The euro’s value compared to the U.S. dollar has experienced notable fluctuations since its introduction, which can be understood through historical context and economic principles.

Why is The Euro Stronger than the Dollar?

Based on the exchange rate, the euro divided by the U.S. dollar gives a value above 1, which means that the Euro price value is stronger than the dollar. Euro currency value is compared to the U.S. dollar because of demand and supply, where high demand or limited supply usually strengthens a currency, and low demand or excess supply weakens it. Additionally, central bank interest rates, inflation levels, economic growth, and the country’s balance of trade all play critical roles in determining the currency’s strength by affecting investor perception and economic stability.

My explanation does not mean the EUR economy is stronger than the US economy because of the value of the currency exchange rate. This is not true. When a country’s currency increases in value compared to other currencies, it can buy more goods and services from abroad for the same amount, making imports cheaper. Conversely, a stronger currency makes the country’s exports costlier for foreign buyers, potentially reducing demand for these exported goods in international markets.

Currency value alone does not indicate the economic strength of a country. The fact that one US dollar is worth approximately 100 Japanese yen does not mean the US economy is 156 times stronger than Japan’s. Similarly, one Thai Baht worth 4.25 Japanese yen does not imply that the Thai economy is 4.25 times stronger than the Japanese economy. Currency values are influenced by various factors, including market perceptions, inflation rates, and monetary policies, and they act as units of measurement rather than direct indicators of economic power. The purchasing power of a currency within its own country and factors such as the size and complexity of an economy play a more significant role in determining economic strength. Therefore, comparing economies based solely on currency values is misleading and does not accurately reflect their relative strengths.

The European Union chooses to strengthen its currency and reduce demand for exported goods. As you know, restrictions and stringent laws in the EU contribute to this situation. Typically, a central authority like the European Central Bank (ECB) might aim to strengthen the currency for various reasons, such as controlling inflation or stabilizing the economy. However, deliberately reducing demand for exported goods is not usually a direct goal. Strengthening the currency can lead to reduced competitiveness of exports, but this would generally be a side effect rather than an intended policy objective. The main focus is often on the broader economic impacts, not just on exports.

The critical difference between the inflation rates in the U.S. and the Euro area as of March 2024 lies in their magnitudes and trends. The U.S. inflation rate stands at 3.48%, above its long-term average of 3.28%, and reflects a decrease from last year’s rate of 4.98%. In contrast, the Euro area’s inflation rate is lower at 2.4% and shows a decreasing trend, down from 2.6% the previous month. These differences in inflation rates can influence the relative value of the currencies, with higher inflation typically weakening a currency’s value due to diminishing purchasing power.

Let’s break down the main points to understand these fluctuations:

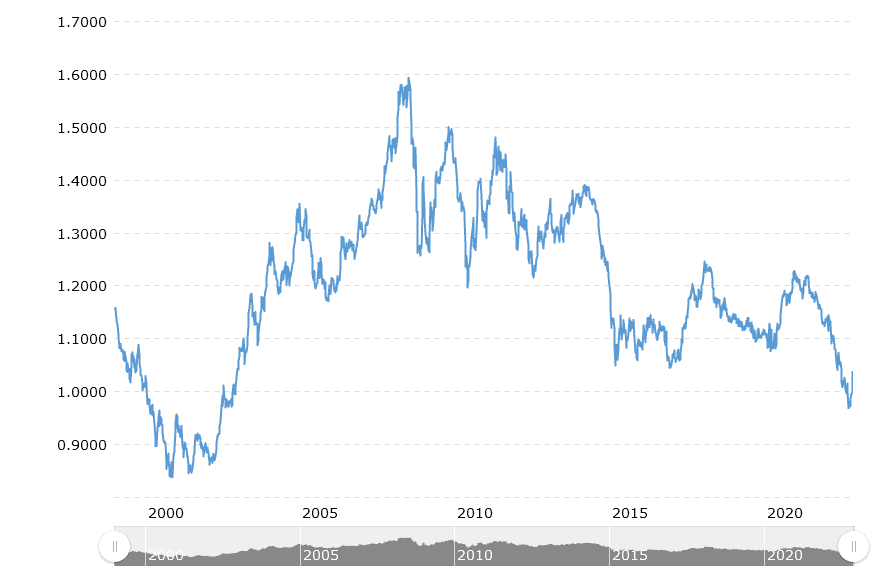

- Introduction and Initial Value: The euro was launched as an accounting currency in 1999, replacing the European Currency Unit (ECU) at par. Initially, it was valued at US$1.1743. This was a theoretical or accounting value because the physical currency (coins and notes) only began circulating in 2002.

- Early Fluctuations: Shortly after its introduction, the euro’s value fell to US$0.8252 by October 2000. This decline could be attributed to various factors, including initial skepticism about the new currency and its stability, differences in economic growth and interest rates between the Eurozone and the U.S., and the strength of the U.S. economy at the time.

- Rise Above the Dollar: By the end of 2002, the euro started to trade above the U.S. dollar and reached a peak of US$1.6038 in July 2008. This rise was driven by various factors, including more robust economic growth in the Eurozone compared to the U.S. and the impact of the U.S. financial crisis, which lowered confidence in the dollar.

- Impact of the Financial Crisis: Between 2009 and 2014, the euro’s value saw a “see-saw” pattern, fluctuating between $1.60 and $1.20. During this period, the U.S. was recovering faster from the 2008 financial crisis than Europe, grappling with a sovereign debt crisis (exemplified by the multiple Greek financial crises).

- Recent Trends and Quantitative Easing: 2015 the euro touched a 12-year low of $1.05. This recent weakness was partly due to the European Central Bank (ECB) implementing quantitative easing (Q.E.) measures to stimulate the economy, typically leading to currency depreciation. At the same time, the U.S. Federal Reserve was considering raising interest rates, which would appreciate the dollar.

- Fundamental Factors Influencing Exchange Rates: The exchange rate between the euro and the dollar, like that between any two floating currencies, is influenced by:

- Balance of Trade and Payments: A surplus in trade or payments typically strengthens a currency through higher demand.

- Economic Growth and Stability: Higher economic growth rates often attract investment, leading to currency appreciation.

- Monetary Policy: Policies like Q.E. (which increases the money supply) can depress a currency’s value, while interest rate increases (which tighten the money supply) can enhance it.

- Political Stability and Economic Expectations: Political uncertainty can weaken a currency, while optimistic future economic forecasts can strengthen it.

Understanding these factors helps explain the euro’s historical and current values compared to the U.S. dollar and its fluctuations over time.

Over the past 15 years, the European economy has not only lagged behind the U.S. and China but has declined relative to the size of the U.S. economy, shrinking from 10% larger to 23% smaller. This shift is highlighted by the growth metrics, where the European Union (including the U.K. before Brexit) saw its GDP increase by only 21% in dollar terms, compared to 72% for the U.S. and a staggering 290% for China. One of the primary reasons for Europe’s slower economic growth is its lack of leadership in pivotal sectors currently driving global economic expansion, such as technology. Unlike the U.S. and China, which host major technology firms across a spectrum of industries, including hardware, software, and e-commerce, Europe has no comparable giants in the tech sector.

Europe’s energy policies compound this technological gap. By relying heavily on imported gas from Russia and some African countries, Europe has exposed itself to significant geopolitical risks and economic vulnerabilities, which is especially evident with the economic strain caused by fluctuations in gas supply. Additionally, unlike the U.S., Europe’s reluctance to engage in fracking has led to higher energy costs for European households, further weakening its economic position.

The defense sector also reflects Europe’s dependencies, with the E.U. relying heavily on NATO—and, by extension, the U.S.—for its defense needs. The recent increase in defense spending by European countries in response to the Ukraine invasion underscores this dependency and the region’s reactive rather than proactive defense posture.

Moreover, regulatory frameworks in Europe have stifled economic dynamism. Strict state aid laws and stringent competition rules prevent prominent national champions’ emergence, inhibiting the aggressive growth seen in U.S. and Chinese companies. These regulatory barriers contribute to Europe’s inability to match the economic growth rates of its global competitors, leaving it at a disadvantage in the fast-paced modern economy.

Read my similar article, Why is the Pound Worth More than the Dollar?