Table of Contents

EasyMarkets has been a leading online forex broker serving customers globally since 2001. Established as one of the earliest pioneers in the online trading industry, the company’s longevity in the market is a testament to its robust reliability, transparency, and innovative trading solutions.

As a broker, EasyMarkets provides clients access to various financial markets, including forex, commodities, indices, metals, and cryptocurrencies. It offers a variety of trading tools designed to cater to both beginner and experienced traders, including a unique feature called dealCancellation that allows traders to undo a losing trade within a specific timeframe for a small fee.

EasyMarkets is committed to upholding the highest standards of regulation and compliance. It is licensed and regulated in several jurisdictions, including by the Cyprus Securities and Exchange Commission (CySEC) in Europe and the Australian Securities and Investments Commission (ASIC) in Australia.

One of the company’s significant strengths is its customer service and education commitment. EasyMarkets provides a wealth of learning resources to help traders develop their knowledge and skills, including webinars, eBooks, videos, and articles on various trading topics.

With a strong emphasis on simplicity and transparency, EasyMarkets aims to make trading as easy and accessible as possible for its users. It offers multiple trading platforms, including its proprietary platform and the popular MetaTrader 4.

Over the past two decades, EasyMarkets has proven its dedication to providing a secure, user-friendly, and versatile trading environment. Its solid reputation, innovative trading tools, and comprehensive educational resources make it a preferred choice for many traders worldwide.

VISIT EASYMARKETSEasyMarkets Facts

- Account Currency Options: Offers a wide range of account currency options, including EUR, CAD, CZK, JPY, NZD, USD, SGD, CHF, GBP, MXN, AUD, PLN, TRY, CNY, HKD, NOK, SEK, and ZAR.

- Minimum Deposit: Allows for a low minimum deposit of just $25.

- Leverage: Provides high leverage of up to 1:500.

- Spread Features fixed spreads starting from USD 0.03.

- Trading Instruments: This company offers various trading instruments, such as currency pairs, precious metals, indices, cryptocurrencies, stocks, and commodities.

- Margin Call / Stop Out: Margin Call is 50%, and Stop Out is 30%.

- Diverse Funding Options: The bank offers numerous ways to deposit and withdraw funds, including transfers to personal cards or electronic wallets.

- Additional Trading Tools: This section provides various tools for in-depth market analysis, risk management, a financial calendar, and updated market news.

- Multiple Trading Platforms: Offers the flexibility to trade from several platforms, including MetaTrader 4, the broker’s proprietary platform, and mobile devices.

- Education Resources: Provides educational materials and courses with tests and issues a certificate upon successful course completion.

- Quick Registration: This enables quick and easy registration and account opening, taking only three minutes.

EasyMarkets Regulation

EasyMarkets operates under several different regulatory environments, ensuring their clients’ funds are handled with the highest levels of security and transparency. Here’s a detailed look at the regulations:

- Cyprus Securities & Exchange Commission (CySEC): EasyMarkets operates in Europe under its subsidiary, Easy Forex Trading Ltd. CySEC licenses it under license number 079/07. The CySEC regulation is widely recognized as reliable and is harmonized with EU financial regulations, as Cyprus is a member of the European Union. This license also allows the broker to offer services throughout the European Union via the MiFID directive.

- Australia Securities and Investments Commission (ASIC): In Australia, EasyMarkets operates under its subsidiary Easy Markets Pty Ltd, which holds an AFS license number 246566 from ASIC. ASIC is known for its stringent standards and strict regulatory guidelines, making it one of the most reliable regulatory bodies in the industry.

- Financial Services Authority of Seychelles (FSA): EF Worldwide Ltd, another subsidiary of EasyMarkets, is licensed by the FSA of Seychelles under license number SD056. Seychelles is a growing offshore financial hub, and its FSA ensures that businesses operating in its jurisdiction adhere to international best practices.

- Financial Services Commission of the British Virgin Islands (FSC): EF Worldwide Ltd is also licensed by the FSC under license number SIBA/L/20/1135. The FSC supervises and regulates all financial services businesses within and from the BVI.

These various regulatory bodies provide a comprehensive legal framework under which EasyMarkets operates, assuring clients that the broker adheres to high ethical standards, that all transactions are transparent, and that customers’ funds are securely held.

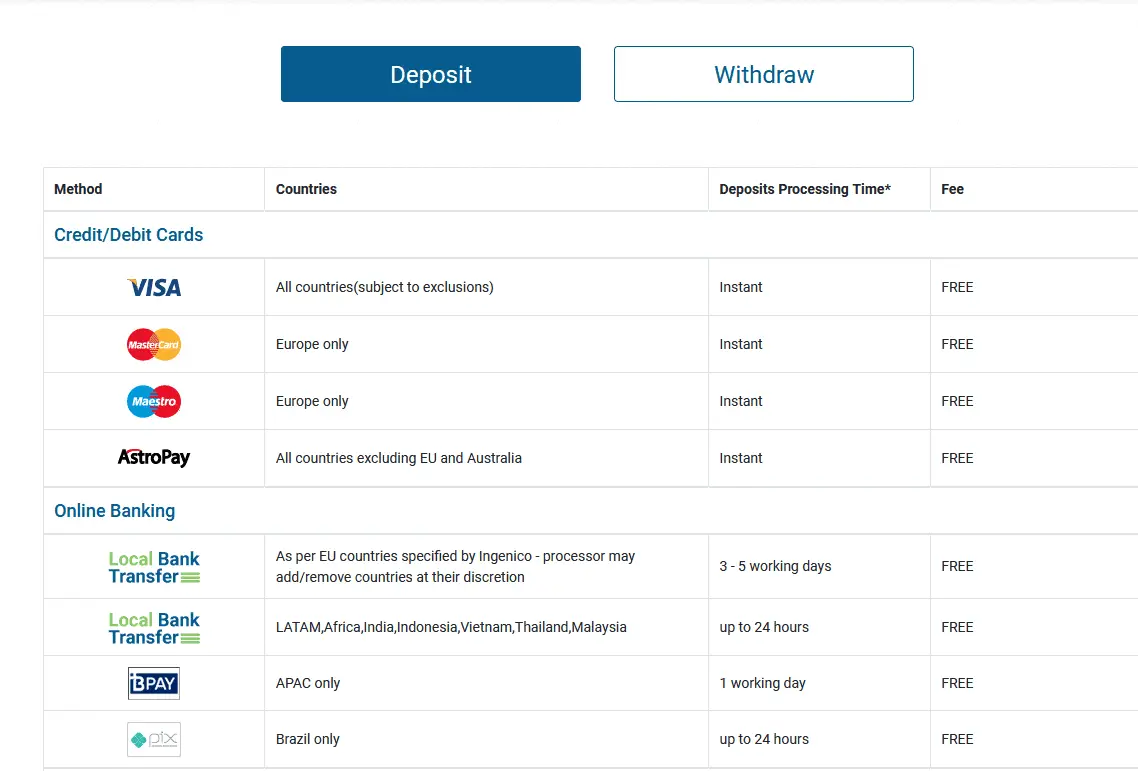

EasyMarkets Payment Methods

EasyMarkets offers diverse payment methods and caters to clients worldwide. They aim to ensure that depositing funds into your trading account is as straightforward and convenient as possible.

Credit/Debit Cards:

- Visa: This option is available for all countries, subject to some exclusions. The deposit processing time is instant, and it is free of charge.

- MasterCard: This is only available for clients within Europe. Deposits are processed instantly without any fees.

- Maestro: This payment method is also exclusive to clients in Europe. It offers instant deposit processing at no cost.

- Astro Pay Card: This card is available in all countries, excluding the EU and Australia. Deposits are processed instantly and are free of charge.

Online Banking:

- Local Bank Transfer: For certain EU countries specified by Ingenico, the processing time for bank transfer deposits is between 3 to 5 working days, without any fees. The processor may add/remove countries at their discretion.

- Local Bank Transfer: For Latin America, Africa, India, Indonesia, Vietnam, Thailand, and Malaysia, the processing time is up to 24 hours and is free of charge.

- Local Bank Transfer (APAC only): The processing time is one working day for APAC countries with no fees.

- QR Pix: Exclusive to Brazil, the processing time is up to 24 hours and accessible.

eWallet:

- Neteller & Skrill: Instant processing time for deposits is free of charge. Availability is subject to a list of non-serviced countries.

- Fasapay: This option is available only in Indonesia. Processing time is one working day, and it is free of charge.

- Local Deposit Egypt: This option is available only in Egypt. Once payment is made to the Local Exchanger, the transaction takes one working day to process. No fees are applied.

- Sticpay & Webmoney: These options are available for all countries except Europe and APAC. They both have a one-day processing time and are free of charge.

- Bitwallet: Exclusive to Japan, with a one working day processing time, free of charge.

- Perfect Money is available for all countries, excluding Europe, Australia, and Singapore. Processing time is one working day, and there are no fees.

Bank Wire Transfer:

- China Union Pay: This option is exclusive to China. It has a 1-2 working day processing time and no fees.

EasyMarkets Platforms

EasyMarkets provides a range of user-friendly trading platforms catering to beginners and experienced traders. Each platform has unique features designed to enhance your trading experience.

1. easyMarkets App

The easyMarkets App brings the markets to your fingertips. Designed to be intuitive, the app integrates trading functionalities and market information within the same interface. Key features include:

- Availability on Android & iOS.

- Integrated analytical tools for market assessment.

- User-friendly interface for easy navigation.

- Unique deal cancellation feature, Free Guaranteed Stop Loss, and Take Profit for risk management.

- You can access all features of the easyMarkets web platform from your mobile device.

2. easyMarkets Web Platform

The easyMarkets Web Platform ensures you can trade from any internet-enabled device, providing versatility and convenience. Its unique offerings include:

- Trade from any internet-enabled device.

- Unique trading tools include dealCancellation, Freeze Rate, Free Guaranteed Stop Loss, and Take Profit.

- Access to a variety of analytical tools for market analysis.

- User-friendly interface for easy navigation.

- Access to over 275+ trading instruments.

- Zero slippage, ensuring your trades are executed at the price you see.

3. easyMarkets TradingView

EasyMarkets has integrated with TradingView, allowing traders to use their easyMarkets accounts on this innovative platform, which is known for its advanced charting tools and social trading component. Its unique features include:

- Easily accessible market analysis.

- Advanced charting tools for technical analysis.

- Trading social networks for sharing trading ideas, trades, and strategies.

- Free Guaranteed Stop Loss for risk management.

- Negative Balance Protection ensures you never lose more than you have deposited.

4. easyMarkets MT4

MT4, one of the most popular trading platforms globally, is also offered by easyMarkets. This platform is known for its advanced features and customizability. Features on easyMarkets MT4 include:

- Access to easyMarkets’ excellent trading conditions.

- Negative Balance Protection.

- Access to Trading Central news and analysis.

- It is highly customizable, allowing experienced clients to tailor the platform to their trading needs.

5. easyMarkets MT5

The MT5 platform offered by easyMarkets is an upgraded version of MT4 with faster processing speeds, more advanced chart indicators, and a built-in economic calendar. Key advantages include:

- High customizability to suit individual trading preferences.

- Variable Spreads from as low as 0.5 pips.

- Up to 1:2000 leverage (excluding EU and AU Retail Clients).

- Negative Balance Protection.

- Permits the use of Expert Advisors for automated trading strategies.

In conclusion, whether you prefer to trade on your desktop, smartphone, or within a social trading network, easyMarkets has a solution to meet your needs and ensure a seamless and efficient trading experience.

VISIT EASYMARKETSEasyMarkets Spreads and Leverage

EasyMarkets provides competitive spreads and leverages across different platforms and instruments. Spreads can be either fixed or variable, depending on the platform used, and the leverage varies as well, depending on the trading instrument.

Below is a summary of the leverage and spreads for some popular currency pairs on different easyMarkets platforms:

1. EUR/USD

- Fixed Spreads: 0.8 (easyMarkets Web/App & TradingView), 0.7 (MT4)

- Variable Spreads: 0.5 (MT5)

- 1 Contract: 100,000 EUR

- Max Leverage: 1:200 (easyMarkets Web/App & TradingView), 1:400 (MT4), 1:2000 (MT5)

2. GBP/USD

- Fixed Spreads: 1.4 (easyMarkets Web/App & TradingView), 1.3 (MT4)

- Variable Spreads: 0.9 (MT5)

- 1 Contract: 100,000 GBP

- Max Leverage: 1:200 (easyMarkets Web/App & TradingView), 1:400 (MT4), 1:2000 (MT5)

3. USD/JPY

- Fixed Spreads: 1.5 (easyMarkets Web/App & TradingView), 1.2 (MT4)

- Variable Spreads: 1 (MT5)

- 1 Contract: 100,000 USD

- Max Leverage: 1:200 (easyMarkets Web/App & TradingView), 1:400 (MT4), 1:2000 (MT5)

4. AUD/USD

- Fixed Spreads: 1.5 (easyMarkets Web/App & TradingView), 1.2 (MT4)

- Variable Spreads: 0.9 (MT5)

- 1 Contract: 100,000 AUD

- Max Leverage: 1:125 (easyMarkets Web/App & TradingView), 1:400 (MT4), 1:2000 (MT5)

5. NZD/USD

- Fixed Spreads: 2.7 (easyMarkets Web/App & TradingView), 2.3 (MT4)

- Variable Spreads: 0.8 (MT5)

- 1 Contract: 100,000 NZD

- Max Leverage: 1:125 (easyMarkets Web/App & TradingView), 1:400 (MT4), 1:2000 (MT5)

The spreads and leverage offered by easyMarkets are competitive and cater to a range of trading strategies. Whether you’re a high-volume trader looking for low spreads or a newbie needing higher leverage, easyMarkets has covered you. Always remember that higher leverage can lead to substantial profits and significant losses. It’s essential to understand and manage your risk adequately.

Conclusion

EasyMarkets, one of the most established forex brokers, presents a comprehensive suite of features, offerings, and platforms catering to a broad range of traders, from novices to seasoned professionals.

Its extensive range of account currencies and a minimum deposit of just $25 provide an easy entry point for new forex traders. The broker offers competitive spreads and leverage of up to 1:2000, depending on the platform and trading instrument used, catering to different trading strategies.

One of EasyMarkets’ critical strengths lies in its robust regulation. With CySEC, ASIC, FSA, and FSC licenses, traders can feel secure knowing they’re dealing with a regulated broker that adheres to stringent international standards.

The numerous deposit and withdrawal options, including credit/debit cards, online banking, eWallet, and bank wire transfers, contribute to the broker’s accessibility and convenience. All transactions are processed promptly, ensuring traders can access their funds when needed.

EasyMarkets stands out for its diverse and user-friendly trading platforms – from its intuitive app and web platform to the popular MT4 and MT5 platforms and even TradingView for social trading. All platforms have various features and tools to support traders’ daily operations.

In conclusion, with strong regulatory oversight, diverse platform offerings, competitive trading conditions, and excellent customer support, EasyMarkets is a reliable and attractive option for traders looking for a trusted forex broker. As always, traders must do their due diligence to ensure the broker suits their trading needs and strategies.

VISIT EASYMARKETSPlease visit more of the best forex brokers: