Table of Contents

Many people invest in 401k to have a secure and convenient retirement. The diversified portfolio of your 401k account increases due to different returns on other securities, like stocks pay dividends and bonds pay interest. Smartness is starting investment in a 401k plan to have more funds at retirement.

Compounding is a prevalent method used by investors to increase the value of their investment at a faster pace. This method can also be used on your 401k investment. Depending upon the type of investment, you can compound your investment annually or monthly.

Compounding your investment is not that big of a task if you look at the monthly contribution you have to make to your investment. However, in the long run, it is highly beneficial.

Read this article to find out how you can compound your 401k investment.

What is a 401k Investment?

401k investment represents investing and savings plans offered by employers to ensure employees have dedicated retirement funds. 401k is an employer-sponsored tax-deferred retirement plan and usually, the most common type of investment choice offered by this plan is the mutual fund.

When people are left with no income source, many individuals invest in 401k plans to have funds for retirement. Every month, a certain amount is deducted from employees’ salaries and put towards the 401k investment. Your employer may also add a percentage of what you contribute to your 401k plan.

A 401k investment is typically a diversified securities portfolio like bonds, stocks, and other securities. It involves both high-risk and low-risk investments. High-risk investment increases the chances of higher returns. At the same time, low-risk investment works as a safety cushion if the market takes a dip. The ratio of high-risk and low-risk investment in your portfolio depends upon the time left for your investment. The closer you are to your retirement, the less risky your investment will be.

Does a 401k Earn Compound Interest?

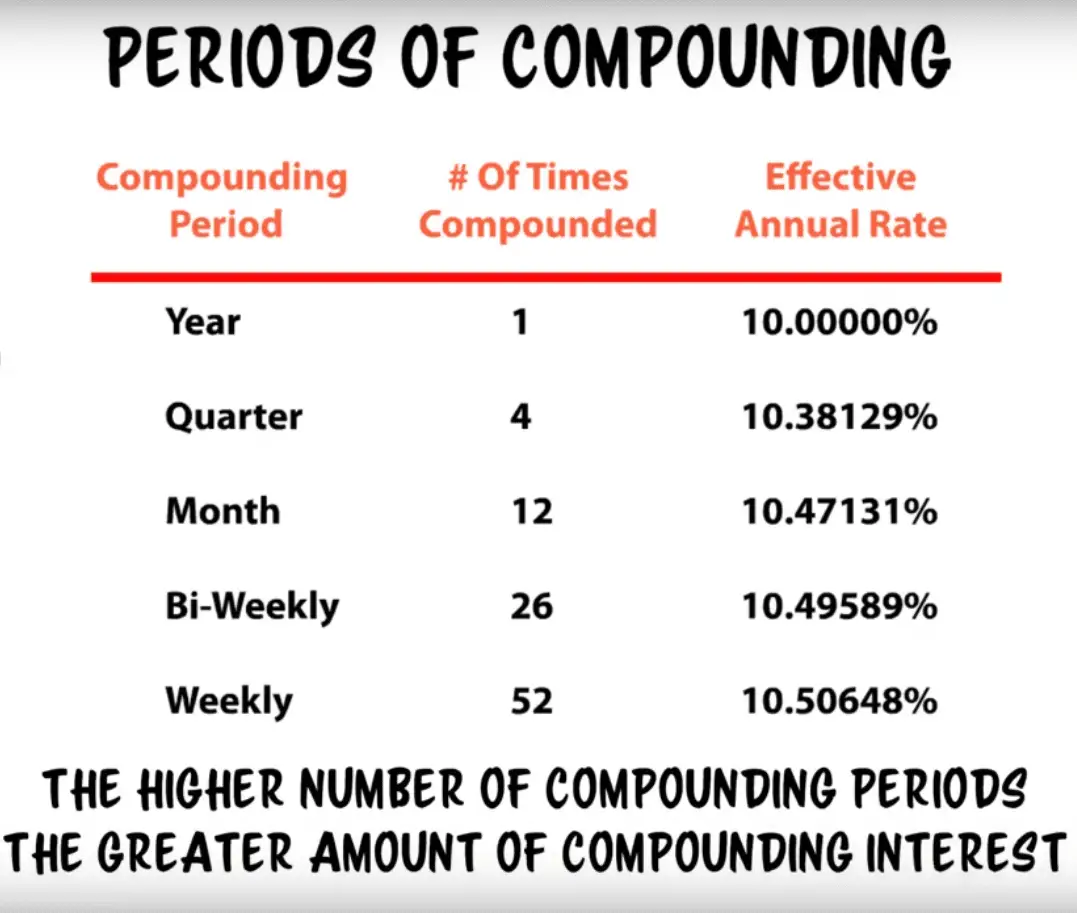

Yes, 401k earns compound interest, where the higher number of compounding periods, the more significant amount of compounding interest. Usually, 401(k) interest is compounded either monthly or annually, defined by the particular investments in the portfolio.

401k is the most efficient way to save for your retirement. You don’t have to worry about saving some money every month from your salary, as it is automatically deducted. Your funds are handed over to experts so that they can strategically invest them on your behalf. Along with all these advantages, you also get tax benefits. Compounding your 401k investment will only benefit you in the long run.

You can indeed earn from simple interest, but compound interest can grow your investment at a faster pace. It gives a snowball effect to your investment; it forms layers of interest upon interest and eventually raises the value of your funds. However, it may not be able to give you promising results in a short-time period. So, it is better to start your 401k plan as early as possible.

Compounding Interest

The concept of compounding interest can easily be understood with the help of an example.

You invest $1,500 at an interest rate of 10 percent. At the end of the year, you will earn an interest of $150. If this interest is added to your investment by the end of the following year, your claim will be compounded as you will earn the interest on your principal investment and the interest that you made.

Now let’s take this example with your 401k plan. You invest a subsequent amount from your salary every month towards the 401k plan; let us assume $150. By compounding this investment monthly, you can earn $15 every month. Compounding can be done annually, quarterly, monthly, or even daily. However, annual and investors typically use monthly compounding.

The more you compound interest in your investment, the faster your funds will grow. However, it isn’t easy to calculate the exact growth of your investment by compounding because your investment portfolio includes diversified securities, and every security works differently when it comes to generating interest. Eventually, the investment will grow by compounding interest, quicker than the simple interest.

Reinvest Dividends

Just like interest is earned on bonds, dividends are earned on stocks. Many companies distribute dividends to their shareholders. These dividends are part of the profits made by the company. The dividends are distributed proportionate to how many stocks you own of that particular company. These are typically small bonuses that can be beneficial if compounded.

Just like reinvesting the interest, you can reinvest dividends for compounded growth of your investment. If you plan to withdraw them, your investment will still grow but at a stagnant speed. Reinvesting dividends is a wise option to increase the pace of your investment growth. The financial manager of your 401k plan typically reinvests these dividends for compounded growth.

How often are retirement accounts compounded?

Retirement accounts can be compounded weekly, bi-weekly, monthly, quarterly, and annually. Usually, 401(k) interest is compounded either monthly or annually, defined by the particular investments in the portfolio.401k earns compound interest, where the higher number of compounding periods, the more significant amount of compounding interest.

How To Benefit More From Compound Interest?

A 401k investment includes different types of securities, and all these securities help you earn interest or dividends. You can compound the interests and dividends for the rapid growth of your investment. However, there are specific ways where you can benefit more from compound interest.

Investing more or leaving your investment in the hands of your financial manager are a few advantages that you can get from compounding interest. It will help you increase your funds and acquire financial security. So, follow these steps to get the best of the compound interest.

- Be Persistent With Your Investment

According to some experts, investors should be persistent with investment. It should not be a one-time thing and should be achieved regularly. Investors can develop a schedule for regular investment, which will eventually grow their investment in the long run. Similar is the situation when it comes to 401k investment.

Market timing is an everyday activity amongst novice investors. However, this theory is not very successful in practice. Regular investment is a better strategy, especially in the case of a 401k investment, where your financial manager takes care of the reinvestment and compounding interest.

- Increase Your Investment

The majority of young employees hate the idea of their salaries getting deducted and put towards an investment. They hate the idea of not getting their hands on their earnings before retirement, for which they would have to wait longer. This is why many prefer to invest as minimum as possible in a 401k plan. They remain oblivious to the advantage of more investment and compounded interest.

Compound interest is more beneficial if it gets started as early as possible. Typically, there is a limit on the amount you can invest in your 401k plan annually. It is advisable to accomplish this limit every year and not stay behind it. Usually, employers also match the funds invested by the employees towards their retirement plans. If you are supporting a subsequent amount, you may earn more than your salary.

Compound interest has a snowball effect that can only give promising results if started at the earliest. The earlier and the more you invest, the more you will benefit from the compound interest. Not to forget the additional advantages like tax benefits, additional funds by the company, and an expert handling your investment.

- Manage your risk

There is no doubt that investment is risky and keeps the investors on their toes every minute. There is a constant fear of losing one’s hard-earned money that they have been saving for their future. There is disturbing news about people losing all their investments or a wrong investment decision. However, these are all results of certain situations and not a prominent event that is bound to happen.

Investing in a 401k plan is the best decision that you can make. It is not that there are no risks involved in such an investment. They have a fair proportion of risk, but you have a financial manager working on your behalf to manage that risk. Your task is to know how a 401k plan works and decide how you would like it to be addressed. After that, you can forget about it and let the experts work into compounding your funds.

Final Thoughts

The idea behind leaving your 401k investment in the hands of your financial manager is that if you check it regularly, it may seem like it’s not working. However, 401k is a long-term plan and is only fruitful in a longer span. That is why it is advised to start it as early as possible and invest as much as possible to see even better growth in your investment.

Compounding is a very successful method and works with almost every type of investment in the long term. Combining it with your 401k plan is a smart decision. Your financial manager knows best as they are experts in their field. Keeping in mind every aspect of your investment, they will work towards increasing your retirement funds.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE