The “PDT Rule” refers to the “Pattern Day Trader” rule specific to the U.S. stock market. This rule was established by the U.S. Financial Industry Regulatory Authority (FINRA) to help regulate the day trading activities of retail investors.

Does Forex Have PDT Rule?

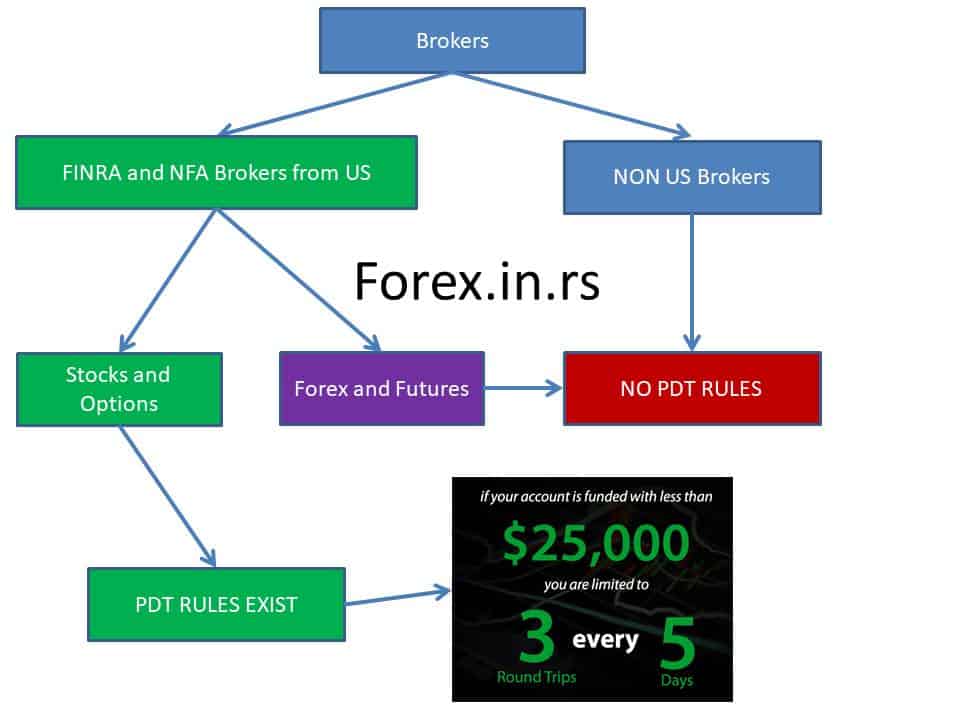

No, forex has no PDT rule, and this Pattern Day Trader rule does not apply to forex traders. PDT rule is created only for stock traders for FINRA-regulated brokers to improve risk management between retail stock traders.

Unlike the stock market, where this rule is enforced, Forex doesn’t have a Pattern Day Trader (PDT) rule. The reason for this difference lies in the regulatory bodies and the markets’ nature. The PDT rule is a regulation introduced by the Financial Industry Regulatory Authority (FINRA) in the U.S., primarily overseeing the stock and options markets. Its purpose is to improve risk management among retail stock traders, especially those prone to overtrading.

On the other hand, forex operates in an over-the-counter (OTC) market, meaning there isn’t a centralized exchange or clearinghouse to standardize and regulate all trades. This decentralized nature of the forex market means that traders in this space aren’t under the same regulations and restrictions as stock traders. So, while the PDT rule was designed to protect retail stock traders from the specific risks associated with day trading on margin, the forex market has its own risk management tools and practices catering to its unique characteristics.

Here’s the PDT rule in detail:

- Definition: A “Pattern Day Trader” is any margin account customer who executes four or more day trades within five business days, provided the number of day trades is more than six percent of the customer’s total trading activity for that same five-day period.

- Requirements: Once someone is classified as a pattern day trader, they must maintain a minimum balance of $25,000 in their brokerage account. This rule applies to both stock and options trading in a margin account.

- Consequences: If a trader is flagged as a pattern day trader and their account balance falls below the $25,000 requirement, they won’t be able to make any more day trades until the account is returned to the minimum equity level. The brokerage can also issue a day trading margin call against the trader, which must typically be met within five business days.

- Margin Rules for Day Trading: The day trading margin rule provides that the maximum leverage a pattern day trader can use is four times the trader’s maintenance margin excess (the account’s equity minus the margin requirement) as of the previous day’s close. If this is exceeded, the broker will issue a margin call. The broker may restrict the trader’s account if the margin call is not met.

- Getting Unflagged: If a trader gets flagged as a PDT but wishes to be unflagged, they typically need to avoid day trading for a specified period (e.g., 90 days) or make a case with their broker that the trades were not intended as day trades. However, policies might differ among brokerages.

- Non-Margin Accounts: The PDT rule only applies to margin accounts. If you’re trading in a cash account, you won’t be subject to the PDT rule, but settlement rules bind you. In the U.S., stocks have a T+2 settlement date, which means it takes two business days for the funds from a sale transaction to be available for reinvestment. If you sell a stock in a cash account, you typically need to wait two days before you can use that cash to purchase another stock, or you might face a “good faith violation.”

Rationale Behind the Rule:

The main idea behind the PDT rule is risk management. Day trading can be highly volatile and can lead to significant losses in a short amount of time. By requiring traders to have a minimum balance, regulators aim to ensure that traders have enough capital to handle potential losses. It’s also a measure to ensure that traders are serious about their trading activities and have a particular understanding and sophistication before engaging in frequent day trading.

However, the rule has its critics. Some argue that it unfairly limits retail investors, while institutional investors don’t face such restrictions. Others believe it’s an unnecessary regulation in an age of advanced trading platforms and tools.

If you’re considering day trading, understand the rules, risks, and strategies involved, and consider consulting with a financial advisor.