Table of Contents

Unlike other financial markets, the forex market is different as it is traded in pairs. It is mandatory to trade in pairs for forex; it also simultaneously provides you with exposure to two currencies. But can we analyze only one currency?

What is a Currency Meter Indicator?

The currency meter indicator or currency strength Indicator shows on the chart a strength between major currencies and how one would perform against the other (Euro vs. USD or GBP vs. USD, etc.). If the EURUSD rate increases, the indicator will show whether the Euro currency is STRONG or the USD currency is WEAK.

- Purpose:

- Measures the relative strength of individual currencies rather than currency pairs.

- Components:

- Typically examines major currencies like USD, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

- Data Source:

- It uses real-time forex data to compute the strength of individual currencies.

- Working Mechanism:

- Breaks down current currency pairs like EURUSD into individual currency components.

- Compares the relative strength of each currency across the market.

- Visualization:

- Typically represented as a line or bar graph.

- Each currency has its line or bar.

- The length or height indicates the currency’s current strength.

- Interpretation:

- If the EURUSD rate is rising and the indicator shows the Euro is strong, it implies that the rise is due to its strength.

- Conversely, if the EURUSD rate is rising, but the indicator shows the USD is weak, it implies that the rise is due to the USD’s weakness.

- Usage:

- It helps traders identify which currencies are driving the forex market at any given time.

- Assists in selecting the best currency pairs to trade based on strengths and weaknesses.

- Provides insights on potential trend reversals, continuations, or breakout opportunities

Download Currency Strength Indicator MT4

Download the Currency Meter Indicator

This article will discuss various things associated with the overall currency strength indicator like forex strong and weak indicator, free currency strength meter indicator mt4, how to trade currency strength meter, currency strength meter work, and much more!

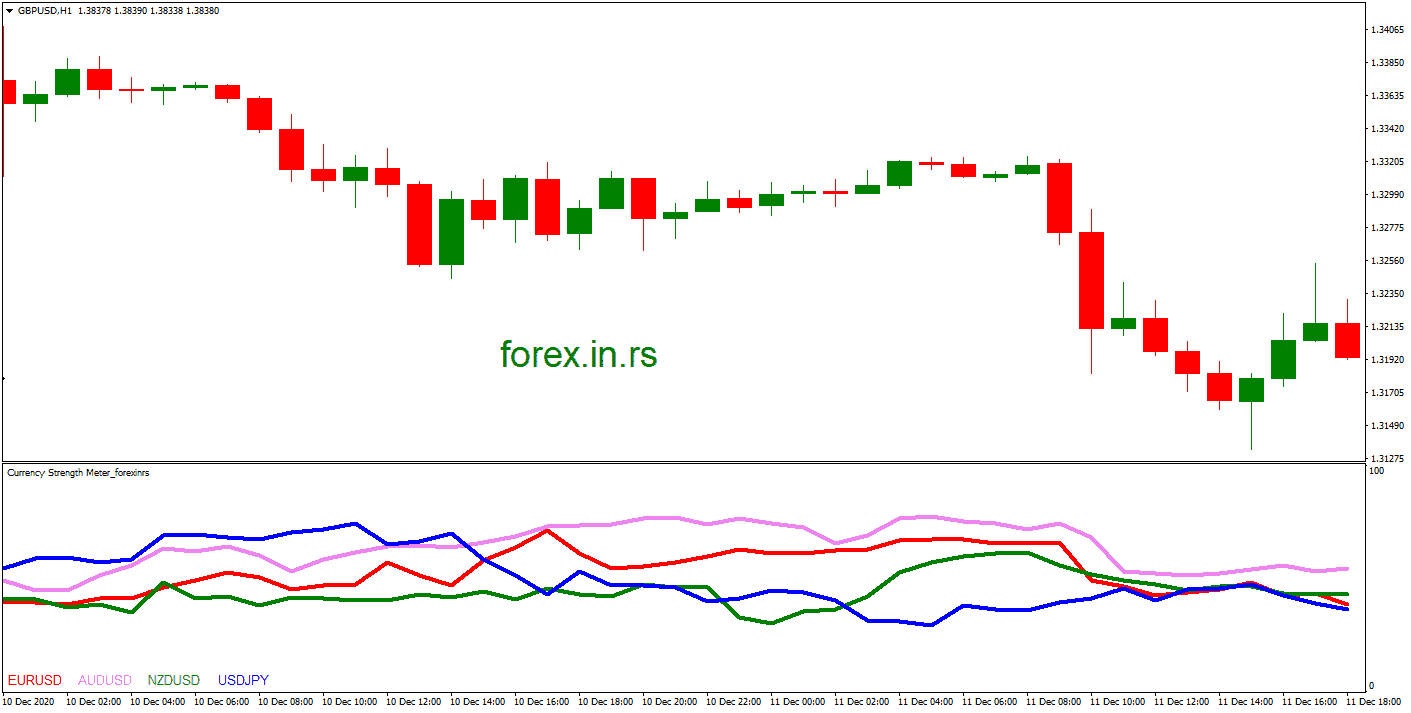

Below is the Currency Power Indicator:

Download the Power Currency Indicator

A Forex indicator shows which currencies appear powerful and which will be vulnerable at any particular time and the motion of those currencies in a chart. You will see another resource at your fingertips if you use an efficient currency strength meter, allowing you to become the next successful trader.

Forex trading requires a trader to know about different currencies and their strength. So, to get the best out of trading Forex, a trader needs to choose a pair of currencies that could help him gain the maximum. One of the techniques to make sure that your currency pair is profitable is to select a pair of currencies in which one is weak and vital. But the difficult task here is determining the individual strength of a currency.

To measure the strength of each currency, many forex traders use indicators like the Currency Power Meter. Read this article to understand how the Currency Power Meter works and how it can be used.

What Is a Currency Power Meter?

To measure the strength of the currencies that traders want to trade in the Forex market, they use an indicator called the Currency Power Meter. Determining the currencies’ strength helps traders make profitable choices before trading in the Forex market.

The strength of a currency can be determined through many deciding factors. These factors could be the economy’s strength, financial or political news, demand, or interest rates. Calculating each currency’s strength by computing these factors could be time-consuming and require extra effort and time from traders. Instead, traders use the Currency Power Meter Indicator to save extra research time.

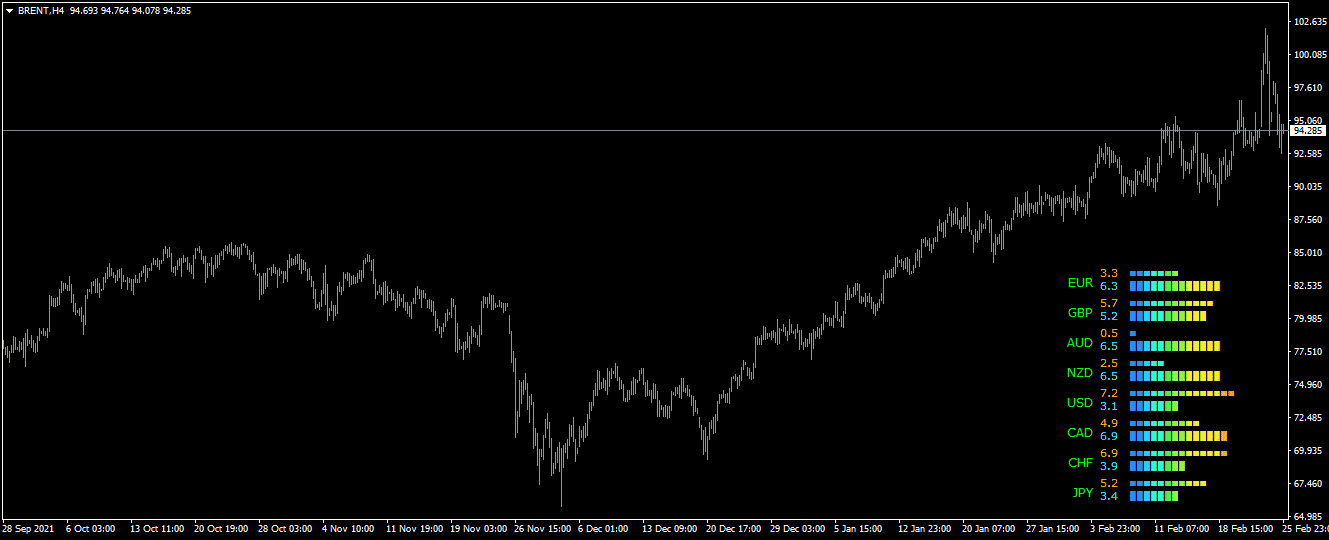

The currency power meter uses a histogram to depict the strength of the currencies. A double-bar graph displays each currency’s strength. One of these bars is wider than the other. The narrow bar in front of the currency shows the currency’s strength at the time frame the trader is in, while the more expansive bar indicates the average strength of the currency on the daily chart.

Since the MT4 terminal lacks an indicator that can help assess the power of different currencies, there needs to be some solution. A complimentary currency strength indicator is created, which we will discuss today in the article.

Description

This Currency Strength Meter indicator creates four charts for different currency pairs and then compares and contrasts the strengths of these currencies with each other. You can find the ticker symbols of these currencies in the lower-left corner. You will find that the colors of symbols and charts match each other. The scale for measuring the power of currency ranges from 0 to 100.

The currency presented first in a pair is called a base currency, and the quote currency is quoted after the base currency. For example, if you take USD/EUR, USD is the base currency, and EUR is the quote currency.

As the chart moves toward the 100 number, the base currency’s power will increase while the quote currency will weaken. Hence, you would consider the overall market in this situation. For instance, if you see an upward trend, but the increasing price is weakening, you should wait until this condition moves over.

Similarly, if the chart goes to zero, the quote currency is more robust, and the base currency is weaker.

The charts near 50 shows that the currencies are at the same strong point, and the trend is neutral.

Characteristics

Correlation defines the strengths that are prevalent in a currency. However, on the downside, MetaTrader 4 does not have an indicator that helps to calculate this criterion.

Correlation is the coefficient that depicts the power of the currency in both multidirectional and unidirectional ways. It can be in the opposite direction of the trend or the same direction as the ongoing trend.

You can scour the financial websites to find this argument. However, if you are looking for something more independent, you can use the built-in feature of CurrecnyStrengthMeter to define the correlation through your indicator window.

For example- If a pair of currencies is near values 20 and 80, they are inversely related. If they have the same direction, they are directly related.

Hence, utilizing the CurrencyStrengthMeter, you can find the currency in high demand amongst the forex traders and create a successful trading strategy.

How can you use this indicator?

CurrencyStrengthMeter is not involved in finding the signals for open trade. However, it does help you comprehend the present and future position of currency pairs in the market.

For instance, if EUR/USD and NZD/USD are above level 50, it gives the verdict of the power of EUR and GBP about NZD and USD.

If the USD/CAD chart moves against the other pair and is below level 50, the USD is weaker than the CAD.

Hence, by finding the relation of strengths and weaknesses among the currencies, the conclusion is that the USD is weak in the example, and you have to create the trading strategy around this part.

While using this indicator, you should always prioritize the timeframes; trade on the high ones if you want more profits. It is so because it reduces noise in the market. However, you will encounter fewer entry points here.

On the other hand, on the lower timeframe, you will find more entre points but fewer quality signals because of the fluctuations.

How to Apply the Currency Power Meter to Your Forex Trading?

Applying the Currency Power Meter is no rocket science. Traders can download it and use it to compare different currencies. Then, by looking at the histogram, they can select a weak and a strong currency they can trade. After traders are done with the selection, the next step is to open the price chart of the chosen currency pair. Then, with the help of technical analysis tools and indicators, the trader can trace the trade entry points.

For example, on your Currency Power Meter, you see that the strength on the daily time frame of USD is 3.8 while that of JPY is 7.5. This gets you a weak-strong currency pair. Now, you can open the currency pair chart of JPYUSD and start trading while using your other Forex trading tools.

Remember that choosing a weak and strong currency pair and the technical analysis align with your trading decision. If this does not happen, the trader must return to the Currency Power Meter and look for another currency pair.

Incorrect Use of Currency Power Meter

As easy as it may sound to use the Currency Power Meter Indicator while trading forex, it is essential to mention that it is not a perfect cut-out for every trading style. Also, the trader needs to know how to use it and not unthinkingly rely on this indicator alone.

This indicator is unsuitable for traders who prefer to trade in short timeframes. This is because the strength of the currency is influenced by high-impact news. Therefore, it may not affect the trading profits in the long term but can create hyper-volatility in a shorter period.

A trader must not misunderstand this indicator with the exit and entry indicators. The sole purpose of this indicator is to check the strength of different currencies that can be traded and select a pair of weak and strong currencies out of them. Therefore, it is advisable not to rely entirely upon this indicator and use other technical analysis tools to make a trading decision.

How Will You Define a True Currency Strength Meter?

The currency strength meter seems to be a visual indicator showing which currency is high and vulnerable immediately. Currency strength metrics combine the exchange rates of various currency pairs to provide an overall measure of each currency’s value. Basic meters do not use relative weight, whereas more sophisticated meters use their version. Aiming to provide trading signals, they can incorporate other indications with currency strength calculation.

To evaluate the intensity of the USD, e.g., a currency strength meter will determine the power of all pairs comprising the US Dollar – USDJPY, GBPUSD, AUDUSD, EURUSD, etc. Afterward, add the numbers to get the total result for the USD.

The narrow USD index measure, which uses a broader range of currencies, is often a lesser-known but more detailed metric. Both operate similarly. They determine the dollar’s strength by combining international exchange rates into one amount and assigning a relative weight to the currencies involved. The comprehensive index’s weighting is based on trade data and is called trade weighting. That’s the percentage of goods imported from the United States in total bilateral trade annually.

Struggles Involved with the Currency Strength Meter

Sadly, there are many problems with currency strength measurements, primarily if they are improperly encoded. Irrespective of many of its characteristics, a currency’s strength meter is useless if it does not have reliable currency strength values. Investors who use obsolete currency strength meters can encounter the following issues:

- MetaTrader 4 or MT4 becomes unresponsive.

- The computer slows down.

- Stuttering

- Whipsaw indications

- Leakage of memory

- The CPU is still running at full speed.

This also generates information that differs from its original definition of what currency strength becomes. For example, smoothing filtering, such as moving averages, is used by some, whereas others, like MACD and RSI, use other filters. By shading filtering on the pinnacle of presenting currency strength, dealers risk receiving incorrect trading signals, resulting in lousy trade execution and close losses.

Instead, currency correlation has been the most accurate way to assess currency strength. An accurately designed Forex correlation matrix that uses the new technology is unlikely to trigger any of these problems while providing many advantages as a currency strength meter.

The Real Currency Strength Meter – The Forex Correlation Matrix

Over time, forex intensity meters have developed into currency correlation matrices, providing more nuanced and precise statistics. Like many correlations, the Forex correlation indicates that two currency pairs are related.

Correlation is just the statistical calculation of the partnership between various monetary assets – the variables are currency pairs). The correlation coefficient can be anywhere from -1 and +1. The positive correlation means that a currency pair would follow the same path. On the other hand, when two currency pairs have a ratio of -1, they will still pass in the reverse direction. Eventually, a correlation of 0 means that perhaps the currency pair’s connection is arbitrary.

We see how currency pairs have a strong association once closely related. Whenever two objects increase at the same rate, they have a strong association; if they go opposite, they have a negative relationship. When two things travel in the same direction, a complete correlation happens, which would be incredibly unusual. If two pairs head about the same way, we assume they correlate highly.

How Does Currency Similarity Be Used to Determine Currency Strength?

Users may use contrasts to calculate the power of particular currencies when exchanged in pairs; for example, the EURUSD is – the Euro combined with the USD.

When the EURGBP and GBPUSD get a negative relationship of -91, it implies both would probably move in separate directions because two long or two short transactions upon those pairs will likely balance one another out.

The GBP seems to be the statement currency in the very 1st pair, which means buying trades expect the Euro to be more robust than the GBP. The GBP seems to be the base currency throughout the 2nd pair, meaning the buy trades expect GBP to be stronger than the US Dollar. This suggests that perhaps a long trade throughout the EURGBP is one in which the GBP is expected to decline, whereas a prolonged trade, as in GBPUSD, is one where the GBP is intended to expand.

Since the two sets have such a strong correlation, one may conclude that the GBP, which is also the shared currency among them, is causing these moves, and hence, the GBP seems to be the dominant currency within that case.

What Are the Benefits of Employing a Real Currency Strength Meter?

As just a Forex strength predictor, the currency correlation matrix has several benefits, such as flexibility. It is used as a short-term measure, its incentive to avoid double positioning and excessive hedging, its potential to indicate risky trades, and the likelihood that this is free.

Short-term Currency Strength Indicators are Very Efficient.

Professional traders often use forex strength meters for short-term measures. They’re handy as an immediate indication of which currency is strengthening, but they’re a glimpse of relative strength than anything; thus, they’re just crucial for providing fast investment decisions and validating other predictors.

Currency Strength Meters are Simplistic.

The ease with which a Forex strength meter can be understood as one of its main advantages. This is particularly attractive to novice traders as they do not have to be specialists in the Foreign exchange market to choose which currencies are performing well or terribly. Instead, they can search for a straightforward visual representation.

The Forex Strength Meter is Completely Free to Use.

However, if you’d like to check out such a currency strength meter, you cannot pay for a costly predictor; the best part is that many platforms provide a free strength meter!

MetaTrader Supreme Version is a downloadable and cost-free MT plugin available to customers. It comes with a 16-indicator kit and the Foreign exchange-correlation matrix, allowing you to compare and distinguish foreign exchange pairs in actual time.

Trading Central offers a strategic analysis, a mini trading terminal, Forex-integrated trade suggestions, and a global sentiment widget for free. Are you prepared for this and better opportunities?

These are some of the best free currency strength metrics in the Major currency strength meter!

Multiple Sensitivity is Avoided When Using Correlation Matrices.

High-correlation assets shift in the very same way. Mostly, as a result, entering several positions of strongly correlated pairs isn’t recommended since you are simply repeating the same transaction. When the market goes against you, you’ll be in a weak spot. If an investor buys the EURJPY, AUDJPY, or AUDCHF in Foreign exchange, they face double exposure due to their high correlation.

Further analysis discovered that the above positions expose the dealer to double access to the JPY and AUD, which may be detrimental to the exchange if the movement is reversed to the investor’s assumptions.

One can see whether currencies are linked at even a moment with just a Forex correlation matrix. It implies you can stop doing certain transactions in the first instance and avoid the double risk of a poor currency.

Unintended Hedging is Eliminated with Web Analyzer Forex Strength Meters.

A trader will prevent needless hedging if the connection intensity among pairs is established beforehand. For example, when there is a linear relationship between EUR/USD and USD/CHF, you can extrapolate that such two currencies are shifting in opposite directions for comparison purposes. As a result, if you allow long transactions on both, you will probably gain one, and in the other, you will lose.

Realizing this ahead of time tends to avoid unnecessary hedging.

Risky Trades Can be Identified by Currency Strength Meters.

The connection between various currencies can sometimes determine the risk associated with a trading strategy. For instance, when we buy EUR/USD and GBPUSD, which are positively linked pairs, we can be exposed to double risk if both currencies are powerful.

It is also possible that any one of the pairs shows intense motion while only ranging, alerting participants to stop trading correlated pairs in the reverse way. If a EUR/USD is in a declining trend and thus the GBP/USD is increasing, e.g., a dealer must avoid buying the GBP/USD since it has a more significant potential loss due to potential USD strength.

Forex Currency Strength Indicator’s Functionality

The correlation matrix here represents the correlations among various forex pairs:

| EUR to USD | Euro to United States Dollar | EURUSD |

| EUR to CHF | Euro to Swiss Franc | EURCHF |

| GBP to USD | Great British Pound to United States Dollar | GBPUSD |

| GBP to JPY | Great British Pound to Japanese Yen | GBPJPY |

| GBP to NZD | Great British Pound to New Zealand Dollar | GBPNZD |

| USD to CAD | United States Dollar to Canadian Dollar | USDCAD |

| EUR to CAD | Euro to Canadian Dollar | EURCAD |

| USD to JPY | United States Dollar to Japanese Yen | USDJPY |

| GBP to AUD | Great British Pound to Australian Dollar | GBPAUD |

| GBP to CHF | Great British Pound to Swiss Franc | GBPCHF |

| EUR to GBP | Euro to Great British Pound | EURGBP |

Pairs positively correlated are likely to migrate in the same path, whereas negatively or inversely correlated pairs vary significantly. Therefore, correlation coefficients, as per their strength, are also classified into 4categories in the matrix described.

| Green: | There is hardly any correlation. |

| Blue: | There is a weak connection between the two. |

| Orange: | Correlation is moderate. |

| Red: | There is a strong link. |

It lets you quickly assess multiple currencies’ strengths and weaknesses through positive scores suggesting dominance and negative results suggesting weakness. That’s what the stats represent:

| Positive Green: | There is little to no connection. Positions on such signs will appear to shift individually and profitably despite being unrelated. | |

| Negative Green: | There is little to no relationship. Positions on such signs will appear to shift individually and profitably despite being unrelated. | |

| Blue with a Positive Value | Up to +30 | There is a weak correlation. Positions on such symbols may appear to shift individually and profitably despite being unrelated. |

| Blue with a Positive Value | up to +49 | Positions on such symbols can resemble each other. For example, positions trending in the same path can yield similar profits. Conversely, positions in opposite directions may cancel one another out. |

| Blue with a Negative Value | Up to -30 | There is a weak link. Positions on such symbols may appear to shift individually and profitably despite being unrelated. |

| Blue with a Negative Value | Up to -49 | Positions on such symbols can resemble each other. Positions that are in the very same path can be reversed. Positions throughout the reverse direction could also be profitable. |

| Orange with a Positive Value | Up to +75 | The correlation is moderately positive. Positions on such signs on the same path would have equal profits. Positions that oppose one another appear to null out each other. |

| Orange with a Negative Value | Up to -75 | The negative correlation is moderate. On such signs, positions in the same path appear to make the same gains. Positions in a reverse way are likely to null each other out. |

| Red with a Positive Value | Up to +100 | It indicates a solid, perfect positive correlation. Positions on such signs in the same direction will indeed receive gains similarly. Positions facing each other will cancel out. |

| Red with a Negative Value | Up to -100 | It shows a robust negative correlation. On such symbols, positions in the same path will likely null each other out. Positions in a reverse way would gain in the same way. |

The CAD seems most robust, with a +91 association between the USDCAD and EURCAD. On the other hand, the lowest association would be between EURGBP and GBPCHF and has -96, implying that concurrent positions in about the same path throughout this pair are pretty likely to null each other. Regarding currency strength, the British Pound is the strongest currency, whereas the Swiss Franc is the weakest.

As you can see, that’s a pretty straightforward idea enabling you to evaluate a country’s currency’s brute power in isolation rather than comparing it to other currencies.

Is it possible for Currency Correlations to Alter?

If there are correlations, it’s necessary to remember that they can alter. Economic pressures worldwide are vibrant; they can often shift continuously. Moreover, correlation coefficients among two currencies may evolve so that a brief correlation can refute a long correlation forecast.

Correlation coefficients over time give a better examination of the situation among two major currencies, which is usually a more accurate and conclusive statistic.

This is why it’s essential to examine correlation daily and why a method such as the MT Supreme Version correlation matrix can be helpful. It updates correlations in live time.

How Does One Get a Forex Strength Meter for Free?

The correlation matrix used in the MT Supreme Version plugin for MT4 and MT5 is among the best possible currency strength meters.

The most widely used Forex trading platforms include MT4 as well as MT5. The capacity to download and then use personalized metrics in conjunction with Expert Advisors (EAs) has been one of their benefits. Although both systems have a helpful set of common indicators installed further into the client terminal, users can import customized indicators developed separately.

Since MT4 is an open system with a large user base, indicator developments are fast. Inside the app, users can look for free and paid customized indicators.

The downloadable MT Supreme Version plugin features a currencies correlation matrix, customized metrics, and a live trading simulation for backtesting techniques. This also encourages you to add various custom markers and EAs that you can find helpful.

Here’s what to download for a free forex currency strength meter for MetaTrader Supreme Version:

- Open a virtual or practice brokerage account.

- Get MT 4 or MT 5 and download it.

- Get the MT Supreme Model and enable it.

- Log in to MT on the device utilizing your brokerage account information.

- You’ll view a comprehensive MT Supreme Edition software beneath Expert Advisors in the Navigator browser.

As you’ll see, choosing the best system and working with a reputable broker are vital trading factors.

Usage of Currency Strength Meter

After you’ve downloaded the MT Supreme Version, obey these measures to use the Foreign exchange-correlation matrix:

- First, enlarge the Expert Advisors list in the Navigator tab.

- Then, throughout the popup window, create any personalized parameters you want.

- Finally, to access the matrix, press ‘OK.’

It can be challenging to use MT if you are unfamiliar with it. Whenever it applies to using a correlation coefficient, the accurate strength currency meter employs sophisticated algorithms while operating simply. It also helps users to select a power for a specific time frame. Usually, 200 bars are required for intraday dealing, whereas approximately 50 bars can suffice for scalping.

Begin with the below periods for various trading timescales like a general rule:

| Intraweek Swing Trading: | H1 or H4 | 500 Bars or 200 Bars |

| Scalping: | M5 | 50 Bars |

| Intraday Trading: | H1 | 200 Bars |

How Can You Use the Real Currency Strength Meter to Its Full Potential?

Remember that correlation varies over time and that experience is not necessarily a reliable predictor of potential correlations. On the other hand, this data could be used to create your strategy on currency strength and reduce your overall portfolio exposure. Follow these pointers:

Avoid Opportunities that Cancel One Another Out:

When you witness two currency pairs moving in opposing directions almost all day, you can understand that buying positions in each of these currencies alleviate any possible gains.

Broaden with Lower Risk:

You can reduce risk by investing in often positively correlated dual currency pairs while retaining an optimistic strategic outlook across periods.

Hedging Exposure:

Risks can be reduced when hedging two forex pairs with proximity and a negative correlation. The logic is straightforward. Whenever a currency pair drops in value, its opposite currencies having a negative association with that pair would most likely win, but at a weaker end price. Though such a plan won’t eliminate losses, it would almost certainly limit them.

Ultimately, the Forex correlation matrix has flaws like any other technical instrument or predictor. The first is that the currency’s strength measure only conveys minimal data. As a result, it’s essential to think about how currencies’ strengths and weaknesses work in the long view.

The following items are included in the long view:

- Are there any compelling grounds to believe the currency meter’s tale?

- Does the currencies meter, like many metrics, correctly tell stories?

- Is the upward trajectory likely to persist?

Conclusion

Like many other technical instruments, Currency strength meters are much more efficient if combined with several other metrics. A strength meter, for instance, may be used to supplement or validate what the other indicators are suggesting.

When an instrument is overvalued or underpriced, the Relative Strength Index (RSI) helps determine whether it is oversupplied or underplayed. By contrasting this detail with a currency strength meter, we can better understand a country’s currency intensity and ability to improve or weaken.

If you ever wish to use a currency strength meter, you should do so in a risk-free demo trading account. I hope this article helps you. All the very best for your currency adventure!

The Currency Power Meter Indicator is a Forex trader’s friend, a beginner, or an expert. Using it with other Forex technical analysis tools and indicators can benefit the trader. It also helps the trader save time that may be wasted on research about different currencies and the economic conditions of their respective countries. They can use this indicator to select a currency pair to start Forex trading.

A trader must never forget that the Forex market is a highly volatile trading zone. Therefore, checking what’s happening around the globe is imperative for Forex trading.