Table of Contents

Those who invest intending to earn higher gains in the longer term already know about the idea of compounding growth. Those who don’t should know that it is an immeasurable tool that can help you grow your investment faster than any everyday long-term investment would.

Compounding can be used in many types of investment. One such investment that benefits from compounding is the index funds. Many index fund investors are already aware of the benefits of compounding, and many are already using this concept and have benefited from it immensely.

However, compounding does not have the same result on every type of investment. Different securities and investments follow different policies and strategies because some may be compounded in a shorter period than others.

This article focuses on the effect of compounding of index funds, how it works, and how often interest on index funds gets compounded.

Index Funds

Before learning how interest gets compounded in index funds, you must know what index funds are and how income distribution on such investments works.

Index Funds are typically investment companies that pool investors’ funds and invest them in a portfolio of diverse securities, bonds, and stocks. Index funds are of two types — Mutual Funds, a more diversified form of index funds, and Exchange Traded Funds (ETFs), which are also diversified portfolios but not as much as mutual funds.

People who have invested in index funds receive profits through dividends or interest on their investment. According to the Investment Company Act 1940, investors receive interest or dividends annually through index funds. The interest and dividends are distributed as per the net asset holdings of the investors.

Does Index Fund Compound?

Yes, index funds compound when you reinvest your earned interest as an investor. If you invest more money and if money longer sits, more compound interest you will make. Additionally, interest compounds of your index fund as often as the frequency of your fund’s distributions. For example, the interest of your index fund will compound annually if your index fund makes distributions that include fund interest once a year.

It is the investor’s decision if they want to earn compounded growth on the interest. Whenever your index funds distribute interest, you can withdraw it or reinvest it back in the index funds or other securities. The reinvestment helps your investment gets compounded because that is when you will gain interest on interest.

The reinvestment of interest becomes part of your principal investment next year. So, when your interest is calculated next year, it will be calculated on increased investment, your investment plus the interest. So, continuing with the reinvestment will eventually grow your investment at a much faster pace.

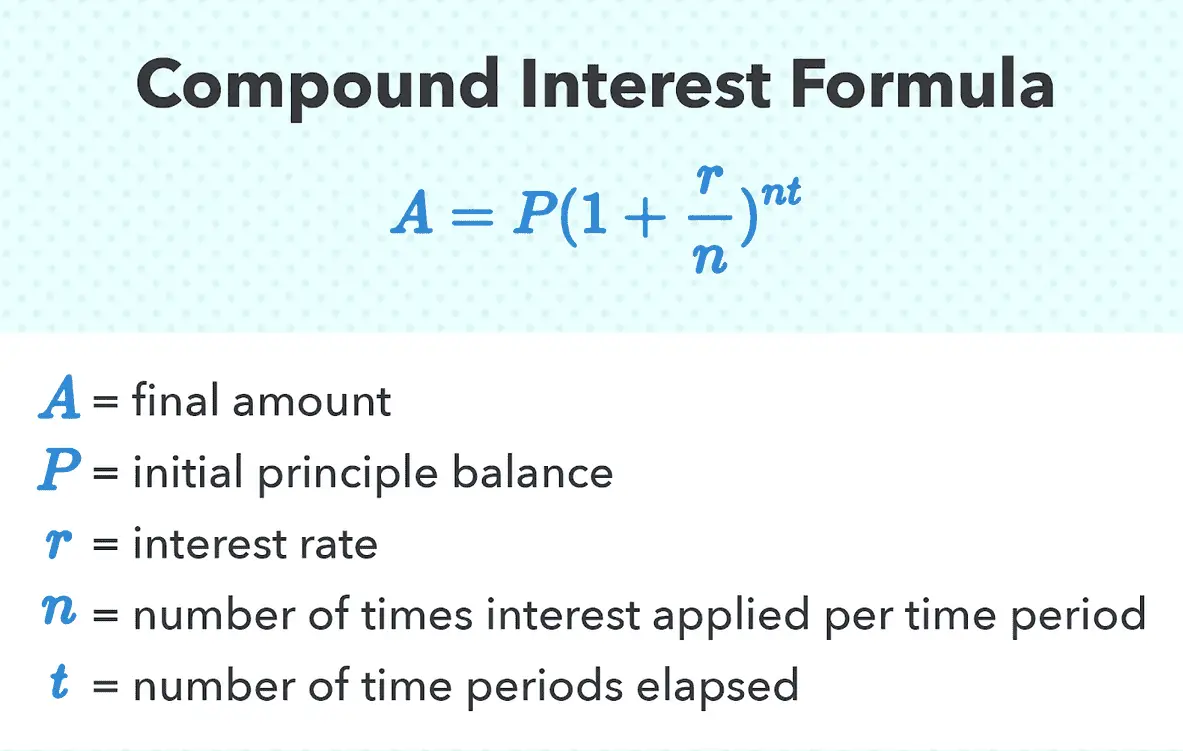

In theory, the concept of index fund interest compounded can be a little complicated to many. So let’s understand this concept more clearly with the help of a practical example.

For example, you invest $30,000 in an index fund at the beginning of 2022. Your index is paying 10% interest; therefore, you will get $3,000 as interest at the end of the year. Now, if you reinvest this interest in your index fund, instead of withdrawing it, your investment will increase to $33,000 for the year 2023.

At the end of 2023, your 10% interest on index funds will be calculated at $33,000. Therefore, the interest for the year 2023 will be 10% or $33,000, that is, $3,300. This is $300 more than the first year because it included the interest on the interest you reinvested.

If this practice is continued, and the interest rate on index funds remains constant (hypothetically), in 10 years, your $20,000 investment will become $51,874. If you do not wish to reinvest and withdraw the interest, your investment at the end of the 10th year will be $40,000.

Note: The interest rate in the above example is taken constantly for all years to make the model understandable. However, it is just a hypothetical assumption, as the interest rates on index funds keep changing every year, as per the market situation.

Frequency of Compounding of Index Funds Interest

There is no particular period in which interest on index funds gets compounded. It depends upon how often your index funds are distributing interest. Your interest can be compounded annually or bi-annually if you earn interest once or twice a year. It is not like interest on standard loans, where the interest can be compounded at any interval, from monthly to annually.

It also depends on the investors how often they reinvest the interest. Therefore, the frequency of the interest compounding on index funds relies on the frequency of reinvestment by the investors and the frequency of the distribution of funds. The more you get interest and reinvest it, the more compounded the interest.

The exponential growth of your investment depends upon the frequency of interest distribution and reinvestment. Therefore, to increase the exponential power of investment development, look for an index fund with more frequent interest payments. It will eventually result in promising growth of your investment.

To make it easy for you to find an index fund that distributes interest more frequently, you can read the following factors determining the interest distribution frequency of an index fund.

Determining the Interest Distribution Frequency on Index Funds

The types of securities in the index funds determine the frequency of interest distribution. This is because different securities pay interest differently. So, the ones included in your index fund portfolio, be it bonds, treasury bills, certificates of deposits, or REITs, determine how often you can get interest and how often it gets compounded.

Index funds are a portfolio of diversified securities that include both dividend-bearing securities, like stocks and interest-bearing securities, like bonds. The ratio of these securities included in your portfolio determines the interest distribution. So, for example, if your portfolio has more bonds, you can expect more frequent interest distribution as bonds generally pay out monthly dividends. However, including all the possibilities, it can range from weekly to annually.

If bonds bearing index funds distribute dividends/interest monthly, the interest gets compounded monthly, stating that it is reinvested. On the other hand, the interest payment is quite different when it comes to certificates of deposit. They generally pay interest at the time of maturity. It could be monthly or bi-annually because the maturity of CDs is either a year or a few months or maybe weeks.

Your index funds’ interest on Treasury Bills is paid at a fixed rate. These interests are distributed twice a year until the time of maturity. Another dividend-paying security is REITs, which pay out interest on mortgage REITs. The interest payout frequency is not fixed; it could be monthly or quarterly. Therefore, your interest gets compounded as often as the index fund pays the interest.

The investors are the rightful owners of any income or profit generated by the investments. Therefore, whether it is mutual funds, index funds, or ETFs, if your portfolio includes securities that pay out dividends or interest, it will probably be given bi-annually. Hence, the compounding will also be done bi-annually for the bi-annual interest.

Considering the above examples, different investments generate interest at different intervals. However, the frequency of interest that you receive depends upon the ratio of these investments in your portfolio and the policies laid down by your index fund company.

Investors can see such policies on the prospectus issued by their index funds.

Final Thoughts

Index funds are a wise investment decision because of their diversified portfolio. Investors get to experience all sorts of investments, with different profit distributions and risks associated with them. Another benefit that investors can get from the interest or dividend by investing in index funds is compounded growth.

According to their policy, different index funds pay interest at different intervals. Therefore, it is the investor’s choice if they wish to reinvest the interest for the compounded growth or withdraw it to let the investment grow at a stagnant speed. Most index funds give their investors options to reinvest the interest manually or automatically.

To summarize the article in a few lines, the more frequently interest is distributed and then reinvested, the more your interest will get compounded, and the more exponentially your investment will grow.