The foreign exchange (forex) market is a colossal financial juggernaut, boasting unparalleled liquidity unmatched by any other global market. A significant portion of this liquidity can be attributed to the massive daily turnover of forex pairs, with the US dollar playing a pivotal role. As the de facto global reserve currency, the US dollar is at the heart of countless transactions, whether for international trade, investment, or central bank operations. This widespread usage and constant demand ensure the US dollar and its paired currencies experience exceptionally high liquidity.

Operating 24 hours a day across major financial hubs, the forex market witnesses a relentless flow of transactions, especially involving the US dollar. This heightened liquidity offers traders more consistent prices, reduced transaction costs, and the flexibility to enter or exit positions swiftly. In essence, the prominence of the US dollar significantly amplifies the innate liquidity of the forex market, solidifying its position as a favored trading destination for investors worldwide.

In our article What is the largest forex market in the world, we analyze the forex market and see the forex pairs list. In another article, we wrote about forex market volume, and here, we will analyze only the most traded currencies.

How Much is the Forex Market Volume Per Day?

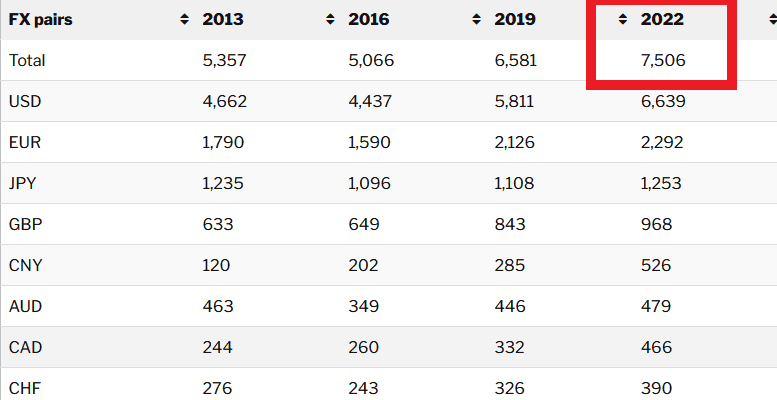

Based on 2023. research, the forex market volume per day is 7.5 trillion dollars. The most significant daily turnover of the global foreign exchange market for the most liquid 40 world currencies was 7506 billion dollars (7.506 trillion dollars). 88.46% of daily turnover in the previous year, or 6639 billion, belongs to US dollars.

Please see the Table of Forex Market Volume per day (daily turnover):

| FX pairs | 2013 | 2016 | 2019 | 2022 |

|---|---|---|---|---|

| Total | 5,357 | 5,066 | 6,581 | 7,506 |

| USD | 4,662 | 4,437 | 5,811 | 6,639 |

| EUR | 1,790 | 1,590 | 2,126 | 2,292 |

| JPY | 1,235 | 1,096 | 1,108 | 1,253 |

| GBP | 633 | 649 | 843 | 968 |

| CNY | 120 | 202 | 285 | 526 |

| AUD | 463 | 349 | 446 | 479 |

| CAD | 244 | 260 | 332 | 466 |

| CHF | 276 | 243 | 326 | 390 |

| HKD | 77 | 88 | 233 | 194 |

| SGD | 75 | 91 | 119 | 182 |

| SEK | 94 | 112 | 134 | 168 |

| KRW | 64 | 84 | 132 | 142 |

| NOK | 77 | 85 | 119 | 125 |

| NZD | 105 | 104 | 137 | 125 |

| INR | 53 | 58 | 114 | 122 |

| MXN | 135 | 97 | 111 | 114 |

| TWD | 24 | 32 | 60 | 83 |

| ZAR | 60 | 49 | 72 | 73 |

| BRL | 59 | 51 | 71 | 66 |

| DKK | 42 | 42 | 42 | 55 |

| PLN | 38 | 35 | 41 | 54 |

| THB | 17 | 18 | 32 | 31 |

| ILS | 10 | 14 | 20 | 31 |

| IDR | 9 | 10 | 27 | 28 |

| CZK | 19 | 14 | 26 | 29 |

| AED | n/a | n/a | 14 | 28 |

| TRY | 71 | 73 | 71 | 27 |

| HUF | 23 | 15 | 27 | 26 |

| CLP | 16 | 12 | 19 | 24 |

| SAR | 5 | 15 | 12 | 18 |

| PHP | 8 | 7 | 19 | 18 |

| MYR | 21 | 18 | 10 | 14 |

| COP | 6 | 8 | 12 | 14 |

| RUB | 86 | 58 | 72 | 14 |

| RON | 7 | 5 | 6 | 9 |

| PEN | 3 | 4 | 5 | 7 |

| BHD | 0 | 0 | 2 | 3 |

| BGN | 1 | 1 | 2 | 2 |

| ARS | 1 | 1 | 4 | 1 |

The table provided gives a historical snapshot of the daily turnover in the foreign exchange (forex) market, spanning over two decades from 2001 to 2022. Let’s analyze the patterns and reasons for the increasing forex daily turnover based on the data:

- Overall Growth: The total daily turnover of the forex market has observed a consistent increase, rising from 1,239 billion dollars in 2001 to 7,506 billion dollars in 2022. This growth signifies the expanding global trade, investments, and the increasing interconnectedness of the world’s economies.

- The dominance of the USD: The US dollar (USD) has remained dominant throughout the observed years. Its daily turnover rose from 1,114 billion dollars in 2001 to 6,639 billion dollars in 2022, reinforcing its role as the world’s primary reserve currency and its significant influence in global trade and finance.

- The emergence of the Euro: The Euro (EUR), introduced in 1999, saw its daily turnover grow significantly, showcasing its establishment as a significant global currency, especially within international trade and the global financial system.

- Japanese Yen and British Pound: Both the Japanese Yen (JPY) and the British Pound (GBP) witnessed growth in turnover, reflecting their significant roles in the global economy, particularly in the finance and trade sectors.

- Rise of the Chinese Yuan: The Chinese Yuan (CNY) showcases a remarkable trajectory. Starting from negligible numbers in 2001, its turnover ballooned to 526 billion dollars by 2022. This rapid ascent mirrors China’s meteoric rise as a global economic powerhouse and the increasing internationalization of the yuan.

- Steady Growth of Others: Other currencies like the Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), and Hong Kong Dollar (HKD) saw steady or incremental growth over the years, indicative of their regional and global economic roles.

The three most important things we can see:

- Forex Market Volume: In 2023, research indicates that the total volume of the forex (foreign exchange) market is 7.5 trillion dollars per day. This figure represents the entire daily transaction amount for all currency trades worldwide.

- Most Liquid 40 World Currencies: The daily turnover (or trading volume) for the most traded and liquid 40 currencies worldwide amounted to 7506 billion dollars, equivalent to 7.506 trillion dollars. This means that out of the total 7.5 trillion dollars in the forex market, 7.506 trillion dollars are from the top 40 most liquid or frequently traded currencies. The slight discrepancy between the overall market volume and the volume of these 40 currencies could be due to other less liquid currencies that aren’t in the top 40.

- US Dollar’s Share: Out of this 7.506 trillion dollars from the most liquid 40 currencies, 88.46% of that turnover, or 6639 billion dollars (equivalent to 6.639 trillion dollars), was associated with US dollar trades. This percentage is a measure from the previous year, suggesting the dominance and liquidity of the US dollar in the forex market. The US dollar is a central currency in many exchange pairs and is a global reserve currency, hence its significant share in daily turnover.

Conclusion

The foreign exchange market has experienced a remarkable surge in daily turnover over the past two decades, underscoring its position as the world’s largest and most liquid financial market. This growth can be attributed to the expanding global trade, investments, and the ever-increasing interconnectedness of the world’s economies. The consistent dominance of the US dollar, the steady rise of currencies like the Euro and the Chinese Yuan, and the significant roles of other major currencies collectively highlight the dynamic nature of this market. As economies evolve and global financial activities intensify, the forex market remains a central hub, reflecting the pulse of global economic trends and movements.