Table of Contents

Forex economic calendar represents a timetable with a list of major economic events during the week. Event risk refers to anything that has the potential to influence markets but cannot be predicted in advance. Please use the presented economic calendar to track significant news events and economic data releases that have the potential to shake up the financial markets and affect your trading.

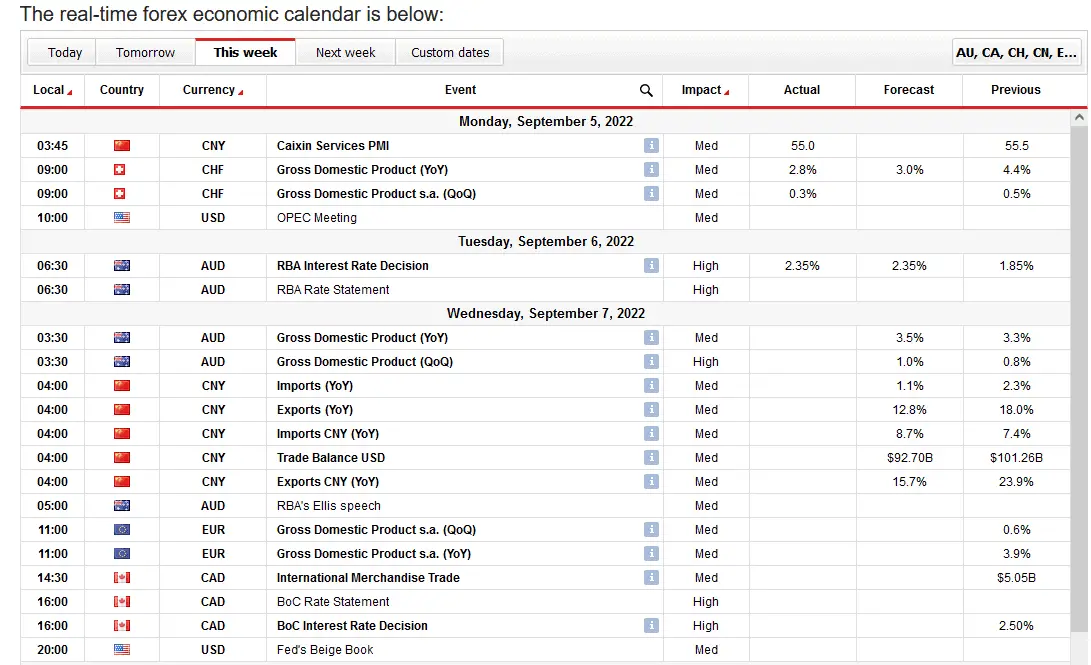

The real-time forex economic calendar is below:

How to use the forex.in.rs forex calendar?

Forex traders need to use a calendar to map essential events that can change forex market prices in a tight time frame. For example, the Forex fundamental announcements calendar or the Forex news calendar can sometimes influence the market for several days, weeks, or months.

Forex news calendars must always be adjusted to the trader’s current preference. A calendar needs to be filtered by date (pick day or week), filtered by currency (if you want EURUSD, then pick EUR and USD), and purified by impact news (low, medium, high). In addition, the Forex calendar needs to be adjusted by preferred time (usually, traders pick a local time). High-impact news can influence the forex market, and these events must be observed.

- Impact

Bars in yellow, orange, and red represent the effect, a simple measure of the possible change that a data release can have on currencies. If a bar is red and lengthy, traders know it contains news that will likely affect the foreign exchange market. If this bar is short and yellow, the likelihood is minimal. We’re in the middle of the road in orange.

- Timing

The information is presented in a day-by-day timeline format. A checkmark will appear when new information becomes available in the “time remaining” column. Upcoming information is below the current status line, indicated by a light grey horizontal line. It’s easy to see how soon the next update will be available since the remaining time is shown. The calendar page will immediately reload once new information is available to ensure you don’t miss critical updates. The option to have an audible alert whenever a new release is made is available.

- Actual/Deviation/Consensus/Previous

The Last figure represents the most recently available data for each economic calendar indicator (data release frequencies vary; they may be from the previous month or quarter, etc.). We also provide a Consensus figure, representing our experts’ average opinion about the indicator’s value. The Actual reading is updated in real time and shown to the right of the instability gauge as soon as it becomes available. Was it a pleasant or unpleasant surprise? We have a public consensus that is either green (indicating that the statistics are improved than expected) or red (indicating that the data is worse than expected) (poorer than anticipated). The Aberration ratio is a unique metric developed by FXStreet that quantifies the degree to which Actual data deviates from the Consent. Its value often floats freely between -7 and +7 on an open scale.

- Currencies

The nation’s flag from which the data originated appears next to its currency symbol. You can do a quick search to see what currencies may be impacted today or in the following days.

You can learn about each key forex economic indicator in our article.

Structure of a forex.in.rs Forex Calendar

Forex or economic calendar differs in how economic indicators are graded. For example, a few websites prefer to rate economic indicators based on the time aspect, while some choose their impact on the economy. A few platforms also prefer to use volatility to rate economic indicators.

The best thing about an online forex calendar is that it helps keep traders updated with all the economic and non-economic events. The tools are updated regularly as they are online, and sometimes, they are automatic and give users 24*7 news and the latest updates.

Screenshot from the calendar:

Different websites can have different looks for their economic calendar. Still, a few things will be the same, including country name, indicator name, impact or importance of the indicator, current value, future or forecast value, past value, etc. These are the essential information you can expect from a typical Forex calendar.

No matter what period you trade on, it would help if you made it a habit to check the forthcoming events on the calendar every day. This is because upcoming events have a good chance of affecting the various financial markets, such as forex, stocks, bonds, and commodities.

Because foreign exchange trading involves the simultaneous purchase of one currency and the sale of another, the Economic Calendar allows you to evaluate and contrast the economies driving each currency. Events on the calendar are given a “low,” “medium,” or “high” grade based on the expected degree of influence they will have on the market.

Even if you don’t trade based on news, you should still check the Economic Calendar twice a day: once in the morning, before you begin trading, and once more in the evening, before closing out your trades for the day. This will ensure you know any high-impact or significant events scheduled for the following day.

Conditions in the market might become turbulent due to high-impact occurrences, particularly in the foreign exchange market. Be aware of any forthcoming economic data releases or events that might result in unexpected volatility and adversely influence your trading, such as any open positions you may have.

Because of the market’s heightened volatility, it is essential to remember that trading around news events might result in significant slippage in a position. Be cautious about limiting your risk and avoiding overexposure and excessive leverage! Avoid making the same errors in trading that other unsuccessful traders have made.

Utilizing Forex Calendar

Most forex traders use the forex calendar to develop their trading patterns with its easy usability.

The economic calendar aids traders in planning and reallocating their assets and portfolios. It also helps increase traders’ awareness of various indicator chart patterns, which can be crucial.

As a forex trader, you should keep aware of economic events by eyeing the forex calendar. On that basis, you can make reasonable and thoughtful trades using your preferred currencies.

Reading the forex calendar is not enough; you must also know how to implement it in trading. In addition, you need to know that a Forex calendar available on different sites would have other mechanisms. Depending on user interests depend on the website and the events the website covers or targets. For example, many websites only cover US-based events in their forex calendar, as the American currency is quite popular in trading.

Websites provide information on events based on various filters like geography, market cap, popularity, etc.

Different nations have different impacts on the forex market. Undoubtedly, the American dollar rules the market, having ‘Reserve Currency’ in many nations. Still, other national events of different countries also impact this arena. Some examples are the UK’s Brexit and Greece’s financial turmoil. Such events have gigantic effects on the currency market, even though the ruling currency is the dollar. Even the US market is impacted by this kind of event.

What Kind of Information Does a Forex Calendar Provide?

Read about crucial forex economic indicators in our article.

A forex calendar mainly highlights two categories: reports on recent economic and financial events and prediction reports of future economic and financial events. These categories are crucial as they impact the forex market and strategies of traders worldwide, helping them take the right kind of trade at the right time.

Indicators are also an essential aspect of a forex calendar. There are two types of indicators based on the time prospect. One is called the leading indicator. These indicators typically change ahead of any gigantic or significant economic adjustment event. However, they change once the economic events of the pattern have already been witnessed.

The volatility factors enter here; based on that, the leading indicators can be separated into three groups based on their impact. The first group is the most relevant and includes the Gross Domestic Product (GDP) announcement, the Purchasing Manager’s Index, the Unemployment rate, Initial Jobless Claims, the Consumer Confidence Index, Durable Goods Orders, Home Sales, and more. They have a more substantial influence on the market as they are sensitive.

The second group contains crucial data. It includes information like the Beige Book report, Housing starts, Factory Orders, Business Inventories, Federal Budget Balance, Average Hourly Earnings, and more.

In the last group are two indicators that reflect the average price stats for consumers and producers. They are known as the Consumer Price Index and Producer Price Index.

In addition to these groups, the Forex calendar shows volatility expectations using three colors. Red indicates a higher impact, orange shows a medium result, and yellow shows a lower impact.

US Economic Indicators in Forex Calendar

The United States economy is the biggest in the world, so its economic calendar takes precedence over all others. When the most crucial indicators affect the dollar’s value, significant impacts on different fairs and exchanges may be seen.

The US Census Bureau, the US Energy Information Administration, the US Bureau of Labor Statistics, and the US Bureau of Economic Analysis are the primary sources for the most influential economic and market indicators. The choices made by the Central Backup, generally declared by Governor Jerome Powell, are followed with great attention.

- GDP Growth Rate

- GDP Annual Growth Rate

- Unemployment Rate

- Non-Farm Payrolls

- Inflation Rate

- Inflation Rate MoM

- Interest Rate

- Balance of Trade

- Current Account

- Current Account to GDP

- Government Debt to GDP

- Government Budget

- Business Confidence

- Manufacturing PMI

- Non-Manufacturing PMI

- Services PMI

- Consumer Confidence

- Retail Sales MoM

- Building Permits

- Corporate Tax Rate

- Personal Income Tax Rate

UK Economic Indicators in Forex Calendar

The Bank of England, led by Governor Andrew Bailey, monitors the economic climate in the United Kingdom, the world’s sixth-largest economy. London, the nation’s capital, is the world’s second-biggest financial hub after New York City.

Since the UK economy is so significant, fluctuations affect several markets and currencies. These are some of the most critical economic calendar indicators for the UK:

- Balance of Payments

- CPI Inflation Indicator

- GDP Growth

- Halifax House Price Index

- Household Expenditure

- Index of Production

- Labor Market Statistics

- Public Sector Expenditure and Debt

- Retail Sales

- The GfK Consumer Confidence

Australian Economic Indicators in Forex Calendar

Australia’s economy is one of the strongest in the world because of its recent expansion. It ranks sixth in the quality of life index. Because of their demand, Australia exports many of its goods to China and other Asian nations.

The Reserve Bank of Australia assists foreign central banks and the Australian federal government. Philip Lowe is the current head of the RBA. The following are some of the leading economic calendar indicators for Australia:

- Balance of Trade

- Building Permits

- Business Confidence

- Consumer Confidence

- Corporate Tax Rate

- Current Account

- Current Account to GDP

- GDP Annual Growth Rate

- GDP Growth Rate

- Government Budget

- Government Debt to GDP

- Inflation Rate

- Inflation Rate MoM

- Interest Rate

- Manufacturing PMI

- Personal Income Tax Rate

- Retail Sales MoM

- Services PMI

- Unemployment Rate

Canada Economic Indicators in Forex Calendar

Owing to its abundant natural resources, the thriving technology sector, and participation in free trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the United States-Mexico-Canada Agreement (USMCA), Canada has one of the world’s strongest economies.

Bank of Canada statements made during Tiff Macklem’s leadership are among the most consequential occurrences. There are several important economic indicators on Canada’s calendar, but some of the more important ones are:

- Balance of Trade

- Building Permits

- Business Confidence

- Consumer Confidence

- Corporate Tax Rate

- Current Account

- Current Account to GDP

- GDP Annual Growth Rate

- GDP Growth Annualized

- GDP Growth Rate

- Government Budget

- Government Debt to GDP

- Inflation Rate

- Inflation Rate MoM

- Interest Rate

- Manufacturing PMI

- Personal Income Tax Rate

- Retail Sales MoM

- Unemployment Rate

How Does the Forex Calendar Impact the Forex Market?

A forex calendar contains information about important forex news. So, forex news and events have an impact on the forex market. Usually, the difference between expectations from economic data and actual data has the most significant impact on the market.

The currency market is also run by political and economic factors that hardly impact a currency’s strength or value. A forex calendar gives information on all such events and helps predict minor or significant changes. As a forex trader, if you can understand and analyze such factors or indicators, you can also know how they impact a nation’s economy. You will also see how to take advantage of these changes in your trading.

These indicators state how a currency would be valued at a certain time. Also, an economic indicator displays the nation’s health stats, which impact the currency, so what’s better than analyzing it?

Various events that tend to change rapidly impact an economy’s total or overall economy. Online forex calendars are quickly updated to reflect such changes in real-time, which eventually helps traders decide their trades.

Let us understand this concept with an example.

The trade balance between the two countries states how much demand and supply there is between them. So, if the demand is higher for one country’s goods and services, that country’s currency would appreciate it. So, the citizens of other countries would have to pay more to buy goods.

Generally, a country with a significant trade deficit is said to have high volumes of imports of international goods or services. As a result, such a nation would have to sell its currency to purchase that other nation’s currency in the global market to balance the trade deficit. Therefore, it would negatively impact the overall economy of that nation.

A forex calendar shows such news, and traders take their trades accordingly, impacting the overall trade situation in the long term. Other particulars, like political change, international trade, economic data release, capital markets, economic outlook, etc., also impact a nation’s economy, eventually taking its toll on the forex market.

Economic reports are the main reason behind a forex trader’s precise moves, and forex calendars are a medium for getting such reports and valuable information.

Many global events affect the financial markets, whether equity or commodities. Learning to trade an economic calendar is essential, even if you use fundamental or technical analysis tools.

An economic calendar is the calendar of forthcoming economic events that happen across the globe and are likely to impact various financial markets like currency, stocks, indices, bonds, and more. In any of the needs you trade, at any time, you have to keep yourself updated with the daily news. Being updated with significant economic events can have substantial effects even for long-term investors.

All the mentioned events are the drivers of volatility and significantly impact the forex market. However, TheNonfarmm Payroll Data has the most impact on the market when released on the first Friday of every month and states the US… jobs market data.

How to Trade an Economic Calendar?

There are three methods through which you can trade the economic calendar.

- Intraday Trading

- Swing Trading

- Momentum Trading

The economic calendar is just another trigger in the overall trader’s strategy. Usually, traders develop a system using a combination of economic events and technical analysis. For example, suppose your strategy based on technical analysis shows that security should be bought. In that case, the economic event can delay the purchase or be used as a catalyst to increase position size if it follows the primary trend.

How to trade an economic calendar example:

Trader trade EURUSD. The price is 1.3, and the primary trend is bullish. The price is around the highest high in the last seven days. NFP economic report is excellent for the US… economy; the number of jobs in the US… economy has increased over the previous month. The trader enters a position right after the news because the economic event confirms the trend, and the trader’s plan is based on technical analysis.

The trader will be flat if the NFP report is bad for the US… economy. The trader will not trade because the technical analysis plan is not confirmed using fundamental analysis (economic event).

Why Should You Use a Forex Calendar?

It would help to use a forex economic calendar as an additional trigger in your overall trading strategy. Except for price and time from the technical analysis, you will need information about vital news because important news can accelerate or decelerate major trends like catalysts.

Even though the usage or importance of forex or economic calendars is not underrated, many forex traders are unaware of how to utilize them for the best. A forex calendar is probably not the answer to all your questions, but it is the information giver you need as a trader to trade it in the market in your favor.

As a forex trader, you must understand the chart patterns and signals the economic calendar provides and make your forecast and trading pattern based on it. It would help you know when to enter and exit the market to feel the most advantageous and control your losses. If any, you must synchronize your trading pattern with the economic moves or events and trade that information at the right time.

Forex calendar is also helpful for traders who are involved in short selling. For example, if you know of an economic event that will prove harmful to a nation, you can sell that currency in the forex market to take advantage. To predict such moves, you also need to have enough skills to implement them at the correct time.

A forex trader needs to know three essential aspects of data given on the forex calendar in the forex market: the preceding period, the current period, and the analysts’ estimation of any specific data.

Keeping yourself updated with these data points can easily help you ace trading and profit from the forex calendar information. The forex calendar also helps traders know how much volatility will be triggered by this prospect’s event or report release.

Conclusion

Forex economic calendar tracks news and important economic events. Forex news has a significant impact on daily and sometimes overall trends.