Table of Contents

The foreign exchange (forex) rates for currencies constantly change depending on several factors, so a business trader may wish to ensure that currency is available at a specified rate. Currency futures contracts are a type of forex futures contract for exchanging a particular currency for another at an exchange rate fixed on a specified future date. These futures are also called forex futures contracts ab, abbreviated as FX futures. Since the future contract value depends on the exchange rate for the currencies, futures contracts are considered financial derivatives.

Currency forwards are similar to forex futures in many ways. However, unlike the forwards, which are customized, the contracts for futures are standardized. These futures contracts are also traded on centralized exchanges. These currency futures may be used for speculative purposes or hedging. Since speculators holding the futures can leverage their position, and the futures contracts are highly liquid, the speculators will prefer to use currency futures instead of currency forwards. Typically, one of the currencies in the futures contract is the US dollar.

1. What Are Futures Contracts?

A futures contract is a standardized legal agreement to buy or sell a specific commodity, asset, or financial instrument at a predetermined price at a future date. Unlike stocks or bonds, where you own the underlying asset, a futures contract is a derivative product, meaning its value is derived from the performance of an underlying asset.

Key Features of Futures Contracts:

- Standardization: Futures contracts are highly standardized. This ensures that terms such as quantity, quality, and delivery time are consistent, making it easier to trade.

- Leverage: Traders are not required to pay the total contract’s value upfront; instead, they deposit a margin (usually a fraction of the total contract value). This leverage allows traders to control a large amount of the underlying asset with a small investment.

- Expiration Date: All futures contracts have an expiration date by which the buyer and seller must settle the contract.

Futures contracts are traded on exchanges such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE) and cover a wide range of assets, including commodities (like oil, gold, and wheat), financial instruments (such as bonds and indices), and even cryptocurrencies.

2. How Futures Trading Works

Futures trading involves speculating on the future price movement of an asset or hedging existing positions. Here’s how the trading process works:

- Step 1: Opening a Position: Traders open a futures contract by buying (long position) or selling (short position) it.

- If you believe the underlying asset’s price will rise, you buy (go long) a futures contract.

- If you believe the price will fall, you sell (go short) a futures contract.

- Step 2: Margins and Leverage: You must post a margin when entering into a futures contract. This margin is a small percentage (typically 5-10%) of the contract’s total value. The margin allows for leveraging the trade, meaning you can control prominent positions with a small capital outlay.

- Step 3: Mark-to-Market: Futures accounts are marked to market daily, meaning the profits or losses are calculated at the end of each trading day based on the market’s closing price. If the position moves against you, the broker may issue a margin call to deposit additional funds.

- Step 4: Closing a Position: Traders can close their futures by taking an opposite position (offsetting). For example, if you bought a contract, you would sell it to close the position. Alternatively, if you hold the contract until expiration, the contract will be settled either via physical delivery or cash settlement, depending on the type of asset.

3. Types of Futures Markets

There are two primary reasons people trade futures: speculation and hedging. Depending on your goal, you will approach futures trading differently.

- Speculative Trading: Speculators seek to profit from price movements in the futures market. They have no interest in the actual delivery of the commodity or asset but rather in the financial gain from buying low and selling high (or selling high and buying low).

- Hedging: Hedgers use futures contracts to protect against price fluctuations in the underlying asset. For example, a wheat farmer might sell wheat futures contracts to lock in a price ahead of harvest, protecting themselves against a potential price drop. Conversely, a bread manufacturer might buy wheat futures to secure a stable price for their raw materials.

4. Important Concepts in Futures Trading

- Leverage and Margin: Futures contracts are highly leveraged. The margin is crucial, allowing traders to control prominent positions with small amounts of capital. However, leverage can be risky because both profits and losses are magnified.

- Mark-to-Market: Every day, futures accounts are marked-to-market, meaning the trader’s account is credited or debited based on the daily price change of the contract. If the market moves against your position, you may face margin calls that require additional funds to maintain the position.

- Settlement: Futures contracts can either be physically delivered or cash-settled. Physically delivered contracts require the actual delivery of the asset (e.g., oil, gold). In contrast, cash-settled contracts are settled based on the cash difference between the contract price and the market price at expiration.

5. Popular Futures Markets

Futures contracts are available for a variety of asset classes. Some of the most popular futures markets include:

- Commodities:

- Agricultural: Corn, wheat, soybeans, cotton.

- Energy: Crude oil, natural gas.

- Metals: Gold, silver, copper.

- Financial Instruments:

- Currencies: Euro, Japanese yen, British pound.

- Interest Rates: U.S. Treasury bonds, Eurodollar futures.

- Stock Indices: S&P 500, Nasdaq 100, Dow Jones.

- Cryptocurrency Futures: Bitcoin and Ethereum futures are available, allowing traders to speculate on the price of digital currencies.

6. Risks in Futures Trading

Futures trading carries significant risk due to the inherent leverage and price volatility. It is essential to understand and manage these risks effectively:

- Leverage Risk: Leverage amplifies both gains and losses. A slight price movement in the underlying asset can lead to significant profit or loss.

- Volatility: Futures markets can be highly volatile, especially in commodities like oil or natural gas, where prices are affected by geopolitical events, supply disruptions, and economic data.

- Liquidity Risk: In some futures markets, particularly for less popular contracts, liquidity can be a concern, leading to wider spreads and the potential for slippage.

- Margin Calls: If the market moves against your position, you may be required to deposit additional funds. Failure to meet margin requirements can result in the forced liquidation of your position.

7. How to Start Trading Futures

Here’s a step-by-step guide to getting started with futures trading:

- Step 1: Learn the Basics: Before diving into futures trading, ensure you understand the mechanics of futures contracts, how leverage works, and the risks involved.

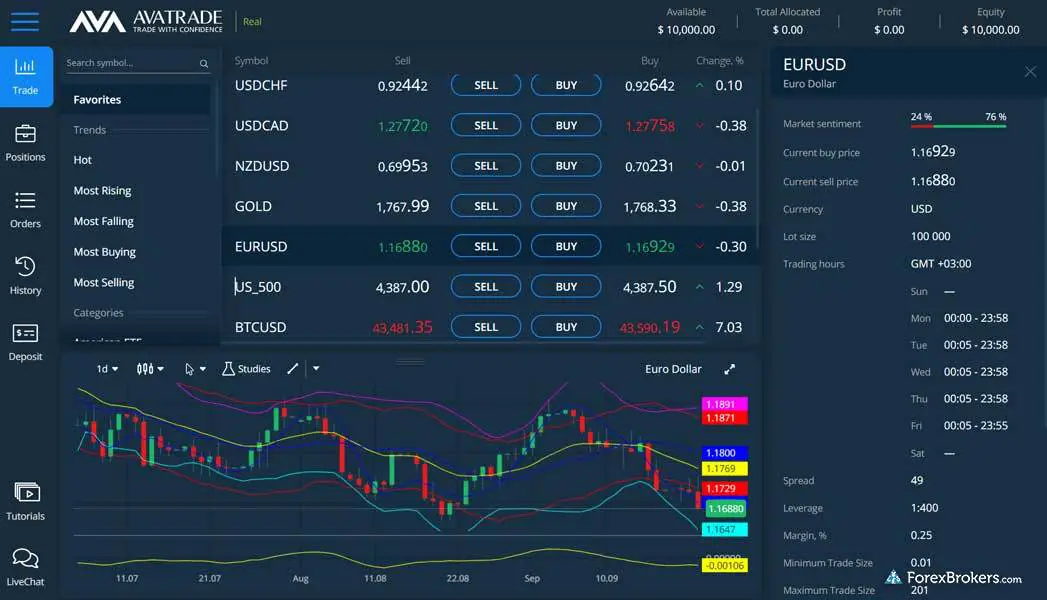

- Step 2: Choose a Futures Broker: Find a reputable broker that offers futures trading. Look for low commissions, good margin terms, and access to the markets you are interested in.

- Step 3: Open a Futures Trading Account: You must open a margin account with your broker, as futures trading requires leverage.

- Step 4: Develop a Trading Plan: A solid strategy is crucial. Whether you plan to day trade, swing trade, or position trade, develop a plan based on your risk tolerance, time horizon, and market research.

- Step 5: Use Risk Management: Set stop-loss orders to limit potential losses and avoid taking excessively leveraged positions that can lead to margin calls.

- Step 6: Monitor Your Positions: Because futures positions are marked to market daily, monitoring them closely is essential to ensure you are meeting margin requirements and adapting to market conditions.

Educating yourself thoroughly, understanding the mechanics of futures contracts, and developing a trading strategy tailored to your financial goals and risk tolerance is essential. For beginners, starting with paper trading (simulated trading) or small positions can help build experience without taking on excessive risk.

Foreign currency futures contract components

Underlying asset – this is the exchange rate specified for the currencies.

Expiration date—for physically delivered futures, it is when the currencies are to be exchanged. In the case of cash-settled futures, it is the last date on which they will be settled.

Size—The size of a futures contract is standardized. For example, the currency contract for euros is typically standardized at 125,000 euros.

Margin requirement – A margin is initially required to enter a futures contract called the initial margin. A maintenance margin is also usually specified. A margin call will occur if the initial margin reduces below the maintenance margin. The trader or investor should deposit money to ensure the margin exceeds the maintenance margin. Margins can be implemented since currency futures can be traded through clearinghouses and centralized exchanges. These margins reduce the counterparty risk when compared to currency forwards. The initial and maintenance margins are typically four and two percent, respectively.

Margin required for currency futures NSE

The required margin for currency futures can be calculated from 0.3% to 1.5% as the gross open position’s value. For example, USDINR is 1% of the gross open position’s value, EURINR is 0.3% of the value of the gross open position, or GBPINR is 0.5% of the value of the gross open position.

How are currency futures used?

Forex futures may be used for speculation or hedging like other futures. The FX futures may be purchased by a business that knows it will require foreign currency in the future but does not wish to purchase it immediately. This purchase will help the business hedge against any volatility in the currency exchange rate. On the expiration date, when the business has to purchase the currency, it will be guaranteed the exchange rate specified in the contract for the FX futures. Similarly, if the business receives a significant amount in foreign currency for payment, it uses futures for hedging.

Example – How can currency futures be used to hedge the risk?

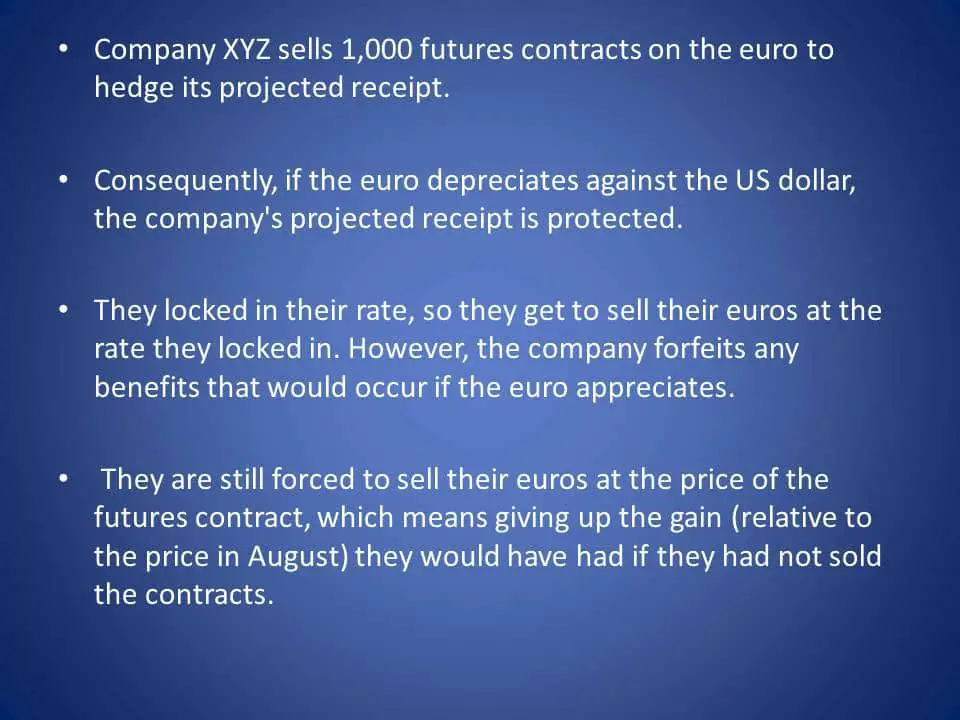

For example, the trader sells futures contracts on the Euro (EURUSD projection down) to hedge its projected receipt. The company’s projected receipt is protected if the Euro depreciates against the US dollar.

Speculators also use currency futures to profit. If they expect the exchange rate for a particular currency to increase, they may purchase a contract for FX futures, hoping for a profit. The speculators can afford these contracts since the initial margin is usually smaller than the contract size. The speculators can leverage their position to increase their exposure to changes in the exchange rate.

Currency futures can also be used to compare interest rates in different countries. If there is no parity in the interest rates, the trader may implement arbitrage, using borrowed funds and a futures contract to profit. Investors interested in hedging prefer to use currency forwards since they can be easily customized compared to standardized futures contracts. In contrast, speculators prefer currency futures since they allow leverage and have high liquidity.

8. Conclusion: Is Futures Trading Right for You?

Futures trading offers the potential for large profits but comes with substantial risks. Traders must know the inherent leverage, the volatility of futures markets, and the need for effective risk management strategies. Futures are often favored by experienced traders who seek to capitalize on short-term price movements or hedge their portfolios.