The Federal Reserve opted to keep interest rates unchanged on Wednesday, signaling that any rate cuts might be deferred until December. This comes as Fed officials now foresee only a quarter-percentage-point reduction for the entire year, adjusting their earlier projections, which anticipated three such reductions.

Economic Activity and Inflation

Recent economic indicators point to robust economic activity. Employment figures remain strong, with the unemployment rate staying consistently low. Over the past year, inflation has shown signs of easing, yet it remains higher than the Fed’s 2% target. The central bank’s latest policy statement highlights “modest further progress” toward achieving its inflation goal, a slight improvement from the previous update in May.

Fed’s Policy and Projections

The decision to maintain the federal funds rate within the 5.25%-5.50% range underscores the Fed’s cautious approach. Policymakers prioritize a sustained inflation reduction before contemplating significant adjustments to the target range. The Fed’s projections have shifted, removing the prospect of rate cuts before the November 5 U.S. presidential election.

Federal Reserve’s Statement Highlights

Released at 2:00 p.m. EDT, the Federal Open Market Committee (FOMC) statement emphasizes the following:

- Economic Activity: Solid pace of economic expansion.

- Employment: Continued substantial job gains and low unemployment rate.

- Inflation: Eased but still elevated; modest progress towards the 2% target.

- Monetary Policy: The target range for the federal funds rate is maintained at 5.25%-5.50%.

- Future Adjustments: Any changes to the target range will be based on a careful assessment of incoming data, the economic outlook, and the risk balance.

The FOMC reiterates its commitment to achieving maximum employment and stable prices over the long run. The Committee acknowledges that the risks to its goals have become more balanced over the past year, yet it remains vigilant regarding inflation risks.

Market reaction

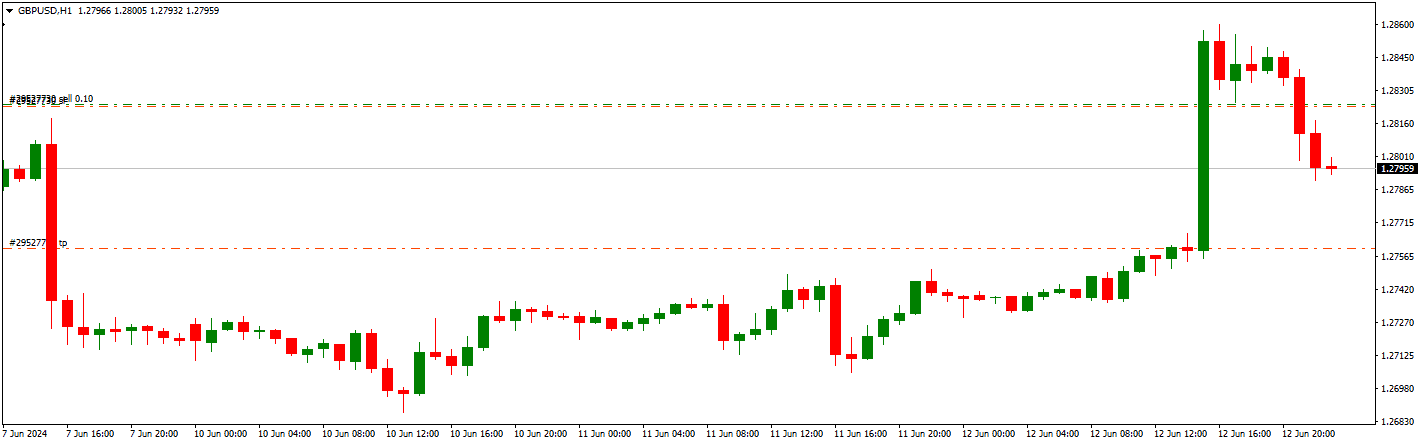

Following the Federal Reserve’s announcement to keep interest rates steady and scale back expectations for rate cuts in 2024, the forex market responded promptly. The EUR/USD and GBP/USD currency pairs dropped by 50 pips, reflecting a swift market adjustment to the Fed’s latest projections and policy stance.

The market expects price movement on levels before the US session and new highs for the US dollar on June 13.

Policy Easing and Asset Holdings

The Fed will continue to reduce its holdings of Treasury securities, agency debt, and agency mortgage-backed securities. Officials indicated that a rate cut will only be considered once there is greater confidence that inflation is moving sustainably towards the 2% objective.

Ongoing Monitoring

In determining the appropriate stance on monetary policy, the FOMC will continuously monitor various information, including labor market conditions, inflation pressures, and international developments. The Committee stands ready to adjust its policy stance if emerging risks threaten its objectives.

Conclusion

The Federal Reserve’s latest decision reflects a careful balancing act. While acknowledging some progress in reducing inflation, the Fed remains cautious, emphasizing the need for further improvements before easing monetary policy. As economic conditions evolve, the central bank’s vigilant approach aims to navigate the complexities of achieving stable prices and maximum employment.