Table of Contents

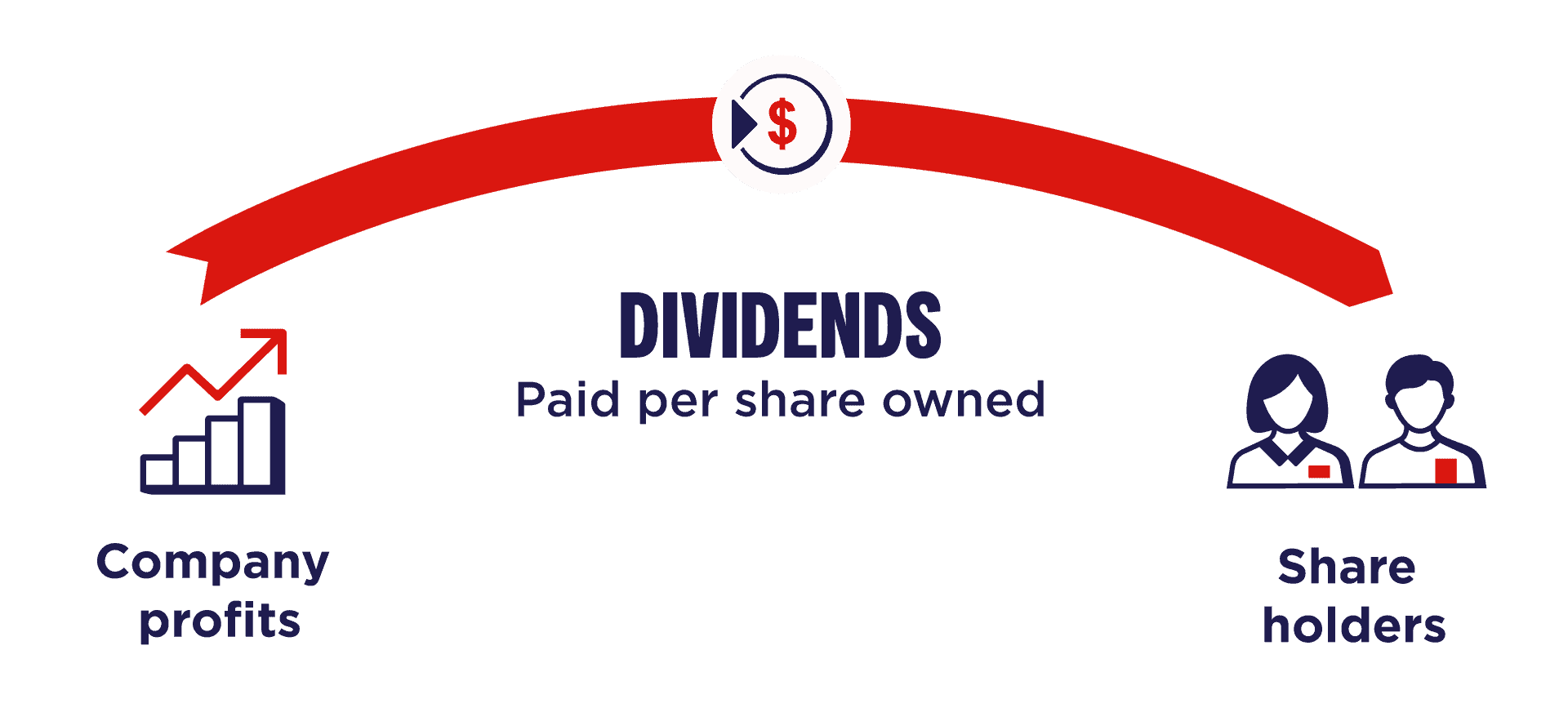

Dividends are payments made by a corporation to its shareholders, usually derived from the company’s profits. These payments are essential for investors to earn income from their equity investments, serving as a direct share of the company’s earnings.

Dividends are typically paid regularly, such as quarterly, but can also be issued as special, one-time payments in certain circumstances. The company’s board decides to distribute dividends, and the number of directors reflects the company’s financial health and future investment plans. For investors, dividends provide regular income and signal confidence from the company’s management in its financial stability and growth prospects.

Now, we need to see a correlation between share price and dividend practice:

Does Dividend Reduce Share Price?

Yes, share prices often drop when a dividend is distributed. This reduction is typically mirrored in the share price, which often drops by approximately the same amount as the dividend per share immediately after the ex-dividend date, as the stock no longer carries the right to receive the most recent dividend.

The correlation between dividends and share prices is a multifaceted relationship, heavily influenced by a company’s dividend policy, which in turn is shaped by its profitability, capital structure, and strategic investment opportunities.

This explanation clarifies the common misunderstanding about the timing and impact of dividend payments on stock prices. The critical point is that the stock price adjustment due to the dividend payment occurs on the ex-dividend date, not the payment date, because, from this date onward, new stock buyers are not entitled to receive the dividend declared.

The initial drop in stock price on the ex-dividend date reflects the value of the dividend being removed from the company’s valuation, as it is no longer part of its assets but is being transferred to shareholders. Despite this adjustment, the stock trades the day, with its price subject to regular market fluctuations. Thus, if a stock’s price appears to rise on the ex-dividend date, it is essential to recognize that it is about the adjusted (lowered) starting point, not the original price before the dividend adjustment.

Let us make an example using a fictive company:

In early 2023, Tech Innovations Corp. (example company name) announced a surprising dividend cut from $0.50 to $0.20 per share, citing a strategic shift towards heavy investment in research and development for future technologies. While the move was intended to prepare the company for long-term growth, it raised immediate concerns among investors.

Share Price Reaction:

Following the announcement, the company’s share price experienced a notable drop, from $50 to $45. This decline can be attributed to several factors:

- Immediate Asset Value Reduction: The dividend cut reduced the immediate tangible value returned to shareholders, prompting a recalibration of the stock’s perceived value. Investors holding the stock for dividend income saw their expected returns diminish, leading to a sell-off.

- Signal of Potential Issues: The sudden dividend decrease raised questions about the company’s current cash flow and future profitability. Even though the reason given was an investment in future growth, investors are often skeptical about the immediate negative impact on earnings and possible underlying issues not disclosed by the company.

- Market Psychology: The dividend cut could also be perceived as a lack of confidence in the company’s future performance. Investors might interpret this move as a signal that the company is bracing for more challenging times, potentially leading to decreased investor confidence and a sell-off.

- Impact on Dividend Investors: The reduced dividend payment makes the stock less attractive for investors specifically focused on dividend income, prompting them to shift their investments to more stable dividend-paying stocks.

Market Cap, Dividends, and Share Price

The relationship between share price, dividends, and the formula for market capitalization (Market Cap) in the context of Enterprise Value can be explained as follows:

The formula for market capitalization is traditionally

Market Cap = Share Price × Number of Outstanding Shares.

However, the formula Market Cap = Enterprise Value + Cash – Debt provides a broader perspective on a company’s valuation, factoring in its capital structure. Enterprise Value (EV) essentially represents the company’s total value as it accounts for both equity and debt holders (i.e., it can be thought of as the theoretical takeover price of the company). By adding cash and subtracting debt, this formula adjusts the Enterprise Value to reflect only the company’s equity value—its market capitalization.

Dividends impact this equation indirectly by affecting the company’s cash reserves and, subsequently, its share price. When a dividend is paid out, the company’s cash reserves decrease, which could lead to a decrease in the Market Cap (since Market Cap = Enterprise Value + Cash – Debt), assuming all other factors remain constant. Moreover, as dividends are distributed, the share price might adjust on the ex-dividend date to reflect the payout, potentially decreasing the Market Cap further if other positive market movements or company performance indicators do not offset the share price drop.

Thus, while dividends provide immediate value to shareholders, their payment can influence the company’s valuation through changes in cash reserves and adjustments in the share price, all of which play into the calculation of the market capitalization using the extended formula.

Stock price reactions to stock dividend announcements

In the study, Stock price reactions to stock dividend announcements, we can see this study sets out to investigate how stock dividend announcements affect stock prices, mainly focusing on the period between 2006 and 2012—a time characterized by slow economic growth and significant financial changes, including the Great Recession of 2007-2009. The backdrop of this study is rooted in the generally accepted accounting principle that distinguishes stock distributions based on their size: distributions of more than 25% are considered stock splits and have no impact on retained earnings. In comparison, less than 25% of distributions are treated as stock dividends.

The significance of stock dividend announcements lies in their potential to convey information about a firm’s prospects to the market, which can, in turn, affect the firm’s stock price. Previous empirical studies have identified market reactions to such announcements, suggesting that they carry valuable information content for investors. However, most of this research is either somewhat outdated or has focused on smaller sample sizes, particularly within the context of the United States.

A dividend policy that consistently delivers or exceeds investor expectations can signal a company’s financial health and confidence in future earnings, boosting investor sentiment and potentially positively impacting share prices. Investors may view regular, stable dividends as a sign of a company’s reliability and profitability, attracting more investment and driving up the stock value.

Conclusion

Distributing dividends is a straightforward method to return cash to shareholders. It’s often used by mature companies with limited growth opportunities to provide their shareholders with a direct return on investment. Dividends can make the company’s shares more attractive to investors seeking regular income, potentially supporting the stock price.

The drop in share prices following a dividend distribution, typically matching the dividend amount post-ex-dividend date, reflects the market’s adjustment to the stock’s reduced value without its most recent dividend entitlement.

Please read the top 15 articles explaining share price:

How to find the price per share?

What Happens to Share Price After Buyback?

What makes a share price go up?

What causes share prices to drop?

How do you calculate the share average price?

How do you calculate the share price from the Balance Sheet?

Why do stock buybacks increase share price?

Do stock splits increase share price?

Does dividend reduce share price?

How does debt affect share price?

How does issuing new shares affect share price?