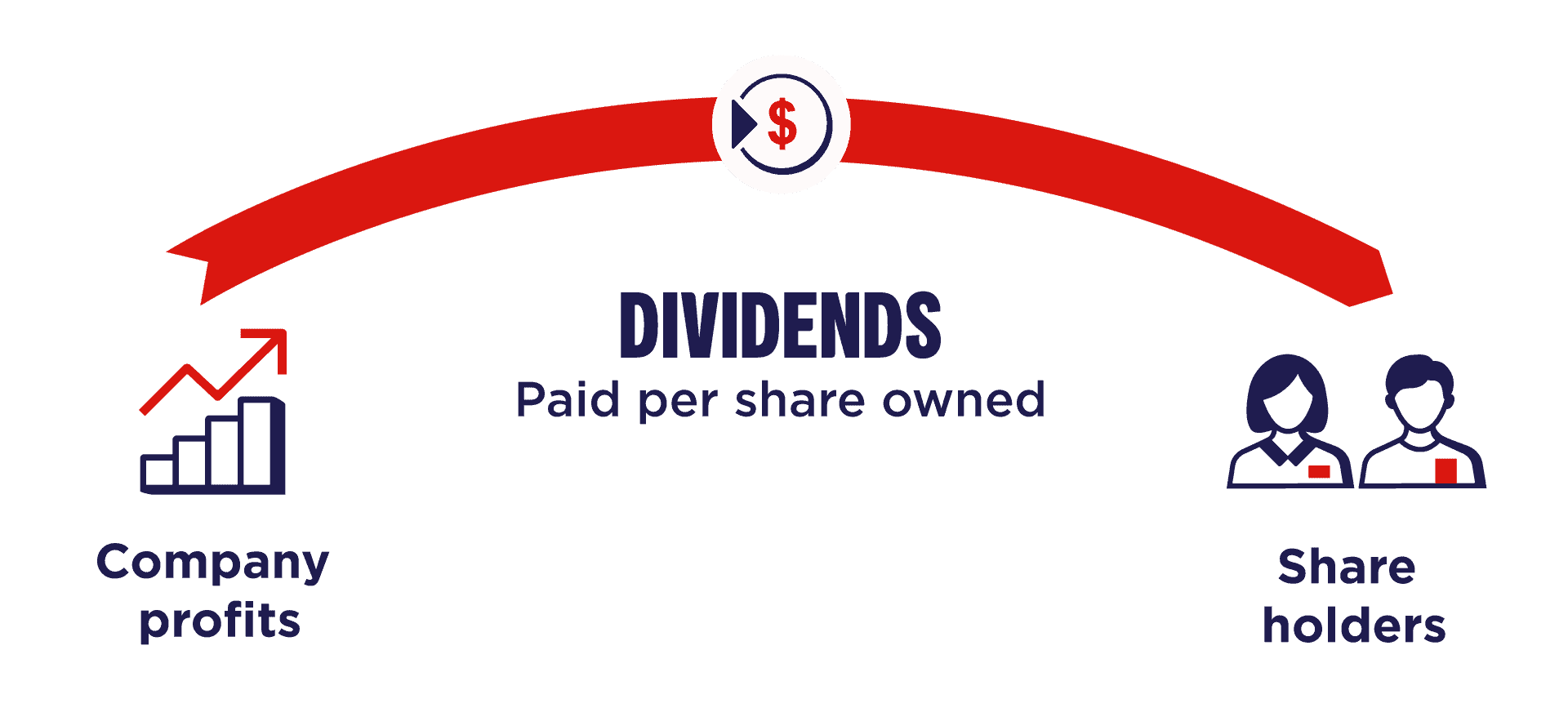

As we know, shares represent ownership in a company, entitling shareholders to certain rights and benefits, including dividends. Dividends are a portion of a company’s profits distributed to its shareholders. However, sometimes dividends remain unpaid due to various reasons such as financial constraints or administrative errors. Unpaid dividends can lead to dissatisfaction among shareholders and legal complications for the company. Companies often implement robust systems for tracking and distributing dividends to ensure shareholders receive all past and current dividends during a payout.

Cumulative preference shares ensure that shareholders have the right to receive any unpaid dividends from previous years, should the company be unable to distribute them. On the other hand, Non-cumulative preference shares do not allow for the accumulation of unpaid dividends; if a dividend is skipped, shareholders holding non-cumulative shares will not receive those missed payments, regardless of future profits.

This crucial difference in entitlement to unpaid dividends distinguishes the two types of preference shares and significantly impacts shareholder expectations and risk management strategies.

We will try to explain the difference using 4 aspects:

- Accumulation of Unpaid Dividends:

- Cumulative Preference Shares: Accumulate unpaid dividends, ensuring future payouts.

- Non-cumulative Preference Shares: Do not accumulate unpaid dividends; missed dividends may not be compensated.

- Shareholders’ Rights:

- Cumulative Preference Shares: Shareholders are entitled to unpaid dividends and expect future compensation for missed payouts.

- Non-cumulative Preference Shares: Shareholders may not necessarily expect compensation for missed dividends, which can impact their perception of risk and returns.

- Risk and Stability:

- Cumulative Preference Shares: Offer a more stable income stream as missed dividends accumulate and are recoverable in the future.

- Non-cumulative Preference Shares: Pose higher risk as missed dividends are not recoverable, leading to potential income fluctuations for shareholders.

- Treatment of Missed Dividends:

- Cumulative Preference Shares: Provide a safety net for shareholders; missed dividends accumulate and must be paid out in the future.

- Non-cumulative Preference Shares: Lack of a safety net; missed dividends in a period may result in shareholders missing out on those dividends without guaranteeing future compensation

Now, I will provide a practical example :

Imagine a company, XYZ Corp, issuing cumulative preference shares with a 4% annual dividend. In a challenging economic year, XYZ Corp faces financial constraints and cannot afford to distribute dividends to its shareholders. However, owning these cumulative preference shares protects you from losing out on your dividends. Instead, your 4% dividend accumulates, adding to the total unpaid dividends owed to you by the company. So, despite the temporary setback, you can anticipate receiving your current and accumulated dividends when XYZ Corp’s financial situation improves.