When you are engaging in any business transaction, whether you are a client who is buying a product or service or whether you are part of the business which is selling a product or service, it is essential to understand what a dead deal cost is and if you are liable for such an expense. This will help you make wise decisions with whom to interact and not interact with, and this will help guide you on when to move forward with a negotiation or when to refrain from entering a negotiation. Thus, arming yourself with knowledge about all that pertains to the issue of a dead deal cost will prevent you from losing money unnecessarily.

Dead Deal Costs Tax Treatment

Dead deal cost is an expense ( any fees, expenses, or other charges) by a seller (the business) or by the buyer (the client) that is related to transactions that are not finalized with buying or selling that the other party has anticipated. The dead deal cost cannot be capitalized and should be treated as an accounting, tax, or regulatory expense.

Dead deal in simple words:

A dead deal is an expense for transactions that don’t close!

The commencement of the accumulation of dead deal costs immediately after completing the signing of a letter of intent referred to as LOI in abbreviated form. At this point, there is the occurrence of due diligence based on the fact that there is much time that is invested internally and externally to engage in the fulfillment of the proposed assumptions of the designated transaction that is presumed to be underway.

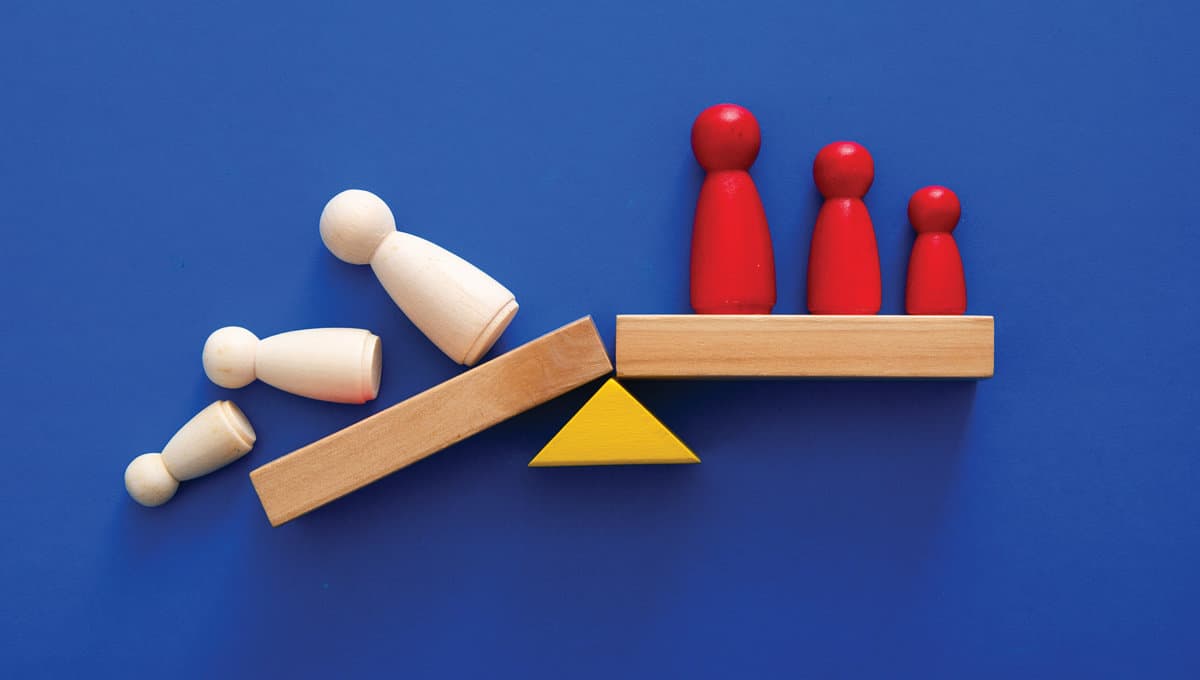

Generally, most dead deal costs are incurred by buyers via the application of due diligence. However, there may also be dead deal costs by sellers as well. With this being the case, it is truly wise for sellers to select buyers who possess a strong history of finalizing various deals. This is true even if the offered purchase price is lower than a higher bid from a more suspect buyer regarding their history of finalizing deals.

Dead deals or sunk costs refer to expenses incurred but cannot be recovered when a business transaction or project does not materialize or is aborted before completion. In the context of M&A (Mergers and Acquisitions), they are the expenses incurred while investigating, negotiating, and financing the purchase of another company that is not recoverable if the deal falls through.

Dead deal costs can be diverse, encompassing the following:

- Legal Fees: These are costs incurred by hiring legal professionals to oversee and facilitate the business transaction or deal. They can involve reviewing and preparing legal documentation, providing counsel on potential legal risks, and ensuring regulatory compliance.

- Due Diligence Costs: Before a deal is finalized, there’s often a due diligence process to validate the financial and operational health of the acquired entity. This can involve hiring auditors, consultants, and other professional service providers.

- Financing Costs: These can include fees paid to potential lenders or investors to arrange financing for the deal. If the deal does not materialize, these costs cannot be recovered.

- Advisory Fees: The acquiring and selling entities may hire financial advisors, investment banks, and other consultants to guide the transaction. If the deal doesn’t close, these advisory fees are sunk costs.

- Opportunity Costs: While not a direct cash expense, it is still significant. It refers to the loss of potential gain from other projects or deals that could have been pursued had time and resources not been allocated to the failed deal.

Dead deal costs can be a significant financial burden for companies, and tiny businesses may not have the capital reserves to absorb these costs easily. Companies try to avoid such costs by conducting a thorough preliminary assessment before fully committing to a potential deal.

Please note that the treatment of dead deal costs for tax purposes may vary based on jurisdiction, with some allowing businesses to deduct these costs as business expenses.

It is not possible to have no costs associated with a deal. On the other hand, some fees are classified as dead in such cases that a transaction moves on to progression via the application of due diligence but does not result in being finalized. Though this may be regarded as the price of conducting business for the buyers, more sophisticated buyers usually tend to avert such costs by ensuring the high likelihood of finalizing the deal being considered. Costs do become dead when deals fall through. This means the deal must be finalized for the charges to be alive. At this point, such applicable costs are constituted as formulating some of the enterprise value of the transaction instead of simply undergoing the process of being written off.

Besides the time applied at the internal level to complete the deal, some costs may be associated with some third parties, which both sellers and buyers may incur. Such costs may include the following elements:

- Legal fees about due diligence and the drafting of the agreement about the purchase and sale of the item along with other related agreements, which may include non-competes or employer contracts;

- The costs of the review of the quality of earnings, assessments regarding working capital, and the review of internal controls;

- The costs of appraisals concerning equipment and properties;

- Assessments relating to environmental conditions in such cases that there is the leasing or purchasing of property, as well as

- Costs related to tax counsel derive a treatment that is the most cost-efficient in reducing taxes concerning both parties’ transactions.

Dead Deal Costs Tax Treatment in the US

The Internal Revenue Service (IRS) generally permits businesses to deduct ordinary and necessary expenses incurred during the taxable year in carrying on any trade or business.

However, when it comes to expenses related to investigating or pursuing the acquisition of a business (i.e., dead deal costs), the tax treatment can be more complex.

In the case of a successful deal, such expenses are typically capitalized and added to the basis of the acquired assets or stock. This means they aren’t immediately deductible but will reduce taxable gain (or increase deductible loss) upon the future disposal of the acquired business.

In the case of an unsuccessful or aborted deal, the costs are generally deductible in the year the decision to abandon the deal is made. However, the deductibility can depend on whether the costs can be classified as capital expenditures or ordinary and necessary business expenses.

We can analyze four costs:

- Capitalized Costs: If a deal is successful, related expenses (including deal investigation, due diligence, legal fees, and advisory costs) are generally capitalized and added to the basis of the acquired assets or stock. They are not immediately deductible, but they can reduce taxable gain or increase deductible loss upon future disposal of the business.

- Deductible Costs: If a deal does not materialize (i.e., it’s a “dead deal”), the associated costs can generally be deducted in the tax year in which the decision to abandon the deal is made.

- Capital Expenditures vs. Business Expenses: The deductibility of these costs often depends on whether they’re classified as capital expenditures or ordinary and necessary business expenses. Capital expenditures usually have a useful life beyond the tax year and must be capitalized and depreciated over time. Ordinary and necessary business expenses can be deducted in the year incurred.

- Link to a Capital Project: Costs directly linked to a capital project, such as acquiring a specific company, will likely need to be capitalized. More general costs, such as fees for maintaining a line of credit, could be deducted.

Under IRS rules, capital expenditures usually have a useful life beyond the tax year and must be capitalized and depreciated over time. On the other hand, ordinary and necessary business expenses can be deducted in the year they are incurred.

One crucial point is that if the costs can be tied to a capital project (like acquiring a specific company), they will likely need to be capitalized. But they could be deducted if they’re more general costs (like fees paid to maintain a line of credit).

In other jurisdictions, the tax treatment of dead deal costs can differ. For example, in some countries, these costs may not be deductible, while in others, they may be fully deductible as business expenses.

Given the complexity of these rules and the potential for significant financial consequences, consulting with a tax advisor or professional familiar with the specific tax laws and regulations in your jurisdiction is always recommended.