Table of Contents

Since the discussions on Brexit began, financial analysts have continuously shared their predictions on how it will affect the GBP exchange rate to the euro. Finally, on 1st February 2020, the act was completed, and the United Kingdom ceased to be a part of the European Union.

Since the vote in the UK in agreement with leaving the European Union, the pound and the euro have been in parity. To make things worse, COVID-19 and frequent lockdowns have worsened situations for the UK and the rest of the European economy. In addition, the global crisis has made the markets more volatile, with interest rates becoming negative.

Follow this article to learn more about the factors that can influence these currencies separately and together. Let’s see what First, let analysts are talking about.

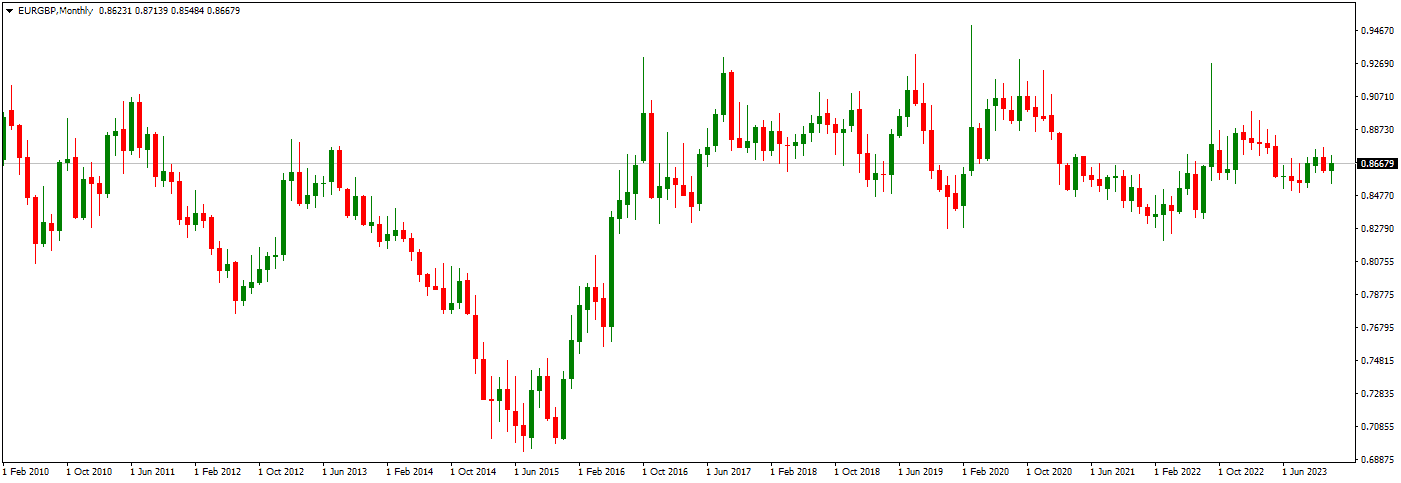

EUR/GBP Chart – EUR GBP Live Chart today price

[stock_market_widget type=”inline” template=”generic” assets=”EURGBP=X” format=”price=0,0.0000|change_abs=0,0.0000″ markup=” EURGBP is trading at {price} that is change from yesterday close {change_pct}.” api=”yf”][stock_market_widget type=”inline” template=”generic” assets=”EURGBP=X” format=”low=0,0.0000|change_abs=0,0.0000″ markup=” Today EURGBP low is {low}.” api=”yf”][stock_market_widget type=”inline” template=”generic” assets=”EURGBP=X” format=”high=0,0.0000|change_abs=0,0.0000″ markup=” Today EURGBP high is {high}.” api=”yf”][stock_market_widget type=”inline” template=”generic” assets=”EURGBP=X” format=”52_week_high=0,0.0000|change_abs=0,0.0000″ markup=” In the last 52 weeks the highest high for EURGBP was {52_week_high}.” api=”yf”][stock_market_widget type=”inline” template=”generic” assets=”EURGBP=X” format=”52_week_low=0,0.0000|change_abs=0,0.0000″ markup=”In the last 52 weeks, the lowest low for EURGBP was {52_week_low}.” api=”yf”]

Foreign exchange is always done with two currencies that form one currency pair. Here, our currency pair is GBP/EUR. Get British pound is our base currency in this pair, and EUR or thin this pair euro is our counter or quote currency. This pair represents the relationship between these two currencies: how many euros are required to buy one pound?

GBP/EUR is a famous cross-currency pair. This is not amongst the most traded pairs such as USD/JPY, USD/CAD, AUD/USD, EUR/USD, and GBP/USD, but it is a famous couple pairing USD pairs. Many investors trade this pair to diversify their portfolios.

EURGBP forecast in 2024 is bullish

EURGBP forecast for 2024. is moderately bullish. The predicted price for the end of 2024 is 0.96 based on technical and fundamental analysis. The monthly RSI is above 40, vital for EURGBP for several months. Strong resistance is at the 0.935 price level (March 202, high).

EUR bullish scenario

- Political Risk – In 2024, the EU will wield its trade, investment, and industrial policies and its ability to shape global norms and standards to move toward strategic autonomy.

- EUR Growth Risks – The persistent burden from higher jobless rates to the economy of the worst damaged eurozone member states still argues for depressed interest rates in 202 and further growth of QE (more PEPP and TLTROs)

- The ECB is expected to follow the Fed, applying symmetric principles (no cuts and no hikes) and slightly adjusting to a minor ultra-accommodative monetary policy.

- The EU will also have to finance its support in the market by continuing bond issuance.

- The European Commission will launch further borrowing under the SURE and NGEU instruments, investing in green and digital technologies. Digitalization is a requirement for the disbursement of grants.

GBP Outlook in 2024

The GBP/USD outlook for 2024 appears complex and influenced by several factors. Firstly, the Pound Sterling managed a turnaround from a four-decade low in 2023, suggesting a potentially robust performance in 2024. However, diverging monetary policies between the Federal Reserve (Fed) in the United States and the Bank of England (BoE) could lead to fluctuations, particularly if the US Dollar remains under pressure. Additionally, the Pound could face challenges due to uncertainties surrounding the UK elections and ongoing economic difficulties. The overall sentiment, as depicted in the monthly charts, suggests that GBP/USD might present attractive ‘buy-the-dip’ opportunities in 2024.

In 2023, the GBP/USD pairing experienced significant volatility, but the Pound managed to maintain its recovery gains, reaching a 15-month high. This performance was partly aided by the US Dollar’s inability to sustain its rebound, indicating a more favorable position for the Pound going into 2024. However, the future trajectory of GBP/USD remains uncertain, with several influencing factors including potential recessions in both the UK and the US, changes in monetary policy, and upcoming general elections in both countries.

The performance of the Pound in 2023 was underpinned by various factors, including the BoE’s monetary policy, inflation trends, and the economic resilience of the UK. Inflation remained a significant challenge in the UK, with the CPI rate persistently high, influencing the BoE’s decision to raise interest rates. This contrasts with the Fed’s approach, where a more passive stance was adopted later in the year.

Looking ahead to 2024, several key factors will influence the GBP/USD pair’s direction. These include potential interest rate cuts by the Fed and the BoE, varying economic outlooks for the US and UK, and the impact of national elections. The potential for rate cuts, alongside economic and political uncertainties, suggests a year of possible volatility and strategic opportunities for traders and investors in the GBP/USD market.

Brexit Deadline and Its Effect on the Market’s Direction for GBP and EUR Forecast

Analysts refrained from passing judgment or making any prediction before the Brexit deal was finalized. They were right. However, they held their opinions because this deal had a major impact on significant GBP and EUR relationships.

Last year, 15th October was the deadline to reach an agreement with the EU, which was open for an extension given the global lockdowns and social-distancing protocols. However, it was essential to wait for the final decision as the Bank of England’s Monetary Policy Committee,e or the MPC, stated it would give its next decision on interest rates once the Brexit deal is finalized, which was supposed to be 5th November 2020.

Citibank’s analysts noted in the bank’s Forex report that the key driver for GBP was the re-emergence of Brexit. The controversial and new UK Internal Market Bill was raising no-deal Brexit concerns again. This resulted in the depreciation of the GBP. The analysts were also concerned with the rate of recovery the UK economy was showing. It was slower than its peers. There were also speculations that the MPC might cut the rates to 0% and add £50bn QE.

A Danish investment bank’s head, Saxo’s John Hardy, highlighted how high volatility is unavoidable for the sterling pound irrespective of whether the deal reaches any conclusion. There can be more fluctuation in the market on either side. Saxo predicted the sterling to remain lower, below 1.10, if the deal doesn’t take place on time.

Canadian Bank CIBC’s analysts also believe the pressure will remain on the sterling pound. Before the Brexit deal was finalized, they predicted the critical variable would be the number of Covid cases—another necessary facto essential for the new EU trading arrangements. The bank believed the UK would need an orderly move to an all-inclusive free trade agreement.

The CIBC analysts explained that while they were expecting the deal to be far from comprehensive given how far-fetched it had become. With the tightening of the timeline, every other heading regarding Brexit will make the pound suffer a series of whipsaws. The analysts also expected to receive animations from a deal or no-deal situation. The doubts regarding Brexit and the V-shaped recovery assumed by the BoEthey also looked challenging because of the tight lockdowns and restrictions in the movement. Whether or not the UK goes into a second lockdown, the recovery in the service sector will be difficult.

Analysts at TDseew Brexit as a major risk in significant rather than strategic terms. They saw that the UK had a narrow deal, and the terms of Brexit would be very; according to them, most of the damages that the real deal caused were already compensated in the trade. They view the pandemic as a larger threat to a more significant sterling pound than Brexit. They were right because the lockdowns and the pandemic hit the UK economy particularly hard.

Commerzbank has a slightly better outlook on the euro rate; Commerzbank’s GBP would likely strengthen against the EUR in 2021. Wallet Investor also has a similar forecast for the currency pair. It predicts that the rate will remain between 1.10 – 1.12 for the remainder of the year.

Conclusion

The UK leaving the EU was a monumental moment. It shook many people. A change of this size never goes down without waves of aftereffects. The UK economy seems to be recovering, but it is too soon to predict anything, given that the world is still dealing with the pandemic. If you wish to gain from Forex without risking too much, you can invest in CFDs. CFDs or Contracts for Differences allow you to profit from the market direction.