Table of Contents

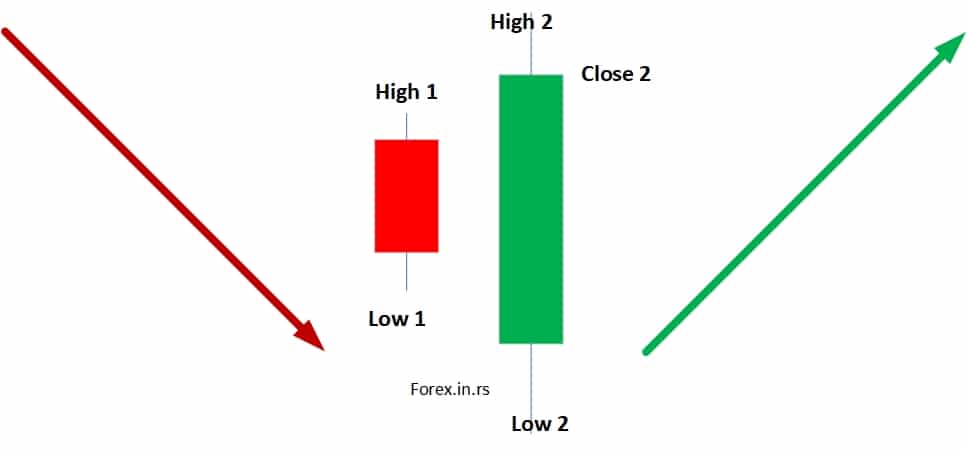

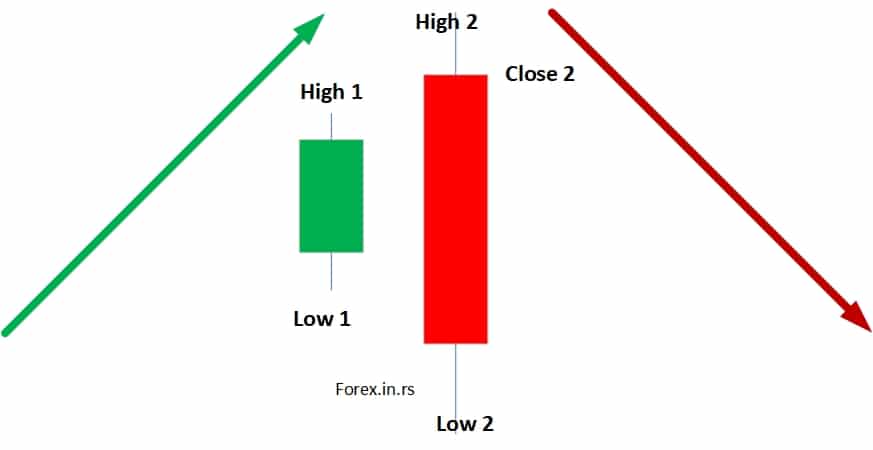

The engulfing pattern is a two-candle reversal setup that signals a power shift in market momentum. This can either indicate a bullish or bearish reversal:

- Bullish Engulfing: Occurs in a downtrend where a large green candle completely engulfs the previous red candle. This suggests buyers have overwhelmed sellers, potentially reversing the trend upward.

- Bearish Engulfing: Occurs in an uptrend where a large red candle engulfs the previous green candle. This indicates sellers have overpowered buyers, signaling a potential downward trend.

Structure of an Engulfing Candle

An engulfing pattern consists of two candles:

- First Candle (Smaller Candle)

- Second Candle (Engulfing Candle)

Key Criteria for an Engulfing Pattern:

- The body of the second candle must completely engulf the body of the first candle.

- The wicks (shadows) are not required to be engulfed, although full engulfment (including wicks) strengthens the signal.

- The second candle’s close price must confirm dominance in the new direction.

Bullish Engulfing Pattern

A bullish engulfing candle appears in a downtrend and signals a potential reversal to the upside.

Bullish Engulfing Criteria:

- The first candle is bearish (red candle) with a lower close than its open.

- The second candle is bullish (green candle) that:

- Opens at or below the first candle’s low.

- Closes above the first candle’s high.

- The second candle’s body must engulf the first candle’s body.

Key Price Conditions:

- First Candle Low: Acts as a possible support level.

- Second Candle Open: Ideally, this is equal to or lower than the first candle’s low.

- Second Candle Close: Must be above the first candle’s high to confirm engulfing strength.

Example:

First Candle: Open = 1.2050, High = 1.2070, Close = 1.2030

Second Candle: Open = 1.2025, High = 1.2100, Close = 1.2090

? The second candle’s close is above the first candle’s high, confirming a bullish engulfing pattern.

Bearish Engulfing Pattern

A bearish engulfing candle appears in an uptrend and signals a potential reversal to the downside.

Bearish Engulfing Criteria:

- The first candle is bullish (green candle) with a higher close than its open.

- The second candle is bearish (red candle) that:

- Opens at or above the first candle’s high.

- Closes below the first candle’s low.

- The second candle’s body must engulf the first candle’s body.

Key Price Conditions:

- First Candle High: Acts as a possible resistance level.

- Second Candle Open: Ideally, this is equal to or higher than the first candle’s high.

- Second Candle Close: Must be below the first candle’s low to confirm a bearish engulfing pattern.

Example:

First Candle: Open = 1.3050, High = 1.3075, Close = 1.3065

Second Candle: Open = 1.3080, High = 1.3090, Close = 1.3030

? The second candle’s close is below the first candle’s low, confirming a bearish engulfing pattern.

Entry, Stop Loss, and Take Profit Strategy

To increase accuracy, follow these guidelines:

Entry Point

- Enter after confirmation with the next candle closing in the direction of the engulfing pattern.

- For bullish engulfing: Enter above the high of the next candle after engulfing candle.

- For bearish engulfing: Enter below the low of the next candle of engulfing candle.

Stop Loss Placement

- For bullish trades, place your stop loss below the low of the engulfing candle.

- For bearish trades, place your stop loss above the high of the engulfing candle.

Take Profit Strategy

- Target previous swing highs/lows, key resistance/support levels, or apply a 1:2 risk-reward ratio.

Key Tips to Improve Accuracy

? Avoid engulfing patterns that form in range-bound markets unless they appear near key support or resistance zones.

? Prioritize engulfing patterns that align with other technical factors like Fibonacci retracements, trendlines, or fair value gaps.

? For strong confirmation, watch for volume spikes during the engulfing candle’s formation, which can signal institutional activity.

Key Entry Criteria

-

Confirmation Candle:

- After the engulfing candle forms, wait for the next candle to close in the engulfing candle’s direction.

- This confirms the momentum shift and reduces the risk of false breakouts.

-

Stop Loss Placement:

- For long entries, place your stop loss below the engulfing candle’s low.

- For short entries, place your stop loss above the engulfing candle’s high.

Common Mistakes to Avoid

- Entering Too Early: Jumping in before the confirmation candle often leads to false breakouts.

- Trading in the Middle of a Range: Engulfing candles in choppy or range-bound markets tend to lack significance. The pattern is most effective at key reversal points.

Additional Tip

The strategy aligns well with concepts like the rubber band trade, where prices extend away from a mean value and then revert. Identifying engulfing patterns near strong support or resistance zones enhances trade accuracy.