Table of Contents

In finance and wealth management, few names evoke the allure and mystique quite like Swiss bank accounts. For decades, having a Swiss bank account has been associated with prestige, secrecy, and the promise of unparalleled financial stability. The concept has been perpetuated through popular culture, with countless movies and novels portraying Swiss banks as the ultimate symbol of wealth and power.

However, the dream of having a Swiss bank account has remained elusive for many individuals due to the stringent requirements and exclusivity associated with such accounts. Nonetheless, a notable exception exists in the form of Dukascopy, a renowned Swiss brokerage firm that not only offers traditional banking services but also provides an opportunity for forex trading.

Dukascopy Review

Dukascopy offers a robust trading platform with advantages such as up-to-the-minute quotes, a Jforex platform, allowance for algorithmic bot trading, and secure client funds up to CHF 100,000. However, the broker also has its share of drawbacks. The offered leverage is limited to 1:200, and client payouts are usually delayed up to a few days.

Client payout delays, a lengthy and complicated registration and verification process, and the unavailability of trading on Saturdays can deter some traders. Despite these minor disadvantages, Dukascopy remains a viable option due to its advanced trading tools and financial security, but it’s essential to consider these factors while choosing.

Dukascopy Main trading facts

- Account currency options include USD, EUR, GBP, CHF, and PLN.

- The minimum deposit required to open an account is $100.

- Dukascopy provides leverage up to 1:200.

- The broker offers spreads starting from as low as 0.1 pip.

- A wide range of instruments, including currency pairs, indices, cryptocurrencies, stocks, metals, and binary options, are available for trading.

- The broker implements a Margin Call at 100% and a Stop Out at 200%.

Dukascopy Broker offers a range of benefits for its clients, enhancing their trading experience in various ways. Firstly, clients can open an account with an accurate Swiss Bank, which provides a secure and prestigious banking environment. The broker’s competitive conditions, such as a low EUR/USD spread starting from just 0.1 and leverage up to 1:200, allow for flexible trading, which Gies. They provide robust support with 24/7 live trading assistance internationally, with different currencies and gold, catering to a global client base.

Clients’ deposits are protected up to CHF 100,000, ensuring high financial security. Dukascopy offers diverse trading instruments, including Forex, Metals, Energy, Cryptocurrency CFDs, Indexes, Bonds, Stocks, and ETFs, providing ample opportunities for diversified investment. The account opening process is streamlined and efficient, with video identification completed in just 15 minutes. The pricing environment is transparent, ensuring fairness and clarity for all traders.

Dukascopy ensures equal trading rights, with all clients accessing the same liquidity and prices through a single data feed, supporting a fair and unbiased trading environment. There are no price manipulations, and orders are executed instantly. The broker is friendly towards various trading strategies, allowing hedging, scalping, and trading robots. Automated trading is supported through the jForex API and FIX API, and a large liquidity pool from over 20 banks ensures that orders can be filled efficiently.

FoMSrisk management, Dukascopy provides tools to control order execution and manage trading risks effectively. The trading platforms are versatile and suited to different trader needs, including features like tick-by-tick price history, an automated trading historical tester, slippage control, over 250 indicators and chart studies, and a wide range of trading orders. Hedging and scalping are also permitted, further enhancing the trading flexibility for Dukascopy clients.

Dukascopy history

Dukascopy Bank started in 2004 in Geneva. I am making it known as the Swiss bank. However, the firm was founded in 1990. At first, it was only a project managed by a physicist’s unit to model the financial markets, but the company has developed and grown after some time. It has formed an online trading platform. It was in 2006 that the organization started its SWFX marketplace, which runs as an ECN. It has grown over time, and it has expanded internationally. The bank now owns the Dukascopy EU IBs AS.

Dukascopy is a unique entity in the financial landscape, bridging the gap between private banking and forex trading. Founded in 2004, the company has earned a reputation for its commitment to financial transparency, cutting-edge technology, and comprehensive services. It is duly licensed as a Swiss bank and operates under the stringent regulations of the Swiss Financial Market Supervisory Authority (FINMA).

What sets Dukascopy apart from traditional Swiss banks is its emphasis on enabling clients to safeguard their wealth and actively engage in foreign exchange trading. By offering both a bank account and a forex trading account, Dukascopy allows individuals to tap into the lucrative world of forex trading while benefitting from the security and stability of Swiss banking.

Dukascopy EU is a Swiss Forex Group with its headquarters in Latvia. It offers many features for traders. First, it offers fast execution through in-house-built technology.

Second, they offer direct access to those that provide liquidity and get the execution in just MS. They also offer tight spreads through ECN liquidity. The Dukascopy offers spreads as low as .2 pips on Euro and USD. They also provide in-depth marketing, in which the traders can monitor the market depth. Every trader will enjoy equal trading rights and be given equal treatment regarding spreads and liquidity.

Is Dukascopy legit?

Dukascopy is a licensed broker regulated by FINMA (Swiss Financial Market Supervisory Authority). It is simultaneously regulated as a bank and a broker. Additionally, Dukascopy Bank owns Dukascopy Europe IBS AS, a European licensed brokerage company based in Riga, and Dukascopy Japan, a Type-1 Tokyo-regulated licensed broker.

Dukascopy is a global institution providing secure online trading services to its clients in the Forex and CFD markets. Since its inception in 1998, Dukascopy has grown exponentially due to its commitment to reliability, quality, and innovation. It’s no wonder that this Swiss broker has become one of the most trusted names in Forex trading.

The answer is “Yes” – Dukascopy is a legit broker regulated by FINMA (the Swiss Financial Market Supervisory Authority). In auditioning regulated as a bank, Dukascopy Bank owns two other entities: Dukascopy Europe IBS AS, a European licensed brokerage firm headquartered in Riga, and Dukascopy Japan, a Type-1 Tokyo regulated licensed broker. All three organizations are subject to rigorous financial and are under constant scrutiny by FINMA. As such, clients can rest assured that their funds are safe when dealing with any of these organizations.

In addition to being highly regulated, Dukascopy provides some of the best trading conditions in the industry today, including competitive spreads and leverage levels, fast execution speeds, and access to more than 50 currency pairs, precious metals, commodities, and stock indices for trading.

Through its cutting-edge JForex platform technology, Dukascopy offers automated trading capabilities through Expert Advisors (EA) or algorithmic trading strategies (API). Furthermore, clients can benefit from their excellent customer service team, which can be contacted via phone, email, or live chat 24/5 during market hours.

Overall, given that it is an established international brokerage firm regulated by FINMA with solid financials and excellent customer service, there should be no doubt that Dukascopy is indeed one of the most reliable brokers available on the market today.

Dukascopy Spreads

Dukascopy’s average spreads are EURUSD around 0.24 pips and GBPUSD around 0.6 pips. In some moments, EURUSD can be as low as 0.1 pip (the max spread was three pips during colossal volatility).

Dukscaopy is realistic, and the below Table will present you with real Dukascopy spreads:

| Instrument | Europe | US | Asia | Min | Max |

|---|---|---|---|---|---|

| AUD/CAD | 1.94 | 1.96 | 2.37 | 1.1 | 20.2 |

| AUD/CHF | 1.49 | 1.52 | 1.89 | 0.9 | 31.9 |

| AUD/JPY | 0.89 | 0.88 | 1.16 | 0.4 | 17.9 |

| AUD/NZD | 2.04 | 2.14 | 2.35 | 0.9 | 14.3 |

| AUD/SGD | 2.34 | 2.67 | 2.89 | 1.3 | 33 |

| AUD/USD | 1.05 | 1.09 | 1.21 | 0.4 | 16.8 |

| CAD/CHF | 1.44 | 1.52 | 2.1 | 1.1 | 30.3 |

| CAD/HKD | 7.15 | 7.12 | 8.39 | 2.4 | 85.5 |

| CAD/JPY | 1.22 | 1.22 | 1.59 | 0.4 | 27.9 |

| CHF/JPY | 1.96 | 2.06 | 2.55 | 0.4 | 33 |

| CHF/SGD | 3.58 | 4.03 | 4.48 | 0.9 | 44.4 |

| EUR/AUD | 2.35 | 2.35 | 2.81 | 1 | 42.4 |

| EUR/CAD | 1.9 | 1.92 | 2.5 | 0.8 | 34.8 |

| EUR/CHF | 1.07 | 1.18 | 1.57 | 0.1 | 11.1 |

| EUR/CZK | 9.38 | 13.45 | 18.09 | 3.3 | 258.9 |

| EUR/DKK | 3.2 | 3.76 | 5.27 | 2 | 41.4 |

| EUR/GBP | 0.9 | 0.96 | 1.27 | 0.4 | 9.7 |

| EUR/HKD | 12.39 | 11.9 | 14.56 | 3.7 | 123.1 |

| EUR/HUF | 16.8 | 21.76 | 19.77 | 3.8 | 139.1 |

| EUR/JPY | 1.07 | 1.01 | 1.36 | 0.2 | 13.8 |

| EUR/NOK | 32.21 | 48.15 | 82.13 | 8.5 | 718 |

| EUR/NZD | 3.05 | 3.25 | 3.8 | 1.3 | 50 |

| EUR/PLN | 16.54 | 19.36 | 41.5 | 3.7 | 347.5 |

| EUR/SEK | 26.86 | 39.15 | 76.22 | 7.1 | 293.4 |

| EUR/SGD | 3.85 | 4.11 | 4.11 | 1.3 | 48.7 |

| EUR/TRY | 99.24 | 195.46 | 75.34 | 41.5 | 1501.1 |

| EUR/USD | 0.27 | 0.3 | 0.31 | 0.1 | 6.9 |

| GBP/AUD | 2.66 | 2.66 | 3.89 | 0.4 | 47.5 |

| GBP/CAD | 2.7 | 2.71 | 4.34 | 1 | 40.1 |

| GBP/CHF | 1.85 | 1.93 | 2.79 | 0.6 | 46.1 |

| GBP/JPY | 2.09 | 2.12 | 2.87 | 0.4 | 37.2 |

| GBP/NZD | 4.1 | 4.55 | 5.08 | 1.3 | 59.9 |

| GBP/USD | 0.85 | 0.92 | 1.18 | 0.1 | 12.4 |

| HKD/JPY | 17.8 | 18.09 | 19.17 | 2.2 | 264.1 |

| NZD/CAD | 2.16 | 2.29 | 2.77 | 1.2 | 48.4 |

| NZD/CHF | 1.57 | 1.71 | 2.24 | 0.9 | 34.8 |

| NZD/JPY | 0.93 | 1.07 | 1.37 | 0.4 | 34.7 |

| NZD/USD | 1.09 | 1.22 | 1.29 | 0.4 | 15.5 |

| SGD/JPY | 2.93 | 3.15 | 3.59 | 0.7 | 39.6 |

| TRY/JPY | 0.34 | 0.88 | 5.15 | 0.1 | 35.4 |

| USD/CAD | 1.18 | 1.19 | 1.47 | 0.4 | 11.9 |

| USD/CHF | 0.95 | 1.09 | 1.33 | 0.4 | 14 |

| USD/CNH | 4.57 | 5.46 | 5.98 | 0.5 | 73.5 |

| USD/CZK | 12.24 | 14.6 | 15.65 | 4.5 | 197.8 |

| USD/DKK | 4.72 | 4.73 | 5.96 | 1.2 | 48.6 |

| USD/HKD | 3.71 | 3.86 | 4.12 | 1.5 | 24.4 |

| USD/HUF | 17.42 | 18.79 | 33.16 | 4.6 | 231.1 |

| USD/ILS | 38.79 | 66.56 | 40.39 | 10.5 | 258.3 |

| USD/JPY | 0.57 | 0.58 | 0.76 | 0.1 | 13.7 |

| USD/MXN | 51.01 | 49.75 | 61.83 | 11.8 | 348.8 |

| USD/NOK | 28.41 | 41.64 | 65.98 | 4.7 | 713.6 |

| USD/PLN | 13.72 | 16.34 | 18.56 | 5.1 | 246.9 |

| USD/RON | 17.94 | 21.6 | 26.77 | 13.6 | 210.6 |

| USD/SEK | 24.92 | 34.11 | 68.9 | 9 | 310.9 |

| USD/SGD | 1.45 | 2.14 | 1.61 | 0.7 | 23.2 |

| USD/THB | 13.26 | 14.51 | 13.39 | 9.1 | 83 |

| USD/TRY | 92.23 | 230.27 | 75.18 | 36.1 | 740.7 |

| USD/ZAR | 62.48 | 82.01 | 129.97 | 17.4 | 1430 |

| XAG/USD | 3 | 3 | 3 | 1.7 | 10.8 |

| XAU/USD | 33.28 | 33.23 | 35.01 | 14.9 | 170.4 |

| ZAR/JPY | 0.4 | 0.49 | 1 | 0.1 | 9.8 |

The Table provides an overview of the spreads for different currency pairs or commodities (instruments) offered by Dukascopy for three geographical areas: Europe, the US, and Asia. Spreads are the difference between a particular instrument’s buy and sell price, representing the cost of trading with a broker.

The ‘Min’ and ‘Max’ columns represent each instrument’s minimum and maximum observed spread. Spreads can fluctuate due to market volatility, liquidity, and time of day. For example, the AUD/CAD pair has a minimum spread of 1.10 and a maximum of 20.20.

Let’s take a closer look at some specific cases:

- EUR/USD: One of the most traded currency pairs worldwide. In Europe, the spread for EUR/USD is as low as 0.27 and can go up to 0.30 in the US and 0.31 in Asia. Its minimum Dukascopy’served spread is as with a maximum of 6.90.

- AUD/USD: This is another frequently traded pair. The spreads for AUD/USD vary from 1.05 in Europe, 1.09 in the US, to 1.21 in Asia. Its minimum observed spread is 0.40, and the maximum is 16.80.

- XAU/USD (Gold): For trading gold, the spreads are 33.28 in Europe, 33.23 in the US, and can go up to 35.01 in Asia. The minimum observed spread is 14.90, and the maximum is 170.40.

- USD/JPY: This pair has spreads of 0.57 in Europe, 0.58 in the US, and 0.76 in Asia. The minimum observed spread is as low as 0.10, and the maximum is 13.70.

How large is Dukascopy compared to other forex brokers?

Dukascopy is a moderate and large forex broker with more than 40.1 million CHF in operating income, where traders annually deposit around 115 million dollars (approximately 105.3 million CHF). The Dukascopy growth rate is high, and the broker’s income is higher yearly.

Is Dukascopy safe?

Yes, Dukascopy is a safe broker that uses the most advanced technology available for fast execution. The same goes for transaction control and cybersecurity strategy that prevents unauthorized access to organizational assets, including trading computers, networks, and data. Dukascopy has an excellent reputation and support, so all traders feel safe.

Visit Dukascopy Broker. Get Swiss Account.

Dukascopy platform

Dukascopy offers three primary trading platforms and three mobile traders. The broker has created its platform, which is now called JForex. Educational traders can use a web-based platform and Java. Mobile traders use mobile or handheld devices such as Apple and Android.

Dukascopy liquidity providers include Commerzbank, Nomura, Currenex, Deutsche Bank, JP Morgan, UBS, Goldman Sachs, Hotspot, and Morgan Stanley. All trades are usually executed in milliseconds.

Dukascopy is a Swiss broker that provides access to global financial markets, including forex, CFDs, stocks, and commodities. The company has developed two robust trading platforms: JForex and MT4.

JForex is Dukascopy’s flagship platform, and it provides traders with an extensive range of tools for swift and efficient trading execution. It offers advanced charting and technical analysis tools such as customizable indicators, multiple timeframes, backtesting capabilities, and integrated pattern recognition systems. JForex also allows the integration of automated trading strategies developed in Java language. This platform is available for desktop, web, or mobile applications on Windows, Mac OS X, or Linux operating systems.

The Dukascopy Bank platform, which institutional investors primarily use, includes valuable features like a currency market depth view, low latency data, and a feed for foreign exchange quotes with over the minimum number of currency pairs available.

The platform also offers a variety of order types, including market orders, limit orders, and stop orders, as well as their derivatives like iceberg orders (market + limit), conditional orders like OCO (one cancels other), etc. Plus, there are features to track your positions using the single account statement functionality.

The two platforms are linked via an intra-account transfer system that allows funds to move between them quickly and securely without any auditioning charges; this makes it easy to use both platforms simultaneously. All customer and merchant funds are held in segregated accounts at major financial institutions such as Credit Suisse or UBS in Switzerland, so clients can rest assured their money is always secure.

Additionally, Dukascopy provides a comprehensive range of educational addresses with plenty of tutorials on using the platforms effectively, informative videos about market analysis techniques, and demo accounts so you can test out strategies before investing real money in them safely. They have also recently launched an online community where traders can connect, helping foster further collaboration within the community.

Dukascopy Platforms Advantages

It is typical for Dukascopy EU to develop several freebies from the mother firm. The ECN trading via the Swiss Forex Marketplace handles transparency, seamless and secure operation, and defrayment to and from the trading account. They conduct webinars, seminars, and even trading and FX-related contests. There are some dissimilarities between the two firms.

Moreover, the Dukascopy Bank, mandated by the Swiss FINMA for both banks and securities dealers, practices consolidated supervision over the Group entities to ensure enough liquidity, including the risk and capital involvement at a group level appropriate. The Group also had a Japan-based unit in Alpari, Japan, in 2015.

Regarding trading conditions, the deposit for a live account opening with Dukacopy Bank for Swiss and Chinese residents is 1000 USD or equivalent. Min. deposit to open an account with Dukascopy Europe is 100 USD or equivalent (Dukascopy minimum deposit is $100). That is a minimum margin for the FX market. To compare, the clients of the Dukascopy Bank need $5,000 to get started.

When you compare the maximum allowed leverage, the Swissquote EU and Dukascopy Europe will have an opportunity to have leverage higher than 1:100.

Regarding trading platforms, the company offers you a lucrative trading platform, which is the JForex. That will give you enough access to the Swiss FX marketplace. That is available for mobile phones and PCs, too. The platform is specially made for traders who are fascinated by automated trading or are developing and testing trading techniques based on the programming language of JAVA. The platform offers some tools and features. That includes the following.

Dukascopy Forex Broker provides an ideal trading platform with various beneficial features to enhance your trading experience. Here are some of the advantages of using Dukascopy trading platforms:

- Extensive Range of Indicators and Chart Studies: With over 250 indicators and chart studies available, traders have many tools to analyze markets in depth. This allows for a greater understanding of market trends, making it easier to make informed trading decisions.

- Incorporation of a News and Economic Events Calendar: Staying updated with financial news and important economic events can significantly influence your trading decisions. Dukascopy includes a calendar of such events in its platform, allowing traders to easily keep track of significant developments and manage their strategies accordingly.

- Automated Trading Capabilities: Dukascopy offers automated trading on the user’s machine or the strategy server. This allows for hands-off trading based on predefined strategies, allowing traders to pursue other interests while their trades are executed automatically.

- Automated Trading Historical Tester: Dukascopy’s trading platforms are equipped with an automated historical trading test. This feature allows users to backtest their trading strategies against historical data, providing valuable insights into their effectiveness and helping to fine-tune strategies before live trading.

- Variety of Charts: Dukascopy provides unique charting options, including figure charts, line breaker charts, range bars, and point charts. This wide variety allows traders to choose the chart type that best suits their trading style and strategy, enhancing their ability to read and interpret market movements.

- MQL4 Expert Advisor Converter: For those accustomed to the MetaTrader 4 (MT4) environment, Dukascopy offers an MQL4 expert advisor that can convert to JAVA. This is particularly advantageous as it allows traders to use their existing MT4 expert advisors within the Dukascopy trading environment, enhancing the convenience and efficiency of their trading activities.

Visit Dukascopy Broker. Get Swiss Account.

Dukascopy Advantages

- Dukascopy provides clients with up-to-the-minute quotes, enabling informed trading decisions.

- Clients can use algorithmic bots for automated trading, giving them an edge in the fast-paced forex market.

- The safety of the client’s funds is ensured up to CHF 100,000, providing high financial security.

- Dukascopy offers multiple account currency options, including USD, EUR, GBP, CHF, and PLN, providing flexibility to clients worldwide.

- With a minimum deposit requirement of just $100, Dukascopy makes trading accessible to many investors.

- The broker provides leverage up to 1:200, potentially enabling clients to maximize their trading gains.

- Dukascopy offers low spreads starting from as low as 0.1 pip, which can enhance profitability for traders.

- A broad range of trading instruments is available, including currency pairs, indices, cryptocurrencies, stocks, metals, and binary options, providing ample opportunities for diversification.

- Dukascopy implements a 100% margin call and a 200% stop-out, which can help protect clients from significant losses.

- Dukascopy’s experience and accolades, including “Best Broker for Crypto Trading” in 2022, “Broker ECN Broker for Beginners” in 2021, and “Best Bank Broker” in 2020, highlight its credibility and commitment to excellence.

- The company provides high-quality online and mobile trading platforms that offer clients flexibility and convenience in managing their investments.

- Dukascopy offers PAMM accounts and supports various forms of order execution, including market execution.

- The company’s commitment to client education and support is evident in its multilingual customer service, available 24/6.

Does Dukascopy accept US clients? However, Dukascopy Broker does third-party S clients. Dukascopy accepts all worldwide clients except Iran, Cuba, North Korea, Japan, Myanmar, Sudan, South Sudan, Syria, and the USA.

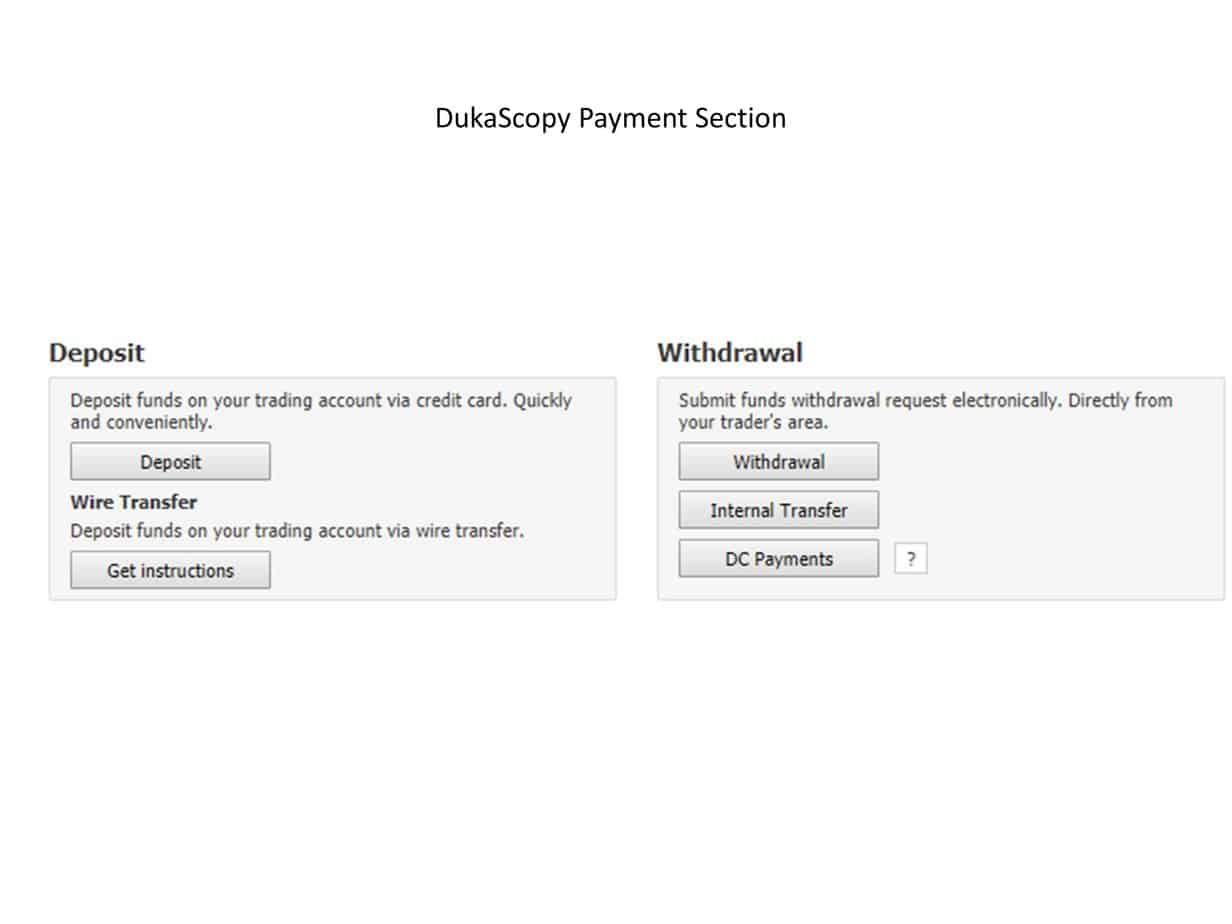

Dukascopy payments

Dukascopy Payments (deposit and withdrawal) are credit cards, bank transfers, Skrill, Neteller, Bitcoin, and Ethereum. Bitcoin or Ethereum do not generate a deposit fee, while payment cards such as credit cards and debit cards generate a 1.2% fee for EUR, GBP, and CHF, 1.5% for transactions in NOK, CZK, PLN, or SEK, 2% for USD transactions, and 2.3% for transactions in RUB, JPY, and CAD.

How do you withdraw money from Dukascopy?

To withdraw money from Dukascopy, you need to do the following steps:

- Log in to the Dukascopy website and access the live trading platform.

- Open the My Account report.

- Go to Account> My Account (Desktop platform) or go to More > Account > Account settings (Mobile Platforms)

- Choose the Deposit and Withdrawal sections.

- Choose withdrawal options such as bank wire, credit card, Skrill, or any other third-party method.

- Set the amount and make a withdrawal.

Conclusion

Regarding the Dukascopy EU trading accounts, customer support is provided through phone, Skype, and email. Moreover, it gives live trading support through telephone 24/5. They offer a minimum account, which is $100. The funds that may be used are a bank wire transfer and others. Their account currencies come in different varieties, like the Japanese yen, AUD, Canadian dollar, NZD, RUB, etc. However, no withdrawal commissions are being offered. Furthermore, the personal account manager is multilingual, so there will be no language barrier if you need help.

The traders may also trade around 25M USD in just a particular click of your fingers. They also give personal trading conditions to ordinary retail FX traders. That means the minimum account size is not more than $100; the Account’s fun is available in the simplest forms, and opening an account is fast and straightforward.

The Dukascopy EU will not assist the famous MT4 platform as much as the other brokers. However, customers can use third-party providers to bridge the MT4. The broker also offers the API combination probability for trading professionals. These people will be rendering around $100,000.

The company’s API is based on the FIX 4.4 protocol. It will get a real-time data feed, submit orders, set, improve, and cancel them, and receive automated notifications for trading activities. Regarding payment, users can deposit and withdraw from their accounts through the bank; debit cards, credit cards, and bank transfers are honored. Moreover, Dukascopy Europe offers an e-wallet—Dukascopy Payments.

In conclusion, Dukascopy provides a robust offering of trading platforms tailor-made for both retail and institutional clients alike, allowing them to access deep liquidity pools across major currencies while still having the security of having their customer funds held in segregated accounts at major financial institutions in Switzerland meaning they can be sure their money will be safe at all times no matter what happens in the markets ensuring peace of mind when entering into any trades.

![]()

Visit Dukascopy Broker. Get Swiss Account.

Please see other top brokers: