Table of Contents

Many forex traders think about using signals to get assistance in generating profits. Although fetching a trustworthy signal supplier is challenging, you’ll be able to develop a good amount of money if you discover the proper one. However, can you make money from forex signals?

Forex signals aren’t capable of making you wealthy as forex could be a long road that you can’t fetch through signals. However, there might be a possibility that it assists you in making a fair amount of money within a shorter span by getting you to put your money on profitable trades. Still, providers do not give you risk and money management methods for a more extended period.

Can You Make Money From Forex Signals?

No, you cannot usually make money from forex signals because forex signals are the bad black box path for traders. Traders need to test strategy, understand entry, stop loss and target conditions and have several years or decades of proof before investing in any strategy. However, some companies have developed profitable strategies that usually do not share.

For the last ten years, I visited many forex signals websites, and I didn’t find any forex signal provider with a good trading record. Traders usually see pips as a measure of success, but this is typically a trap. Maximum drawdown and Sharp ratio are excellent tools to measure portfolio success.

For example, Zulutrade is an excellent company and has offered signals from traders for 15 years. If you search any trader that provides signals for more than two years, you will see that most of them ruin their accounts. Most of the forex signals providers are new signal providers.

How do forex signal providers make money?

Forex signals providers make money based on the volume that traders follow or charge a flat monthly fee. Usually, forex providers generate a lot of signals per day and they get pip or two for each trade when they receive a commission based on volume. However, some providers charge a monthly fee (for example $100 or $500 per month, etc.)

But, how to see the real performance of a forex signal provider?

Forex Signal provider case study

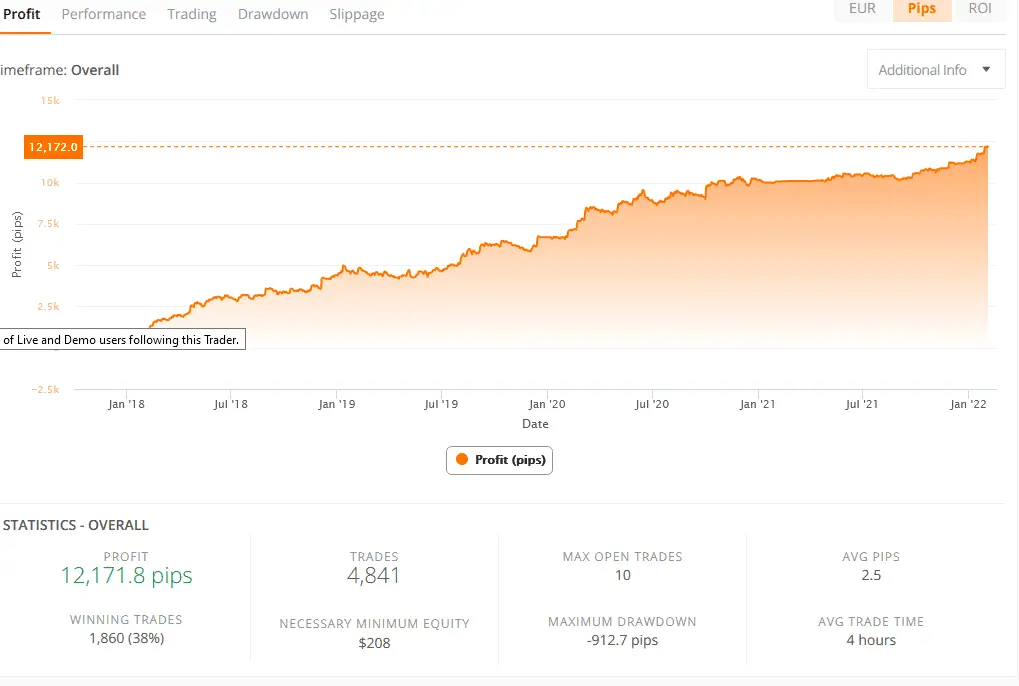

Below is presented the excellent performance of one forex signal provider. However, it is only on the first look:

Your maximum drawdown needs to be less than 10% to be a profitable trader. For example, if you lose 10%, you will need 11% to be break-even, and if you lose 20%, you will need 25% to earn to be break-even. See risk table:

The problem is that all forex signals providers provide a lot of trades simultaneously. So you will see ten trades per time. Usually, the average profit is around 20 pips, and stop-loss is up to 300 pips. So you can see 1-2 years of excellent results, and then the account will be blown.

If you see any profitable account older than two years, usually, it will have an enormous drawdown.

Traders think that this account is profitable, but it is not. It is a high-risk portfolio. You can lose all money at any moment because forex signal providers do not want to close positions.

Forex Signals: Reality Or Fake?

How do Forex signals work? These are suggestions for buying and selling, along with ideas that help traders understand when and where to step in and get out of a trade. Also, check out the Internet; it is bombarded with the services of Forex Signal, assuring you will be rich if you do whatever they say!

It sounds like a great idea. But don’t you think it needs to state many facts to be proven effective? Just picture yourself sitting in the comfort of your home, hoping to receive a text that guides you through the process, and that’s it, you’ll be rich!

If life was this easy, or forex was this simplified, then why would people take specialized courses, try, fail, and then get up, make an effort to make forex work for themselves? Of course, they would also subscribe to one of these mailers and become rich, right? Did you ever come across a successful trader who would take other suggestions from others and then place their trade on those insights?

Many such services are merely scams that bring in money to them and take everything from a person who trusted them. So naturally, the figures promised to you will blow your mind, luring you towards investing more and more. But some signal providers aren’t a hoax but rather totally genuine, providing paid or sometimes free signals to generate awareness for their brokerage service.

They might also be marketing these signals and aim to make it a profitable venture for themselves. Say, for example, a particular broker’s service has around 500 shoppers, and each of them is paying $50 in the name of a fee. An amount as considerable isn’t the one to leave the forex commerce business aside!

4 Factors to keep in mind when choosing a Forex Signal Provider

Forex signals can assist you in making profits, but forex signal success isn’t promised. So, here are a few factors everyone must consider while getting a signal provider’s services.

Go through legal matters and regulations.

The foremost factor to note is getting to know the one that serves the purpose. Forex signal trading is a form of industry wherein constant care, and study of market trends are required. A person in himself can’t manage all of this, so it is better to hire a company for this case.

It is also convenient to get the hang of its reliability considering the official data they release. A company will always be a lot more transparent than an individual and have valid account information and specific details about the founder of the company and further management.

An expert provider cannot be a scammer, and if you still wish to verify, check their registration with the country’s regulatory bodies.

Check the Track Records

Study all of their records to ensure that the service for forex signals isn’t a hoax and can assist you in generating profits. If the company holds a fundamental point, they will never shy away from providing you with their track records. Further ahead, you’re always permitted to go and look at the Internet, check a few forums, and understand them. But, keep in mind that even a 100% success rate can’t guarantee success.

Identify what they promise for profits.

Remember, a trustworthy signal provider will never assure you 100% wins as they know that trading is always a risk factor in some of the other ways. At moments, even the best of traders fall. Therefore, if the company promises 100% wins, it is better to stay away from them.

Check whether they provide manual or automated signals

Several forex signal providers might be using humans to monitor market trends and then make a final decision as per the same. These humans can decide simply by putting their minds into the market’s psychology.

Whereas, there is another machine option, where you can track the market trends. This machine eliminates the chances of human errors. It depends on what type suits you better. But ensure you speak and conduct research before you finally place your money.

Forex Strategies: Are they suitable for the long term?

Say, for instance, you have decided to fix yourself to a particular signal provider and trade as per their signals. But, can you make money from forex signals?

It all relies on what your desired outcome is. For example, if some profit by moving left and right, then a short-term provider can be helpful for you. But in case you wish to do it for a more extended period, then what? Here’s why a signal provider won’t be the best for the long term.

Management of risk

Almost all signals providers do not have additional strategies for risk management under their services. Sadly, it is a factor that severely impacts your profitability. However, the providers might inform you to try and avoid the risk factor that goes above a percent of the capital, which still isn’t a typically strong plan for managing the risk. These people have no idea about your quotient for risk and how it settles into your trading style. Their planning emphasizes a targeted trade and ensures that it bears profits for the trader.

Strategy of trading

Apart from not providing a plan for tackling the risk, signal providers also do not bother about your trading strategy. It is so because these providers don’t worry about your achievement goal, be it six months long or last as long as ten years. Neither of the signals provided by them focuses on the main picture or your trading style. In short periods, you might get a good amount, but forex signals are not for you if you have long-term goals.

What to do if not forex signals?

As a trader, if your target is to become a successful forex trader and attain wealth, then the only path to it is learning. It will help if you are put in pain to get to know the functioning and dynamics well enough to develop a profitable strategy finally. Even after having a signal provider or a mentor, if you’re thinking about how to become rich through forex trading, then there is only one route, and that is educating yourself.

But, in case you are determined to be dependent on the forex signals, then ensure that you are working too. The entire accountability cannot be placed on a provider because that trade is specifically important to you. The route to getting rich is focussing on the trade on yourself and leaving a small concentration for the provider.

Primarily learning via different methods and hiring a tutor or going through various online courses. After that, make an effort to develop a robust strategy that focuses on both profits and management of the risk. Then ensure that the signals synchronize with the approach you plan to implement them.

Finally, the patience and straightforward mindset required for executing trades like a sole trader are pretty important too. Even though there are signals present for you or not, controlling emotions, observing the market, and avoiding excessive trading are crucial.

In Conclusion

Many traders step into the puddle thinking that the use of forex signals will help them leave the learning part aside and attain a profitable income without any hassle. If they do not get themselves stuck in hoaxes and can find a trustworthy source, they can get good gigs.

But, if you’re thinking about getting rich off forex, then forex signals cannot be the only reliance. A strategy for trading is a must, along with a strong plan for managing the risk. Also, let’s not forget that patience and control of sentiments is essential.