Table of Contents

Risk management is one of the most critical aspects of trading, directly influencing a trader’s consistency and profitability. This article will explore the concept of dynamic risk management in trading. This approach involves adjusting risk levels based on the quality of trade setups, market conditions, and the trader’s current performance. This adaptive strategy allows traders to make informed decisions on position sizing and risk exposure, ultimately enhancing their ability to navigate market volatility.

Please check my video about risk management:

What is Dynamic Risk Management?

Dynamic risk management refers to the flexible adjustment of risk based on the perceived quality of a trading setup. Rather than applying a static risk percentage across all trades, traders categorize their trades into different levels, such as A setups, B setups, and C setups, each corresponding to varying confidence levels and market alignment.

- A Setup: A high-probability trade where multiple timeframes (e.g., 30-minute, 1-hour, 4-hour charts) align in the same direction. Additional factors like favorable news or market sentiment further support the trade. In this scenario, traders can afford to take on a higher risk, typically increasing their position size or risking a higher percentage of their account.

- B Setup: A trade with potential but lacks complete alignment across all timeframes or market conditions. For example, a 30-minute chart may show a trend reversal, but the 4-hour chart remains undecided or bearish. The trader would reduce risk using a smaller position size in such cases.

- C Setup: Trades with less conviction are usually avoided unless specific conditions present a compelling reason to enter. These setups might have conflicting signals across different timeframes and could lead to smaller profits or higher losses. Traders typically avoid these or risk an even smaller fraction of their capital.

Dynamic Risk Adjustment in Practice

- Identifying Trade Setups: The first step in dynamic risk management is categorizing each trade setup. By examining the alignment across multiple timeframes, traders can determine the strength of the trade. For instance, a trader might look at the 30-minute, 1-hour, and 4-hour charts. If all charts show a clear uptrend with favorable pullbacks, the trade qualifies as an A setup, justifying a higher risk.

- Adjusting Position Size Based on Setup Type:

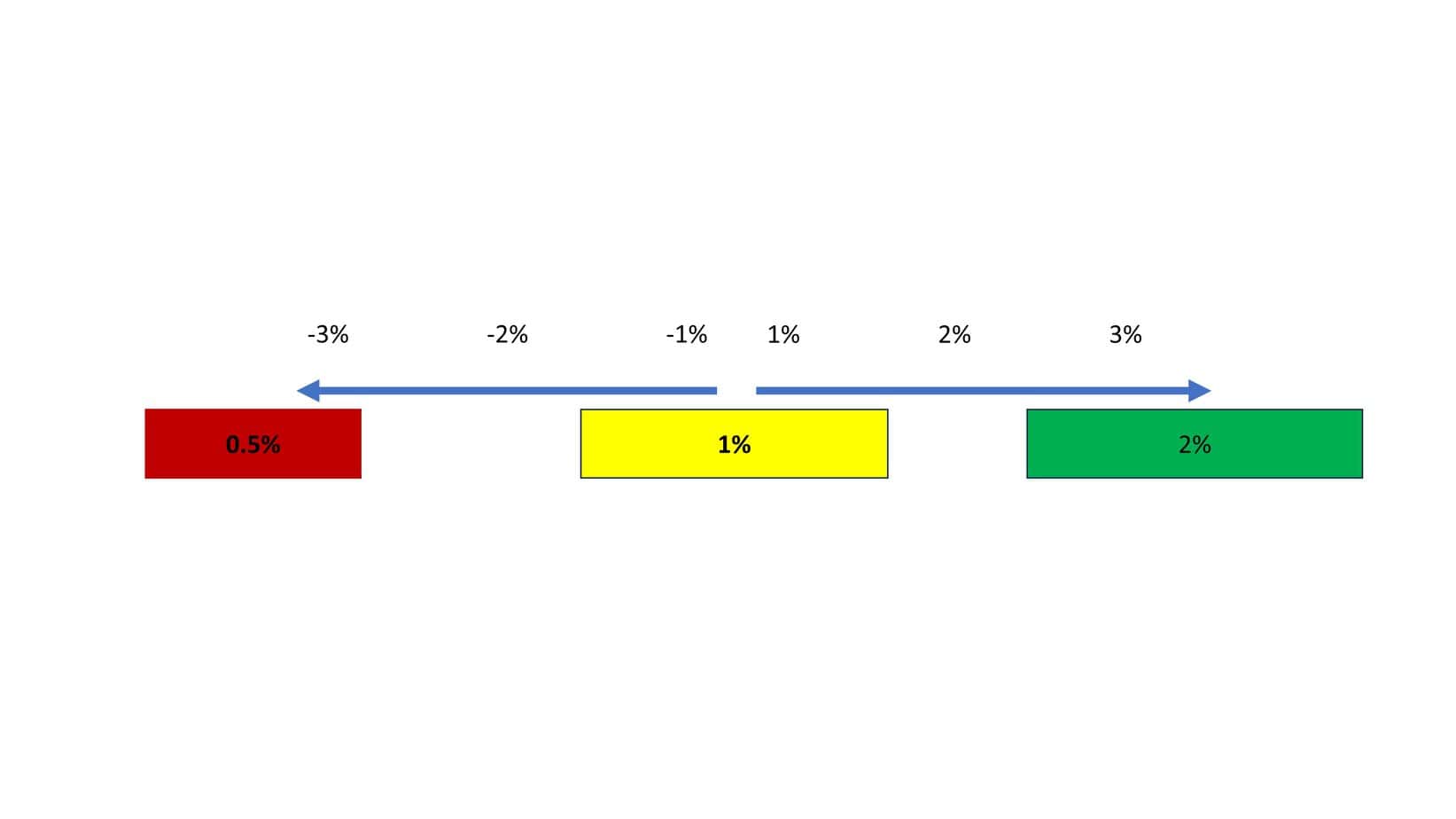

- A Setup: When a high-probability opportunity arises, traders might risk up to 2% of their account on the trade. For example, if a trader has a $100,000 account and sees a strong trend alignment across multiple timeframes, they could enter the trade with a 2% risk, meaning a potential $2,000 loss if the trade fails.

- B Setup: With less conviction in the trade, the trader could risk only 1% or less. For instance, if a trader spots a trade that only aligns on the 30-minute chart but shows mixed signals on the higher timeframes, they may enter with a smaller position size, limiting risk to $1,000 (1%) or even $500 (0.5%).

- C Setup: These trades with lower confidence or contradicting signals would warrant minimal risk—0.25% or less. However, experienced traders often avoid these setups altogether.

The Role of Portfolio Performance in Risk Adjustment

Dynamic risk management involves adjusting risk based on trade setups and considering portfolio performance. As a trader, it’s essential to raise or reduce risk depending on your account’s status—whether you’re in profit or facing a drawdown.

- Increasing Risk After Profits: If you’ve built up profits and are in a strong position, you may feel more comfortable increasing your risk for A setups. For instance, after making a 3% profit on your account, you can afford to take more risk on a high-probability trade. However, the risk increase should still be conservative, not exceeding 2% of the total account value to prevent over-exposure.

- Reducing Risk During Drawdowns: It’s crucial to reduce risk during losing streaks or periods of drawdown (e.g. when your account is down 3% or more). As difficult as this may be psychologically, trading smaller position sizes during a drawdown helps preserve capital. Risking 0.5% or less per trade during such times can allow you to recover steadily without further damage to your account.It’s essential to remember that even an A setup can fail during a drawdown phase. By maintaining discipline and reducing risk, you avoid compounding your losses and increase your chances of recovery.

Overcoming Psychological Barriers in Risk Management

One of the most challenging aspects of dynamic risk management is psychological discipline. Traders often struggle to reduce their position size in a drawdown to recover their losses quickly. This emotional reaction can be dangerous and often leads to further losses. To avoid this, traders should:

- View risk reduction as a strategic move: Imagine taking a “vacation” from risk and trading with reduced size for some time. This mindset shift can help alleviate the emotional resistance to scaling down risk.

- Stick to your predefined risk limits: Even when an excellent A setup appears, if your account is in a drawdown, it’s crucial to follow your risk management rules. Resist the temptation to over-leverage.

Dynamic Risk Management in Prop Trading

Dynamic risk management takes a slightly different approach for traders working with prop trading firms. Prop firms often impose strict drawdown limits, such as a maximum 10% drawdown, to protect both the trader and the firm. As a result, the standard risk for each trade in prop trading is usually limited to 0.5% per trade. This lower risk helps traders avoid breaching their account limits even after a series of losing trades.

In some cases, if a trader is up 2-3% on their prop account, they may be allowed to increase their risk on an A setup to 1%. However, even in this scenario, the risk increase is conservative, preventing large drawdowns that could threaten the account.

Conclusion

Dynamic risk management is a powerful tool for traders aiming for long-term success. By adjusting risk based on trade setups, market conditions, and portfolio performance, traders can enhance consistency while protecting their capital from unnecessary exposure. Whether trading your account or managing a prop firm’s capital, the key is to remain disciplined, follow the plan, and adapt risk according to the market’s signals. The ability to dynamically adjust your risk can mean the difference between surviving harsh market conditions and thriving in periods of market alignment.