Table of Contents

There are various technical tools and indicators available for traders to use. These tools help them understand the market sentiment and open or close positions accordingly. A widespread phenomenon that can occur while using these tools is divergence. Divergence, in general, means moving in a different direction. In the case of a security market, divergence can happen between two other trends: asset prices or the indicators used.

Fundamental traders relate divergence to the situation when the trend and the indicator move in different directions. Divergence can be classified into two parts: negative and positive. Negative divergence is when the price moves higher, but the indicator indicates otherwise. That is, it is moving downwards. On the contrary, the indicator shows a higher point when the price moves downwards. This is an essential aspect of trading as it indicates the possibility of a trend reversal.

However, such divergences can be challenging to identify and occur more often in highly volatile markets like Forex. To prevent traders from making such mistakes, they can take the help of the MACD Divergence Indicator. It is similar to the RSI divergence indicator described in our download section.

Please read this article to learn more about the MACD Divergence Indicator for MT4 and how traders can take its help to spot divergence on the price chart. In addition, you can download the MACD indicator with two lines if you need an upgraded version. To learn about the best MACD settings, visit our page.

Download MACD Divergence Indicator MT4

Below, you can download the MACD divergence indicator MT4 alert. It works as a MACD divergence scanner MT4 tool and draws buy and sell arrows on the chart when divergence occurs.

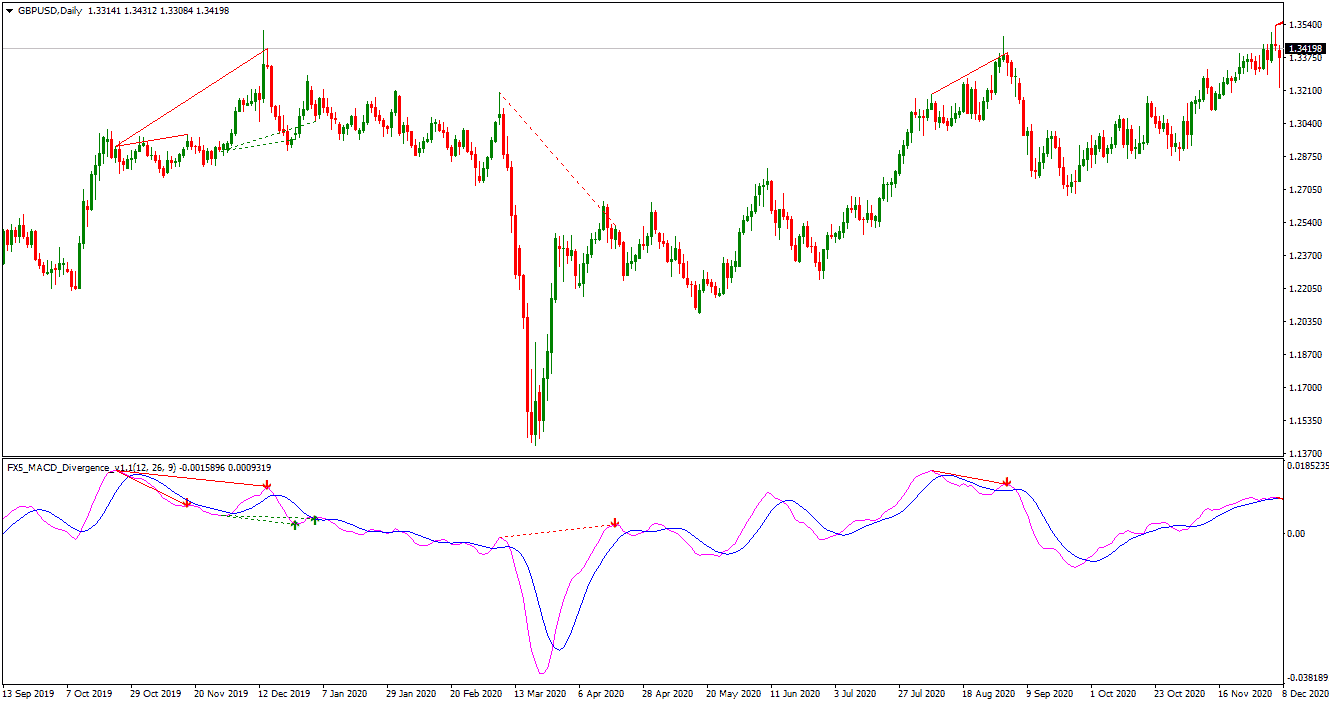

DOWNLOAD MACD DIVERGENCEBelow, you can see the image:

What Is the MACD Divergence Indicator?

The MACD Divergence Indicator helps Forex traders to know where the divergence will form. It follows its unique way of highlighting these points. Along with the divergence, the indicator also allows traders to determine the buying and selling signals with the help of arrows. These powerful features make it suitable for both new traders and experts. Beginners can use this indicator to learn where the divergence forms and how to open or close positions in such situations. At the same time, expert traders can use it to confirm their anticipated movements.

This Divergence Indicator for MT4 works on the MACD lines. It does not use complex charts or graphs to make it complicated to understand. Instead, it uses solid lines to indicate regular divergence and dotted lines to indicate reverse divergence. But before using the indicator, traders must realize regular and reverse divergence.

The bullish and bearish divergences are further classified into regular and reverse divergence. When the Forex price or security reaches a lower low, but the indicator suggests a higher low, it is known as a regular bullish divergence. On the contrary, if the price reaches a higher low but the indicator is making a lower low, reverse divergence is the case. In the case of bearish signals, the situation is reversed.

These regular and reverse divergence signals simplify the traders’ task of allocating extra effort to recognize every divergence correctly.

How To Use the MACD Divergence Trader With MT4?

As mentioned above, the Divergence Indicator for MT4 uses solid and dotted lines to highlight the divergences on the price chart. Also, it uses red and green arrows to indicate selling and buying signals, respectively. Blue and magenta lines display the MACD lines in this indicator, while green and red lines show bullish and bearish divergences.

Once you apply the indicator to your MT4 terminal, it will display the above lines and arrows on the price chart. These lines and arrows work to alert the formation trends and possibilities of trend reversals. In addition, the buying and selling signals help the new Forex traders not get confused and learn and make successful trading moves.

This indicator can be used on any chart and is flexible with all timeframes. However, to see the better performance of this indicator, it is advised to use it on charts with higher time frames.

Conclusion

The MACD Divergence Indicator is highly recommended for Forex trading. Because of its versatile nature, it can assist traders in making profitable trades. It is free to download and easy to apply on the MT4 terminal. In addition, it provides valuable information about the market, which can be a little confusing for new traders to understand at the beginning.

However, relying on only one indicator, even if it can provide quite a lot of information, is not recommended. Instead, traders must accompany this indicator with other indicators and technical tools to confirm the market sentiments.