for exchanging national currencies against one another.

Regulatory differences

One of the differences in the regulation of the market for currency and commodity trading. The forex markets have not such strict regulations when compared to the highly regulated commodities market. Though there are some forex regulations, these are not strictly enforced, and traders and brokers bypass these rules. So some traders prefer to trade in a market that is regulated by the government, and their assets are safe.

Comparing leverage

Forex traders can easily access a large amount of leverage while trading in forex when they open their account with a forex broker and add funds to the account. Though some leverage is available in the commodities market, it is far less than the leverage for forex trading.

Exchanges for trading

The commodities are traded on the exchange, while the forex trades are finalized over the counter with forex brokers or through the interbank market. Since they are traded on the exchange, there are limits to the daily range for the commodities traded on the exchange. After the limit is reached, the market has reached its limit down or up, and no further trades are allowed for the commodity. If a commodity trader has placed a trade that is adversely affected by the exchange limit, it could result in losses since the prices will remain the same.

Though a trader can also make losses in Forex, they can usually exit the trade, whenever they wish, unlike the commodity markets where exchange limits are implemented.

Compromised trading

A trader who wishes to get both forex and commodity trading advantages can opt for trading in commodity-based currencies. For example, the Australian dollar is positively correlated to spot gold price, though the correlation strength may fluctuate. Similarly, the economy of New Zealand depends on the dairy sector, and its currency is correlated to the prices of whole milk powder. The Canadian dollar is correlated to crude oil prices, and when prices of oil increased from 2014 to 2016, the value of the Canadian dollar also increased.

So the question is: forex or commodities – what is better for trading? Both markets are excellent and offer a huge opportunity. The trader only needs to specialize in some markets (either fx and commodities or stocks or only some types of stocks or currency pairs), and this is it.

Can we compare stock commodity forex? Yes, we can. All markets have similarities (technical analysis, charts, trading theory…), and there are differences such as trading hours, regulation, number of instruments, leverage, etc.

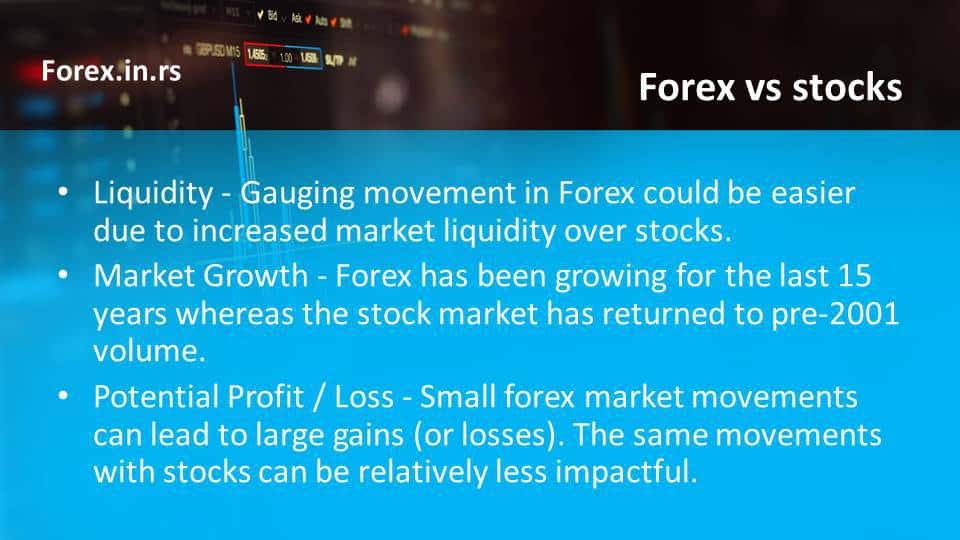

For example, below is a comparison of forex and stocks:

The currencies of emerging markets are also linked to growth in commodity prices and are inversely correlated with the US dollar. These currencies have a high rollover, and trading these currencies can help offset the volatility observed for commodity trading.