Table of Contents

What are E-mini Futures?

The E-mini or e-minis is an electronically traded futures contract that tracks the S&P 500 stock market index. It represents a fraction of the value of a corresponding standard futures contract.

E-mini is an electronically traded financial future on a commodity at a predetermined date and price. E-mini tips are rules put forward by a group of experts in trading to help those learning to trade. E-mini sessions have many opportunities; you can lose capital if you aren’t careful. To improve your trading, here are some of the vital steps that can help you during trading.

The E-mini Futures markets are enticing due to the tremendous opportunities they offer. These markets provide the potential for significant gains but also have unique hazards. Successfully navigating an E-mini session without eroding your capital can be challenging, especially for those new to the field. This article will provide insight into some of the best E-mini Futures trading strategies developed over a 12-year career.

This trading course derives its strategies from extensive experience and is designed to deliver optimum results. We will walk you through the top E-mini Futures strategies to help you confidently trade.

Understanding the E-mini S&P 500 Futures

The E-mini S&P 500 represents one-fifth of the value of the standard S&P futures contract, giving traders access to unique price patterns and inherent volatility. Like all markets governed by supply and demand, the E-mini follows the same fundamental principles applied to forex, stocks, and cryptocurrencies. These volatile price movements make trading challenging and exciting.

Top 5 E-mini Futures Trading Strategies

To succeed in trading E-mini Futures, having a strategy that gives you a competitive edge is essential. Here are the top five categories of strategies that have proven successful over time:

- Trend Trading

- Momentum Trading

- Rotational Trading

- Swing Trading

- Breakout Trading

Let’s dive deeper into how each of these strategies works.

1. Trend Trading

Trend trading is one of the most effective strategies for E-mini Futures. Traders typically sell or buy at Fibonacci retracement levels that align with the prevailing market trend. By buying during pullbacks within an uptrend, traders can enter trades at opportune moments.

Example:

- Stop Loss: Set under the 50% or 78% Fibonacci retracement level.

- Entry: Buy at the 38% or 62% Fibonacci retracement level.

- Profit Target: A risk-to-reward ratio 1:3 is ideal for a trend-following trade.

2. Momentum Trading

Momentum trading capitalizes on price movement strength. Traders believe prices moving in a particular direction will continue until the momentum weakens. Momentum trading can be particularly effective during periods of high volatility, allowing traders to profit from rapid price movements.

Example: An E-mini gold momentum trader might have anticipated a positive price run following a scheduled economic report in April. The idea is to buy during upward momentum and exit before the trend reverses.

3. Rotational Trading

Rotational trading is a medium-term strategy used in markets with no clear direction. The market may show compressed price action with no clear trends, but traders can capitalize on small fluctuations within a range.

Example:

- Entry: Sell within eight ticks of the session high or buy within eight ticks of the session low.

- Profit Target: Eight to ten ticks toward the point of control of the trading range.

- Stop Loss: Two ticks above the daily high (for a sell) or below the daily low (for a buy).

4. Swing Trading

Swing trading focuses on short-term gains by holding open positions for multiple trading sessions. Although swing trading involves higher risks due to more extensive margin requirements, careful planning can make it highly profitable.

Example: Hold positions for several consecutive sessions, aiming for smaller, consistent gains. This strategy can be effective for traders willing to accept greater exposure to the market for potentially higher rewards.

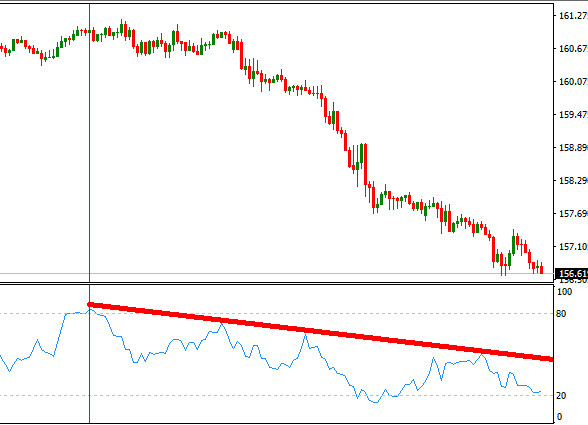

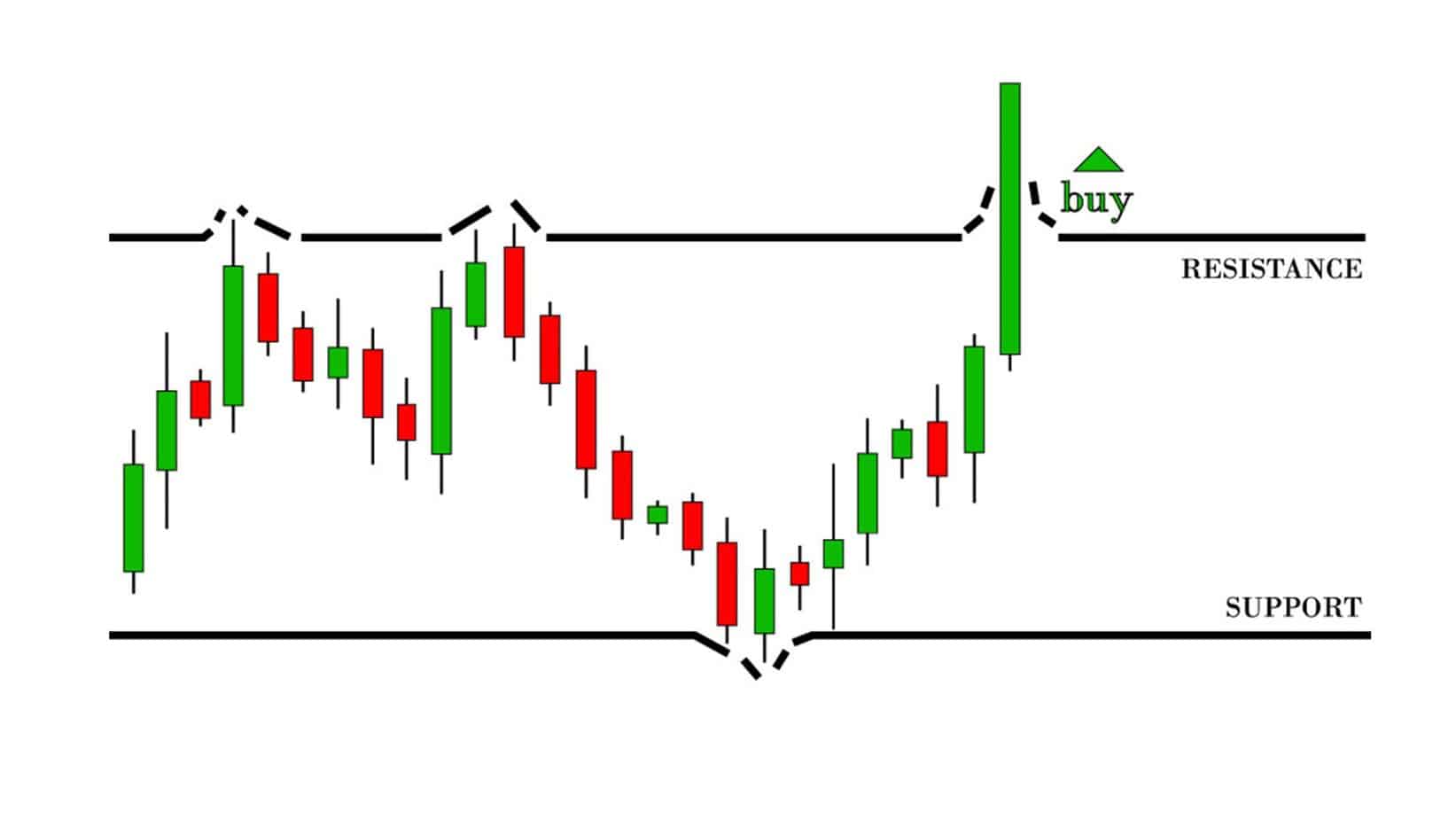

5. Breakout Trading

Breakout trading seeks to capitalize on sudden price movements when an asset’s price breaks through a defined support or resistance level. Breakouts often follow periods of price consolidation, and traders can take advantage of these sharp movements to enter trades early in the new trend.

Example:

- Entry: Buy after a breakout above resistance or sell after a break below support.

- Profit Target: Typically, traders aim for a large reward relative to the risk.

My Best E-mini Futures Trading Strategy: Monthly Breakout

One of my top-performing strategies involves monthly identifying breakouts, using technical and fundamental analysis.

Steps:

- Market Research: Analyze the E-mini S&P 500 using market analysis and analyst commentary.

- Technical Setup: Draw trend lines on the chart and identify critical support and resistance levels.

- Breakout Identification: I observed strong resistance at the 2944 price level, which the market couldn’t break for months. I entered a BUY trade when the price finally broke this level on September 4.

- Trade Management: I aim to hold positions for 1-4 weeks, with a target of 2-4 times the daily Average True Range (ATR). If significant fundamental news goes against my trade, I may exit early.

Benefits of Trading E-mini Futures

E-mini Futures provide traders with several advantages:

- 24-Hour Trading: You can trade E-mini contracts virtually around the clock.

- Deep Liquidity: The high liquidity helps keep trading costs low.

- Leverage: With E-mini contracts, you can control a significant market value with a small margin deposit.

Risk Management: Protecting Your Capital

While E-mini trading offers excellent opportunities, it comes with risks that need to be carefully managed:

- Stop Loss Discipline: Always use stop-loss orders to limit your downside.

- Risk-Reward Ratio: Stick to a 1:3 risk-reward ratio to ensure your winning trades outweigh your losses.

- 2% Rule: Never risk over 2% of your total account balance on a single trade.

Conclusion

E-mini Futures trading strategies offer various approaches, each with its strengths. Whether you prefer trend trading, momentum trading, or breakouts, developing a disciplined trading plan that fits your style is critical. Don’t forget to manage your risk carefully—without a solid risk management strategy, even the best plan can lead to significant losses.

By following these strategies and maintaining discipline, you can navigate the E-mini Futures markets and potentially achieve long-term success. Always remember that every strategy requires practice and patience to master, so take the time to refine your approach before committing large amounts of capital.