Table of Contents

The engulfing pattern is one of technical analysis’s most recognized candlestick patterns. It signals a potential reversal in the market and is categorized into two types: bullish engulfing and bearish engulfing patterns. Identifying these patterns is crucial, but integrating them with fundamental analysis can significantly enhance trading accuracy and profitability. Based on the insights from my FxIgor’s YouTube tutorial, this article will delve into the mechanics of the engulfing pattern and demonstrate how to combine it with fundamental analysis for more informed trading decisions.

Please see my video with a full explanation:

What is an Engulfing Pattern?

An engulfing pattern occurs when a candlestick fully engulfs the previous candle, signaling a potential shift in market sentiment. This pattern can be broken down into two types:

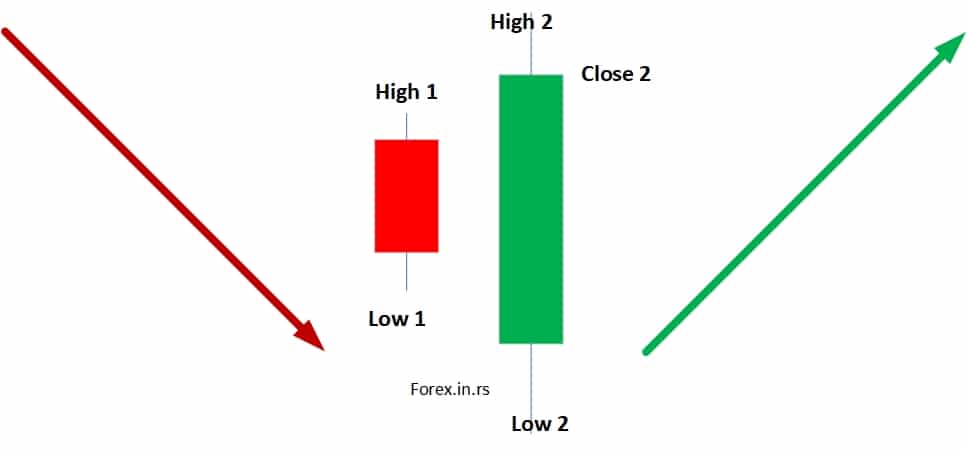

- Bullish Engulfing Pattern:

- Formation: A bullish engulfing pattern appears after a downtrend. It forms when a small red (bearish) candlestick is followed by a large green (bullish) candlestick that completely engulfs the previous candle.

- Implication: This pattern suggests a potential reversal from a downtrend to an uptrend, indicating that the bulls are gaining control.

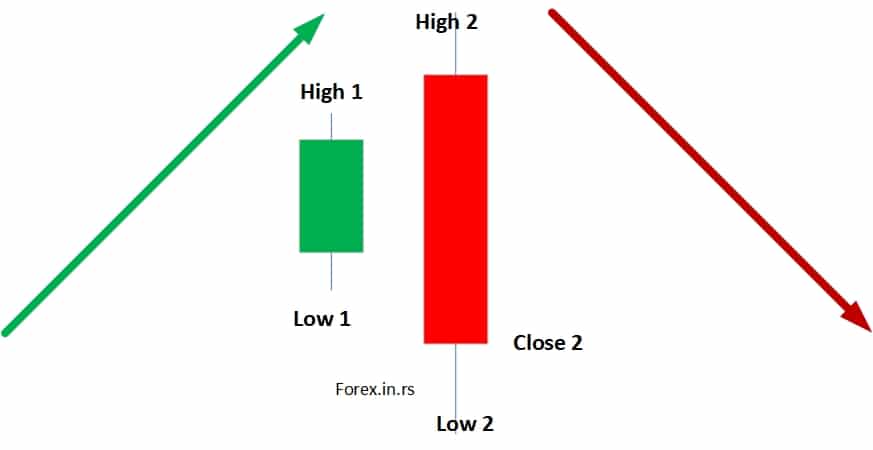

- Bearish Engulfing Pattern:

- Formation: A bearish engulfing pattern forms after an uptrend. It occurs when a small green (bullish) candlestick is followed by a more prominent red (bearish) candlestick engulfs the previous candle.

- Implication: This pattern indicates a potential reversal from an uptrend to a downtrend, suggesting that the bears are taking over.

The Importance of Fundamental Analysis

While the engulfing pattern is a powerful signal, it doesn’t always guarantee a successful trade. Many traders experience false breakouts where the pattern fails to hold, leading to losses. I emphasize integrating fundamental analysis with technical patterns to mitigate this risk.

Fundamental analysis involves evaluating economic indicators, news events, and financial reports that can influence market sentiment. By aligning the engulfing pattern with fundamental insights, traders can increase the probability of a successful trade.

Case Studies: Combining Engulfing Patterns with Fundamentals

I provide several examples where fundamental analysis was crucial in validating engulfing patterns. Here are a few critical cases:

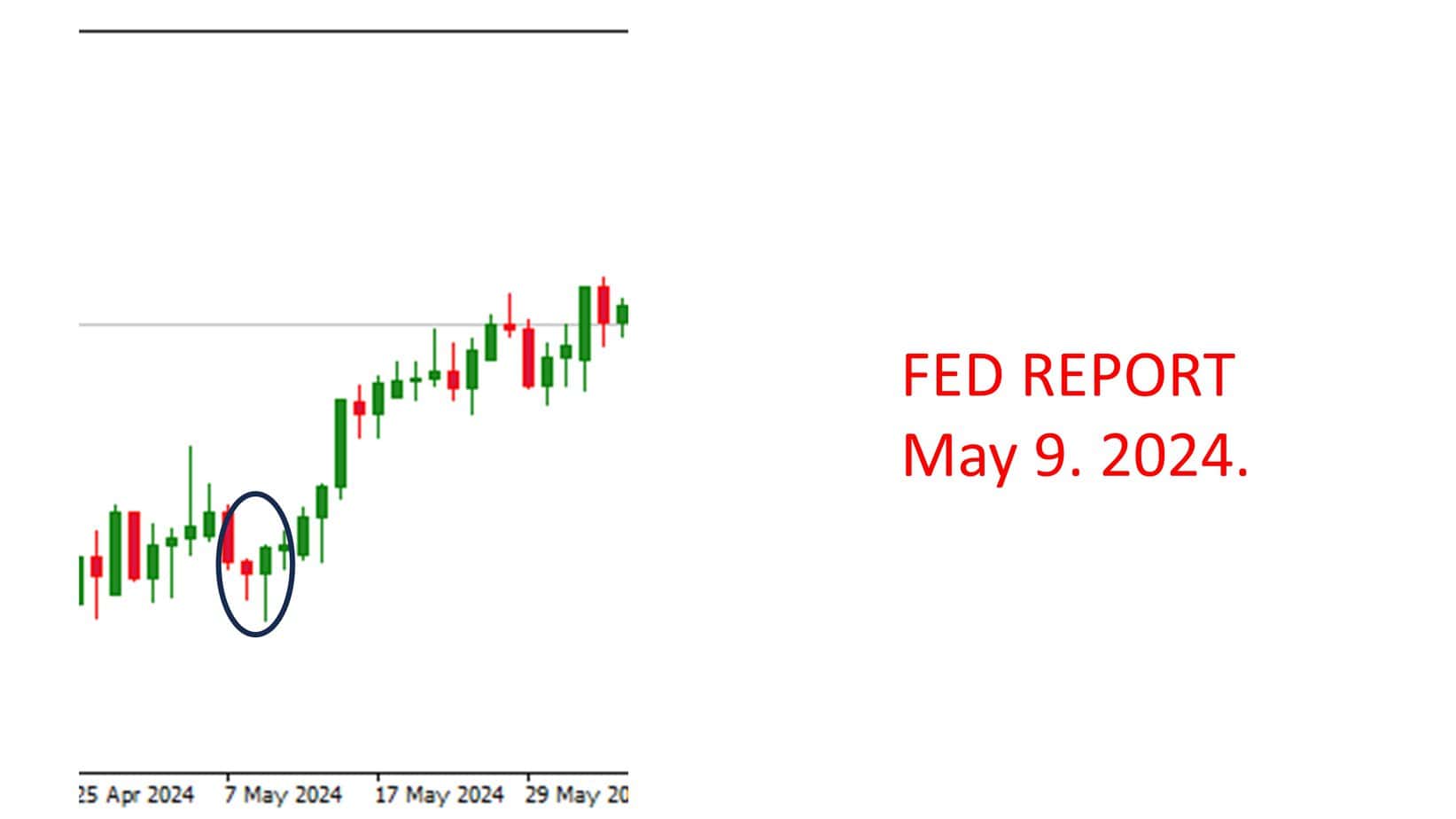

- Example 1: Bullish Engulfing Pattern Post-Fed Report (May 9, 2024)

- Scenario: On May 9, 2024, a Fed report coincided with the formation of a bullish engulfing pattern. The Fed’s decision to maintain the official bank rate, despite market fears of an interest rate decrease, led to a positive reaction in the British Pound (GBP).

- Analysis: Traders who identified this bullish engulfing pattern and understood the implications of the Fed’s report could have capitalized on the GBP’s subsequent rally, leading to hundreds of pips in profit.

- Example 2: Bearish Engulfing Pattern and Nonfarm Payroll Data (August 2, 2024)

- Scenario: On August 2, 2024, the U.S. nonfarm payroll data was released, showing a much lower-than-expected employment change and an increase in the unemployment rate. This data followed a bearish engulfing pattern in the USD.

- Analysis: The disappointing employment figures weakened the USD, accurately reflected by the bearish engulfing pattern. Traders who combined this technical signal with the fundamental news could have profited from the USD’s decline.

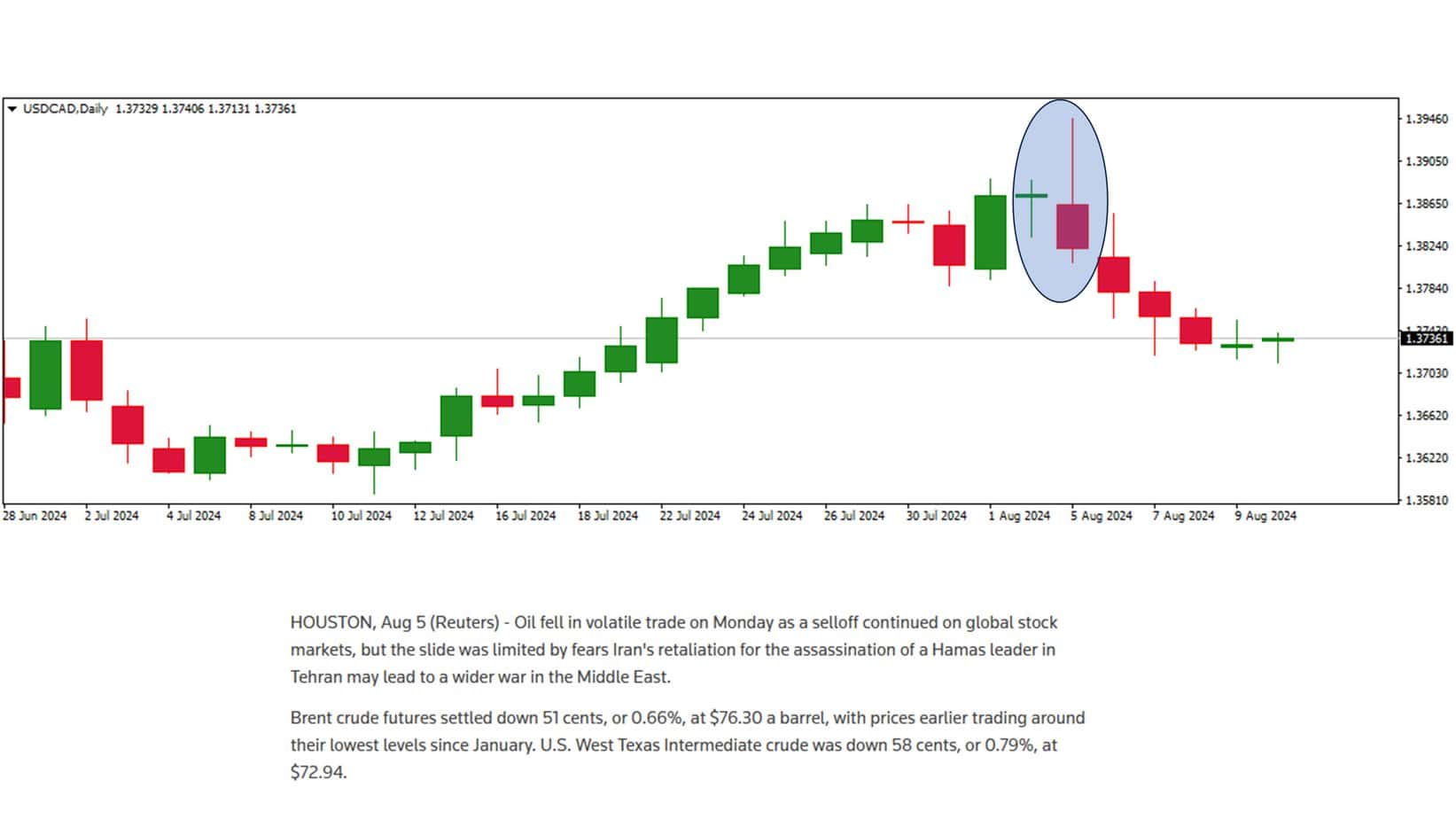

- Example 3: Bearish Engulfing Pattern in Response to Geopolitical News (U.S. Dollar/CAD)

- Scenario: In this example, the USD/CAD pair formed a bearish engulfing pattern in response to news about potential conflict in the Middle East. This affected oil prices, a key Canadian Dollar (CAD) driver.

- Analysis: The uncertainty surrounding the Middle East led to volatility in the oil market, which, in turn, impacted the CAD. This geopolitical news validated the bearish engulfing pattern in the USD/CAD pair, giving traders a clear signal to short the USD/CAD.

- Example 4: Intervention-Induced Bearish Engulfing Pattern (British Pound/Yen)

- Scenario: On July 11, 2024, rumors of a significant intervention by the Bank of Japan to stabilize the Yen led to a bearish engulfing pattern in the GBP/JPY pair.

- Analysis: The intervention, which reportedly involved the Bank of Japan spending 3.5 trillion Yen, caused a sharp decline in the GBP/JPY pair. Traders who recognized this fundamental event and its impact on the market could have taken advantage of the bearish engulfing pattern to secure substantial profits.

Conclusion

The engulfing pattern is a reliable tool in a trader’s arsenal, but its effectiveness is greatly enhanced when combined with fundamental analysis. By understanding the broader economic and geopolitical context in which these patterns form, traders can make more informed decisions and avoid the pitfalls of false signals. My examples underscore integrating fundamentals with technical analysis to achieve better trading outcomes.

Incorporating this approach into your trading strategy could lead to more consistent and profitable trades. I suggest you constantly monitor critical economic events and news and align them with your technical signals to maximize your trading potential.