Table of Contents

Whether a novice or an expert trader, you always need a reliable broker. The hunt for a broker does not end at their certifications and regulations; it goes beyond that. There are different types of brokers, and if you wish to trade successfully, you should choose yours wisely.

There are two types of accounts: an ECN account and a standard account. Your choice of broker largely depends on your choice of broker. ECN or Electronic Communication Network refers to the connection of computers. The definition might sound expansive and vague, but it is advantageous in Forex trading. Let’s read about both accounts to summarise ECN vs. standard accounts.

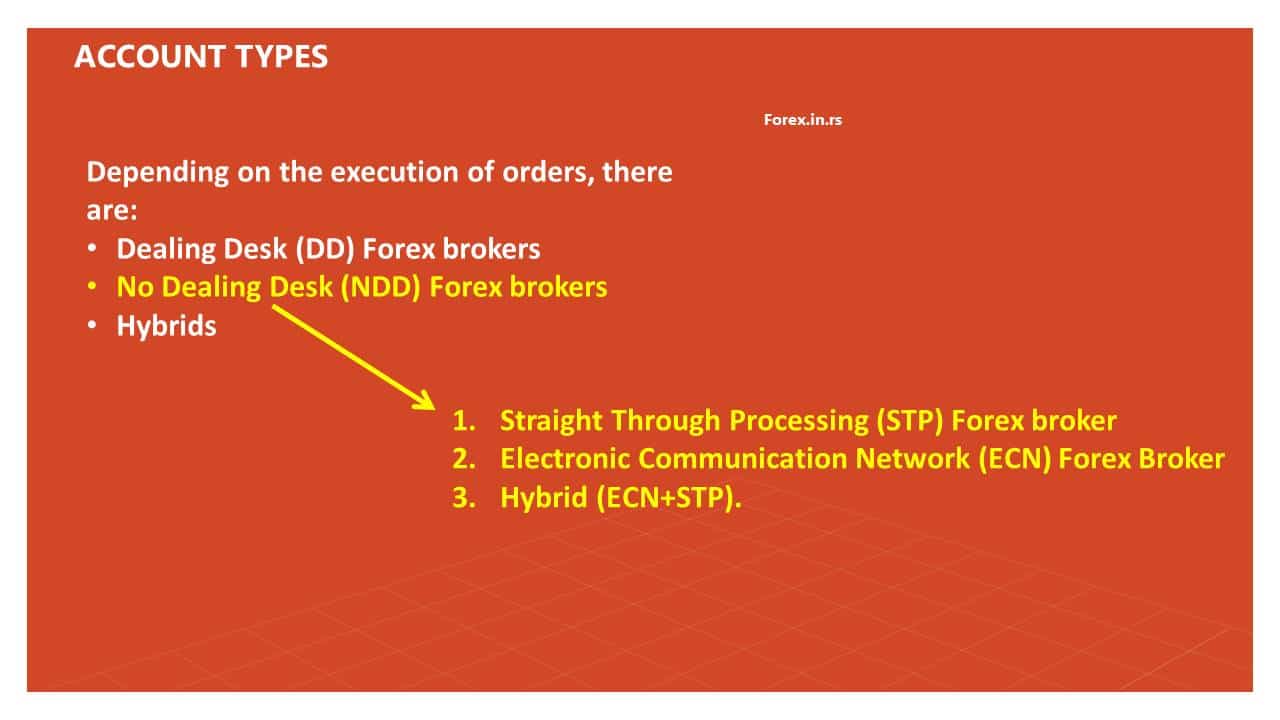

To understand account types based on order execution type, we need to understand four terms: dealing desk broker, non-dealing desk broker, ECN account, and STP account.

What is a Dealing desk broker?

Dealing desk or DD brokers represent legitimate brokers who make money through spreads, provide liquidity, and have “money makers” licenses. These brokers (the majority of brokers) usually can take the opposite side of traders’ trades. They can offer artificial quotes and orders that are filled on a discretionary basis.

Dealing desk brokers make money through the spread, the difference between a currency pair’s bid and ask price. They widen the spread to earn a profit on the trades they take on from their clients. This means that dealing desk brokers have a conflict of interest with their clients, as their profits come from their client’s losses.

Dealing desk brokers typically offer fixed spreads, meaning the spread does not change regardless of market conditions. This can be advantageous for traders who prefer knowing their trading costs upfront. Still, it can also be a disadvantage when market volatility increases, as the spread may be more comprehensive than in a variable spread environment.

Non-dealing desk forex broker

Non-dealing desk forex or NDD brokers use technologies without a dealing desk to directly connect clients and liquidity providers. NDD brokers do not sell any re-quotes when an order needs to be filled, and they can be STP or ECN brokers.

In contrast, non-dealing desk brokers, or ECN (Electronic Communication Network) brokers, typically route their clients’ trades directly to liquidity providers such as banks and financial institutions. This means that non-dealing desk brokers do not have conflicts of interest with their clients, and their profits are based on commission charges.

What is an ECN broker?

ECN brokers use Electronic communication networks (ECNs) and represent non-dealing desk brokers that act as intermediaries in transactions between individual clients and the market/interbank system. ECN brokers offer a direct connection between clients and liquidity providers, do not trade against their clients, and never take the other side of their customers’ trading positions.

What is an ECN account?

An ECN (Electronic Communications Network) account is an order-matching execution system that gives the trader direct access to liquidity providers. ECN accounts effectively as the significant liquidity source hub, designed to match buy and sell orders and connect traders’ accounts with forex networks such as banks, hedge funds, and all the major market players.

What is a Raw ECN account?

Raw ECN account is an ECN account with tight spreads, almost zero. As a result, with a RAW ECN account, traders can experience some of the lowest trading costs in the industry.

What is an STP broker?

The STP or Straight-Through Process broker is a non-dealing desk broker with an internal liquidity pool represented by different liquidity providers (banks, hedge funds, market players) competing for the best bid/ask spreads STP broker orders.

Many traders prefer ECN over standard accounts, as you get liquidity through networks. So what is the ECN account definition? In simple words, it is a computerized way of trading. So let’s see who benefits the most from it.

There is a difference between the asking price and the bid price, also known as the spread. The tighter the spread, the more beneficial it will be for the trader. Unfortunately, some trades are incredibly tight and seem to be reaching the breakeven point. The difference between the ask and sell price is the commission that your broker is entitled to.

Difference between ECN and STP broker

The difference between an ECN and an STP broker is that ECN routing differs from STP routing. ECN is a hub that gives the trader direct access to liquidity providers. At the same time, the STP broker has an internal liquidity pool where liquidity providers compete for the best bid/ask spreads for STP broker orders. ECN broker’s minimum lot size is one mini lot, and STP broker can offer a smaller lot size than ECN brokers.

This commission can vary a lot. It would help if you were careful when looking for a broker. Generally, this commission matches one-half of a pip. It is usually cheaper when you hold short-term positions and do several ins and outs. Many believe they can apply the same to long-term trade, but that seldom works. ECN trading is more beneficial for short-term traders. This is because short-term traders are more concerned with the cost of transactions, while long-term traders are not.

In this kind of account, liquidity may dry up occasionally. For example, let’s assume that Nonfarm Payroll Numbers have started coming out. In this case, many traders will prefer to leave the marketplace. Around this announcement, the general pip can rise from 0.2 pips for the pair to 15 on the network. This is a considerable margin and can drastically impact a trader’s or investor’s earnings.

If you are associated with a more extensive network broker, you can still hope for a tighter network as they try hard to keep tighter spreads. This is because they have more traders on their network, drastically increasing the spread size can negatively impact them.

ECN vs. Standard Account

The differences between ECN and Standard accounts are:

- ECN orders are executed using direct access to liquidity providers, while standard account orders are all filled internally within that broker’s customer pool.

- ECN account has a commission (pay a fixed commission for every trade you take), while a standard account does not have a commission (only spread)

- ECN account has a tighter spread than standard accounts.

- ECN accounts offer non-dealing brokers only while dealing desk (market-making ) brokers can offer standard accounts.

- ECN charges only commission for execution without placing any premium on the raw spread, while a standard account artificially charges a premium spread to profit from execution.

- DD brokers offer smoother price fluctuations in standard accounts than ECN brokerage accounts.

The main difference between a standard account and an ECN account is that it generally has a fixed spread. The broker assumes the role of the counterparty in any position. While it is not always apparent, this is the usual trend. In a standard account, you usually get spread for approximately two pips. It is more expensive than what is offered on an ECN account, but the number of transactions that standard account holders do is less than those of ECN account holders. Therefore, it is more beneficial for long-term position holders.

One of the most significant advantages of this account is that it keeps you updated with the latest news. This can save you a lot of time.

The downside of this account is that the spread is more comprehensive than what ECN brokers offer. Once again, holding a position for weeks and days will not alter your profits. However, short-term traders must keep the spread size in mind before they opt for a standard account.

The smoother price fluctuations offered by the Standard account of Dealing Desk brokers can make it easier for traders to place trades, as they can rely on more stable pricing. However, traders may miss out on tiny price fluctuations they want to trade. This is because dealing Desk brokers do not track every small price movement in the underlying market but instead offer prices based on their internal pricing algorithms.

In contrast, ECN brokers typically offer pricing based on the underlying market, meaning they track every slight price movement and provide spreads that reflect current market conditions. This can result in more variable pricing and broader spreads. Still, it also provides traders access to more price information and the ability to trade on tiny price movements.

Variation in Costs

The first thing you need to settle upon is the money you are willing to spend. It will help if you seek a broker that justifies the cost. Every trader needs a broker who is not only decent but reliable as well. There was a time when Forex trading was associated with the wild west. Following the advancement in technology in the past decade, Forex trading has become quite transparent, allowing you to decide what kind of account or broker will be better for you in a better light.

Look for a broker who offers you value for money. Most brokers are safe to work with, but you might need additional research if you are a scalper. Otherwise, the probability of encountering difficulties with an ECN or standard broker is slim.

FAQ:

Q1. What is the true difference between a standard and an ECN account?

As per the true ECN account meaning, the account is supposed to match the orders and accordingly execute them. Here, a trader is only charged an execution commission. There is no premium levied on the raw spread. Unfortunately, market-making brokers often manage standard accounts. As a result, they artificially charge you a premium spread.

Q2. What is a true ECN account?

In its true essence, an ECN account can be seen as a system of order-machine execution. Here, the account holder is charged a small commission on the trades executed rather than the raw spread.

Q3. What are STP and ECN?

Straight Through Processing or STP, brokers pass orders from the client directly to a liquidity provider, often a third party. Electronic Communications Network or ECN brokers match client orders for trade execution.

Q4. Which is the right choice, STP or ECN?

The answer to this question depends on the kind of trader that you are. ECN will be a better choice if you are a short-term trader, as the spreads are tighter. However, if you are a long-term trader, you can go for STP irrespective of the spread because the number of transactions you will make is less. Any experienced trader would be able to benefit from both accounts.

Q5. What is a MetaTrader4 ECN account?

MetaTrader 4, or MT4, is an online trading platform. ECN accounts offered on this platform are called MT4 ECN accounts.

Q6. What are the operations of ECN brokers?

ECN is also known as a non-dealing desk. An ECN broker will fill in your details, and the network will match a buying client with a corresponding selling client. The broker makes a profit by charging a commission on the conversion.

Q7. What do you mean by ECN pricing?

ECN pricing includes a lower spread, but a commission is charged on all trades and transactions. This commission can be generally avoided by working with non-ECN brokers, like STP brokers. However, working with an ECN broker will be cheaper if you are a prominent trader in a liquid market.

Conclusion

The main difference between ECN and Standard accounts is the commission, price fluctuation, and transaction processing. You can easily decide which option will be viable depending on your trading preferences. Remember that the additional cost is one of the main reasons some traders cannot make enough profits. Therefore, be mindful while finalizing a broker.